Introduction to Economic Indicators

Trevor Williams

25 years: Macroeconomist in banking

In this video, Trevor shares his thoughts on some key economic indicators. He further analyses what each indicator tells us about the economy and how they all interact.

In this video, Trevor shares his thoughts on some key economic indicators. He further analyses what each indicator tells us about the economy and how they all interact.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Introduction to Economic Indicators

7 mins 56 secs

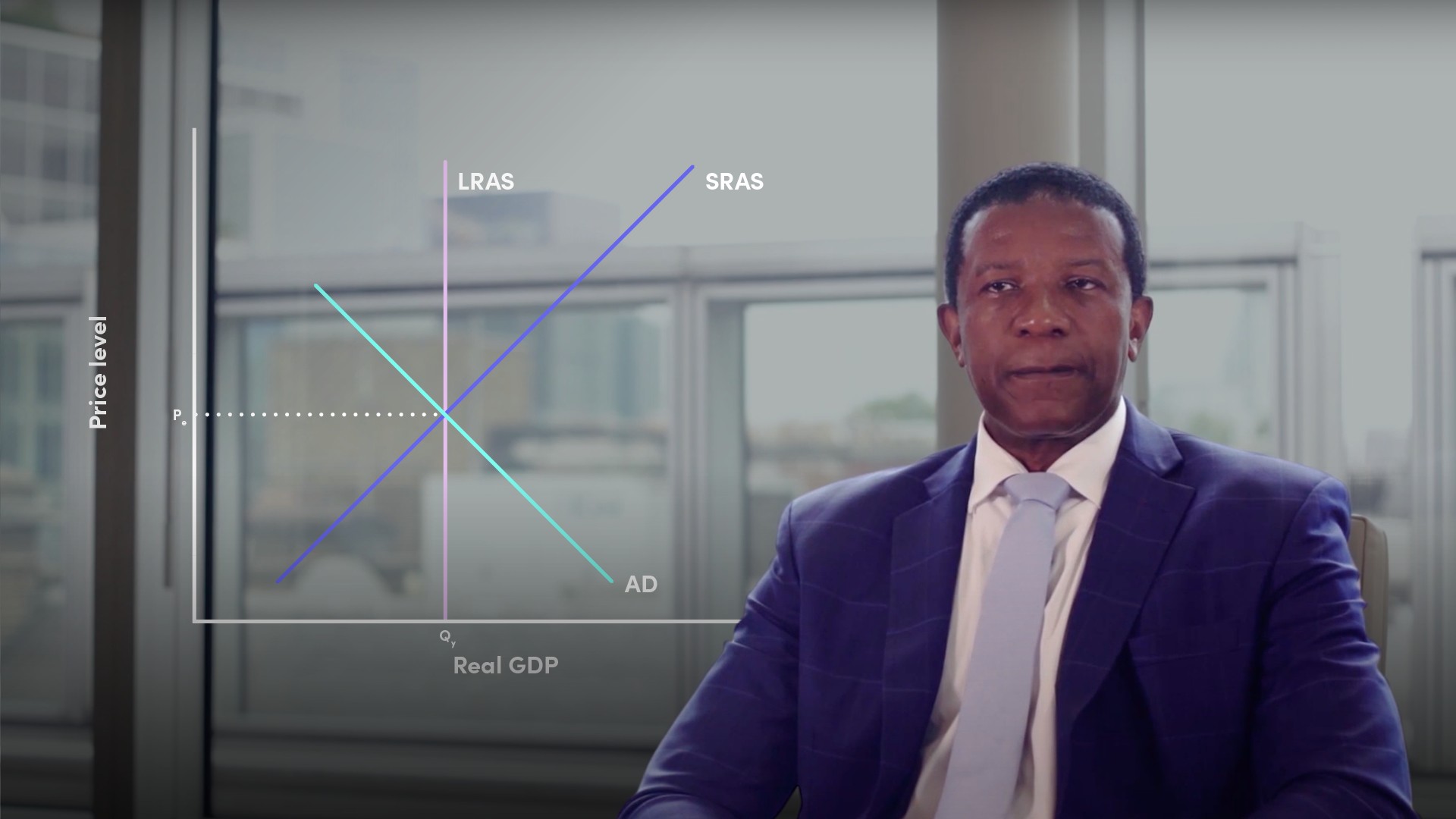

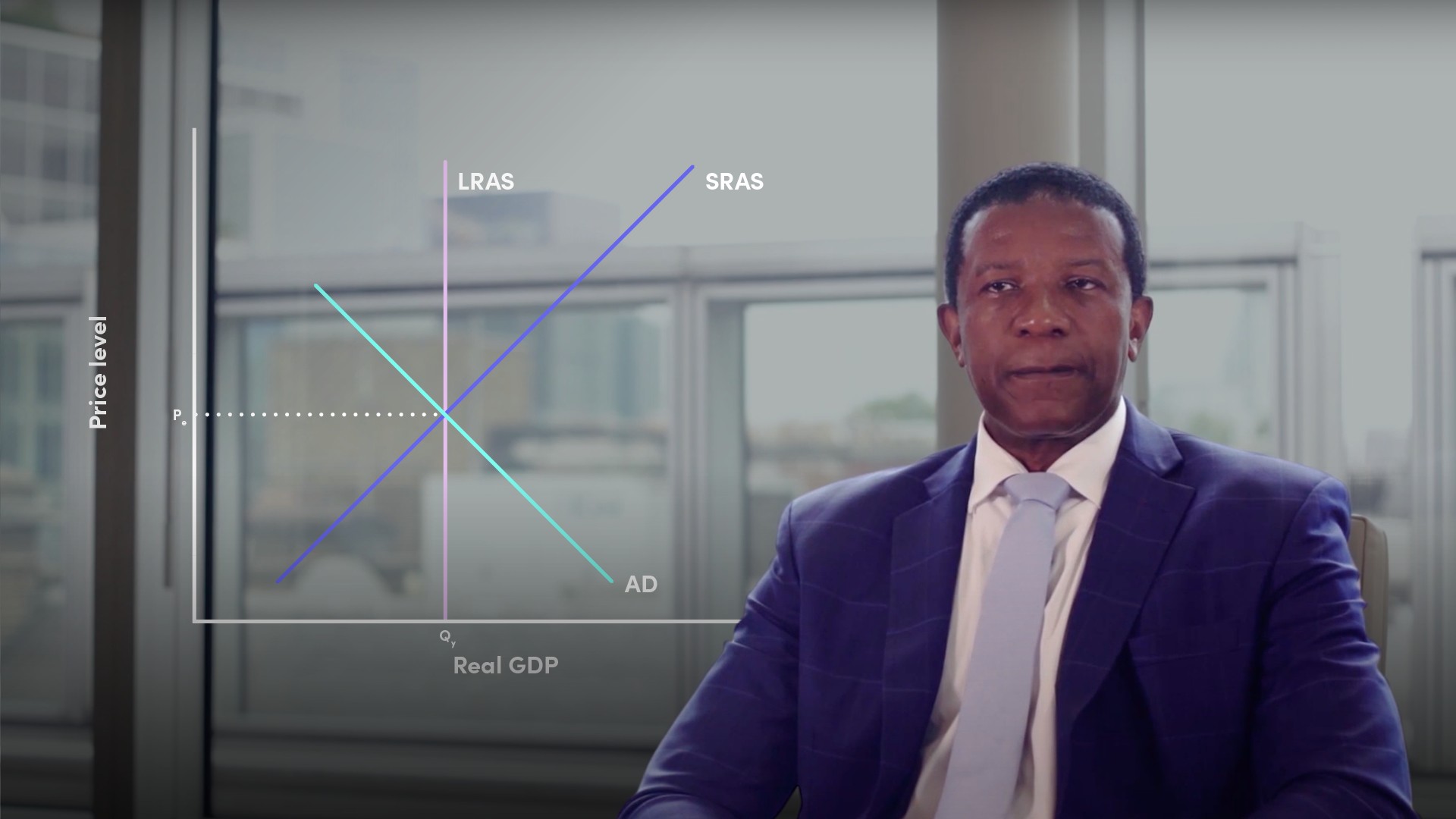

Economic indicators are the key to understanding the behaviour of financial markets. From bond investors, to equity investors to commodity traders, private equity, and hedge fund activities, their success is ultimately determined by how well the economy performs. The economy's ability to generate net value-added, or growth, from producing goods and services forms the lifeblood of financial market activity.

Key learning objectives:

Identify the indicators that impacts the economy

Outline GDP’s effect on corporates and markets

Understand the impact of monetary and fiscal policies on the economy

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Trevor Williams

There are no available videos from "Trevor Williams"