Correspondent Banking Products and Evolution

Paul Taylor

35 years: Corporate banking

In a previous video we discussed that, historically, the main two product lines for a correspondent banking team were Payments and Trade Finance - both very much transactional banking product lines. In this video, Paul discusses how management of credit and risk, key international events and rightsizing of bank portfolios led to the evolution of correspondent banking.

In a previous video we discussed that, historically, the main two product lines for a correspondent banking team were Payments and Trade Finance - both very much transactional banking product lines. In this video, Paul discusses how management of credit and risk, key international events and rightsizing of bank portfolios led to the evolution of correspondent banking.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Correspondent Banking Products and Evolution

12 mins 59 secs

Correspondent banking has developed extensively over the past 20 years. From the change in management of product lines to the key events that have had a lasting impact, correspondent banking has experienced a variety of change.

Key learning objectives:

Understand how correspondent banking has changed

Key events that changed correspondent banking

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

How were other product lines managed?

- Global Custody: This is essentially the safe keeping, settlement, administration and reporting of ‘marketable securities’ and ‘long term cash’ held by banks and their clients across international borders

- Loans and Deposits: Not a feature of all correspondent banking relationships - but as part of their funding strategies, banks in certain countries used to borrow from other banks, either bilaterally or as part of a syndicated loan. In turn, banks, their subsidiaries or their clients would have the need to keep foreign currency or offshore deposits and other relationship banks would be a typical home for these deposits

- Trading - FX and Derivatives: Arguably the most prominent product line - banks essentially trade with each other to hedge interest rate and foreign exchange risk. This would either be on a proprietary basis, or in respect of client flows.

- Underwriting and advisory services: Universal and investment banks offering these services would target their client base of banks as they would with corporate clients, hoping to win lucrative capital raising or M&A business

These product lines were extremely important. They would typically be highly remunerative and could certainly be classified as 'bank to bank' dealings. At the time however, they were not considered to be part of the ‘correspondent banking’ world and as such, were not typically managed or co-ordinated by the correspondent banking teams.

How was risk and credit managed?

20 years ago the risk and credit function focused on the analysis of counterparty and country credit risk. This would in turn be broken down into credit/risk analysis of the economy, sovereign and political risk along with the domestic regulatory regime, currency stability and finally an assessment of the banking counterparties.

What key events changed correspondent banking?

- 9/11 & remedies against terrorist funding: The aftermath of 9/11 and other terrorist threats transformed the degree to which banks had to perform due diligence on their cross border correspondent banking relationships

- The regulatory regime in Europe: A series of regulatory reforms - most notably the various Payments Service Directives in Europe, has led to a marked change in the fees that banks can charge in the cross border payments markets and to the time critical service levels they needed to deliver

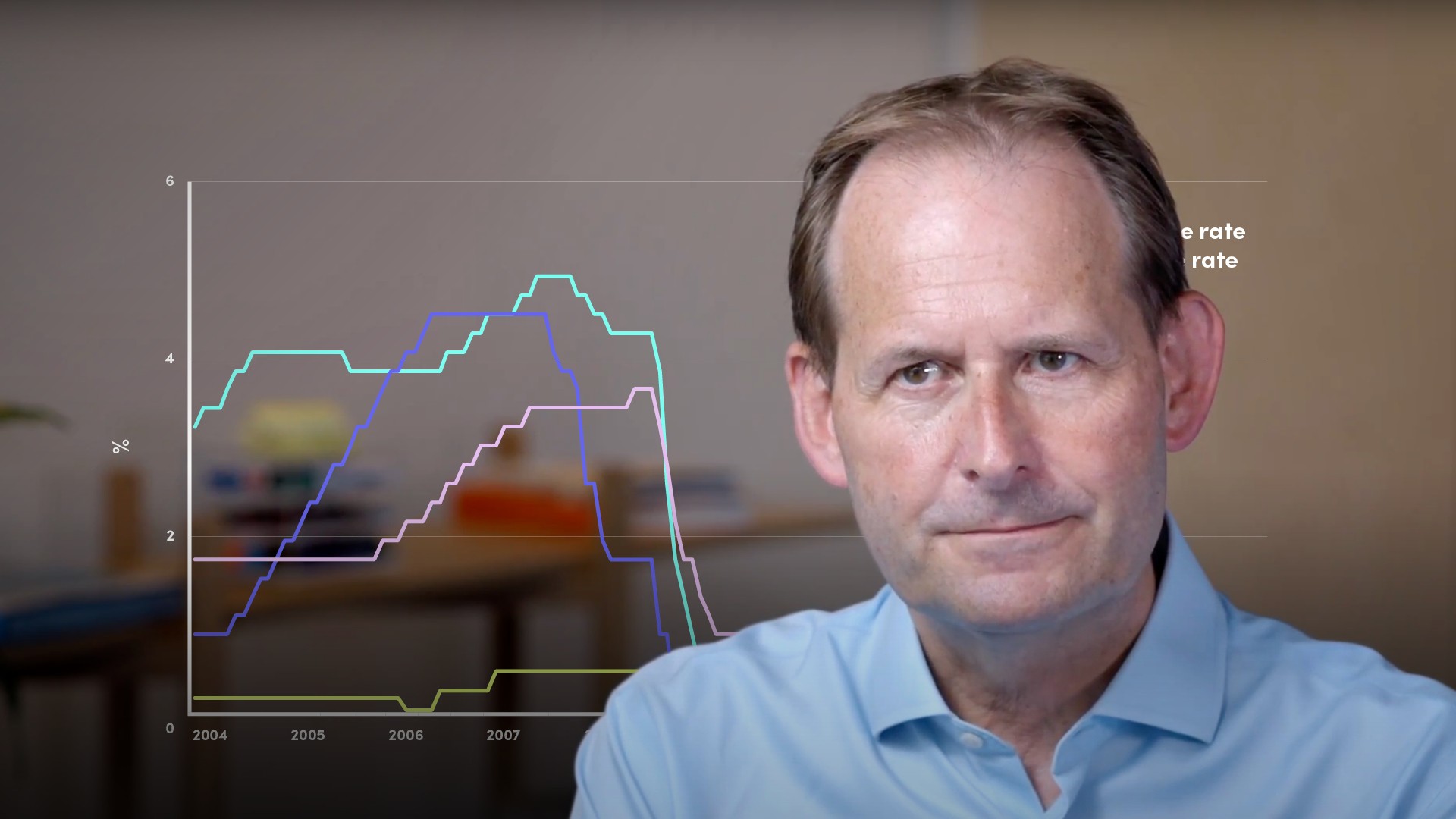

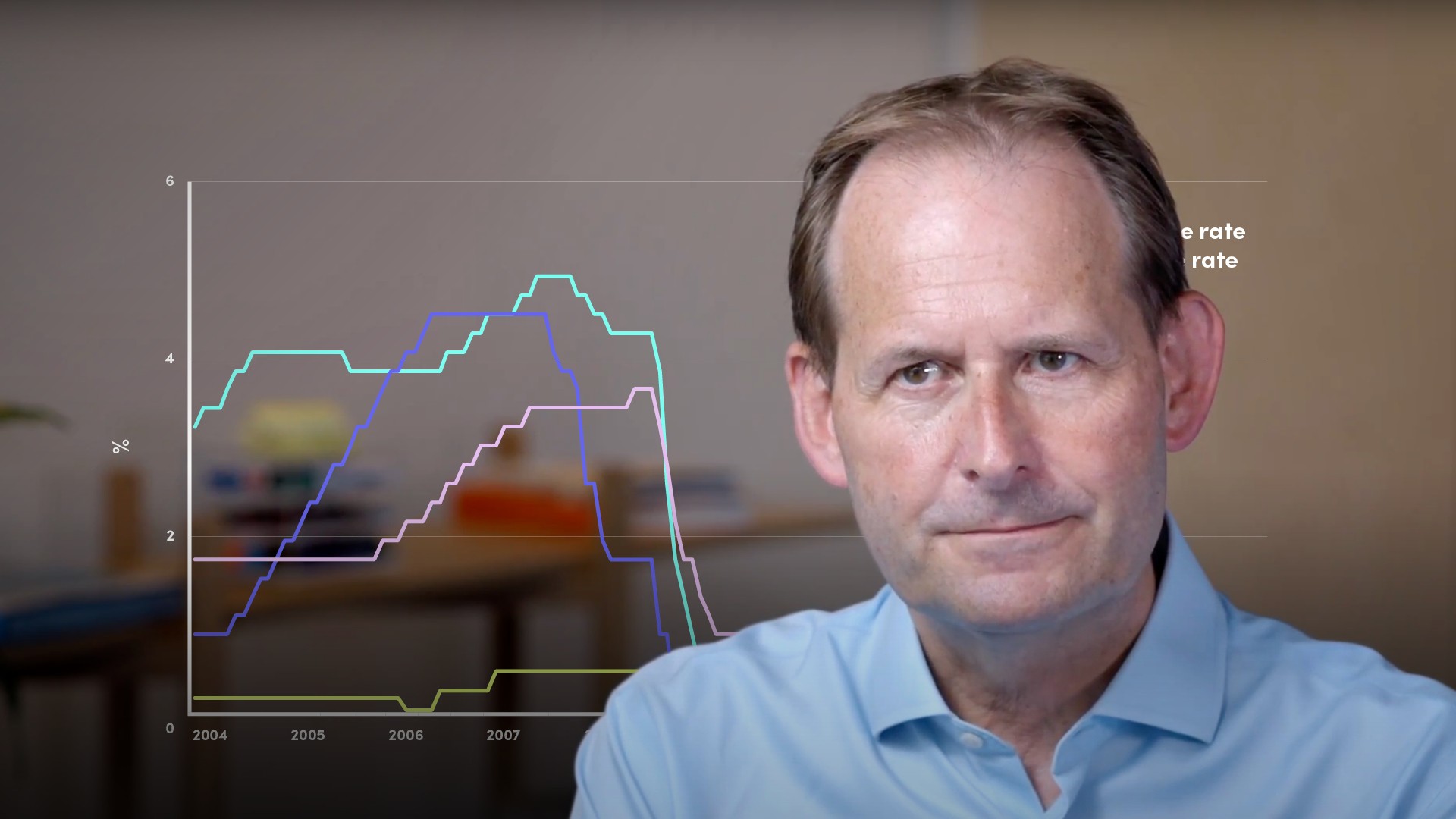

- The Financial crisis: The Financial credit crisis (starting in 2008) was a watershed event for the sector in so many ways but for many correspondent bankers it immediately changed the focus from ‘driving earnings and product penetration’ between banks, to one of 'containment' and careful management of counterparty risk alongside rigorous AML/KYC analysis. The relationship focus moved from ‘expansion’ to ‘survival’ mode in the matter of a few months

- Low interest rates & treatment of Credit balances: The aftermath of the credit crisis saw the imposition of very low interest rates globally. This was bad for correspondent banks who depended on interest earnings, in addition to fees, for revenue on their various correspondent accounts

- Risk v Reward: proactive credit management: Post crisis Correspondent Banking Coverage teams were not unreasonably expected to be on top of all risks and exposures – effectively a ‘first line of defence’. They were also increasingly expected to be involved in wider market discussions with trading and fixed income/equity colleagues. Exposure was now rationed on counterparties depending on necessity, risk and reward, and needed to be allocated carefully, as well as being carefully aggregated to stay within limits

- Digital disruption: They also have to consider the impact of new entrants into the payments markets, providing another downward pressure on margins and profitability

How did the ‘rightsizing’ of bank portfolios lead to exit programmes?

As a mitigant, larger banks reviewing portfolios did have to balance out the risks of holding too many relationships with not having sufficient to cover its clients - and the need for wide access into global markets. However, as the compliance burden became even more significant, many OECD banks started downsizing, and in their view de-risking - portfolios - particularly in emerging markets - and rather than, for example, having 9 or 10 correspondent banks in a country - they would consolidate business on perhaps 2 or 3 banks in each individual market.

Unfortunately for some smaller banks in certain countries, most global banks chose the same 2 or 3 banks with the highest credit rating and market share and so a material number of perfectly sound ‘mid-ranking’ banks were faced with an inability to access overseas markets. This caused a material impact resulting in financial exclusion for some banks, their clients and in some extreme cases, whole economies and regions.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Paul Taylor

There are no available videos from "Paul Taylor"