Why top finance institutions choose us?

Expert

Unlock the expertise of over 100 genuine industry leaders

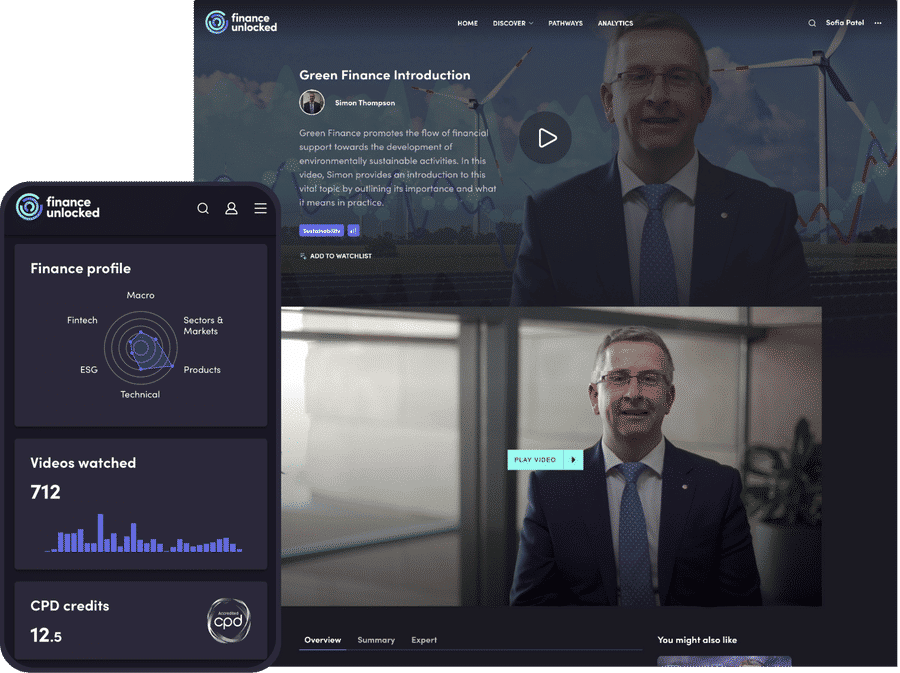

On demand

Access courses wherever and whenever, through our cutting-edge platform

Focused on finance

All of our content has been created specifically for finance professionals