Categories

Discover our Courses

Featured Pathways

More pathways

Banking Essentials - Part I

This pathway will walk us through the basics of banks, starting with some of the different types and their main functions, then starting to look at the regulation faced by the banks, both before and after the Global Financial Crisis.

Greenwashing

Greenwashing is the act of distributing false information about something being more environmentally friendly than it actually is.

More pathways

Ready to get started?

Plans & Membership

Find the right plan for you

Our Platform

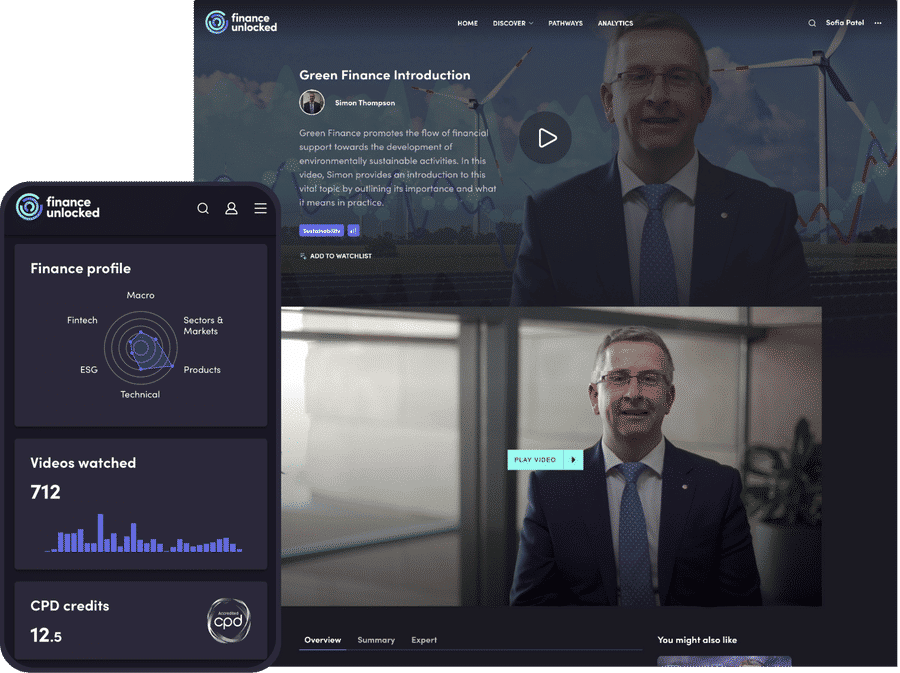

Expert led content

+1,000 expert presented, on-demand video modules

Learning analytics

Keep track of learning progress with our comprehensive data

Interactive learning

Engage with our video hotspots and knowledge check-ins

Testing & certification

Gain CPD / CPE credits and professional certification

Managed learning

Build, scale and manage your organisation’s learning

Integrations

Connect Finance Unlocked to your current platform

Featured Content

More featured content

Tackling the Cost of Living Crisis

In this video, Max discusses the cost-of-living crisis currently enveloping the UK. He examines its impact on households as well as the overall economy.

CSR and Sustainability in Financial Services

In the first video of this two-part video series, Elisa introduces us to sustainability. She begins by looking at the difference between sustainability and corporate social responsibility, two terms that can be easily confused.

More featured content

Ready to get started?

Our Solutions

About Us

Testimonials

More testimonials

Mark Homans

Our sky high NPS following learner feedback speaks for itself - this platform has delivered a lot of value.

Fiona Quinn

Learning is accessible and the tool assists in the continued development of all our employees. It is a fantastic tool for our business!

More testimonials

Ready to get started?

Categories

Discover our Courses

Featured Pathways

More pathways

Banking Essentials - Part I

This pathway will walk us through the basics of banks, starting with some of the different types and their main functions, then starting to look at the regulation faced by the banks, both before and after the Global Financial Crisis.

Greenwashing

Greenwashing is the act of distributing false information about something being more environmentally friendly than it actually is.

More pathways

Ready to get started?

Plans & Membership

Find the right plan for you

Our Platform

Expert led content

+1,000 expert presented, on-demand video modules

Learning analytics

Keep track of learning progress with our comprehensive data

Interactive learning

Engage with our video hotspots and knowledge check-ins

Testing & certification

Gain CPD / CPE credits and professional certification

Managed learning

Build, scale and manage your organisation’s learning

Integrations

Connect Finance Unlocked to your current platform

Featured Content

More featured content

Tackling the Cost of Living Crisis

In this video, Max discusses the cost-of-living crisis currently enveloping the UK. He examines its impact on households as well as the overall economy.

CSR and Sustainability in Financial Services

In the first video of this two-part video series, Elisa introduces us to sustainability. She begins by looking at the difference between sustainability and corporate social responsibility, two terms that can be easily confused.

More featured content

Ready to get started?

Our Solutions

About Us

Testimonials

More testimonials

Mark Homans

Our sky high NPS following learner feedback speaks for itself - this platform has delivered a lot of value.

Fiona Quinn

Learning is accessible and the tool assists in the continued development of all our employees. It is a fantastic tool for our business!

More testimonials

Ready to get started?

Why top finance institutions choose us?

Expert

Unlock the expertise of over 100 genuine industry leaders

On demand

Access courses wherever and whenever, through our cutting-edge platform

Focused on finance

All of our content has been created specifically for finance professionals