Climate Stress Scenarios and Stress Tests

Robert Engle

Nobel Prize winning economist

In this final video collaboration with MMF, Nobel Laureate and economist Robert Engle discusses using climate portfolios to stress test banks and prepare for future damage.

In this final video collaboration with MMF, Nobel Laureate and economist Robert Engle discusses using climate portfolios to stress test banks and prepare for future damage.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Climate Stress Scenarios and Stress Tests

11 mins 26 secs

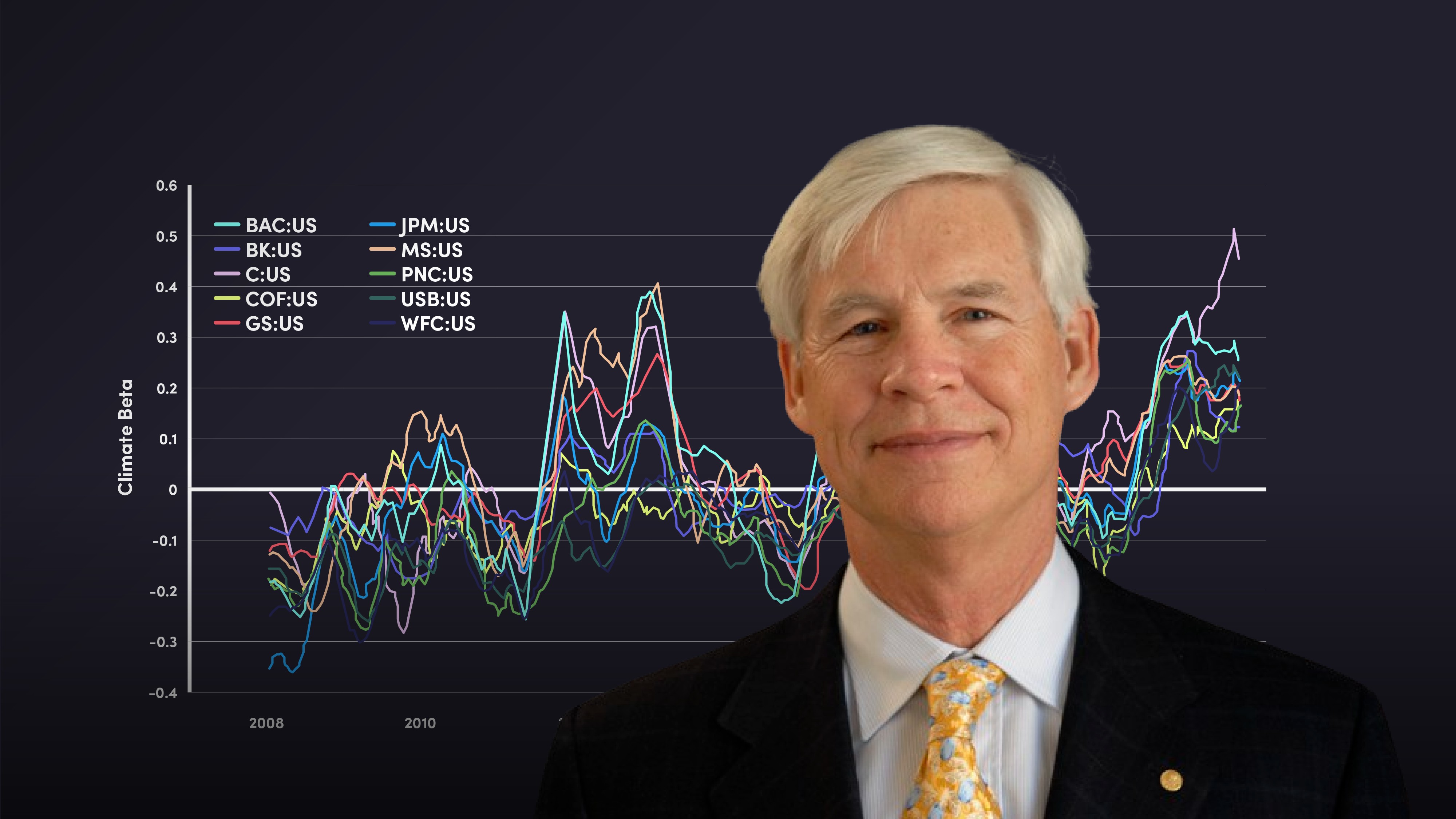

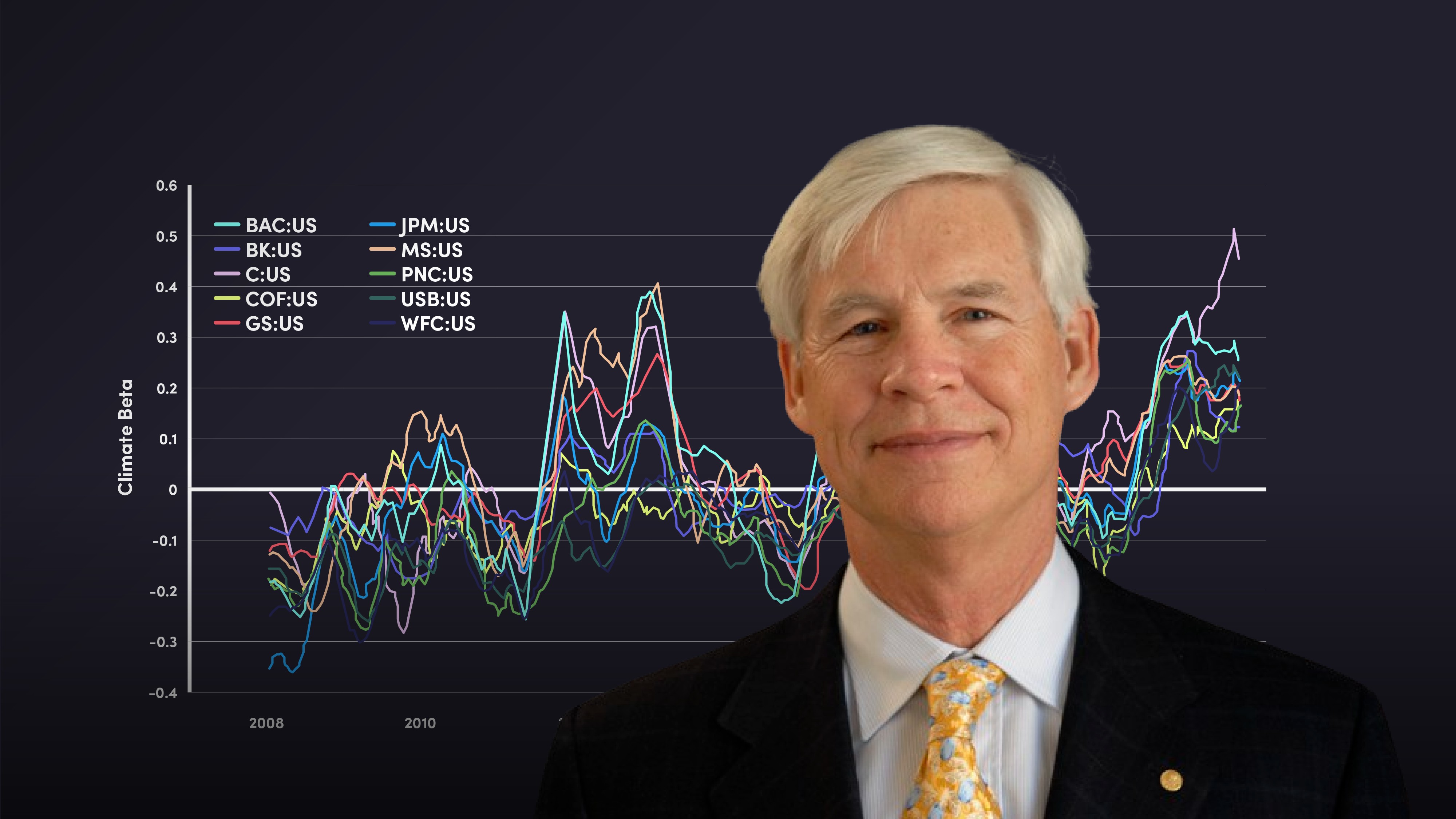

We can use climate factors portfolios as a way to stress test central banks by calculating the beta dynamically and then calculating capital shortfall. By examining the gas and oil loans of banks against the climate beta, there is a positive correlation, suggesting that the betas are actually picking up something in their portfolio.

Key learning objectives:

Understand how to use climate portfolios to stress test banks

Learn how much climate damage you can prepare for

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

How can you use climate portfolios to stress test banks?

We can measure the risk and return of a hedge portfolio by looking at the volatility and examining the impact on financial institutions of a change in these factor portfolios. If the factor portfolio shows substantial movement in climate risk, then assets correlated with that are going to go down in value. If the bank is holding a lot of assets with this kind of characteristic, then the asset value of the bank is going to go down and this could be sufficiently important that it will lead to financial instability in this bank. Additionally, if many banks are holding the same kind of portfolio, it's likely to lead to a systemic risk.

Do the climate betas coherently relate to the portfolios?

Based on the active gas and oil loans of the holdings of the large US banks (Morgan Stanley, Goldman Sachs, USB etc), if you plot against the climate beta there is a positive slope. This suggests that the betas are picking up something in the portfolio of these loans.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Robert Engle

There are no available videos from "Robert Engle"