Clearing Houses

Abdulla Javeri

30 years: Financial markets trader

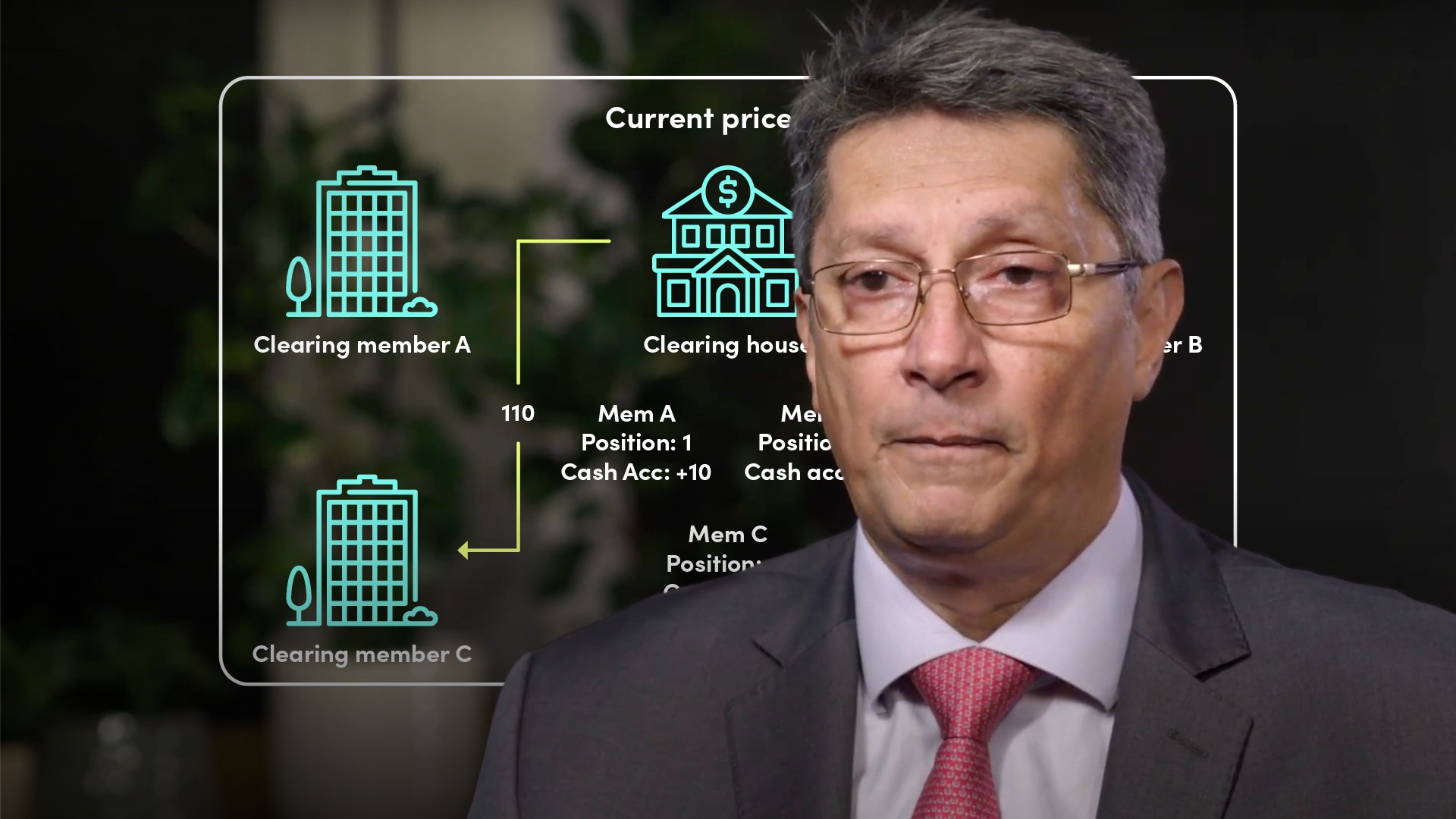

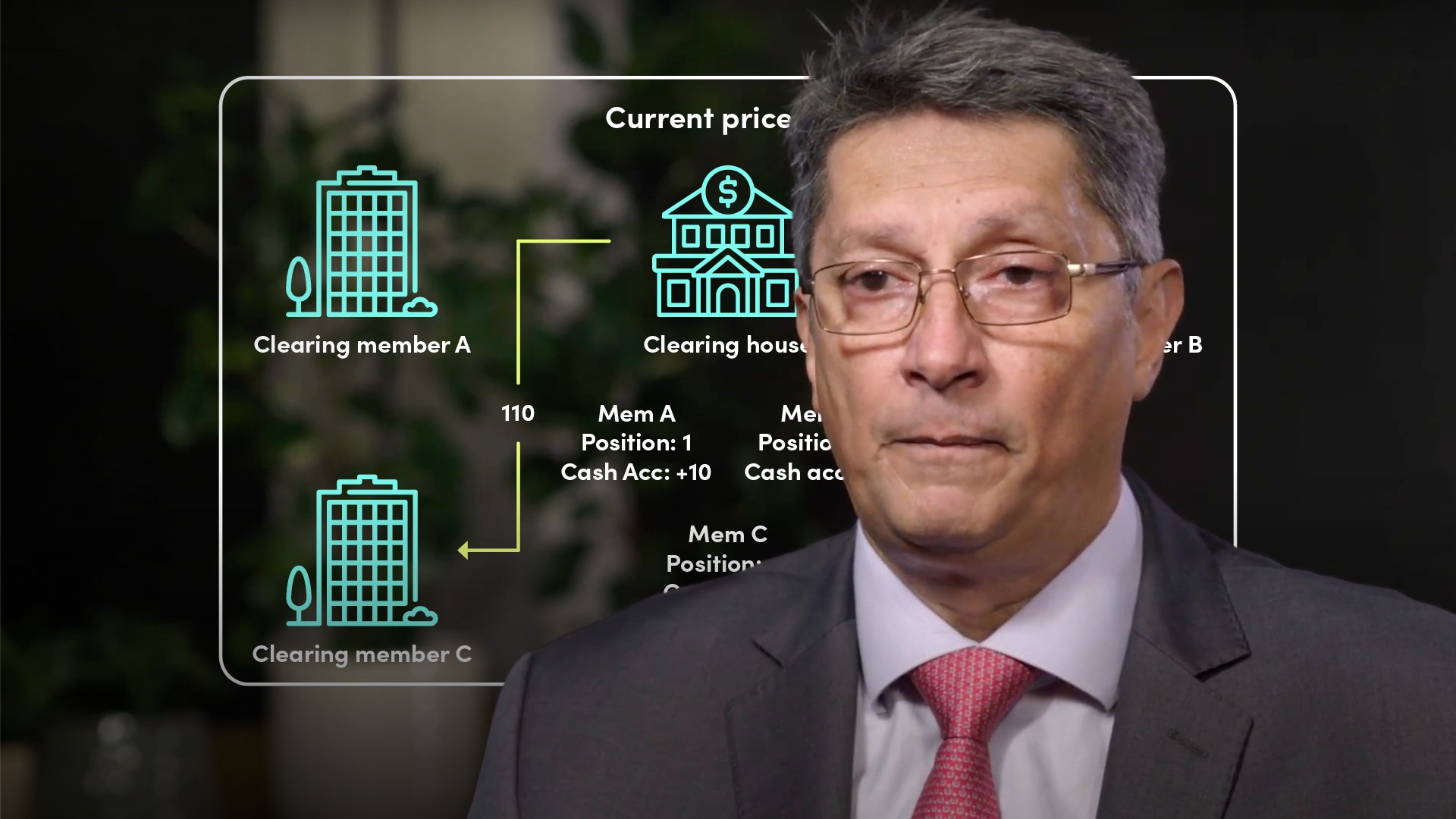

In the third video of his series, Abdulla explains why a clearing House is crucial to the smooth functioning of business on the exchange. He discusses the role of Clearing Houses as guarantors of contract performance, acting as central counterparty in every transaction administering all post-trade activity; including delivery and settlement.

In the third video of his series, Abdulla explains why a clearing House is crucial to the smooth functioning of business on the exchange. He discusses the role of Clearing Houses as guarantors of contract performance, acting as central counterparty in every transaction administering all post-trade activity; including delivery and settlement.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Clearing Houses

5 mins 14 secs

Clearing Houses provide a crucial role in the functioning of derivatives (and stock) exchanges.

Key learning objectives:

Outline the purpose and role of Clearing Houses

Learn the tools that Clearing Houses deploy in order to ensure contractual obligations will be fulfilled

Understand the basic operation of the margining system

Understand what happens in the event of an Exchange Member defaulting on its obligations

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What is the purpose and role of Clearing Houses?

- Through the process of Novation they become the Central Counterparty in every transaction conducted on the exchange.

- The Clearing House acts as guarantor of contract performance thereby substantially reducing counterparty credit risk.

- Administers all post trade activity up to and including delivery and settlement, including the operation of margin cash flows and issuing delivery and exercise notices when contracts expire or when options are exercised.

What does the Clearing House do in the event of default?

In the event of a default, the Clearing House will immediately close up all the positions of the defaulting member by undertaking offsetting trades in the market. This will crystallise the net losses incurred by the defaulting member. The Clearing House will then use the defaulting member’s margin funds or posted collateral to offset those losses.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Abdulla Javeri

There are no available videos from "Abdulla Javeri"