Fund Valuation

Mark Doran

40 years: Fund management

In this video, Mark looks at the ins and outs of a typical fund balance sheet. He then delves into how the values of a fund’s individual assets are tracked and recorded. Finally, he looks at an example of how to calculate the net asset value of a fund as a whole.

In this video, Mark looks at the ins and outs of a typical fund balance sheet. He then delves into how the values of a fund’s individual assets are tracked and recorded. Finally, he looks at an example of how to calculate the net asset value of a fund as a whole.

Both potential investors and existing investors of funds need to know the value of the fund shares (units), in order for them to make investment decisions. To determine the value of a share, the whole fund value needs to be determined, which isn’t straightforward due to the different types of assets and changing prices.

Key learning objectives:

Understand the difference between illiquid and liquid assets

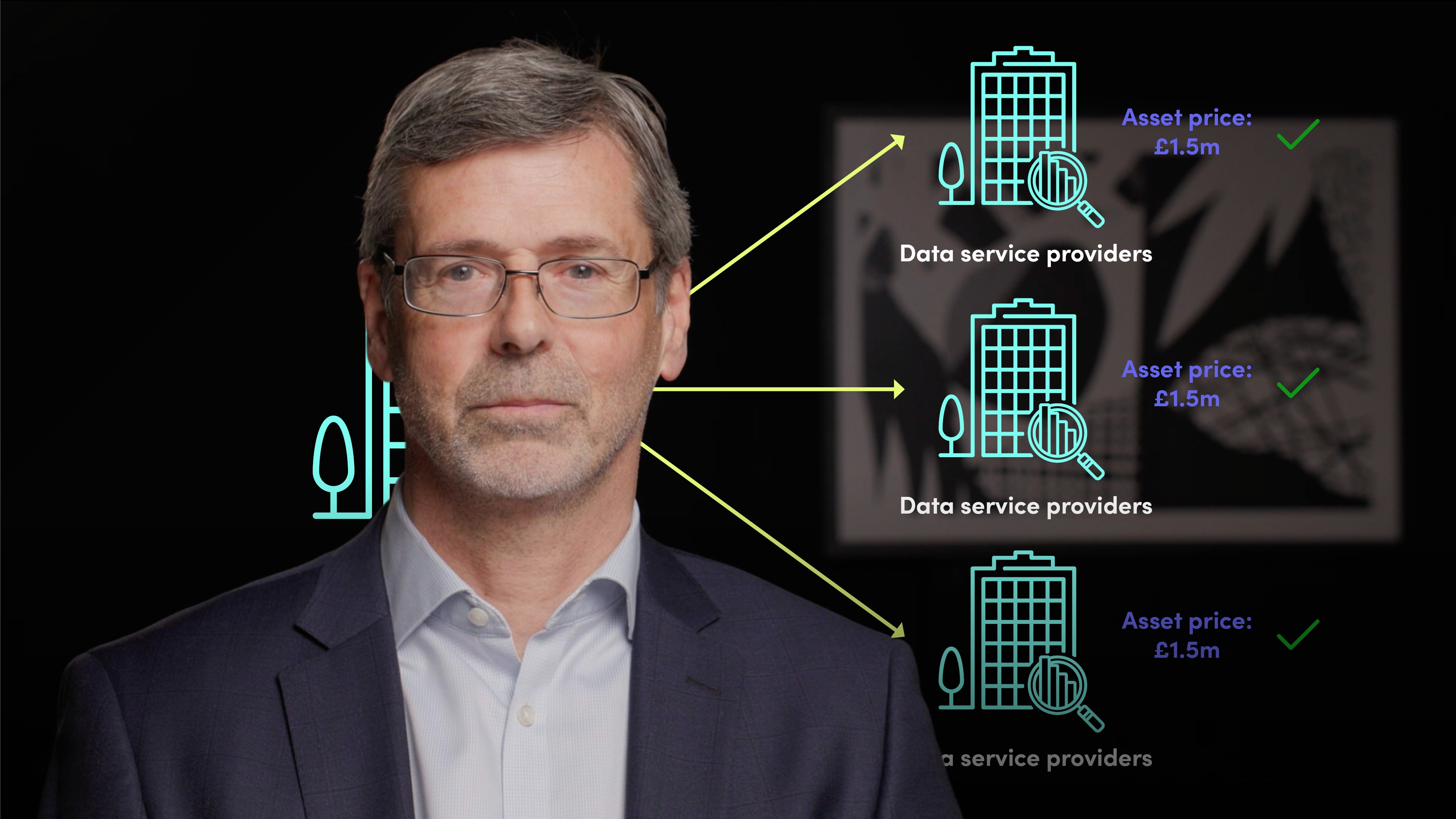

Identify how assets are valued

Understand the Net Asset Value

Now free to watch

This video is now available for free. It is also part of a premium, accredited video course. Sign up for a 7-day free trial to watch more.

How does an asset manager value the investments it holds?

Each individual fund can decide their own valuation policies, but they must all ensure transparency and full disclosure, and they can value all the assets of the fund when necessary.

For public shares, it is easy to find the price as this is publicly available.

For assets that have traded over the counter, such as bonds, a broker will have to confirm the price at a set time of day. This process of finding the value of a security is known as mark to market (MTM).

For illiquid assets, such as real estate, an independent external expert must be employed to decide upon a fair value for them.

It is much easier to find the price of liquid assets, such as publicly traded shares, government bonds, corporate bonds of major companies, foreign exchange rates, short term interest rates or commodities. Whereas less liquid assets include private equity, real estate or alternative investments.

How do we calculate the fund NAV?

Once the correct value of the investments has been determined, you can find the value of individual fund shares, or the Net Asset Value.

NAV = Net value of the fund / Number of shares.

For example, if the value of the fund is $99,097,574.93 and the fund has 4,515,928 shares, the net asset value is 99,098,574.93 / 4,515,928 = $21.94.

Now free to watch

This video is now available for free. It is also part of a premium, accredited video course. Sign up for a 7-day free trial to watch more.

Mark Doran

There are no available videos from "Mark Doran"