UK Insurance Regulation

Ted Wainman

20 years: CA & educator

It is evident that when an insurance company fails, this has an adverse impact on the policy holders as well as the FSCS due to the interconnectedness of the financial market. Therefore, there is an incentive to ensure that insurance companies are financially sound, well run with good corporate governance structures in place, and an appreciation of the risks that they are underwriting.

It is evident that when an insurance company fails, this has an adverse impact on the policy holders as well as the FSCS due to the interconnectedness of the financial market. Therefore, there is an incentive to ensure that insurance companies are financially sound, well run with good corporate governance structures in place, and an appreciation of the risks that they are underwriting.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

UK Insurance Regulation

6 mins 16 secs

Lehman Brothers declared bankruptcy on 15th September 2008, when the Federal Reserve was unable to persuade other Wall Street banks to bail it out. The very next day, AIG – the world's largest insurance company – was on the verge of bankruptcy, due to its exposure to Credit Default Swaps on the US housing market. AIG was bailed out initially in the form of an $85bn loan, with the Fed taking ownership of nearly 80% of AIG's equity. Over the coming years, following restructuring, the bailout then rose to over $150bn in total.

Key learning objectives:

Understand the statistics for the UK insurance industry

Understand how insurance companies view the strength of their balance sheets

Understand the Financial Services Compensation Scheme

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Understand the statistics for the UK insurance industry

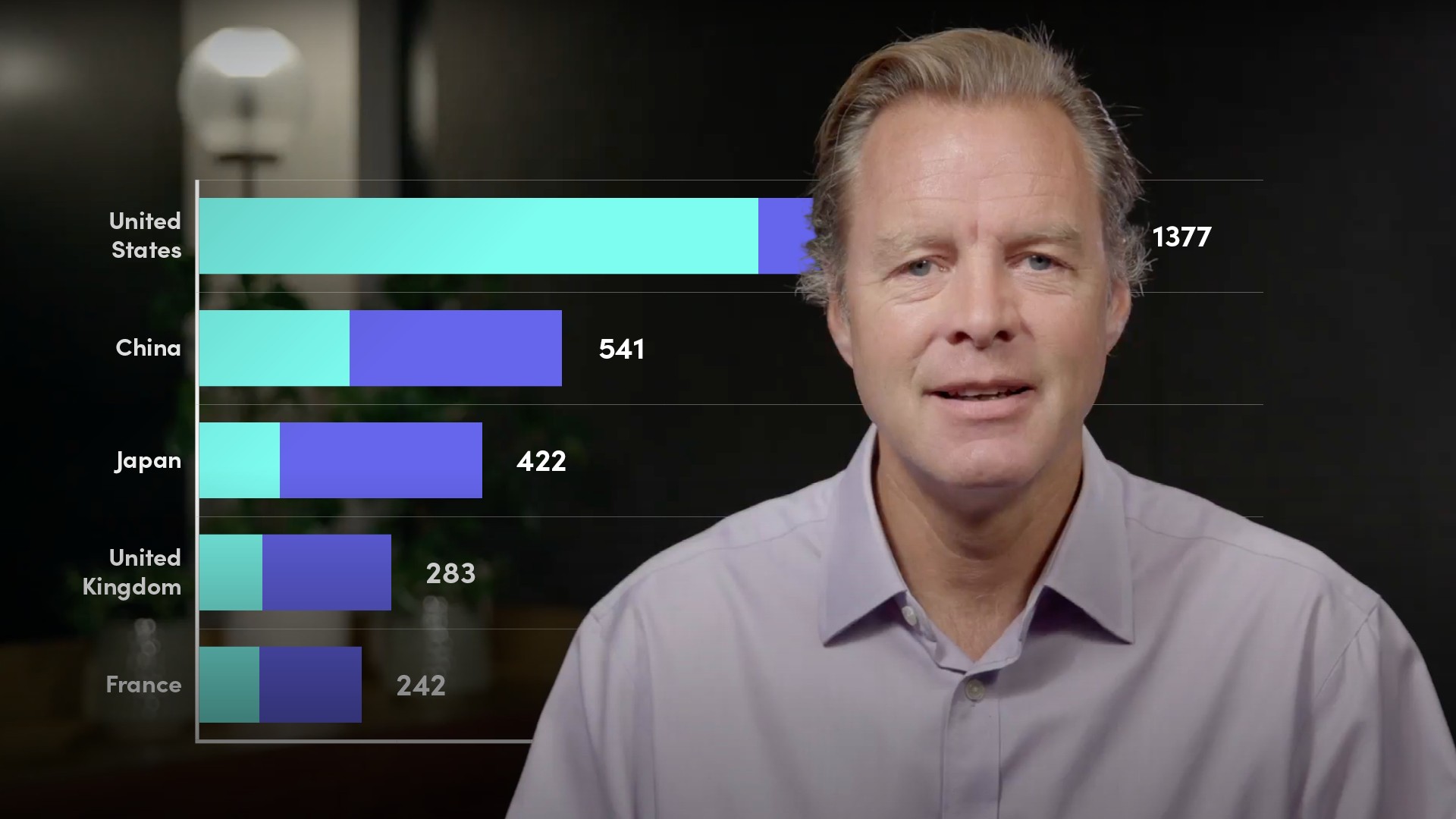

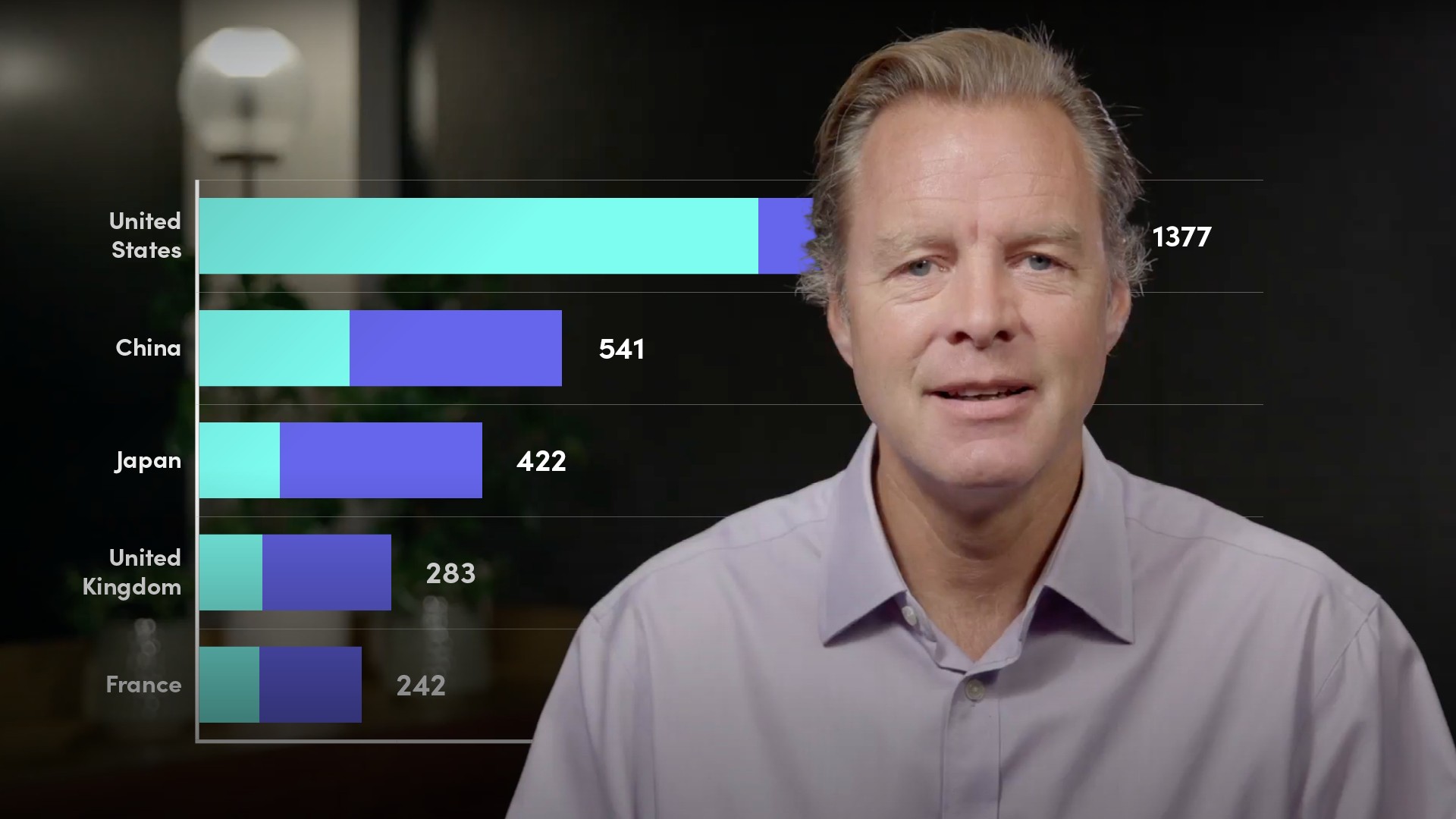

- It is the 4th largest market in the world

- It contributes £30bn to the economy

- It provides £1.74tn of investments to the capital markets

- There are nearly 1000 companies, employing over 300,000 employees

- It contributes nearly £12bn in tax

What is the Financial Services Compensation Scheme?

The aim of the FSCS is to protect policyholders who have taken out policies with companies that are covered by the scheme. Where possible, this will involve selling, or transferring, the insurance policies from the failed company to another insurer. If there is no taker for the policies then the investments of the insurance company will be liquidated and the policy holders will receive a proportion of what they might have been entitled to.

How do insurance companies view the strength of their balance sheets?

- Solvency requirements

- Credit ratings provided by the independent credit rating agencies

- The reputation of the company in the marketplace

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Ted Wainman

There are no available videos from "Ted Wainman"