Calculating Accrued Interest in the Money Markets

Abdulla Javeri

30 years: Financial markets trader

Abdulla explains how interest is actually calculated in the money markets using day count conventions and interest accrual: the two major global money market conventions.

Abdulla explains how interest is actually calculated in the money markets using day count conventions and interest accrual: the two major global money market conventions.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Calculating Accrued Interest in the Money Markets

5 mins 27 secs

The money markets use a relevant day count in order to calculate the appropriate amount of accrued interest. Different geographical regions use different day counts thus leading to necessary adjustments.

Key learning objectives:

Define the money markets

Understand the differences in day count conventions

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What are the money markets?

Money markets generically are markets that facilitate short term funding in large volume and have distinctive sub sectors.

- The inter-bank market where banks borrow and lend amongst themselves to balance their short term funding requirements

- Another segment is for collateralised borrowing or lending which we refer to as repo markets

The calculation of interest and yields in all these sectors are determined by the relevant day count convention used in each jurisdiction.

How do you calculate the accrued interest using the money market day count example?

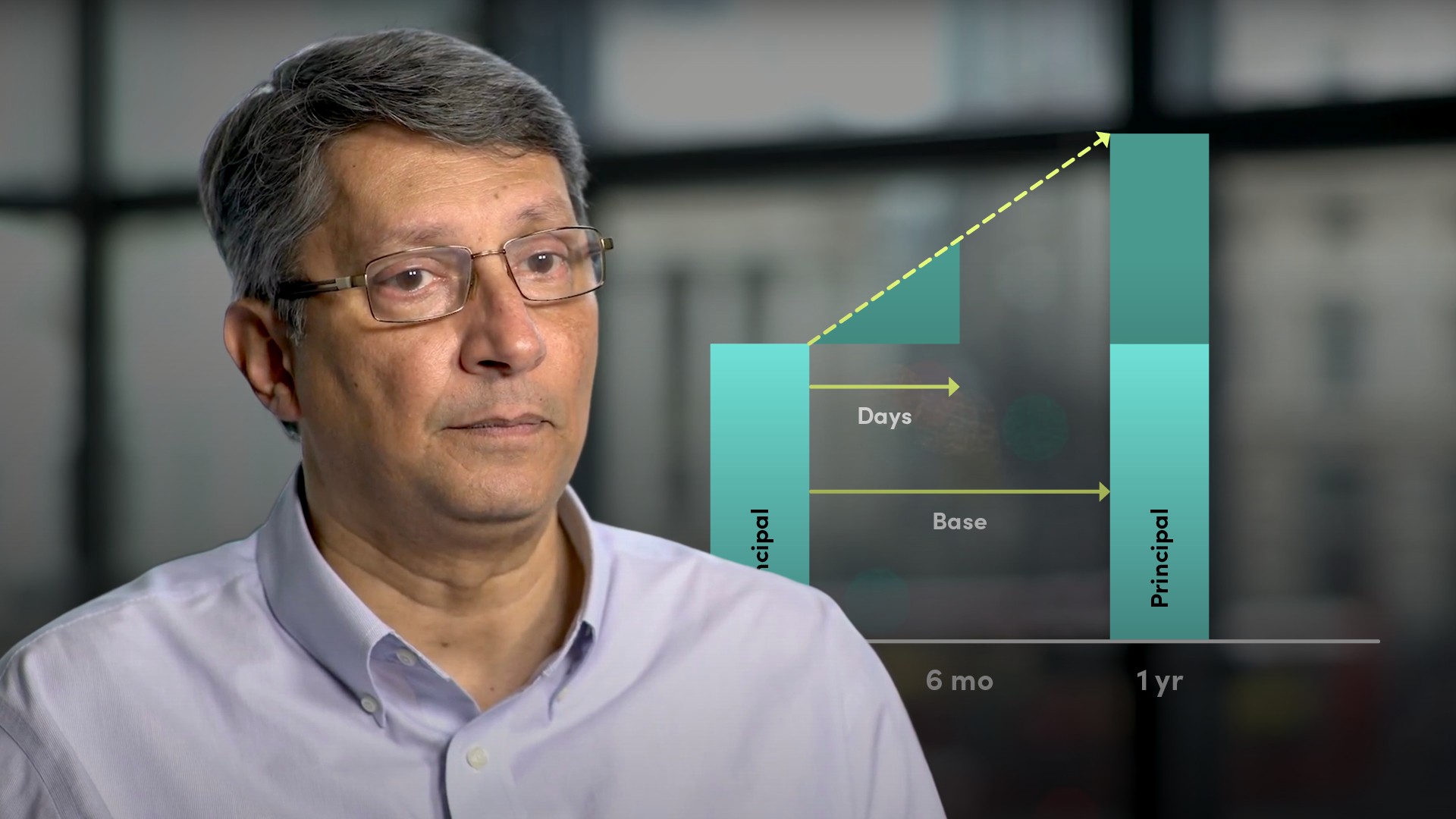

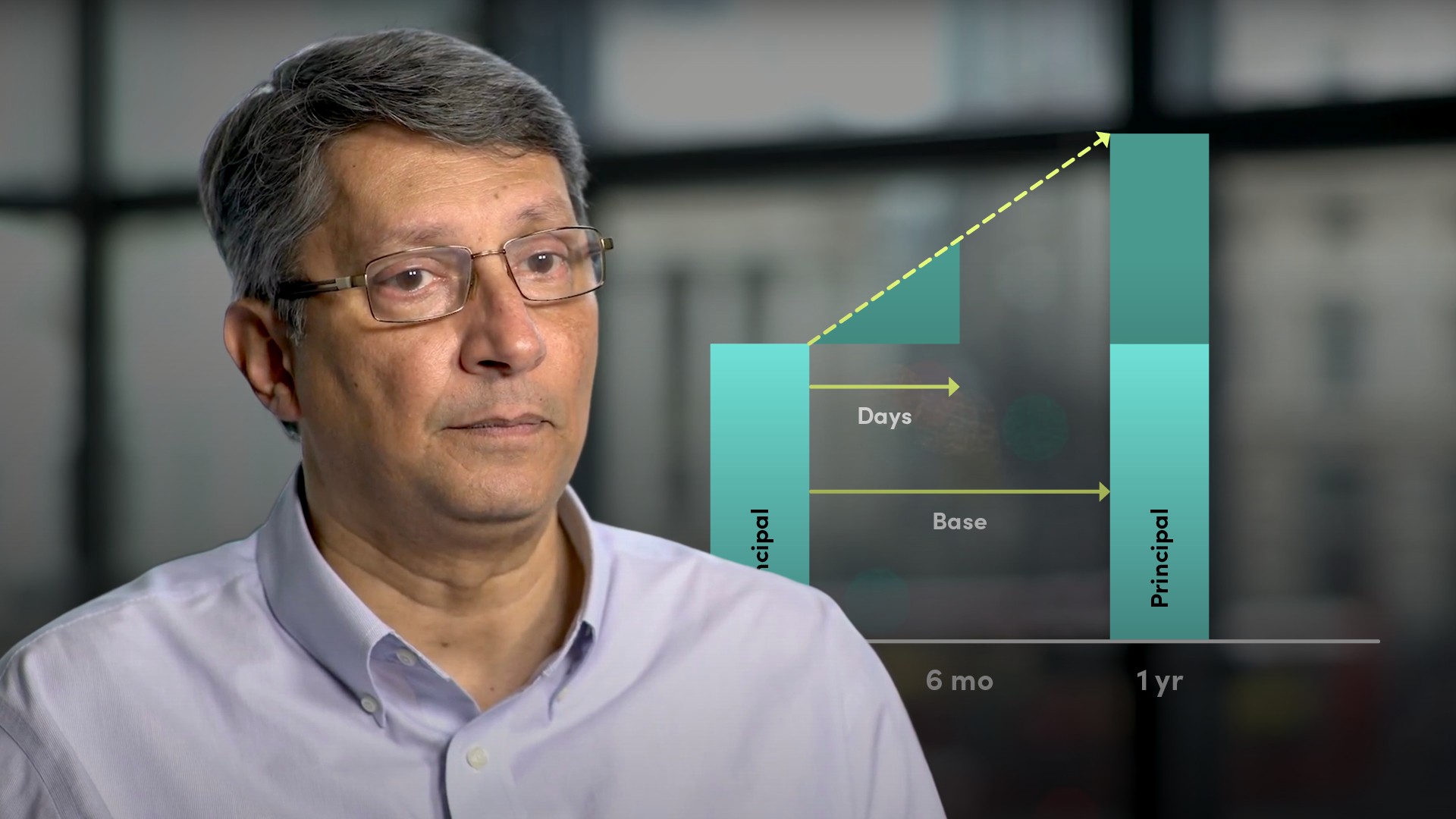

Say you deposit money for one year. You agree to the interest rate up front, let’s say 5%. Remember that’s a nominal annual rate and is fixed for the year. Every day a certain amount of interest accrues or attaches itself to that deposit and at the end of the period it’s all paid out along with the principal. Suppose instead, you invest for 6 months. The amount of interest that would accrue would depend on the fraction of the year the funds were on deposit. And that fraction or accrual is calculated as the actual number of days in the period divided by the number of days in the year. Or, Actual/base.

You deposited £100k for six months and that particular six month period had 182 days in it. There are 365 days in the year, so the accrual would be 182/365, and the interest payment would be the principal times the annual rate times the accrual.

Where interest accrual is concerned there are numerous day count conventions in use. They are dependent on the market, money market, bond market, swaps market etc. and the geographical location of the market. We’ve just covered the two major global money market conventions.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Abdulla Javeri

There are no available videos from "Abdulla Javeri"