Private Equity Limited Partner Risk Management

Gavin Ryan

25 years: Private equity & banking

Risk depends upon perception and therefore the identity of the party assessing the risk. Gavin discusses risk in terms of the two main viewpoints in private equity: the limited partners (LPs) and the general partners (GPs).

Risk depends upon perception and therefore the identity of the party assessing the risk. Gavin discusses risk in terms of the two main viewpoints in private equity: the limited partners (LPs) and the general partners (GPs).

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Private Equity Limited Partner Risk Management

8 mins 41 secs

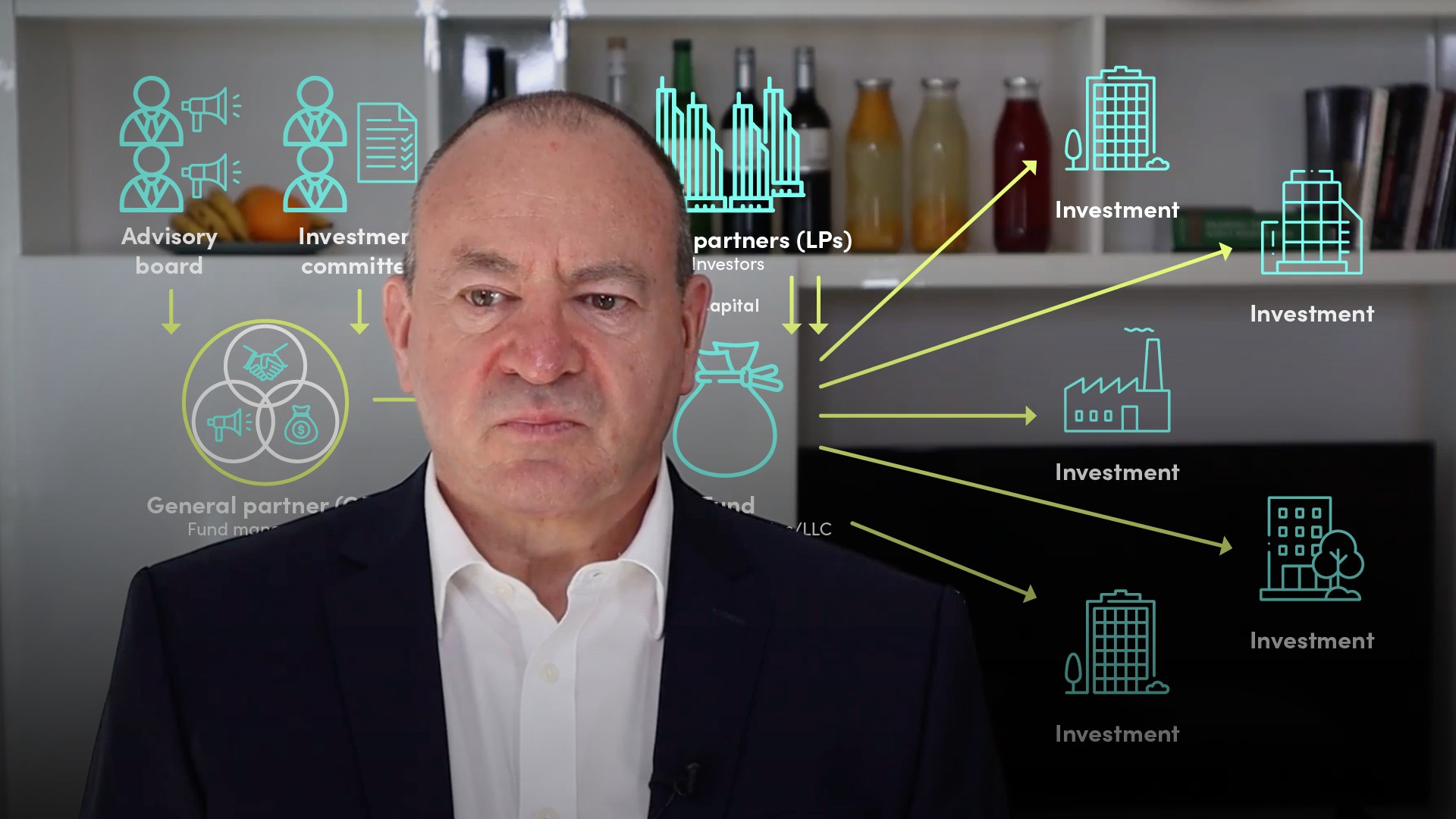

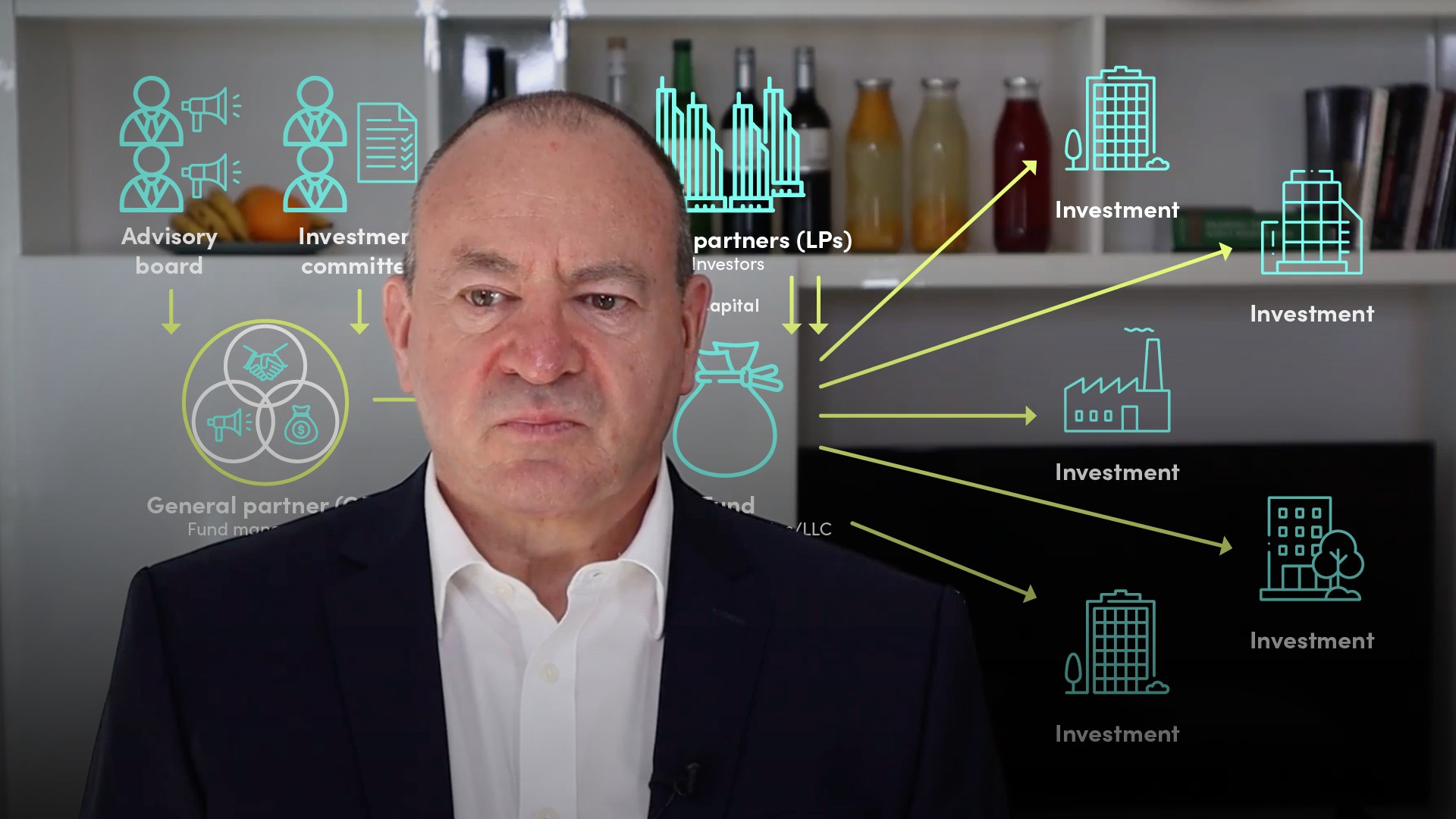

Risk assessment in private equity is divided into assessment of risks specific to limited partners (LPs) and risks specific to general partners (GPs). There is no separate risk manager function in private equity. The Fund Investment Committee has a crucial role in managing risk and providing a second opinion.

Key learning objectives:

Identify the risks faced by LPs

Identify the risks faced by GPs

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What are the risks faced by LPs?

LPs will manage four classes of risk:

- Asset class risk

- Portfolio risk

- Fund manager risk

- Co-investment risk

Two of the risks that stand out the most are the duration risk, given that the commitment made by an LP is long term with very limited options to withdraw; and secondly “blind pool” risk, in that the LP only knows the general investment strategy at the time of making the commitment.

What are the risks faced by GPs?

GP risks will vary as the fund moves through its life cycle.

One of the most important risk factors for GPs is operational risks, in particular succession and staff risks. A strong Investment Committee will help to significantly mitigate risks.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Gavin Ryan

There are no available videos from "Gavin Ryan"