EU Solvency II Capital Requirements Illustration

Sukhy Kaur

15 years: Debt capital markets

In this video, Sukhy explains us about Own Funds and it's types - "Basic Own Funds" and "Ancillary Own Funds". She further highlights how much available capital Unlock Insurance has to cover its Minimum and Solvency Capital Requirements.

In this video, Sukhy explains us about Own Funds and it's types - "Basic Own Funds" and "Ancillary Own Funds". She further highlights how much available capital Unlock Insurance has to cover its Minimum and Solvency Capital Requirements.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

EU Solvency II Capital Requirements Illustration

10 mins 3 secs

As part of the capital requirements under the Solvency 2 regime, European insurers are required to comply with the Solvency Capital Requirements and Minimum Capital Requirements. This guarantees that insurers always have enough capital available to withstand certain tail risk events. We dig into the detail around the coverage ratios of these requirements. In particular we delve into the definition of Own Funds and how much of this capital is actually eligible for the purposes of these ratios. We also apply this to calculate the SCR and MCR coverage ratios for a fictional company – Unlock Insurance

Key learning objectives:

What are Own Funds?

What are Eligible Own Funds?

How can we apply this to Unlock Insurance?

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What are Own Funds?

An insurer’s Own Funds are the measurement of how much available capital an insurer has on the balance sheet to cover its SCR and MCR requirements. Own Funds can be split into two categories:

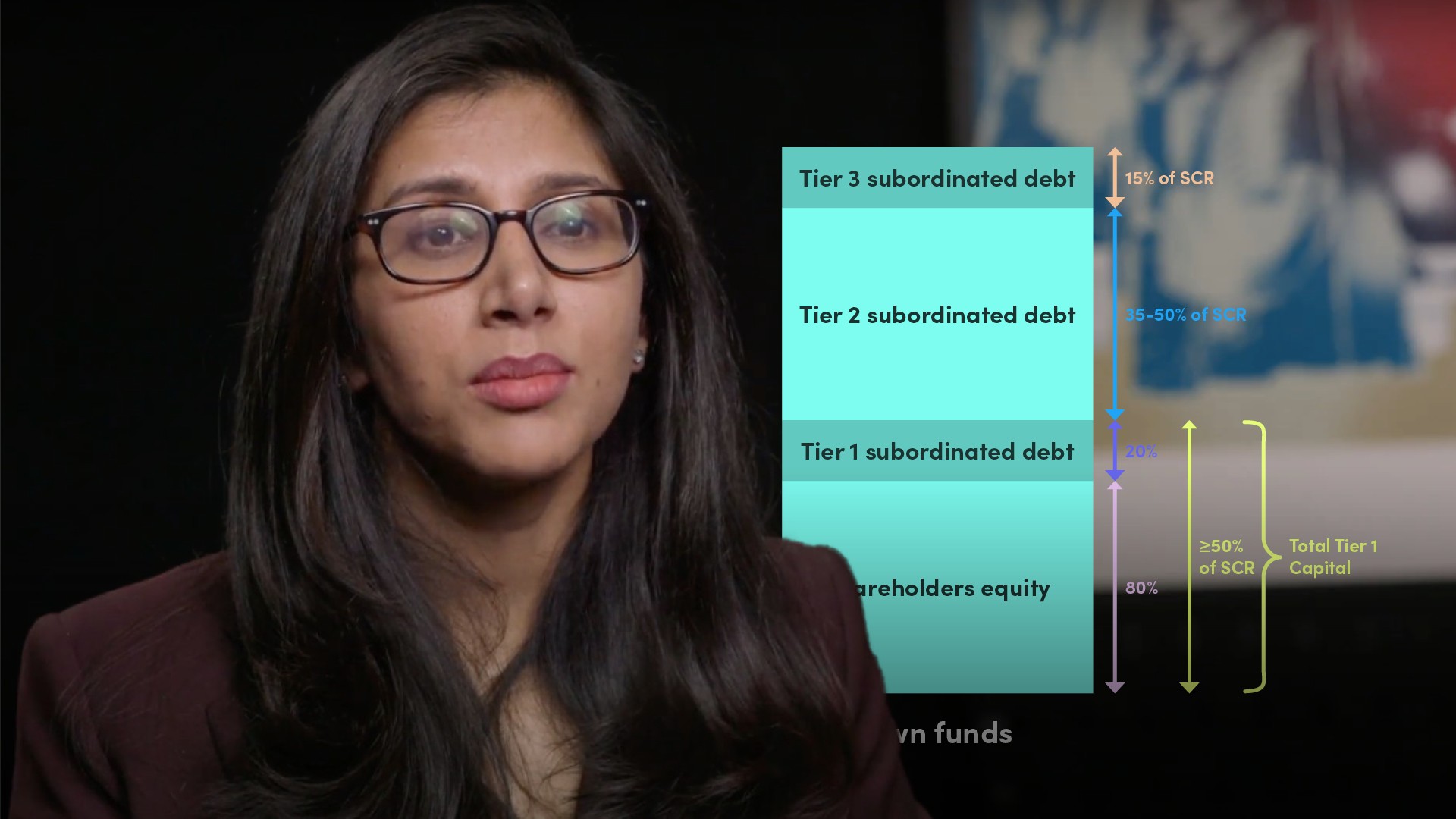

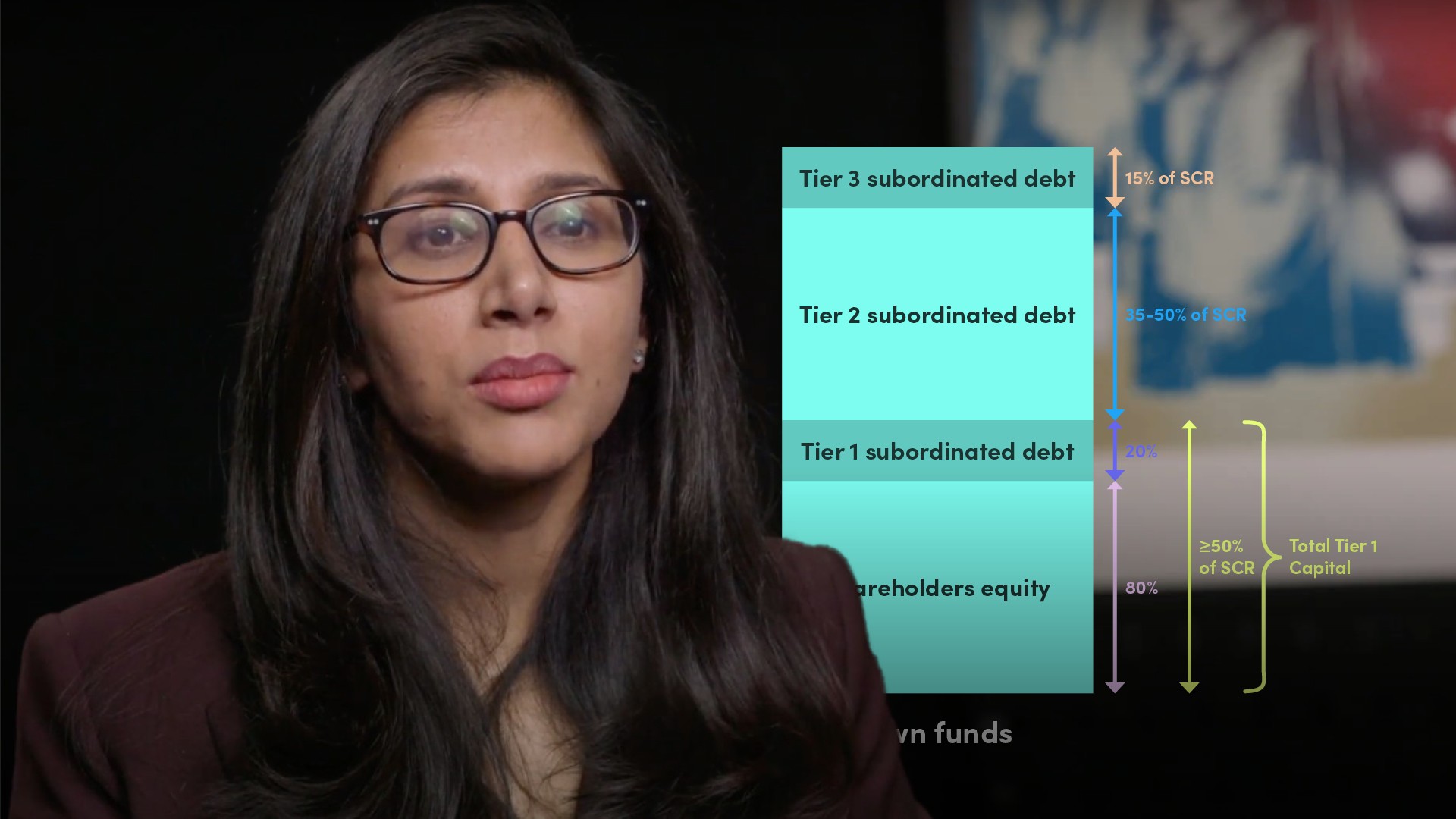

1.Basic Own Funds which are readily available within the insurance company. Basic Own Funds can then be split into the following Tiers of Capital:

- Tier 1 Capital – this is the highest quality as it is the most permanent and loss absorbing form of capital. It is undated in nature and coupons are cancelled if not paid.

- Tier 2 Capital – is the next layer of capital which is also subordinated in nature, but Tier 2 has a fixed maturity and it tends to be long dated. Coupons are deferred if not paid.

- Tier 3 is the lowest quality of insurance capital, with a shorter maturity of 5 years

2.Ancillary Own Funds are currently unpaid but can be called upon if required under certain conditions, such examples of these include guarantees or letters of credit.

What are Eligible Own Funds?

Eligible Own Funds is the component of actual Own Funds which are eligible to qualify for the coverage of the SCR and MCR. The eligibility is decided by the regulator, which includes restrictions on the amount of each Tier of capital an insurance company can use to cover their SCR and MCR.

The restrictions for the purposes of the SCR are as follows:

- Tier 1 subordinated capital is subject to a maximum of 20% of Total Tier 1

- At least 50% of the SCR must be covered by Tier 1 Capital

- A maximum limit of 15% of the SCR is placed for Tier 3 capital

- Tier 2 capital is therefore subject to a range of greater than 35%, but no more than 50% of the SCR

The restrictions for the purposes of the MCR are as follows:

- At least 80% of the MCR must be covered by Tier 1 capital, the rest must consist of Tier 2 capital only

- Therefore, a maximum of 20% Tier 2 capital is eligible to cover the MCR

- No Tier 3 Capital is permitted to cover the MCR

How can we apply this to ‘Unlock Insurance’?

Unlock Insurance currently has a SCR requirement of EUR100m and a EUR40m MCR requirement. They also have the following Own Funds on their balance sheet:

- EUR200m of Shareholder’s Equity

- EUR10m of Tier 1 subordinated Capital

- EUR20m of Tier 2 subordinated Capital, and

- EUR 10m of Tier 3 subordinated Capital

How can we calculate the SCR Coverage Ratio?

SCR Coverage Ratio = Total Eligible Own Funds / SCR

All of Unlock Insurance’s capital falls within the SCR limits and therefore all their capital is eligible:

- =200m Shareholder’s Equity + 10m Tier 1 capital + 20m Tier 2 capital +10m Tier 3 capital

- = EUR240m / EUR100m = 240% SCR coverage ratio for Unlock Insurance

How can we calculate the MCR Coverage Ratio?

MCR Coverage Ratio = Total Eligible Own Funds / MCR

A maximum 20% of MCR can be covered by Tier 2 capital, therefore EUR8m of Tier 2 is eligible. No Tier 3 capital is eligible for the coverage of the MCR:

- =200m Shareholder’s Equity + 10m Tier 1 capital + 8m of Tier 2 capital

- = EUR218m / EUR40m = 545% MCR coverage ratio for Unlock Insurance

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Sukhy Kaur

There are no available videos from "Sukhy Kaur"