The Failure of Lehman Brothers I

January Carmalt

20 years: Research & banking

The collapse of Lehman Brothers stands today as the largest bankruptcy in American history. In this video January highlights the reason behind the collapse of Lehman Brothers and where did it go so wrong.

The collapse of Lehman Brothers stands today as the largest bankruptcy in American history. In this video January highlights the reason behind the collapse of Lehman Brothers and where did it go so wrong.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

The Failure of Lehman Brothers I

10 mins 11 secs

On 15 September 2008, Lehman Brothers collapsed and became the largest bankruptcy in US history, just months after reporting record profits. Today Lehman is a cautionary tale of Wall Street greed and hubris, however its demise lay in collaborating with Main Street and facilitating the mortgage boom of the Nineties and Noughties. A series of balance sheet busting acquisitions catapulted Lehman into one of the country’s largest underwriters of subprime mortgages. Lehman had evolved from an asset-light, transaction driven trading house into a bloated behemoth laden with toxic assets, notably structured CDOs and ABS securities that offered high returns but which cleverly concealed intrinsic risk. As rates increased and mortgages soured, markets fell dramatically to expose billions in losses at highly leveraged banks, Lehman in particular, that would eventually lead to its insolvency.

Key learning objectives:

What was the Glass-Steagall Act and how did its repeal indirectly facilitate Lehman’s demise?

What are ABS and CDO securities and how did Lehman employ them to grow its mortgage business?

What are leverage ratios and why are they important?

What are level 3 assets and why are they important?

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What was the Glass-Steagall Act and how did its repeal indirectly facilitate Lehman’s demise?

Put simply, the Glass-Steagall act of 1933 placed legal boundaries separating retail banks from investment banks. This prohibited retail banks from engaging in riskier investment banking activities including trading or underwriting securities on behalf of its customers, and/or acting in an advisory capacity for corporate clients (likewise affiliating with other companies who engaged in such activities). Vice-versa, it prevented investment banks from engaging in retail lending and deposit taking activities. The repeal of Glass-Steagall came with the Gramm-Leach-Bliley Act in 1999 and permitted investment banks and retail banks to collaborate and merge. The repeal of Glass-Steagall allowed Lehman Brothers to engage in retail banking activities and thereby take advantage of the booming subprime and Alt-A mortgage market. Lehman’s acquisition spree included Alt-A lender Aurora Loan Services and subprime lender BNC Mortgage. By 2008 Lehman had become one of the country’s largest subprime mortgage underwriters.

What are ABS and CDO securities and how did Lehman employ them to grow its mortgage business?

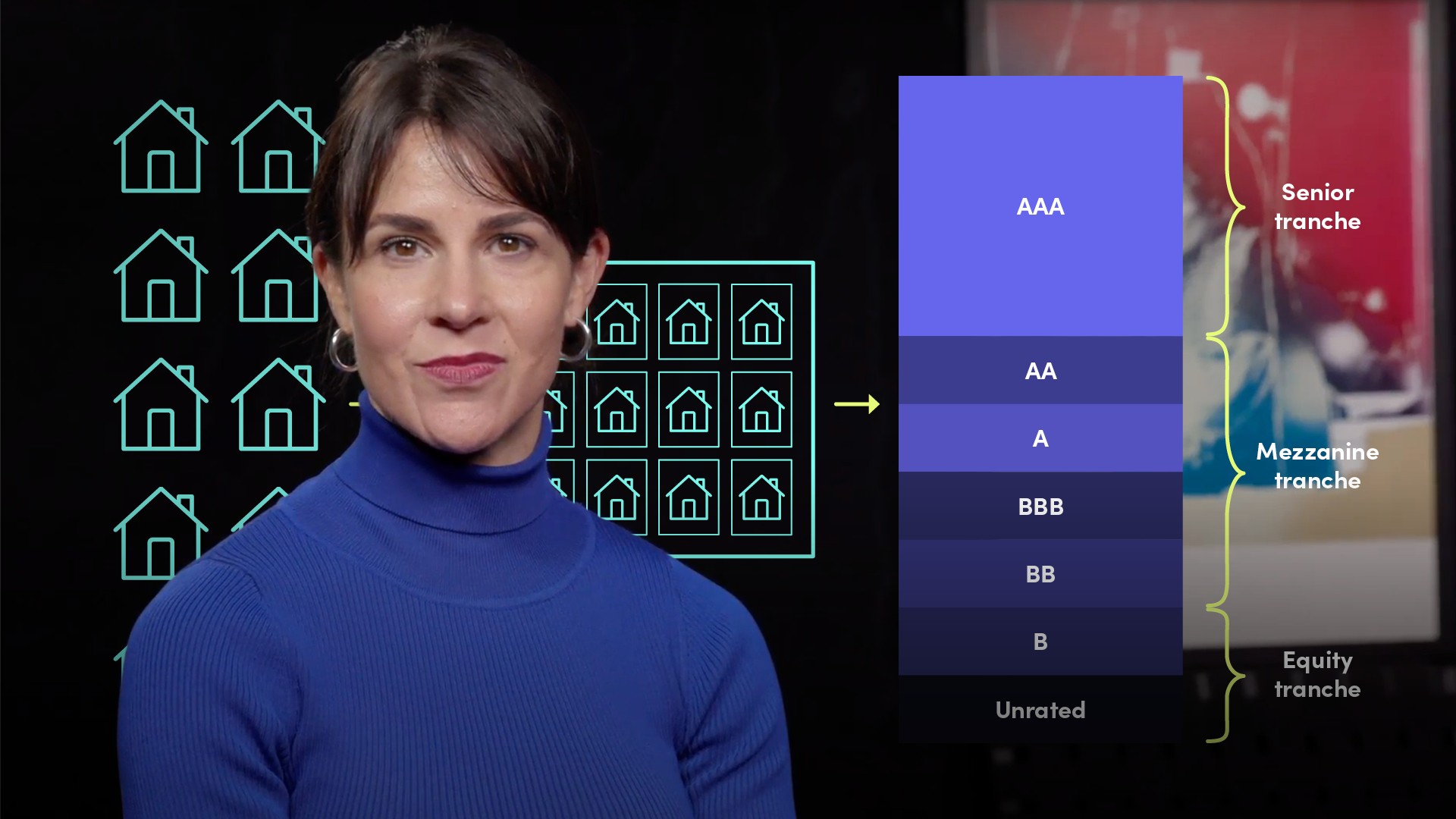

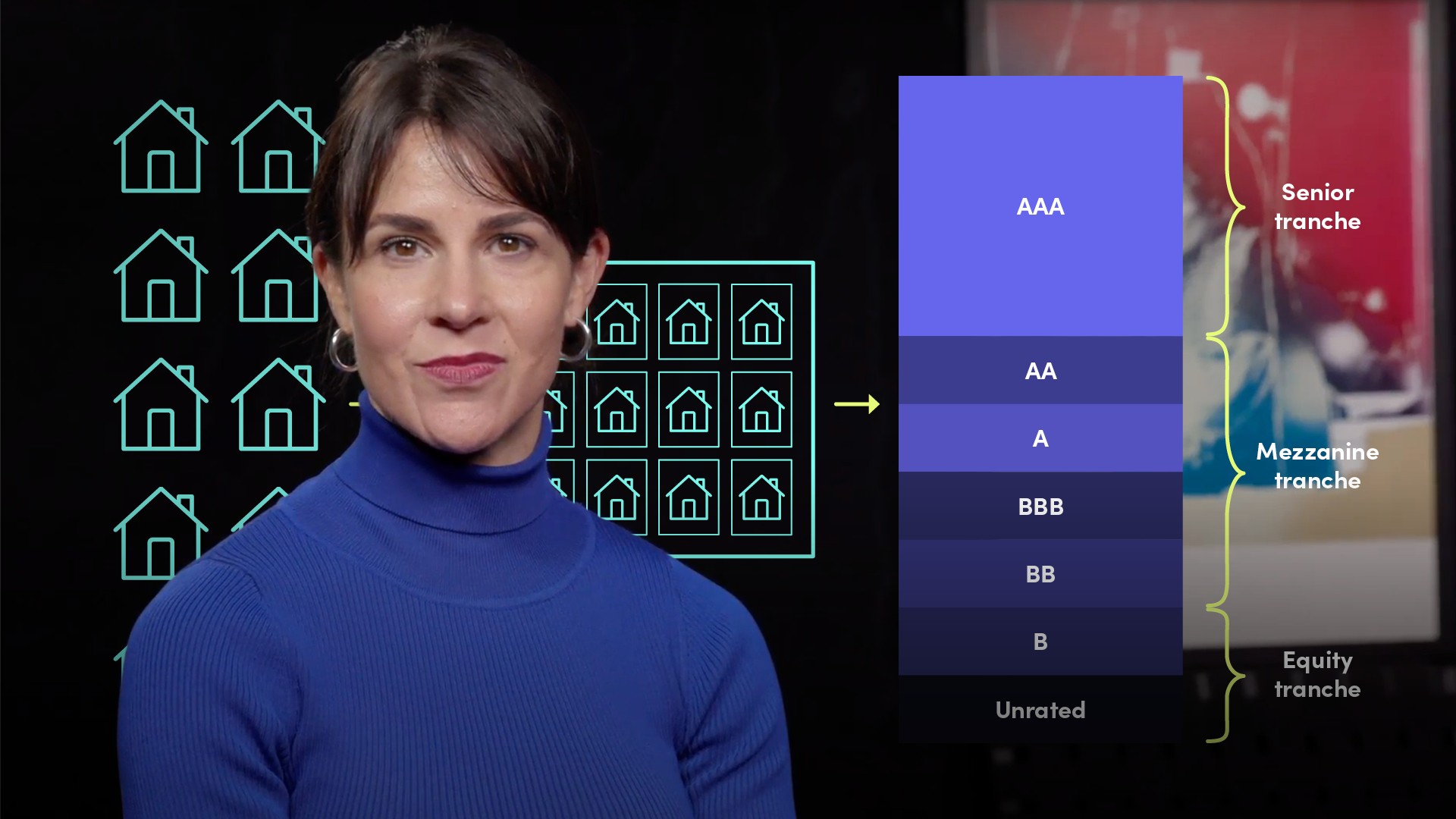

Asset Backed Securities (or MBS, Mortgage Backed Securities) are securities backed by a pool of debt , often auto loans or home loans and serviced by the interest and principal repayment of said pool of debt. Similarly, Collateralized Debt Obligations are structured securities that bundle then re-package and tranche loans, in this instance often subprime mortgages, each tranche ranked from senior to subordinated and assigned credit ratings according to their risk-modelled cash flows. These complicated, highly structured securities facilitated the mortgage boom of the 90’s and Noughties as retail banks originated loans and partnered with enterprising investment banks which underwrote, cleverly re-packaged and then syndicated billions in high risk subprime mortgages in the form of CDOs and ABS to investors. In a low-rate environment, demand for these high-return, optically low risk securities remained high for total return investors seeking yield. However, as rates increased and mortgage defaults rose, valuations of CDOs plummeted.

What are leverage ratios and why are they important?

When analysing investment banks, the leverage ratio is calculated as total assets divided by shareholders’ equity. These ratios are important as they are a key indicator of balance sheet strength. The higher the ratio, the smaller the capital buffer, or solvency of an institution. In 2008, leverage ratios for Lehman Brothers and its Wall Street rivals were well above 30x. At 31x, a 3% write-down of total assets would wipe out Lehman’s entire equity base of $28bn. Since 2008, leverage ratios have improved dramatically, falling from over 30x, to around 10x for most Wall Street players as the regulatory regime and minimum solvency requirements have strengthened.

What are level 3 assets and why are they important?

Level 3 assets are those securities impossible to accurately price due to an acute lack of liquidity. In 2008, over $40 billion of Lehman’s financial assets were classified as Level 3 assets. These included Lehman’s portfolio of MBS, ABS, CDOs and synthetic CDOs that had become largely illiquid and eclipsed Lehman’s $28 billion of shareholders’ equity.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

January Carmalt

There are no available videos from "January Carmalt"