Post Pandemic Inflation Cycle II

Thanos Papasavvas, CFA

30 years: Asset management

In this video, Thanos explains why inflation is not dead, but hibernating and about to wake up. He further talks about the number of factors that raise inflation above market expectations which impact both developed and emerging markets and particularly those which are resource and commodity importers.

In this video, Thanos explains why inflation is not dead, but hibernating and about to wake up. He further talks about the number of factors that raise inflation above market expectations which impact both developed and emerging markets and particularly those which are resource and commodity importers.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Post Pandemic Inflation Cycle II

7 mins 20 secs

Inflation is expected to come back not in the near term and not through an inflationary crisis - as we have the tools and the know-how to battle that. These are likely to have an effect on both developed and emerging markets and, in particular, on resource and commodity importers.

Key learning objectives:

Identify the 5 key reasons that may cause inflation to return

Explain each of the above reasons in detail

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What are the 5 potential reasons that will cause inflation to return?

1.Receding Globalisation

Globalisation is receding, with supply chains moving closer to home, thereby rising labor costs. Alongside geopolitical trends, the latest pandemic has shown the value of keeping supply chains closer to home for certain national industries. As a result, labour costs are expected to rise as manufacturing comes closer to the developed world.

2. Geopolitical tensions

Geopolitical problems instigated by President Trump over the last few years are not temporary. Sino-US tensions are also expected to continue under the Biden administration; the 'tone' may be different, but the 'message' remains hawkish.

Likewise, tensions between the US and the EU will improve, but the EU administration cannot rely on the Transatlantic relationship post-World War II, as future presidents will not adhere to the pre-Trump ideology. We therefore expect tensions to continue and tariffs to be part of statecraft. Higher tariffs are also a major contributor to higher prices.

3. Unprecedented stimulus

The magnitude of policy stimulus post Covid-19 has been unprecedented. In the first two months, the G7 finance ministers provided $7tn of fiscal stimulus, which was more than three times the stimulus of the 2008-2010 Global Financial Crisis at $1.9tn, with central banks contributing 19% to Japan, 13% to the US and 9% to the UK.

Budget deficits and levels of debt have risen to levels unacceptable only a few years ago – when the medicine for crisis stricken eurozone countries of the South was austerity.

4. Widespread stimulus

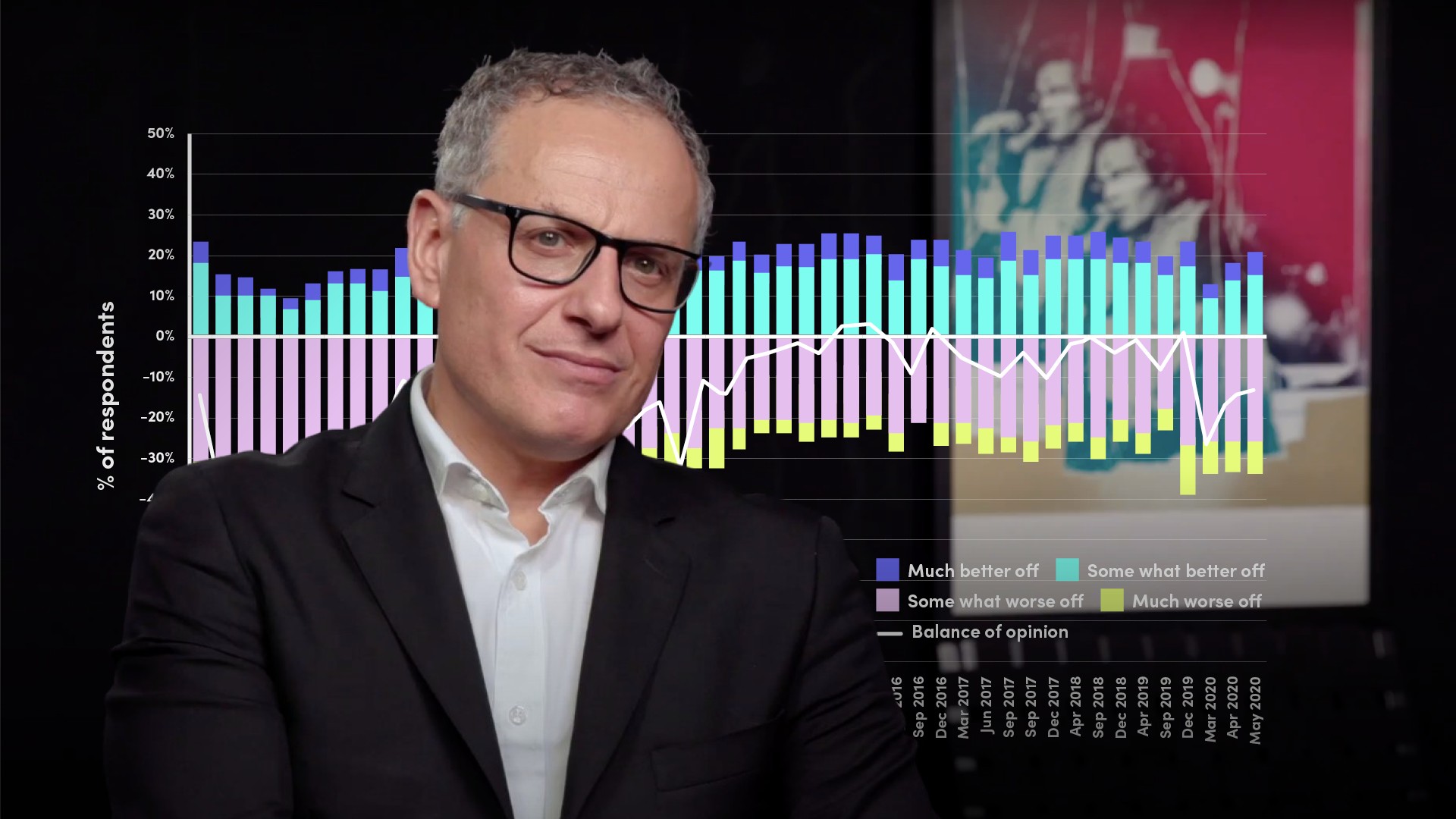

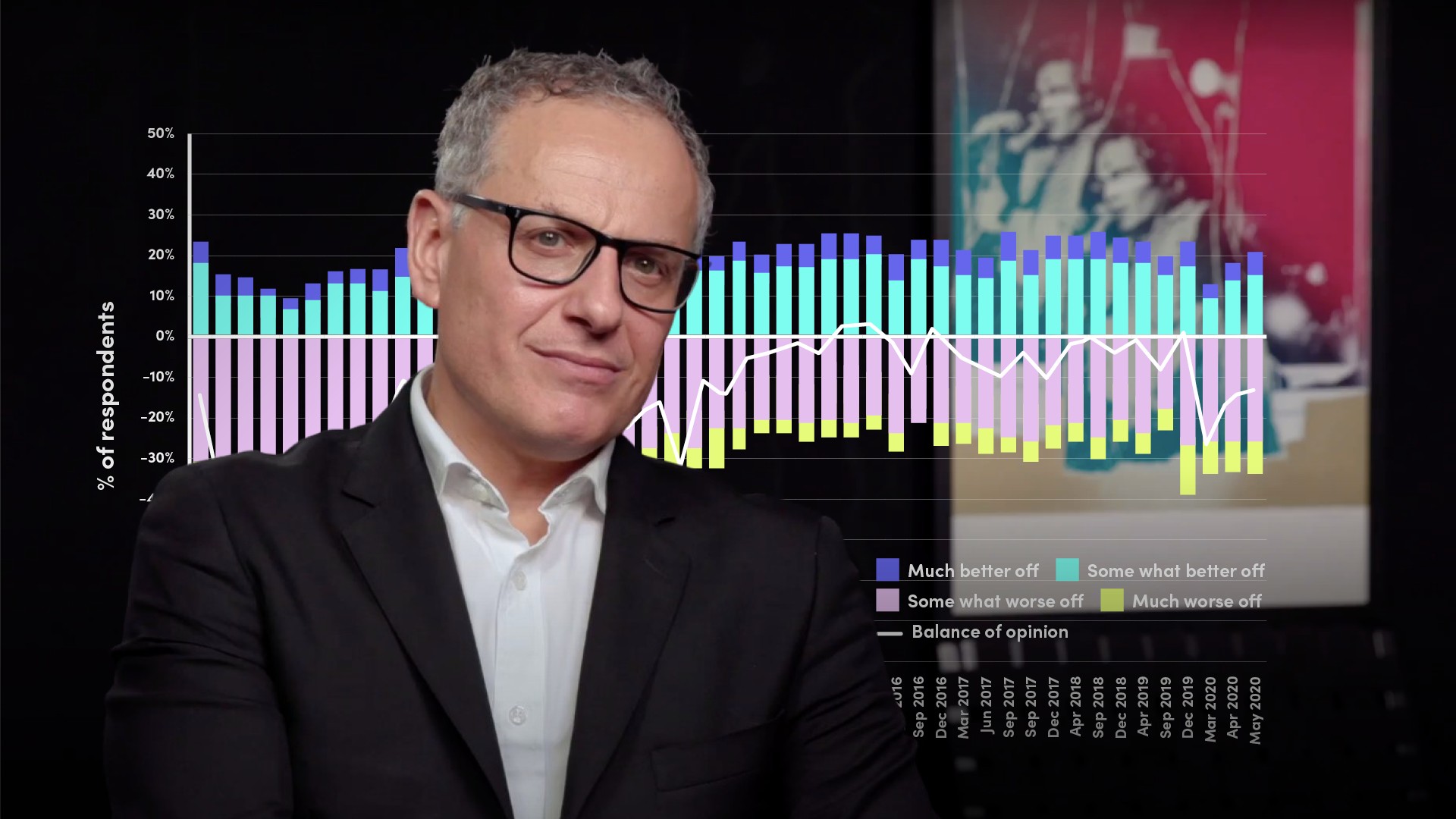

Another key distinction compared to the GFC is that the stimulus was not only aimed at systemic institutions, but mainly enabled banks to fix their balance sheets and prevent collapse. This time round, stimulus has been widespread across households and small and medium-sized businesses across all sectors of the economy. Households have maintained a relatively positive consumer sentiment when compared to previous recessions. Once we see economic stability alongside some vaccine developments, consumers are very likely to surpass the recent highs – fuelling demand and rising prices.

5. Central banks want inflation to wake up

We have seen a clear shift in policy thought from the Federal Reserve which announced a change in its inflation policy towards an average of 2% inflation compared to a target of 2% inflation. This denotes an acceptance of inflation having to rise above 2% in order to ensure that the average over time achieves the 2% level.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Thanos Papasavvas, CFA

There are no available videos from "Thanos Papasavvas, CFA"