What is the Net Stable Funding Ratio (NSFR)?

Moorad Choudhry

34 years: Banking and Capital Markets

The Net Stable Funding Ratio, or NSFR, is one of many liquidity risk metrics used as part of a bank’s suite of risk exposure indicators. Moorad describes the objective of the NSFR and how it is defined, as well as what Available Stable Funding (ASF) and Required Stable Funding (RSF) mean as factors of the NSFR metric.

The Net Stable Funding Ratio, or NSFR, is one of many liquidity risk metrics used as part of a bank’s suite of risk exposure indicators. Moorad describes the objective of the NSFR and how it is defined, as well as what Available Stable Funding (ASF) and Required Stable Funding (RSF) mean as factors of the NSFR metric.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What is the Net Stable Funding Ratio (NSFR)?

7 mins 35 secs

NSFR is used to determine how much “available” funding there is for a bank, and how much funding is “required” over the long term. A bank must run an NSFR of above 100% at all times, to indicate that it has a long term stable structural funding position in place. A bank that reports a level below 100% must take steps to either increase its ASF, reduce its RSF, or both.

Key learning objectives:

Define NSFR and outline its aims

Describe the NSFR metric and what it tells us

Define the terms ASF and RSF

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What is NSFR, and what are its aims?

- The Net Stable Funding Ratio (NSFR) is a bank liquidity risk metric that was introduced as part of the Basel Committee's banking supervision guidelines following the 2008 bank crash.

- In short, the aim of the NSFR is to strengthen the maturity profile of a bank’s funding, in order to maintain a stable funding structure.

What is considered by Basel to be the minimum length, to qualify as “good funding”?

The longer the better, of course, though Basel has set the line at one year, beyond which funding is considered to have value for NSFR purposes, whereas funding with a remaining term of less than one year essentially has a lower value.

What is the theory behind NSFR?

It promotes balance sheet funding resilience over the longer term; setting a limit for it ensures that sufficient long-term funding is in place to support a bank’s assets. In other words, maintaining an adequate NSFR should help considerably in ensuring a stable funding structure for any bank over the long term.

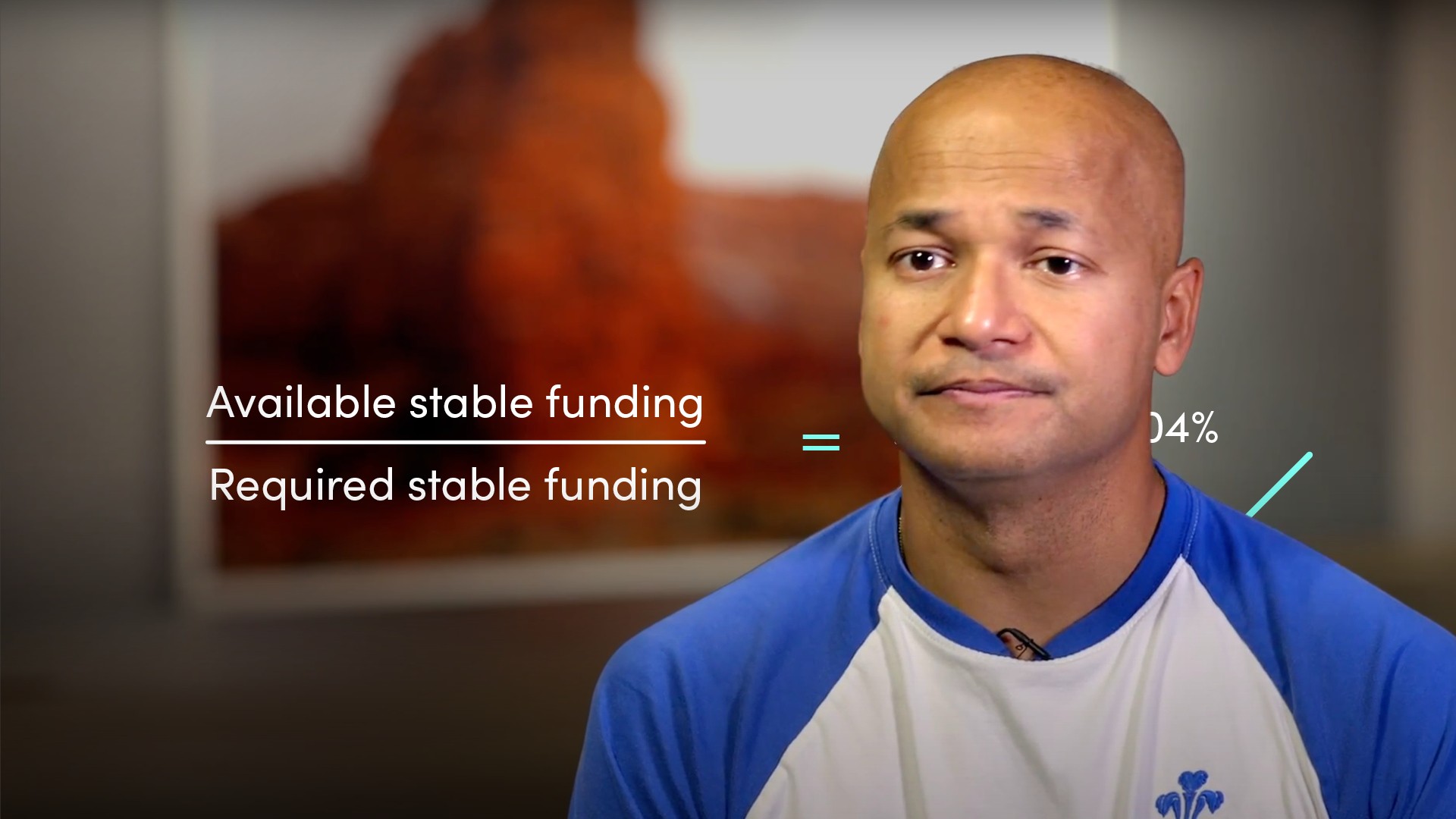

What is the NSFR metric, and what does it tell us?

Available Stable Funding / Required Stable Funding >c.100%

- The metric measures the amount of stable funding as a proportion of the total requirement for such stable funding

- A low ratio indicates a concentration of funding in shorter maturities which can give rise to roll-over and mismatch funding risks

- The minimum value of the NSFR is set as a regulatory limit that a bank will not be allowed to fall under. The BCBS recommended limit for NSFR is a minimum of 100%.

How does the BIS define available stable funding (ASF)?

A bank’s total ASF is the portion of its capital and liabilities that will remain with the institution for more than one year.

- ASF factors range from 100% - meaning that the funding is expected to be still fully available in more than one year - to 0% - reflecting that the funding from this source is unreliable. The three other ASF factors are 95%, 90% and 50%.

- The total amount of ASF is the sum of the ASF amounts for each category of liability.

How does the BIS define required stable funding (RSF)?

A bank’s total RSF is the amount of stable funding that is required to hold given the liquidity characteristics and residual maturities of its assets and the contingent liquidity risk arising from its off-balance sheet exposures

- An RSF factor of 100% means that the asset or exposure needs to be entirely financed by stable funding because it is illiquid. An RSF factor of 0% applies to fully liquid and unencumbered assets. The other RSF factors are 85%, 65%, 50%, 15%. 10% and 5%.

- The total RSF amount is the sum of the RSF for each category.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Moorad Choudhry

There are no available videos from "Moorad Choudhry"