Trade Finance as a Risk Management Tool

Aidan Applegarth

30 years: Commodity & trade finance

Within Trade Finance there is an inherent conflict between buyers and sellers in different locations. In this video, Aidan explores how effective risk management affords the transparency and ‘hands on’ engagement that facilitates diligent commercial lending.

Within Trade Finance there is an inherent conflict between buyers and sellers in different locations. In this video, Aidan explores how effective risk management affords the transparency and ‘hands on’ engagement that facilitates diligent commercial lending.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Trade Finance as a Risk Management Tool

4 mins 34 secs

To understand the role of Trade Finance in managing risk, we need to appreciate the inherent conflict when buyers and sellers in different locations interact. This pivotal risk management role becomes an enabler for providing working capital, since it affords the transparency and ‘hands on’ engagement that facilitates diligent commercial lending. It means that potential problems may be spotted before they can cause harm, allowing protective steps to be taken. It is a key contributor to Trade Finance’s low default experience.

Key learning objectives:

Understand how trade finance is used in relationship to risk management

Know what trade finance means in regards to working capital

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Why is trade finance important when evaluating risk?

Essentially, the lowest risk for a seller is the highest risk for a buyer, and vice versa. That means that a buyer would be disadvantaged by having to trade using a seller’s preferred terms, and a Seller would be disadvantaged by having to trade using a buyer’s preferred terms.

Unless there are overriding reasons why one should adopt the other’s preference (for example, they’re part of the same group or trust each other unequivocally) then they need to meet at a ‘sweet spot’ where each is comforted by the use of a professional intermediary. That sweet spot is typically where banking channels are used to Issue or Advise Documentary Letters of Credit, or to handle Inward or Outward Collection of monies.

Why is trade finance important when evaluating working capital?

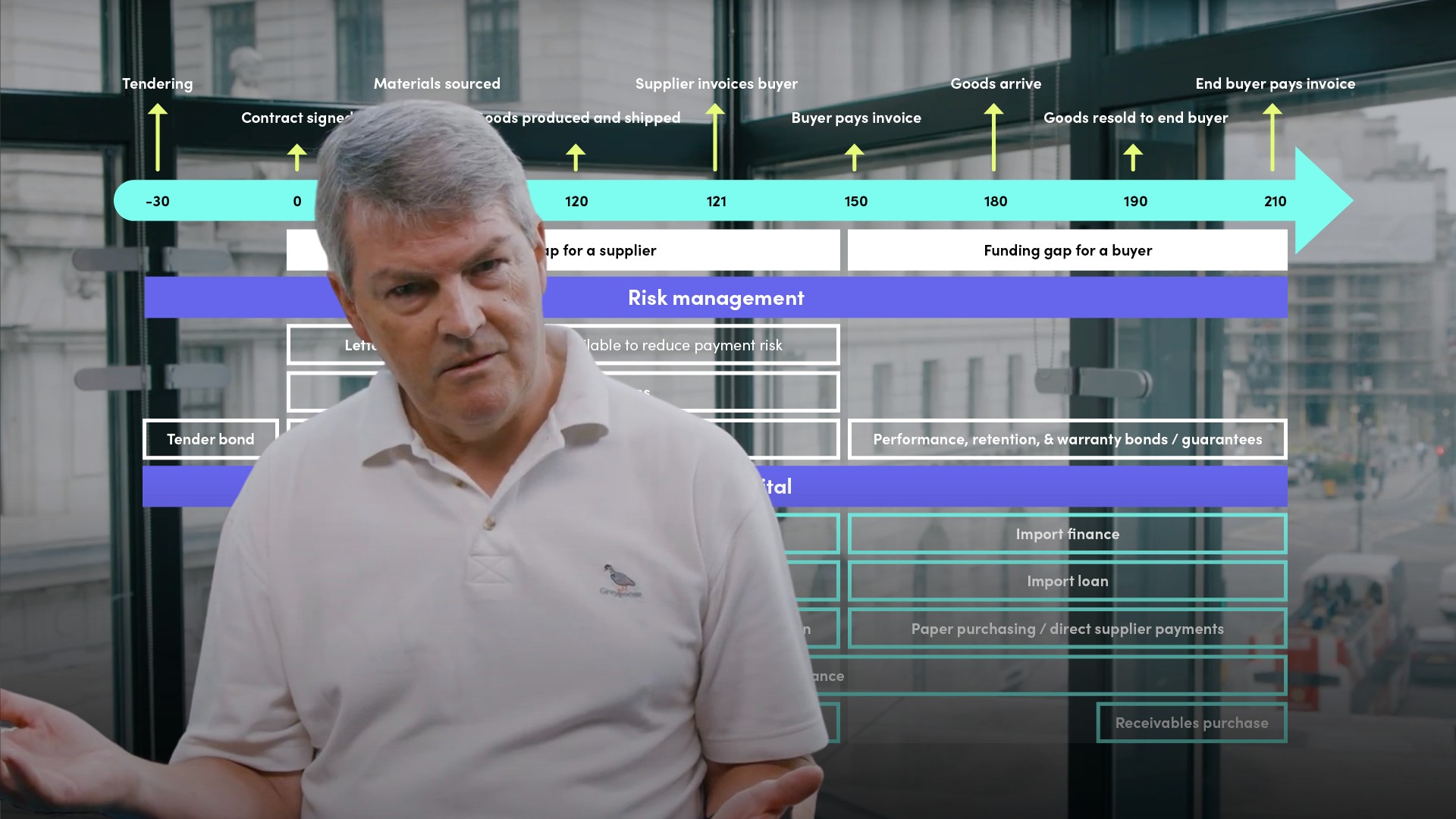

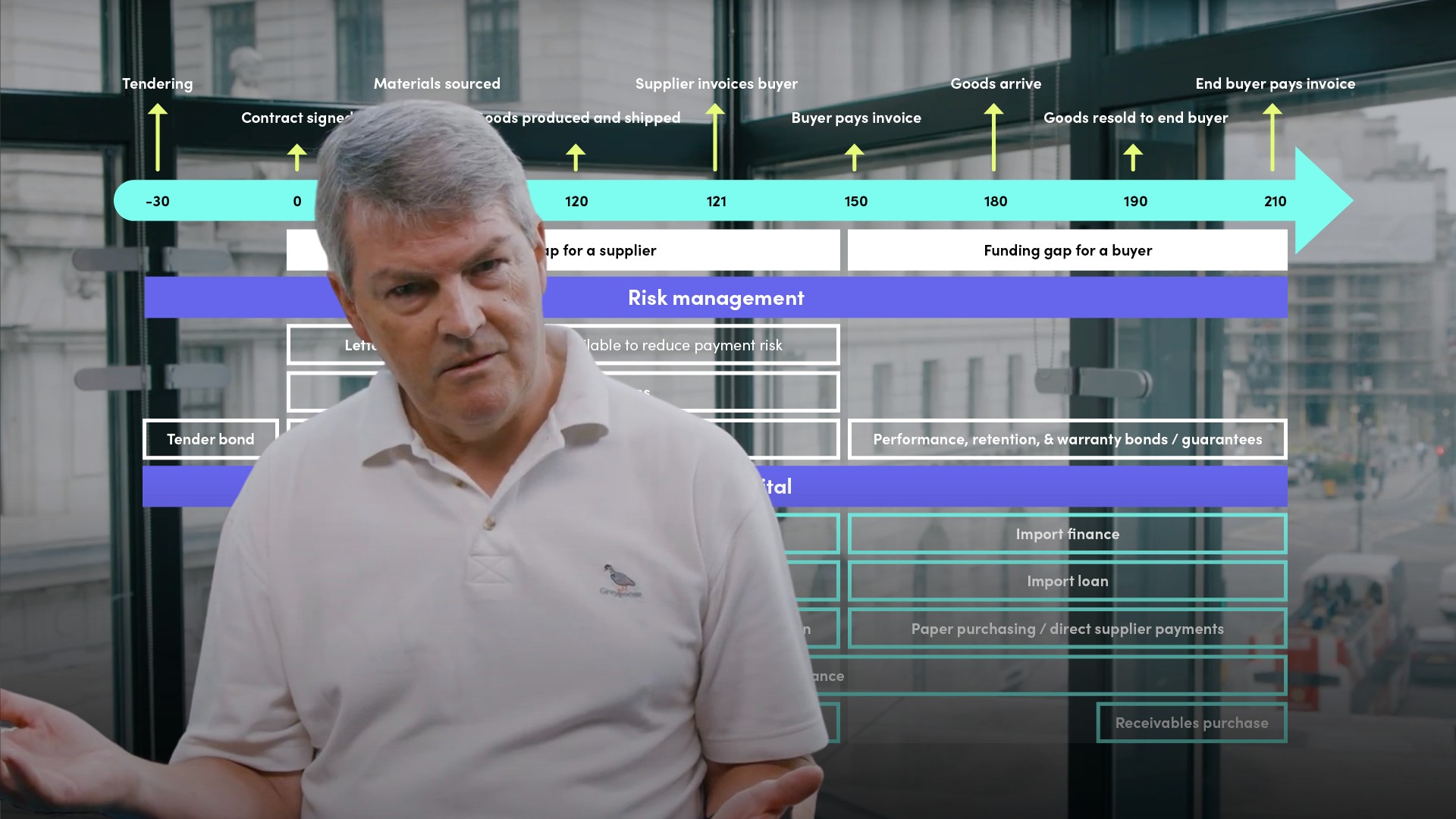

To put the Risk Management role of Trade Finance in to perspective as a provider of working capital, let’s look at an illustration of the Trade Cycle which offers at the top [the black bar] a timeline that captures key milestones during a ‘typical’ trade transaction, from tendering through sourcing materials to shipment and eventual payment.

What does the Trade Cycle tell us?

Revealed here are the funding gaps for the supplier and for the buyer, and below that are the Trade Finance instruments that provide risk management solutions. Finally here are the working capital products that meet each party’s funding gap. What should be noted here is that these working capital solutions are blended to the risk management solutions such that applying risk management instruments becomes the enabler for the provision of working capital. This is key to contributing to Trade Finance’s low loss default experience.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Aidan Applegarth

There are no available videos from "Aidan Applegarth"