XVA Case Study

Steven Marshall

25 years: Derivatives trading

In this video, Steven explains a worked example of how to calculate and estimate the costs associated with an uncollateralised interest rate swap. The costs include CVA, DVA, FVA, and the cost of capital.

In this video, Steven explains a worked example of how to calculate and estimate the costs associated with an uncollateralised interest rate swap. The costs include CVA, DVA, FVA, and the cost of capital.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

XVA Case Study

12 mins 42 secs

XVA adjustments encompass a range of crucial factors, including adjustments for credit, funding, collateral, and cost of capital. Credit Valuation Adjustment (CVA) is used to evaluate the anticipated loss in the event of a counterparty default. Secondly, the Debit Valuation Adjustment (DVA) considers the economic gain the bank may receive if its creditworthiness declines. Thirdly, the Funding Valuation Adjustment (FVA) reflects the expenses associated with financing the transaction. Finally, the Capital Valuation Adjustment (KVA) assesses the impact of the cost of capital throughout the lifespan of the deal. In summary, XVA adjustments play a critical role in determining the overall value and risk associated with complex financial transactions. The trade used in the example is an uncollateralised $10m interest rate swap between a bank and a counterparty with the bank paying fixed and receiving floating.

Key learning objectives:

Understand how CVA is calculated

Understand how DVA is calculated

Understand how FVA is calculated

Understand how KVA is calculated

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

How is CVA calculated?

The Credit Valuation Adjustment (CVA) is used to calculate the expected loss in case of default by the counterparty in the $10m uncollateralised interest rate swap.

The calculation involves considering the swap only when the present value is positive, using a Monte Carlo simulation to determine the Expected Positive Exposure (EPE), and discounting the expected losses using a Credit Default Swap (CDS) curve and an assumed recovery rate.

The CVA charge is then calculated, which, in this case, is around $70,000 or an 8.5bps running spread, but the risky duration of the swap needs to be considered (please refer to the video for a comprehensive table display).

How is DVA calculated?

The economic Debit Valuation Adjustment (DVA) is sometimes used for accounting purposes, even though it can be controversial.

DVA is computed using the "Expected Negative Exposure" (ENE), which is calculated similarly to the "Expected Positive Exposure" (EPE) using a Monte Carlo simulation. Using Bloomberg, we can view the ENE profile and calculate the DVA benefit using our CDS curve with a spread of 100 bps and a 40% recovery, which in this case is $25,700 or 3bps running spread (please refer to the video for a comprehensive table display).

How is FVA calculated?

The Funding Valuation Adjustment (FVA) is the cost of financing a transaction when no collateral is posted. It's normally calculated by adjusting the discount rate to the funding level where cash is funded for the term.

The adjustment is symmetric and depends on whether the present value is positive or negative. For this swap, the FVA benefit is less than $1,000, which is positive due to the US yield curve being upward sloping (please refer to the video for a comprehensive table display).

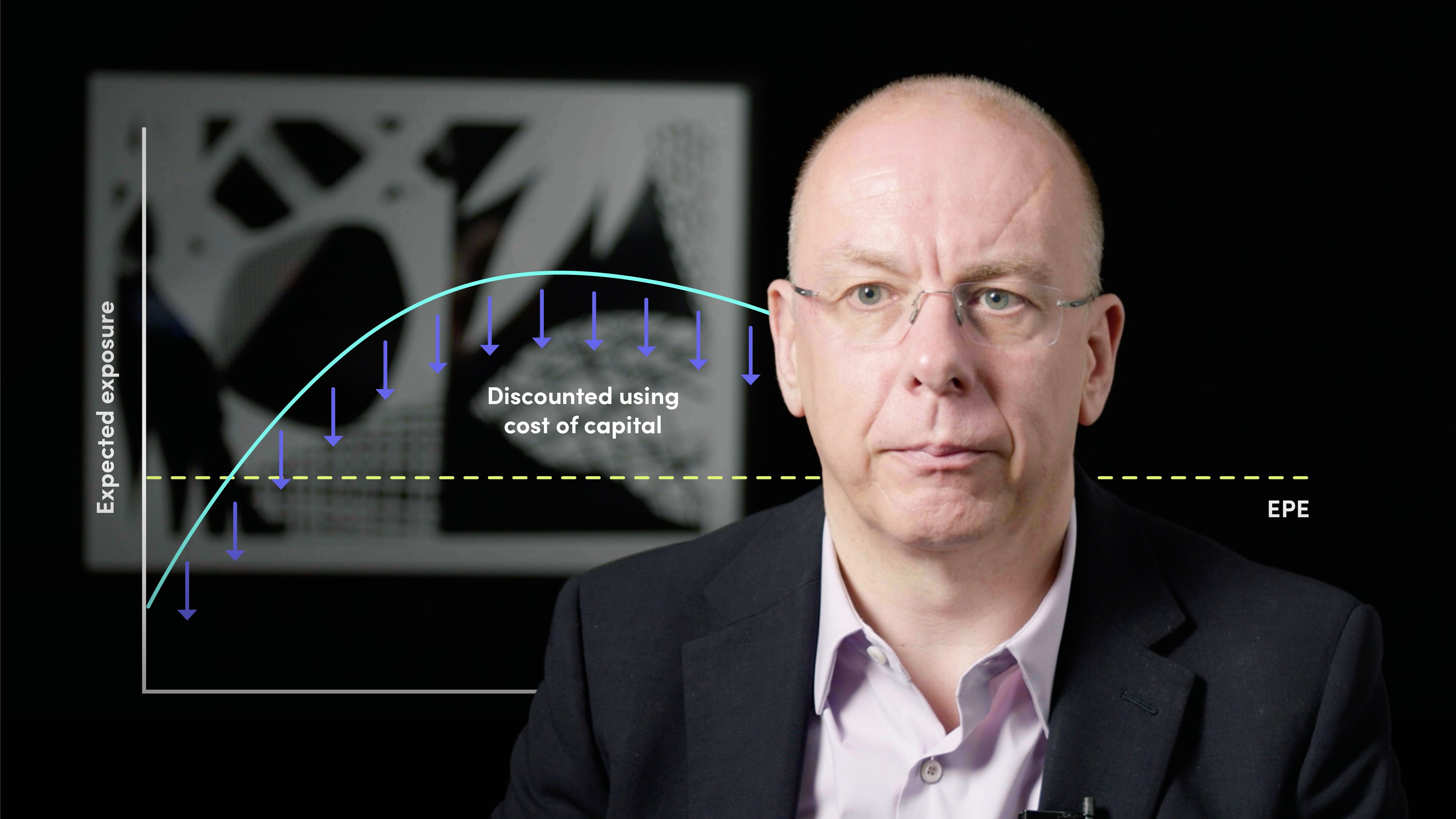

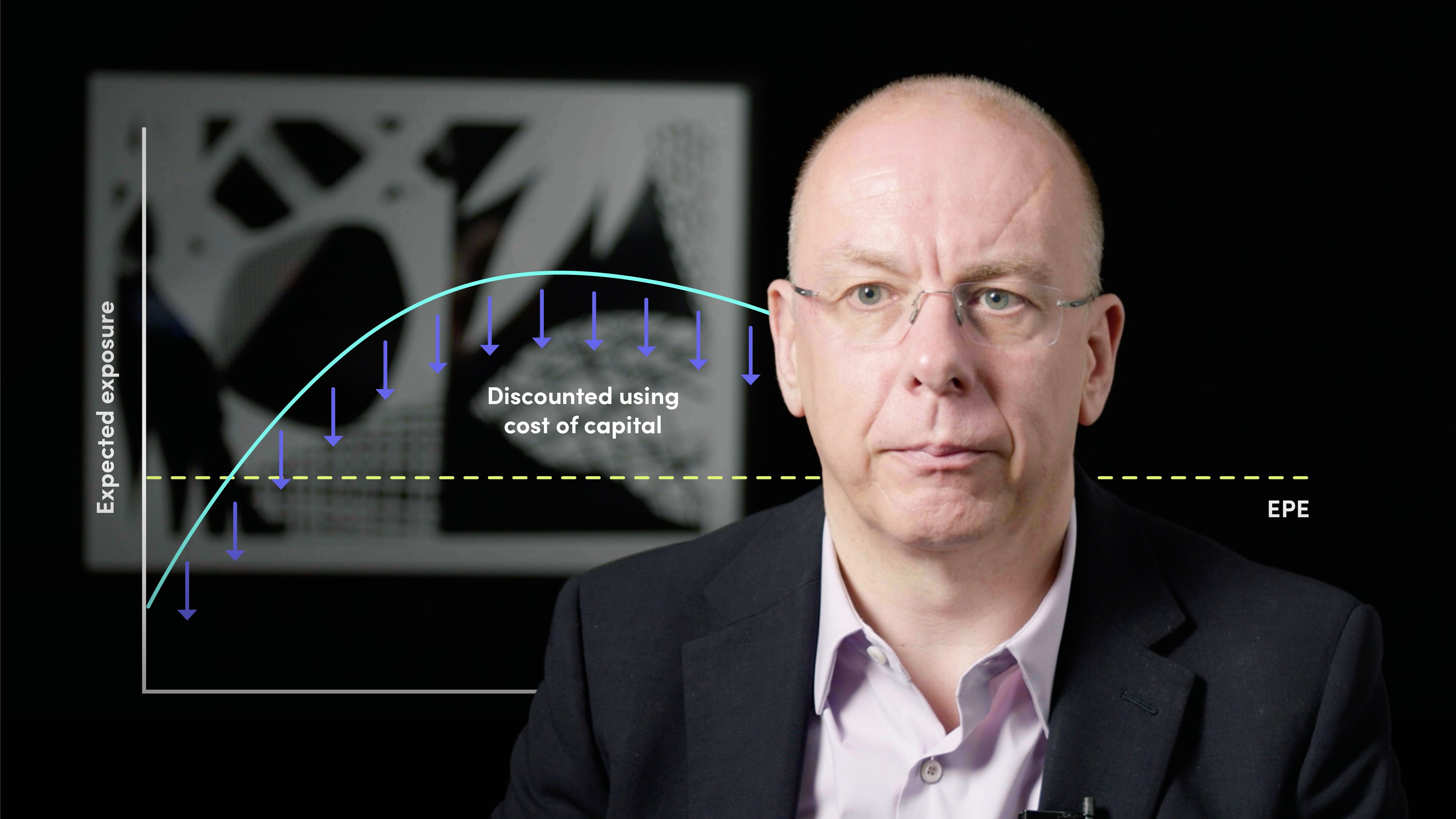

How is KVA calculated?

Calculating CVA, DVA, and FVA is relatively simple, but estimating the cost of capital over the life of a deal is complex. Under Basel 2.5, the EPE profile was used to estimate the forward Counterparty Credit Risk, but Basel 3 requires more complex calculations for the Risk Weighted Assets (RWA). Estimating an average cost of capital is possible, but determining the optimal deployment of capital is important. If capital is not fully deployed, it might be deployed for a shorter period at a lower rate, and locking up capital for a longer period should require a higher return due to the loss of the option of deploying that capital later. This drives a term structure for capital discounting.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Steven Marshall

There are no available videos from "Steven Marshall"