Finance Unlocked has committed to reach net zero emissions by 2022

The urgency of the climate crisis has never been more clear: humanity must drastically reduce its carbon emissions if it is to avoid catastrophic levels of global warming.

Our commitment to Net Zero

Our commitment to Net Zero

As a business involved in the global effort to educate about the importance and practicalities of climate change action, we strive to ensure that our operations align with our values.

Finance Unlocked has committed to reaching net-zero emissions by the end of the year.

This means reducing or offsetting our carbon emissions so that the business as a whole does not add any greenhouse gases to the atmosphere. We have already begun to analyse our practices, suppliers, and systems to identify carbon sources and find ways to eliminate them or offset them through ecological carbon capture.

Why we are taking action

Why we are taking action

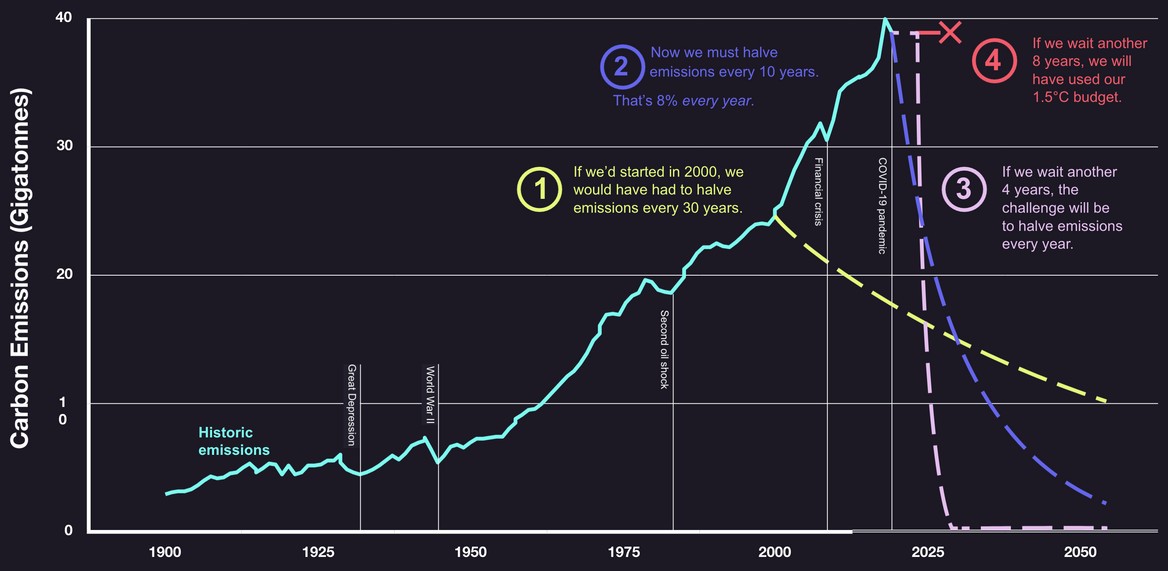

To stabilise temperatures at below 1.5°C of warming, and avoid triggering runaway climate change, emissions need to fall by about 8% every year for the next two decades.

To put that 8% figure in context: in 2020, COVID-19 enforced full-scale shutdowns of economies and entire transportation sectors; this only caused a 7% drop in emissions!

The Tech Zero Taskforce

The Tech Zero Taskforce

That's why we’ve joined Tech Zero, a group for tech companies committed to climate action. Other members include; Babylon Health, Citymapper, GoCardless, Habito, OLIO, Onfido, Revolut, and Wise. Our work will make it easier for other companies to set and reach their own net-zero targets.

Our Pledge

Our Pledge

To keep warming below 1.5°C - and avoid the worst impacts of the climate crisis - we’re committed to removing all emissions we possibly can from our operations and offsetting any that cannot be eliminated immediately to ensure Finance Unlocked is Net Zero by 2022.

As part of our Net Zero commitment we will:

As part of our Net Zero commitment we will:

- Publish a detailed action plan to reach Net Zero by the end of 2022

- Measure and publish all scope 1, 2 and 3 greenhouse gas emissions reports publicly each year (our already low carbon footprint was measured as 10.03 CO2e in 2019 and 28.64 CO2e in 2020 in an audit by Earthly)

- Appoint a member of the executive team to be responsible and accountable for our Net Zero target

- Continually work to reduce our emissions as a priority, offsetting what cannot be reduced or removed by 2022

- Report progress against our targets to our Board annually, and on this website

- Achieve B-Corp status following the submission of our application in 2021