Commodity Derivative Settlement

Emma Jenkins

30 years: Commodities expert

In this video, Emma explains us the two settlement mechanisms for commodity derivatives, "physical-settlement" and "cash-settlement". She also examines how well the price of a commonly traded commodity derivative, the commodity forward, converges to the price of the underlying commodity under each settlement mechanism.

In this video, Emma explains us the two settlement mechanisms for commodity derivatives, "physical-settlement" and "cash-settlement". She also examines how well the price of a commonly traded commodity derivative, the commodity forward, converges to the price of the underlying commodity under each settlement mechanism.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Commodity Derivative Settlement

8 mins 39 secs

Key learning objectives:

Describe the main features of a forward contract.

What is price convergence?

Explain why the prices of physically-settled contracts converge to the price of the underlying commodity.

Why can price convergence be weaker for cash-settled contracts?

Overview:

Commodity derivatives can either be physically-settled or cash- (or financially-) settled. The concept of price convergence is explained. Physically-settled contracts generally exhibit the best price convergence. Cash-settled contracts use an index to calculate the final cash settlement amount and will only exhibit good price convergence to the underlying commodity if the index closely tracks the underlying market. Forward contracts are defined and used to demonstrate price convergence.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Describe the main features of a forward contract.

- A forward contract is an agreement to buy or sell a fixed quantity of an agreed physical format of a commodity at a fixed price on a fixed settlement date.

- The quantity, price and settlement date are all agreed at the inception of the forward contract and cannot be changed.

- The buyer agrees to buy the commodity at the agreed fixed price and the seller agrees to sell the commodity at the agreed fixed price.

- The agreed fixed price is called the forward price.

What is price convergence?

Price convergence is when the price of a contract aligns with the commodity which underpins the contract. Movements in the price of the contract are closely correlated with movements in the price of the underlying commodity.

Explain why the prices of physically-settled contracts converge to the price of the underlying commodity.

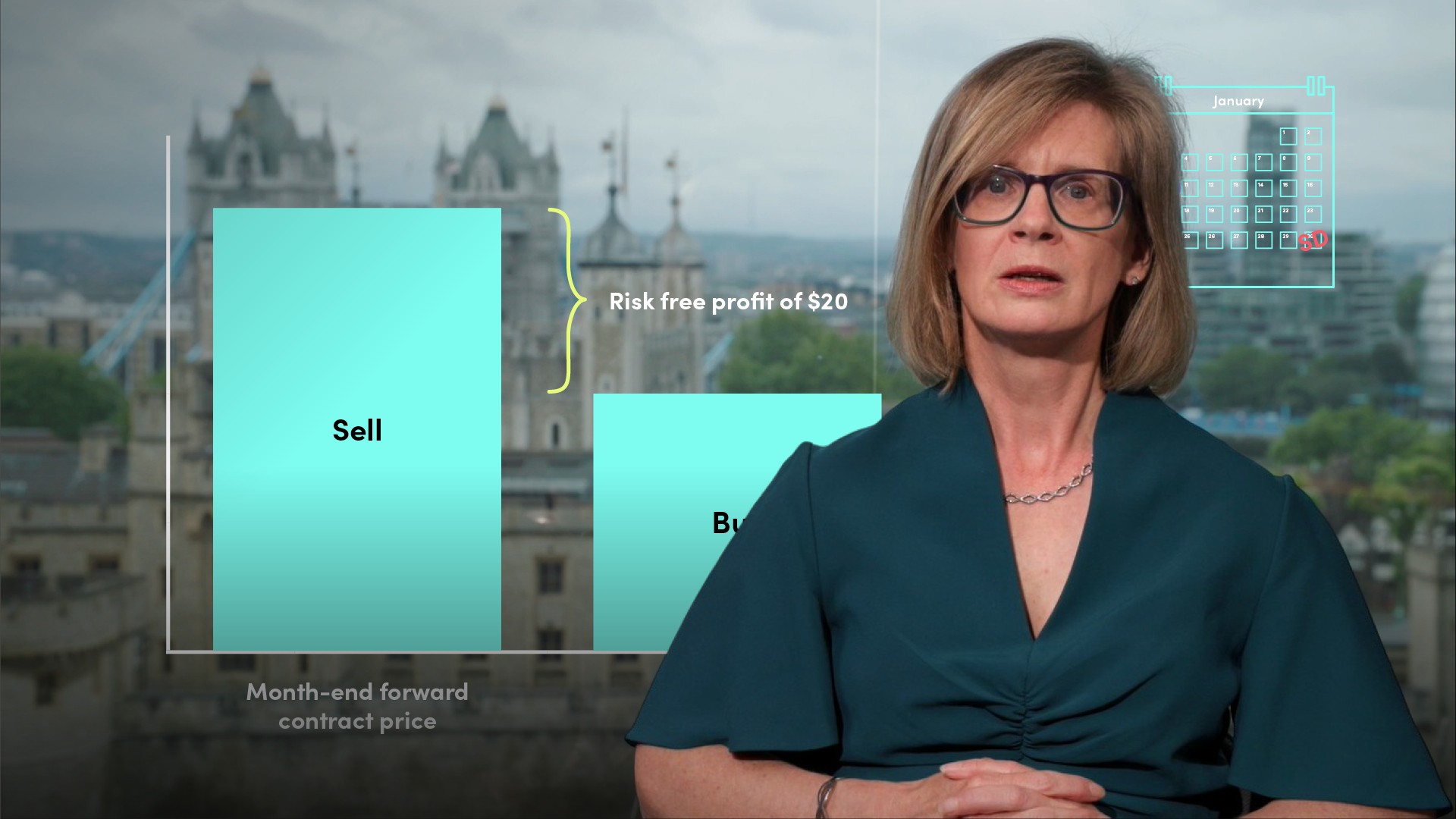

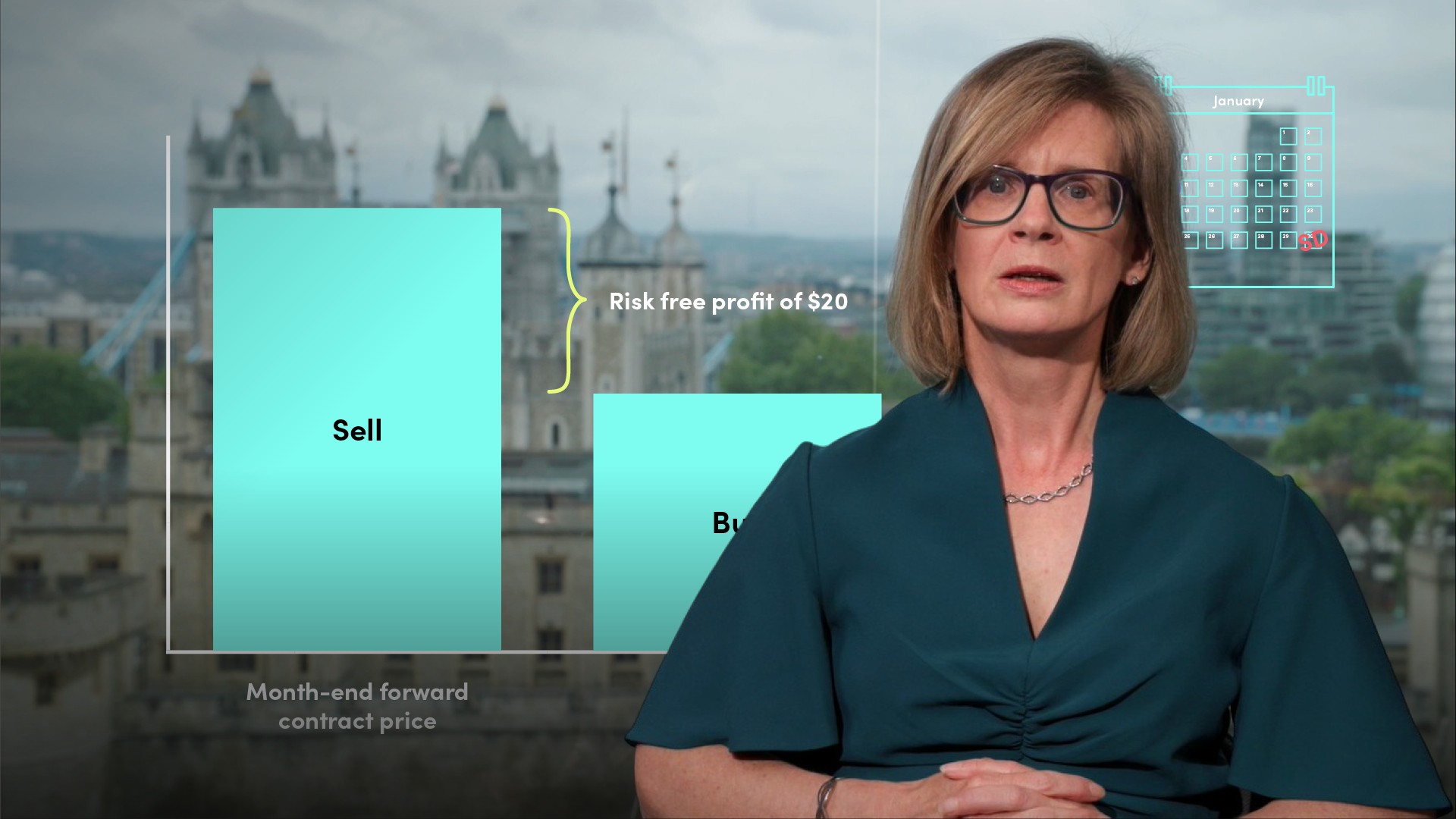

Physically-settled contracts essentially become the underlying commodity on the settlement date. If there is a discrepancy between the price of the contract and the commodity, there is a risk-free opportunity for profit:

- The cheaper asset can be purchased and the more expensive one sold.

- On the settlement date, the cheaper asset can be delivered to satisfy the sale of the more expensive one since the two assets are equivalent.

- The difference in prices is realised as a risk-free profit (less transaction costs).

While the price difference persists, there is an incentive to purchase the cheaper asset (putting upward pressure on those prices) and to sell the more expensive asset (putting downward pressure on those prices). If both assets can be readily traded, the price difference will be eliminated, and the prices converge.

Why can price convergence be weaker for cash-settled contracts?

Cash-settled contracts use an index to determine the value of the contract on the settlement date. Hence cash-settled contracts will converge to the value of the index on the settlement date, rather than directly to a specific commodity. The index associated with the cash-settled contract should closely track the underlying commodity market for the cash-settled contract to exhibit good price convergence. Price convergence for a cash-settled contract can be weaker than for a physically-settled contract since the cash-settled contract is one step removed from the underlying commodity.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Emma Jenkins

There are no available Videos from "Emma Jenkins"