The world of finance, unlocked

Discover our extensive content library covering all key areas of Finance. Find the right category for you, see our latest content, discover our featured programs and start your learning journey today.

Explore by category

Looking for something specific?

Search our extensive content library to find what you are looking for

Featured content

Tackling the Cost of Living Crisis

In this video, Max discusses the cost-of-living crisis currently enveloping the UK. He examines its impact on households as well as the overall economy. Max also outlines why traditional policy tools may not be enough to bring us out of the crisis and discusses some unconventional policies which may help.

Max Mosley • 10:39

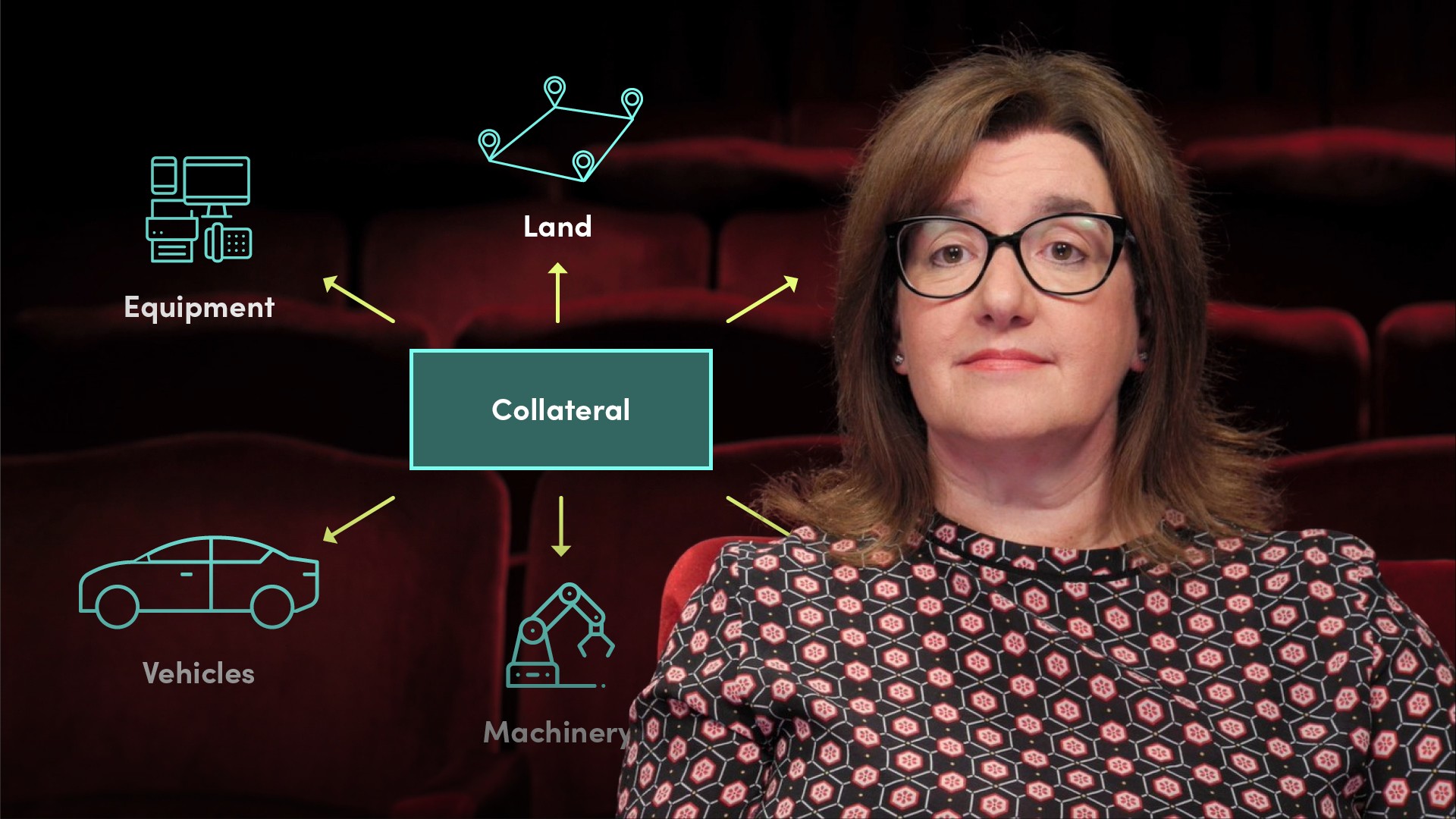

Collateral and Credit Risk Mitigation

Lenders can minimise LGD, and mitigate credit risk by taking collateral. This video explores all the different aspects of collateral such as the purpose of collateral, the different types of assets taken as collateral and the key points a lender must consider when taking collateral.

Belinda Green • 07:18

Alternative Data in Finance

Alternative data is the new gold in finance. Every time that we like, dislike, or post something online, we are creating this new breed of data. In fact, some companies are now using this to predict quarterly earnings and performance. Join Carlos Salas in this video as he explores the benefits and challenges of alternative data.

Carlos Salas • 09:09

Featured Certificate Program

Finance for the Corporate or Investment Banking Professional

Learn everything you need to know for a wildly successful career in corporate finance or investment banking, building from the foundations of markets to key specialist topics. Taught by top industry experts in each specific field.

Featured Certificate Program

Finance for the Non-Finance Professional

Working in a finance-adjacent role but not specifically trained as a finance professional? This course is for you. Get up to speed with the foundations of financial markets, banking, and much more to rapidly progress your understanding, and your career.

Featured Certificate Program

Finance for Board Executives

As a board executive, you must be able to prudently guide financial decisions, understand market movements, and effectively assess the health of business accounts. This course will give you a solid foundation in key financial concepts, allowing you to steer financial decisions with confidence.

Trending Pathways

Meet our experts

Josephine Tan

20 years: M&A

Simon Thompson

Managing Director and Author

Saket Modi

20 years: Chartered accountant & educator

Amit Kara

30 years: Macroeconomist

Nisrin Abouelezz

20 years: Structured finance and diversity advocate

Sir Ronald Cohen

Father of impact investing

Ciaran Rooney

20 years: technology, cybersecurity & operations

Lindsey Matthews

30 years: Risk management & derivatives trading

Trending video modules

Central Banks and Net Zero

The climate crisis has become one of the biggest threats to global economy, requiring the intervention of central banks. In this video, Sarah Breeden helps us understand the role of the Bank of England in supporting the economy from climate related risks. She briefly explains what science around climate change shows and then explains the future risks we face and the impacts that this will have.

Sarah Breeden • 06:43

Diversity and Inclusion in Financial Services

In this two-part series, Nisrin shares her insight into diversity and inclusion in the workplace, with a particular focus on the financial services industry in the UK. She also talks us through her experience as a woman in the banking sector, as gender equality, or the lack thereof, is a key issue among many others when it comes to matters of diversity and inclusion.

Nisrin Abouelezz • 06:25

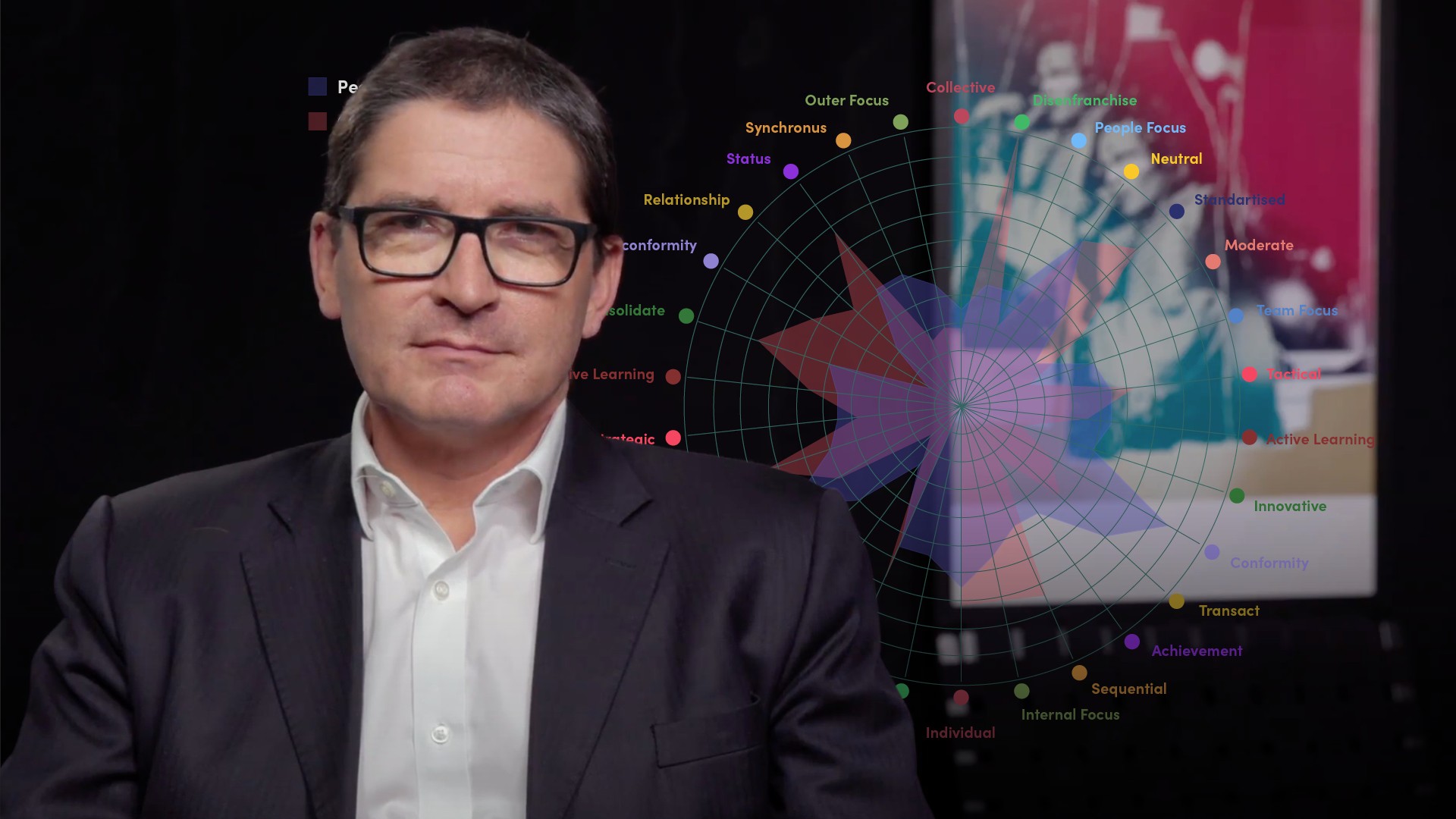

Internal and External Culture Assessment Tools

In part one of this video Roger described how conduct regulators are introducing culture measurement from 2021 onwards. In this video, he takes a deep dive into culture assessment and reporting tools and explains both internal and external tools required for cultural assessment.

Roger Miles • 14:08

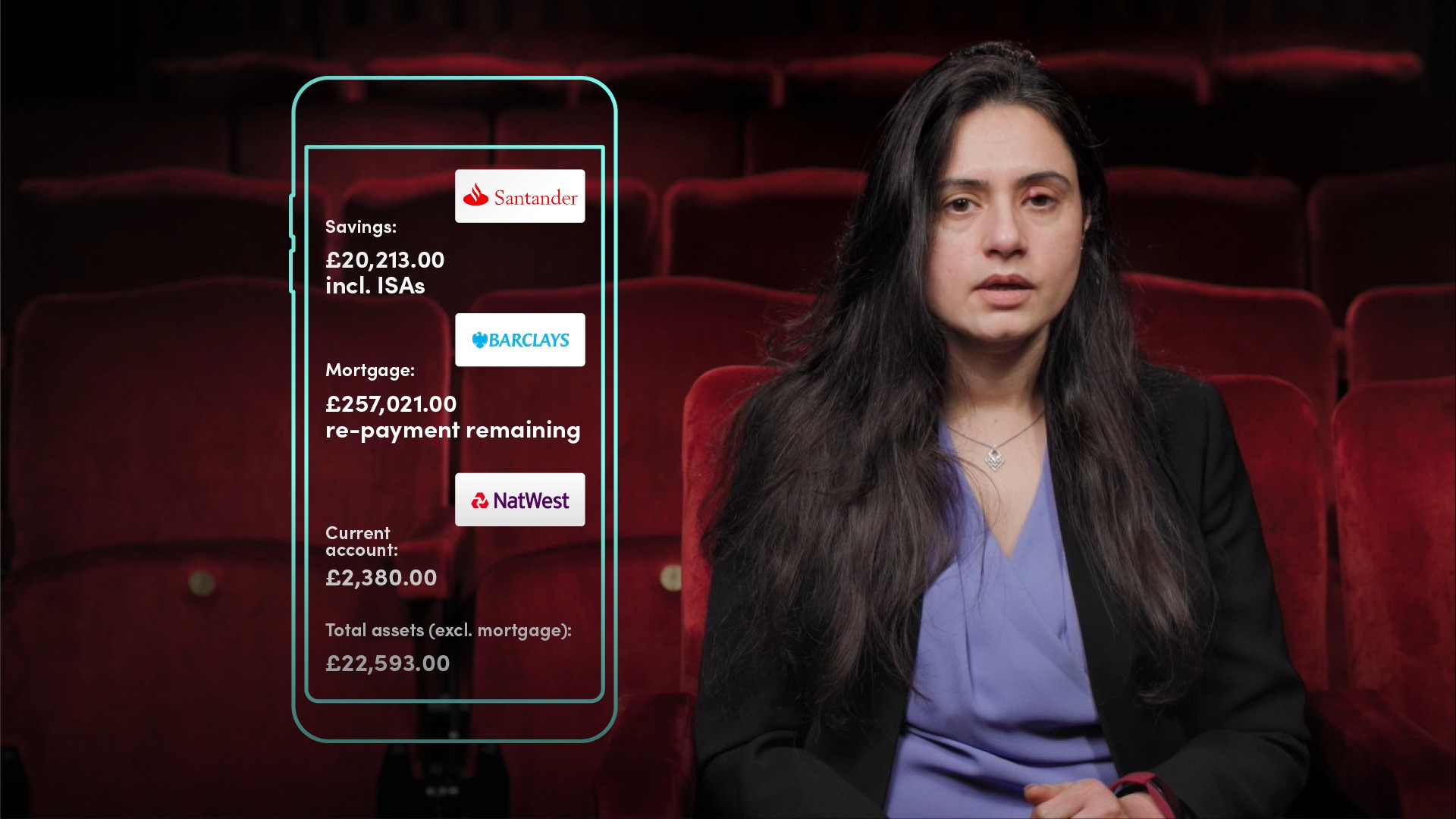

What are the Benefits of Open Banking?

Open banking refers to the idea that customers have a right to see, and utilise their entire portfolio of account information across all financial institutions with whom they have a relationship. In this video Ritu gives us an overview of Open banking and further highlights the expected practical implications of open banking for the customer.

Ritu Sehgal • 04:20

Macroeconomic Simulation of a Global Carbon Tax Shock I

In this video, Kemar explores the effects of a rise in carbon tax accompanied by a temporary rise in global credit constraints. Kemar will guide you through the two key aspects of a carbon tax shock and the anticipated economic knock-on effects.

Kemar Whyte • 09:43

The Need for Global Insurance Regulation

In the first video of this series, Sukhy emphasises the importance of regulating insurance companies with reference to the infamous collapse of AIG during the financial crisis. Sukhy discusses the international role of the Financial Stability Board (FSB) in insurance regulation post-financial crisis.

Sukhy Kaur • 09:19

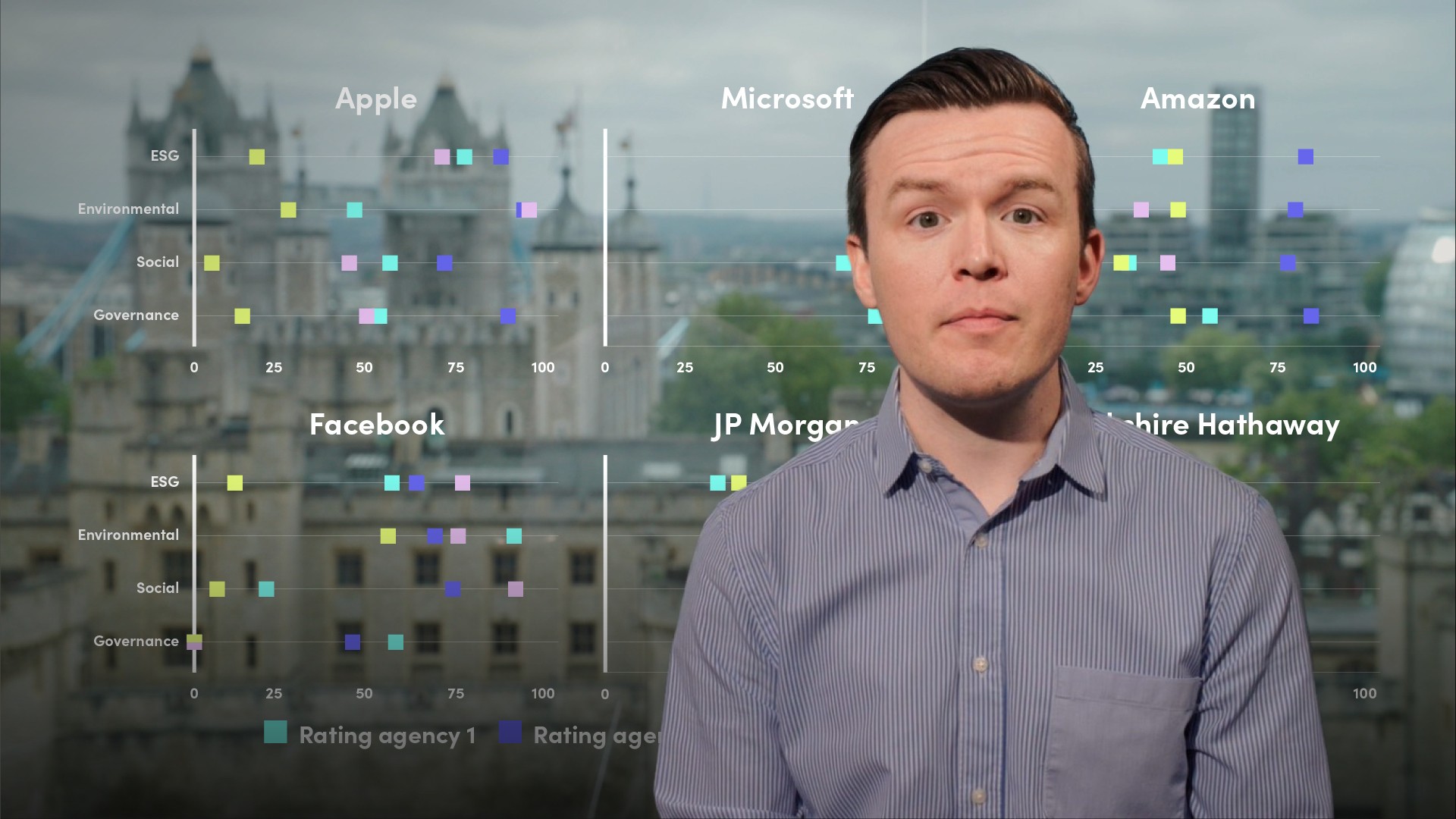

ESG Investment Data

ESG investing and sustainable investing are umbrella terms for investments that seek positive returns and long-term positive impacts on the environment, society, and the performance of the business. In this video, David talks about the difference between ESG and other forms of investing. He further introduces us to the six principles of the UN’s Principles for Responsible Investment and finishes by talking about the ESG metrics that provide an investor with insight into a company’s past impacts, current management process, and potential future resilience.

David Wynn • 11:58

Mark Homans

Director of Strategy and Operations

Santander UK

Our sky high NPS following learner feedback speaks for itself - this platform has delivered a lot of value.

Nicola Stürmer

Head of People

StructureIT

Our challenge was to bring our teams up to speed with financial products so they could create the right solutions for our clients. Finance Unlocked’s simple solution has exceeded all expectations, helped foster curiosity and retain talent.

By submitting this form, you agree to our terms and privacy policy