Interest Rate Basics

Abdulla Javeri

30 years: Financial markets trader

In this video, Abdulla covers the basic interest rates we are likely to encounter and uses a spreadsheet example.

In this video, Abdulla covers the basic interest rates we are likely to encounter and uses a spreadsheet example.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Interest Rate Basics

7 mins 58 secs

Key learning objectives:

Understand why interest exists

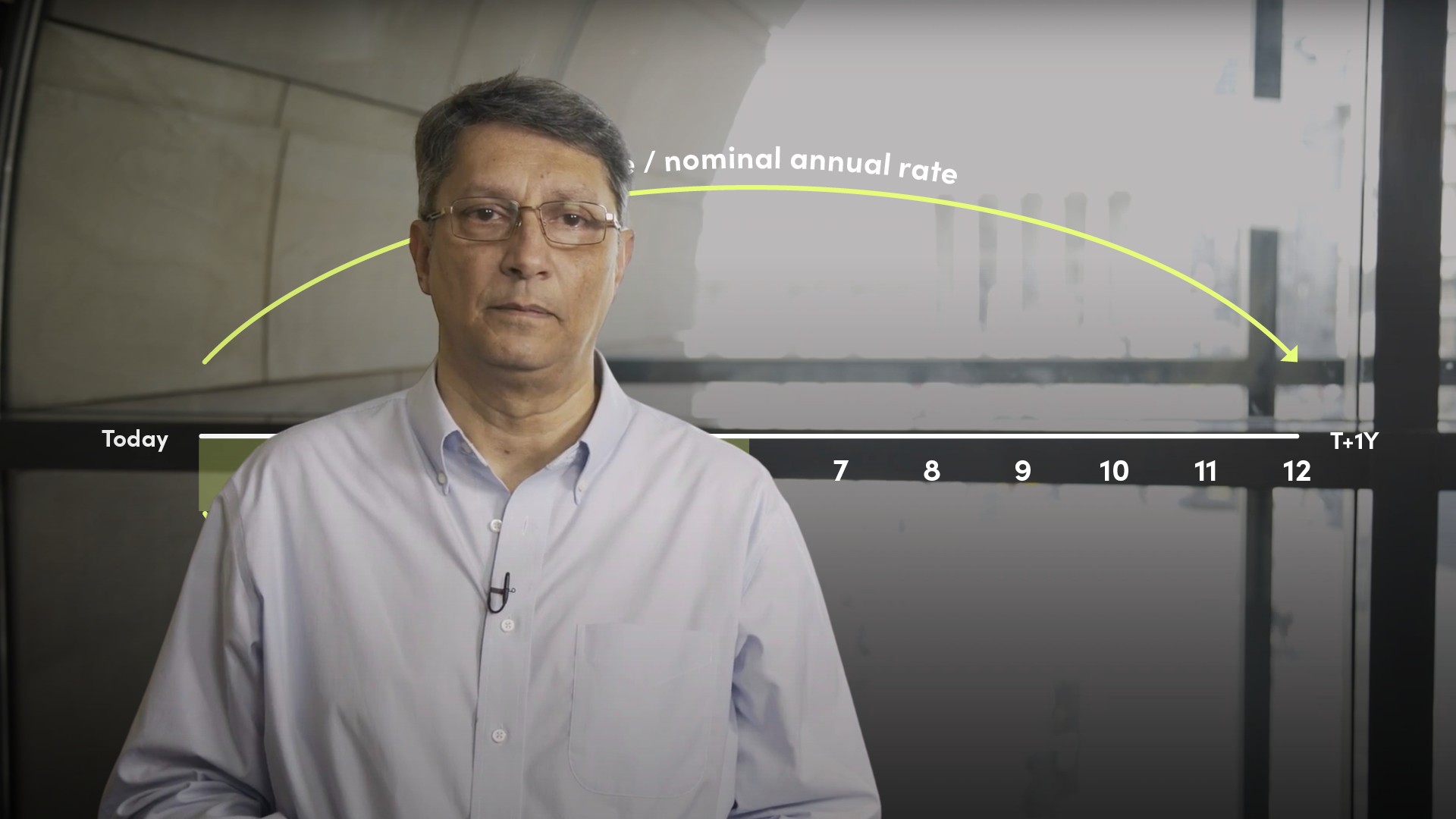

Define simple or nominal interest

Describe the periodic rate

Describe the effective annual rate

Describe the continuously compounded rate

Overview:

Interest exists because money is a valuable asset. Money allows investors to invest and earn a return or yield. If money is lent, investors are denying themselves that opportunity, so access to money belonging to another party has to be paid for. The interest rate is the cost of accessing that money.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Why does interest exist?

Interest exists because money is a valuable asset. It allows investors to invest and earn a return or yield. Money lent out represents an opportunity cost to the lender, so access to money belonging to another party has to be paid for. The interest rate is the cost of accessing that money.What is simple or nominal interest?

Interest rates are quoted as an annual percentage figure as a simple or nominal annual rate, irrespective of how long the money is actually borrowed or invested for, or how often interest is paid. The assumption is that interest is paid once at the end of a one year period. Investing $100 at 5% a year will earn $5 of interest in a year.What is a periodic rate?

The periodic rate is the rate for the period as opposed to the year. If we only want to invest $100 for six months at a quoted annual nominal rate of 5%. The periodic rate, the six-month rate, will be roughly 2.50%, resulting in $2.50 of interest at the end of six months.What is an Effective Annual Rate?

Many bonds pay interest semi-annually; mortgage interest is paid monthly. The Effective Annual Rate (EAR) is the amount earned or paid over a year taking into account interest payments made during the year. Interim interest payments are rolled up with principal and reinvested. With semi-annual payments, that means investing for six months and reinvesting for another six. Investing $100 at 5% p.a with semi-annual interest payments involves receiving $2.50 in six months and re-investing both principal and interest at 5% p.a for the remaining six months. This results in an EAR of 5.0625%.What is a continuously compounded rate?

Continuous compounding is used as a measure of asset returns. It assumes that there is an infinite number of interest payments in a year. Continuously compounded rates are used to value things like options and futures and as a way of measuring asset returns over a given period, especially when the asset price cannot fall below zero.Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Abdulla Javeri

There are no available Videos from "Abdulla Javeri"