What are Medium-Term Notes? II

Aya Suzuki

15 years: Capital markets

In the second part of Aya's video on Medium-Term Notes (MTNs), she discusses the benefits of issuing MTNs, explains the dealer's role and identifies the key buyers.

In the second part of Aya's video on Medium-Term Notes (MTNs), she discusses the benefits of issuing MTNs, explains the dealer's role and identifies the key buyers.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What are Medium-Term Notes? II

8 mins 42 secs

Key learning objectives:

Identify why companies issue MTNs, and who buys them

Outline the role of a dealer in issuing MTNs

Identify the motivation for a company to consider an inaugural private placement

Overview:

A Medium-Term Note is a form of privately placed debt in a bond format. They are especially useful to those people wishing to raise funds quickly, such as asset managers. A MTN dealer acts as an intermediary to an investor, executes transactions and provides hedging.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Why do companies issue MTNs?

Benefits include:- Time of access to raise funds

- Flexibility on terms and costs

- Confidentiality

Companies issue MTNs because it allows borrowers to complement other funding sources, such as public market funding or loans. Consider a UK-based issuer whose funding needs are predominantly in British pounds, with only 100 million Euros. As they have fewer assets in the euro area, 100 million Euro is too small for a benchmark transaction, but works well for an MTN trade.

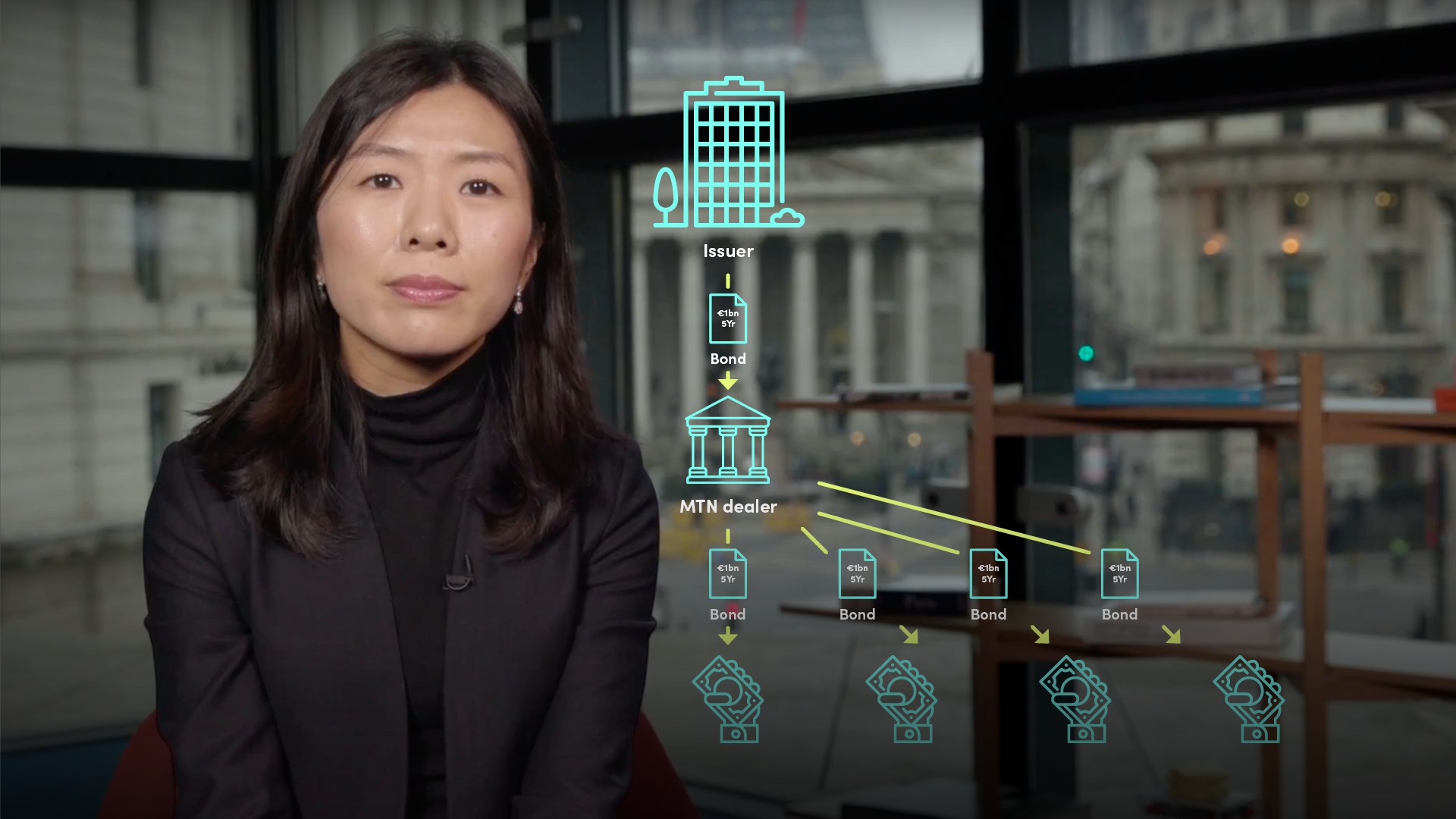

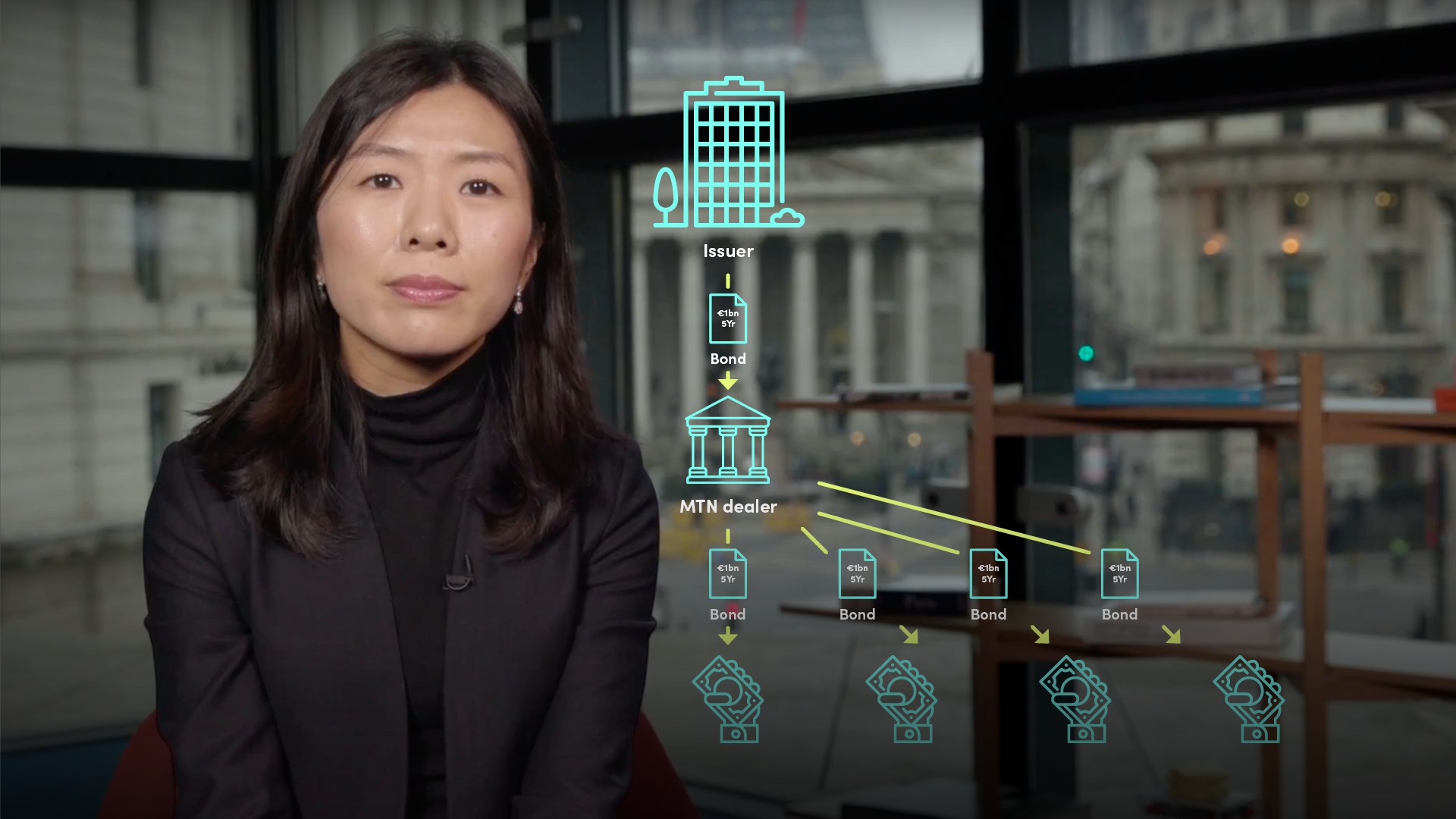

What does a dealer do?

Dealer - Typically an investment bank that arranges the transaction for the borrower and acts as an intermediary to an investor.

- Dealers generate interest for MTNs

- Helping issuers to achieve their funding objectives.

- Dealers execute transactions and provide hedging

- For example, a typical MTN transaction where the issuer is a European bank and the investor is a European life insurance company is a fixed-rate note. However, if the issuer wants to pay a floating rate linked to a Euro benchmark rate but the investor wants to receive annual fixed rate coupons, the dealer on the transaction will arrange to exchange cash flows through the interest-rate swap market.

- Dealers assist the closing and settlement of MTN transactions

- Dealers are typically responsible for initiating and leading the documentation process.

Who buys MTNs?

- Life insurance companies

- Life insurance companies are large MTN buyers, especially at long maturities. Insurers need long dated assets that match their long-dated liabilities

- Asset managers

- They appreciate the readiness of MTNs, which allows them to invest whenever they have excess cash

What is the motivation for a company to consider an inaugural private placement?

- As the company grows, it may appreciate further flexibility on the terms of its borrowing

- Banks typically lend up to 5 years, however, the company may be able to borrow longer dated money from the institutional investor base. Also, bank’s do not lend money without collateral, while institutional investors can lend money on an unsecured basis.

- The company may wish to diversify the source of borrowing

- If market conditions are favourable, particularly if interest rates are low across major markets.

- The company may consider a private placement as a stepping stone to future capital market transactions

- Through the process of issuing a private placement, the company will have direct interactions with institutional investors and thus can start building new relationships with them.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Aya Suzuki

There are no available Videos from "Aya Suzuki"