Difference Between Compliance and Voluntary Carbon Markets

Gordon Rowan

20 years: Origination and Credit Structuring

In the previous video, Gordon explained the need for carbon pricing and trading and then looked at a couple of potential solutions to prevent GHG volumes rising even further through the likes of carbon taxes and compliance carbon markets. In this video, he will explain in detail the voluntary carbon markets and their role.

In the previous video, Gordon explained the need for carbon pricing and trading and then looked at a couple of potential solutions to prevent GHG volumes rising even further through the likes of carbon taxes and compliance carbon markets. In this video, he will explain in detail the voluntary carbon markets and their role.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Difference Between Compliance and Voluntary Carbon Markets

8 mins 48 secs

Key learning objectives:

What are voluntary carbon markets?

What are the essential criteria used in greenhouse gas offset programmes?

Understand the difference between compliance and voluntary carbon markets

Understand the benefits of voluntary carbon markets

Overview:

Voluntary carbon credits represent an efficient way to price carbon within market economies and try to aid the efficient reorganisation of our societies to limit or avoid climate change. As well as generating impressive returns, voluntary carbon credits offer the benefits of portfolio diversification and an attractive risk premium over traditional asset classes.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What are voluntary carbon markets?

Voluntary Carbon markets generate credits that are generated from tangible projects which remove, reduce, or avoid CO2 emissions compared to business-as-usual scenarios. Over time, technology-based solutions are expected to expand as their price per tonnes of CO2 declines.

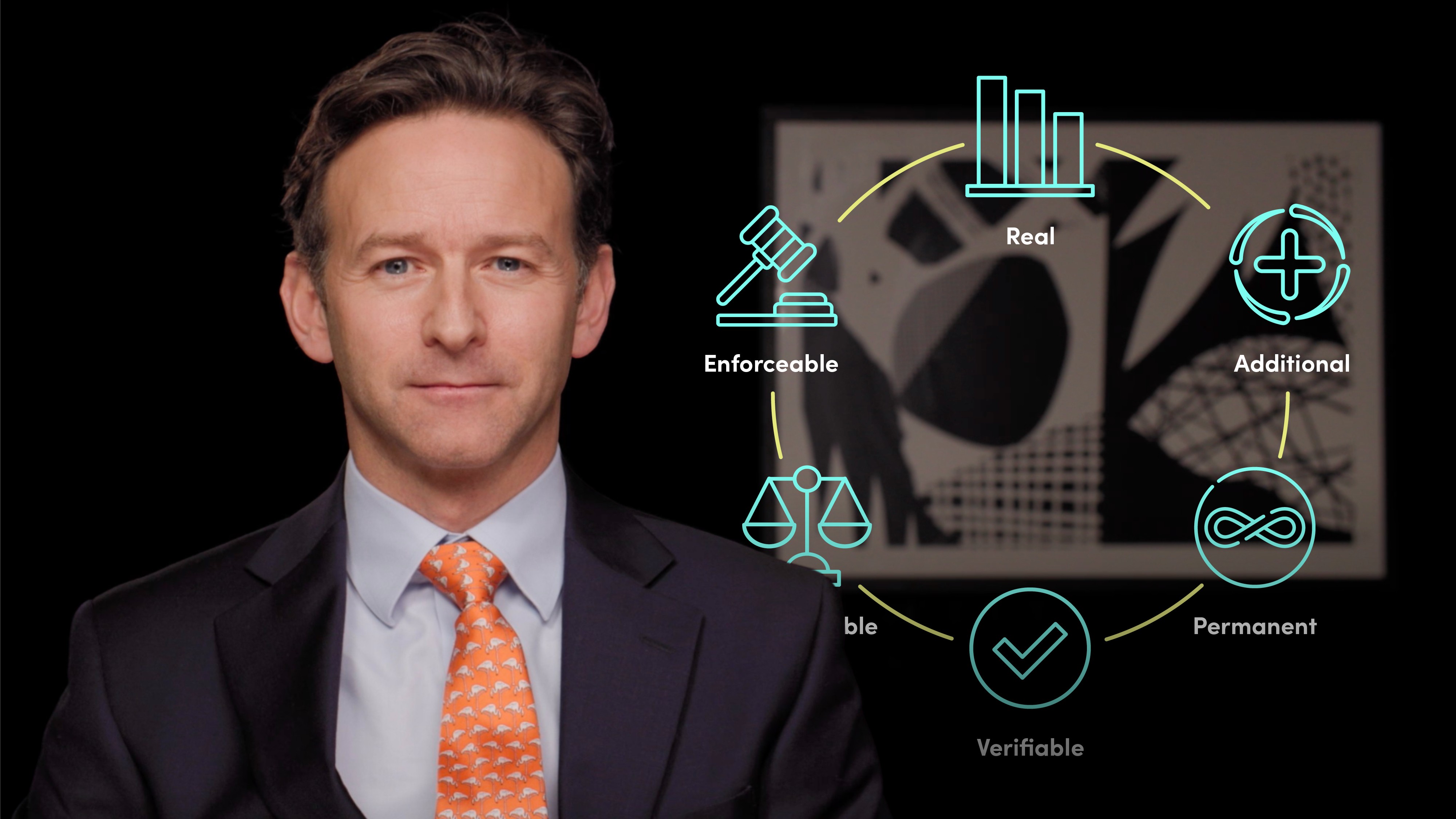

What are the essential criteria used in greenhouse gas offset programmes?

- Real: offsets must represent real emission reductions that have already occurred (ie, the reduction is not projected to occur in the future).

- Additional: offsets must represent emission reductions that are in addition to what would have occurred otherwise.

- Permanent: offsets must represent emission reductions that are non-reversible, or must typically be sequestered for a long number of years in the case of carbon biosequestration projects.

- Verifiable: sufficient data quantity and quality must be available to ensure emission reductions can be verified by an independent auditor against an established protocol or methodology.

- Quantifiable: emission reductions must be reliably measured or estimated, and capable of being quantified.

- Enforceable: offset ownership is undisputed and enforcement mechanisms exist to ensure that all programme rules are followed and the market’s environmental integrity is maintained.

What is the difference between compliance and voluntary carbon markets?

Carbon trading has grown into a mature, investable market with sufficient number of instruments, liquidity and price discovery. There are 39 compliance markets across the world with the best known being the EU ETS, the US Regional Greenhouse Gas Initiative (RGGI) and the Western Climate Initiative (WCI). Investment today into the various forms of voluntary carbon markets is not overseen by a single regulator nor government but has exceeded $1 billion dollars in traded value in 2021. This size is expected to grow 26x by 2050.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Gordon Rowan

There are no available Videos from "Gordon Rowan"