Put-Call Parity

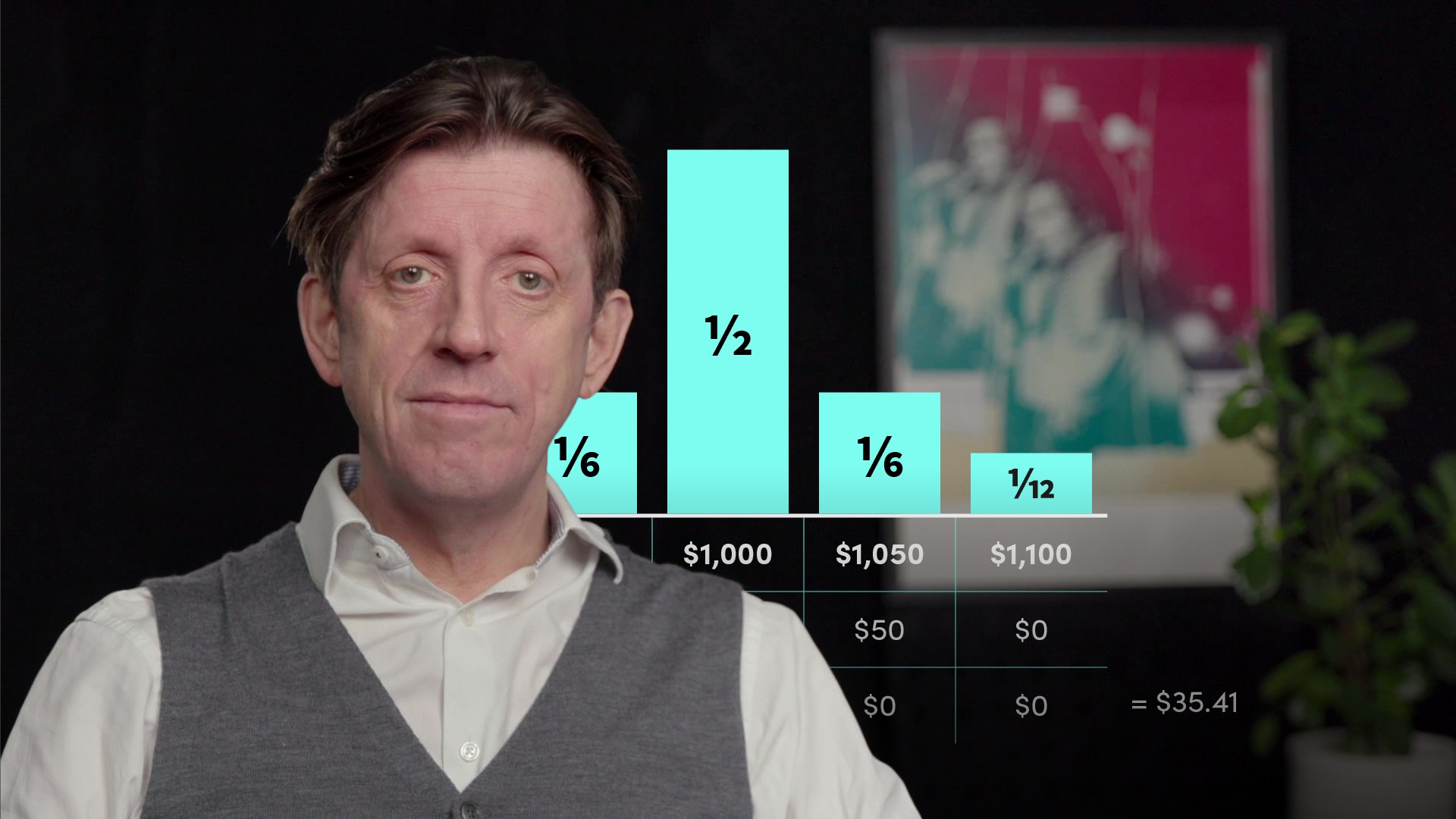

Put Call Parity is a formula linking put and call prices together to reflect the market pricing efficiency. It applies to European put and call options with the same strike price, same expiry and the same underlying futures. The parity principle sets up the relationship between them all. In simple terms, put-call parity is achieved when the call premium plus the strike price (of the call and put option) equals the futures price plus the put premium. The parity principle holds that if, say, the futures and call prices change, the put price should also change such that the relationship holds. If parity is broken, a trader can by definition earn a risk-free arbitrage.