Savings and Loan Crisis

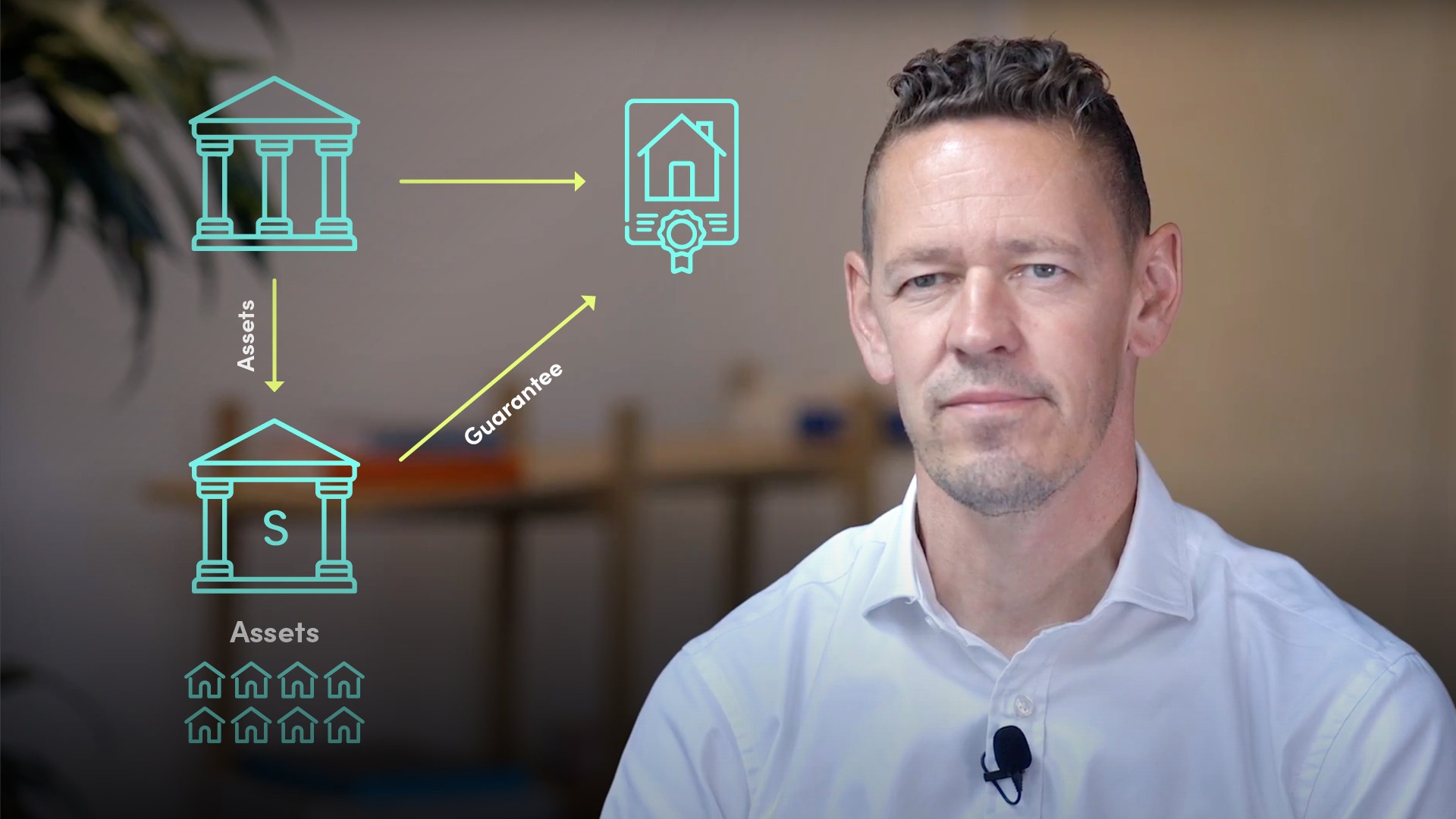

The US Savings & Loans (S&L) crisis of the 1980s to early 1990s was a domestic crisis affecting Savings & Loans institutions. These are retail financial institutions, also known as thrifts, accepting retail deposits and extending retail mortgages and other forms of consumer finance. The elongated crisis led to the collapse of more than a thousand institutions. The crisis was caused by multiple factors over many years: A negative interest-rate spread and chronic asset-liability mismatches at the beginning of the 1980s as interest rates spiked to tame high inflation. Thrift institutions had Federally-imposed caps on deposit rates so could not offer competitive rates, leading to huge deposit outflows. As rates headed higher, thrifts’ short-term deposit funding ended up being more expensive than their long-dated fixed-rate mortgages. Deregulation widened the scope of activities that S&Ls were allowed to engage in and altered other aspects of the industry at a time of reducing regulatory oversight. Lack of regulatory action to shut insolvent thrifts, which then super-charged deposit rates and offered other incentives to attract deposits, particularly jumbo and brokered deposits, in attempts to grow out of their financial distress. This led distressed S&Ls to make reckless investments particularly in real estate to generate the returns to pay the high deposit rates. Reckless management lacking proper internal controls.