Time Value of Money (TVM)

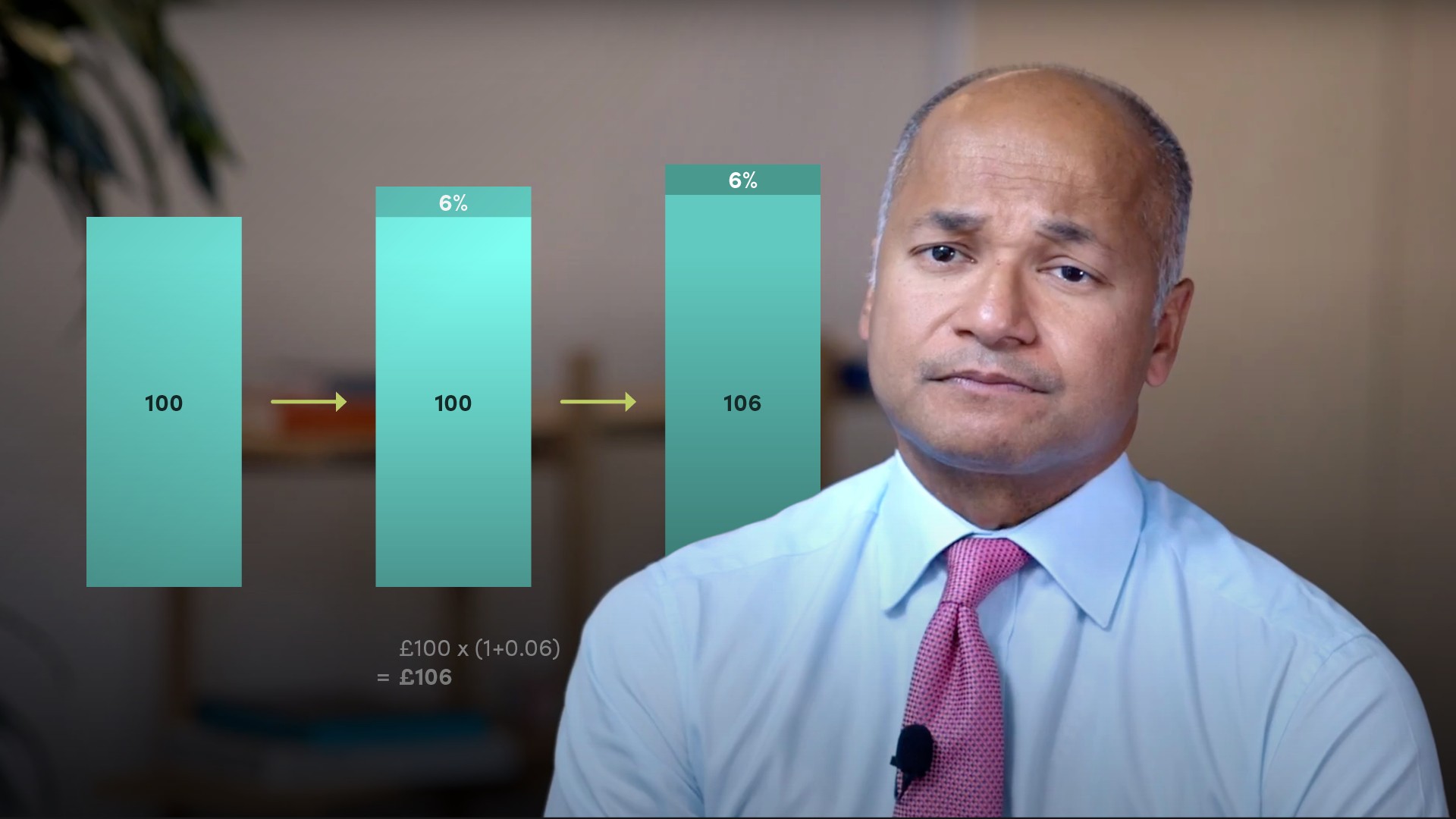

Money has time value: in a positive interest rate environment a dollar today is worth more than a dollar tomorrow on the basis that it can be invested today to earn a compounded return in the future and counteract the effects of inflation. Understanding the time value of money is core for investors, analysts and companies looking at which projects to fund. The formula for calculating future value is PV x (1 + interest rate )^n years. To calculate present value, the equation can be adjusted to PV = FV/(1 + interest rate)^n years. So if an investor deposits USD1,000 for five years with a 5% interest rate, the future value of the investment assuming no default is USD1,276.28. Conversely, the present value of USD1.276.28 received in five years discounted at 5% is USD1,000. The notion of compounding in calculating time value is critical and also explains why using cash today to pay off debt to avoid compound interest on borrowing is typically a sound strategy. Calculating present value is vital to evaluate which projects a company should fund, or what investments an investor should buy. Discounting future cash flows to their net present values (using a risk-free rate of return, the company’s cost of capital, or a required rate of return) offers a clear signal as to which projects better match the company’s investment appetite by meeting its required rate of return.