Too Big to Fail

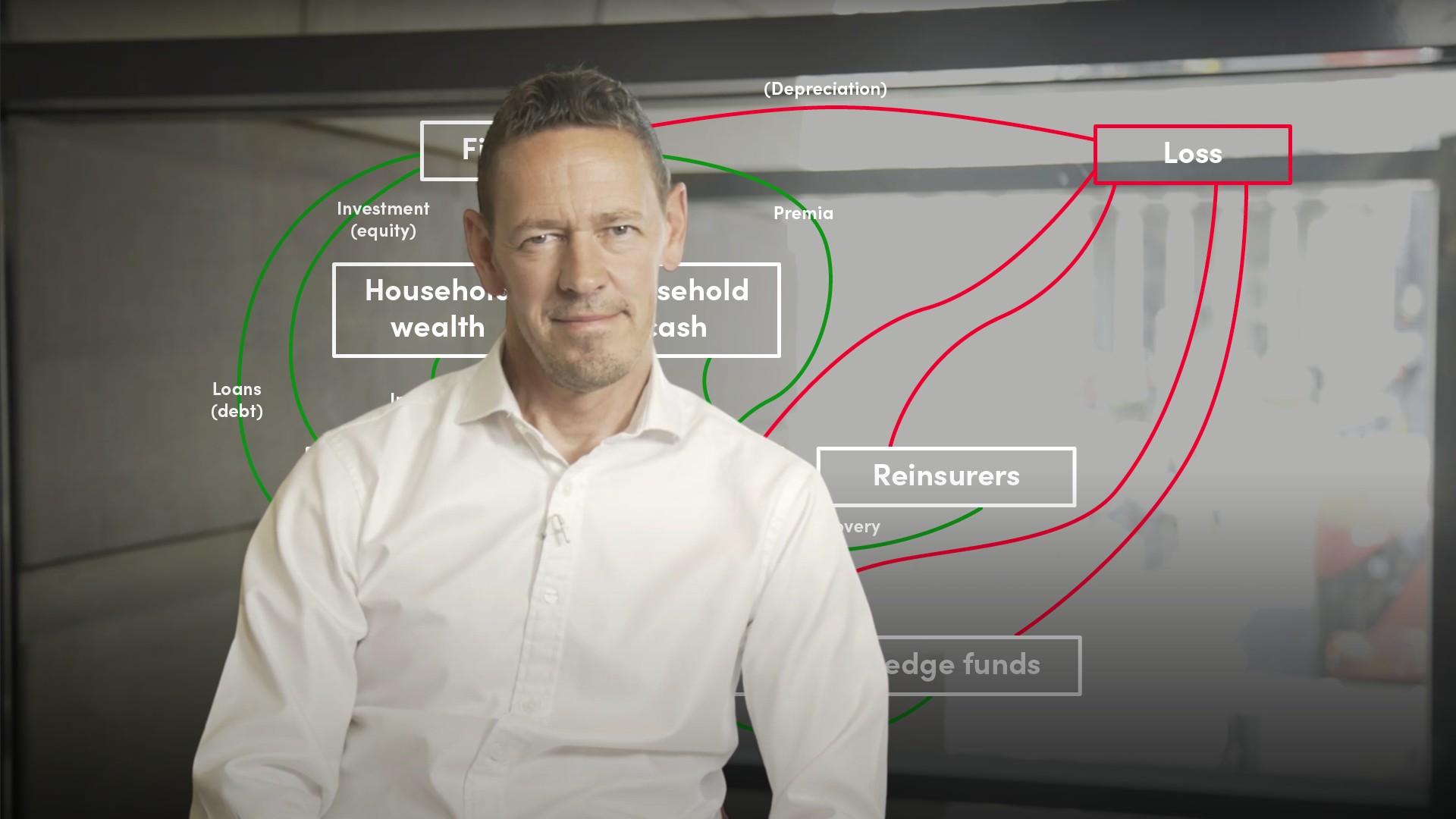

Too big to fail is a term ascribed to companies and, since the 2008 global financial crisis, to banks that are so big and so deeply intertwined with the global economy and global financial system that their failures would risk systemic breakdown. The phrase was popularised at the time of the global financial crisis, when governments world-wide bailed out large banks using taxpayer funds in the wake of the bankruptcy of Lehman Brothers. Lehman’s failure had brought to the fore deep levels of interconnectedness (as lending and trading counterparties) between poorly capitalised but highly leveraged financial institutions. One legacy of the crisis is a much tighter bank regulatory framework with higher capital and lower leverage levels. Another legacy is the creation by the Financial Stability Board of a special category of banks, dubbed Global Systemically Important Banks, or G-SIBs. G-SIBs are banks that are deemed too big to fail. They are required to maintain higher capital buffers (including maintaining the Total Loss-Absorbing Capacity standard) and to regularly update their resolution plans. They are also held to higher supervisory standards. The November 2021 G-SIB list contained 30 banks in its five additional capital buckets: 10 from the US and Canada, 13 from Europe, three from Japan and four from China.