Sample modules

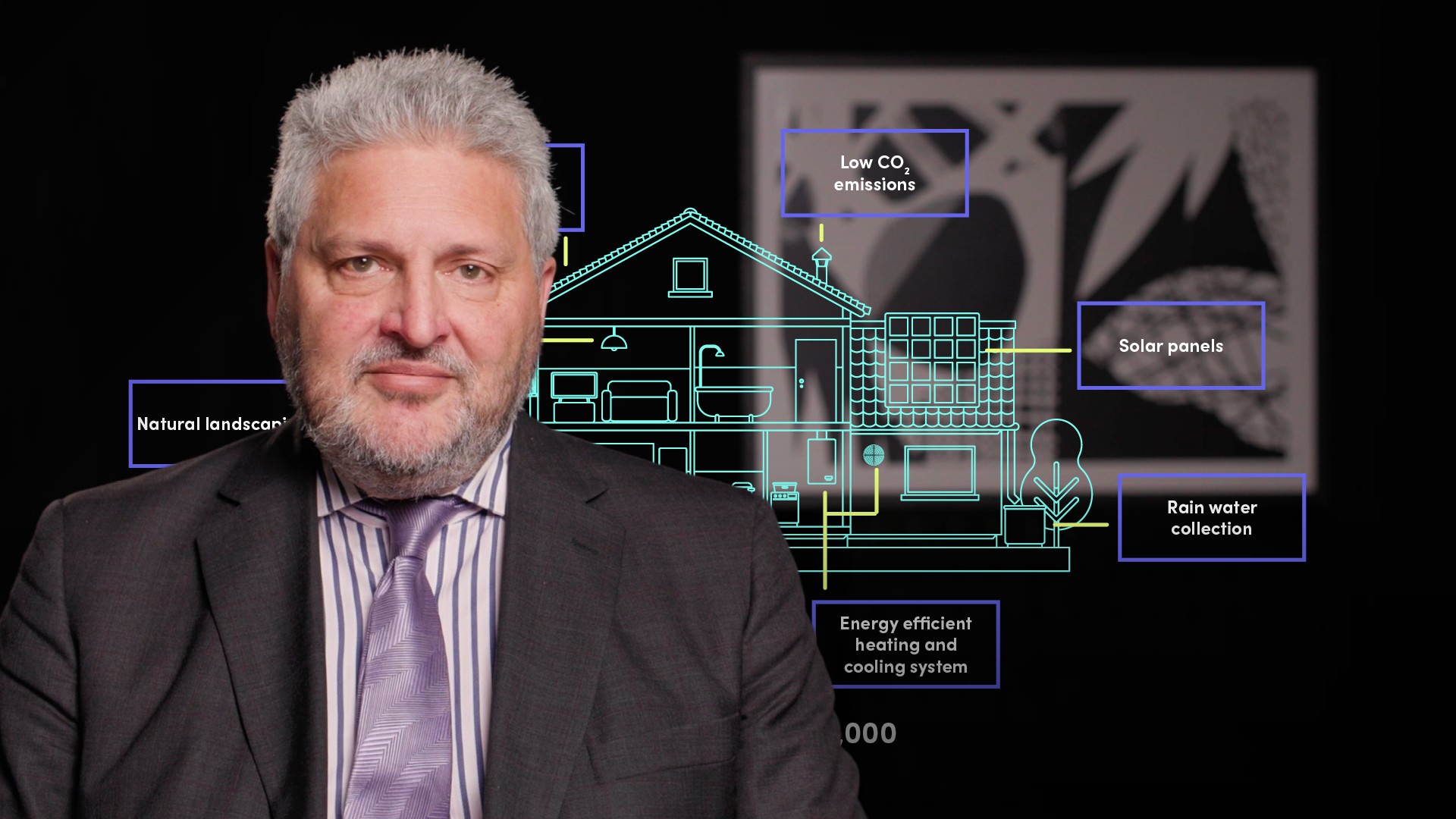

What Constitutes a Good Treasury and ALM Function?

Successful bank is likely to have good quality Treasury & ALM teams. These teams are often amongst the most professional and hard working in the bank. Join David as he discusses what good ALM practice looks like, and how to achieve it.

David Stunell • 10:07

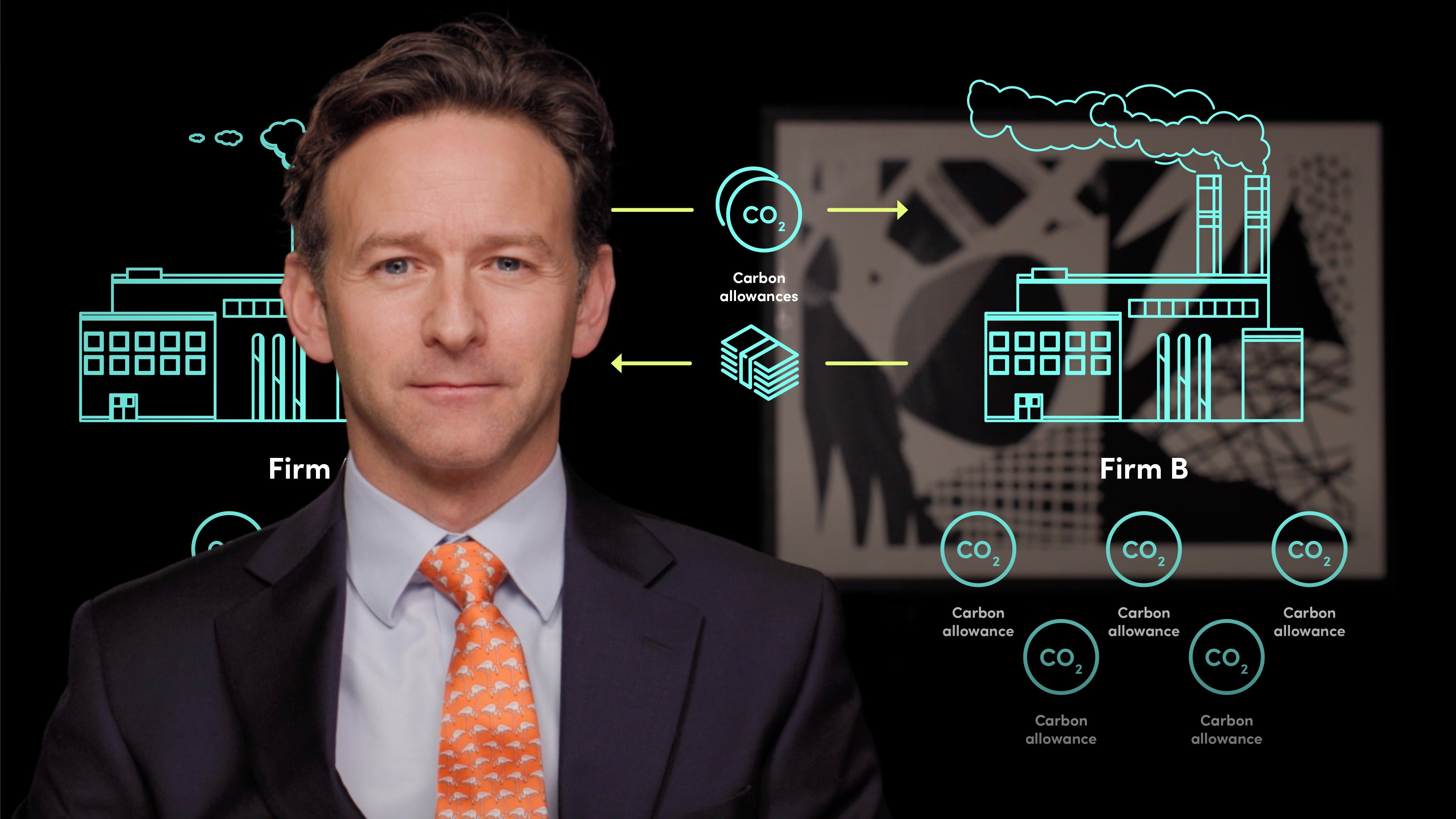

Introduction to Greenhouse Gas Emissions

In this video, Gordon introduces the Keeling curve, the concentration of carbon in the atmosphere, and the idea that market-based tools such as cap and trade can help us to reorganise our economies to reduce the amount of CO2 being emitted into the atmosphere.

Gordon Rowan • 07:25

Equity Dilution, Pre-Emption and Underwriting

With a focus on the UK market, Rupert explains the main equity capital raising options that are available to companies that are listed. In this video he also explains key concepts which are frequently used in the equity capital markets.

Rupert Walford • 04:56

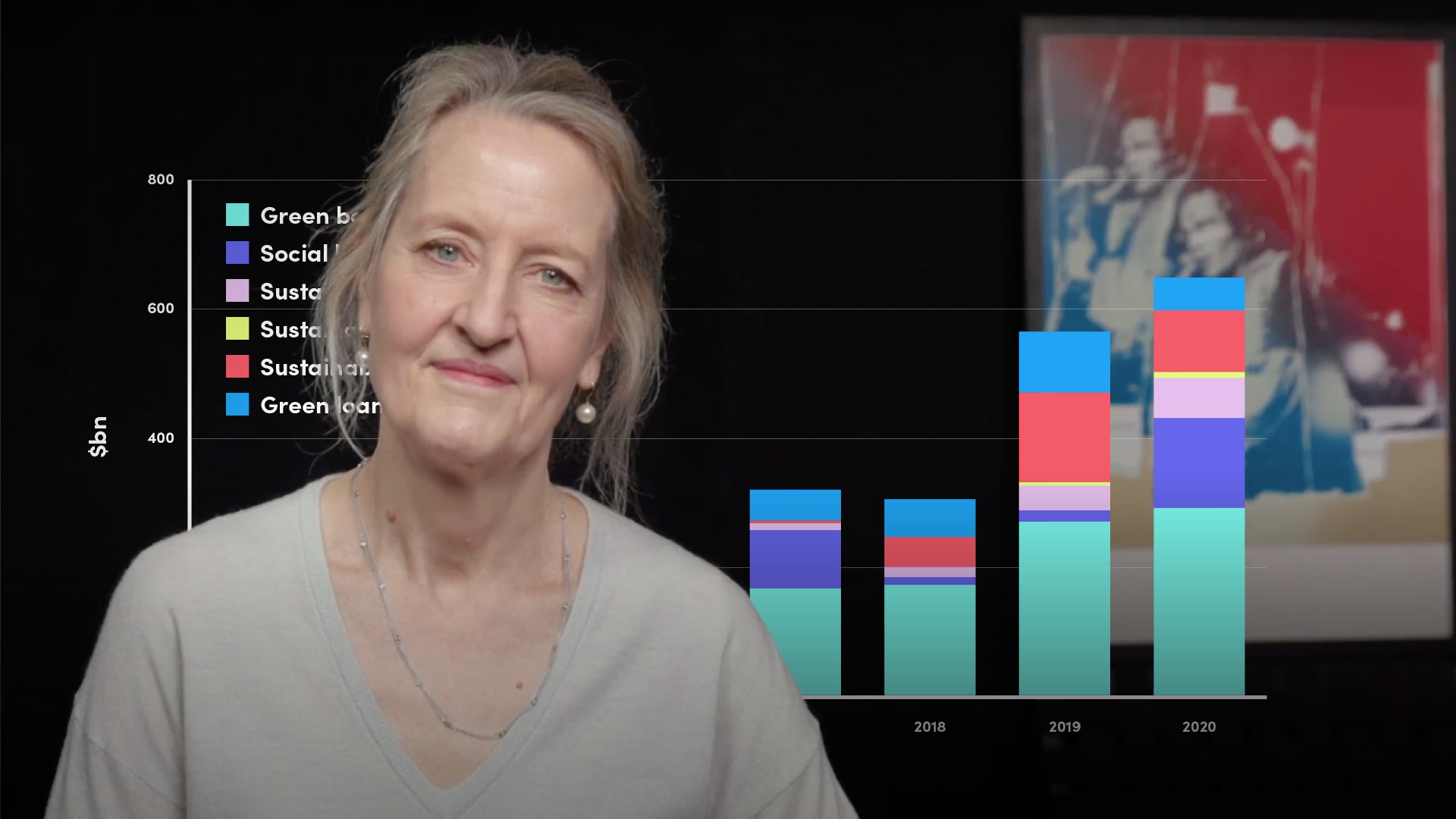

Mobilising the Finance Sector to Net Zero

To reach the $100-150tn required to meet net zero, significant commitments will need to be made over the coming years. New initiatives are starting up to encourage this investment such as GFANZ. This video outlines the commitments to reach net zero and further highlights how we can get the money where it is needed.

Mark Carney • 07:13

Navigating EU Disclosure & Reporting Initiatives

In this video, Keith explores key EU climate initiatives in more detail, including the basis on which these initiatives are being launched - the EU Green Deal. He talks about the Just Transition Mechanism and the Fit for 55 Package that are part of the Green Deal as well as areas that the Green Deal programmes cover, such as biodiversity.

Keith Mullin • 10:05

History of the Basel Accord

In the aftermath of the global financial crisis, there was an unprecedented overhaul of the global framework regulating the banking system. Sukhy explains this regulatory framework and discusses the strengths and weaknesses of Basel I and II that ultimately led to the current version - Basel III.

Sukhy Kaur • 15:54

Central Banks and Net Zero

The climate crisis has become one of the biggest threats to global economy, requiring the intervention of central banks. In this video, Sarah Breeden helps us understand the role of the Bank of England in supporting the economy from climate related risks. She briefly explains what science around climate change shows and then explains the future risks we face and the impacts that this will have.

Sarah Breeden • 06:43

Introduction to Correspondent Banking

All economies are dependent on international trade. As soon as companies and individuals need to trade products or services internationally, correspondent banking has a role to play. Rob goes into detail on what correspondent banking is, why it is necessary and how it impacts trade finance.

Robert Ellison • 18:57