What are the Benefits of Open Banking?

Ritu Sehgal

20 years: Corporate banking

Open banking refers to the idea that customers have a right to see, and utilise their entire portfolio of account information across all financial institutions with whom they have a relationship. In this video Ritu gives us an overview of Open banking and further highlights the expected practical implications of open banking for the customer.

Open banking refers to the idea that customers have a right to see, and utilise their entire portfolio of account information across all financial institutions with whom they have a relationship. In this video Ritu gives us an overview of Open banking and further highlights the expected practical implications of open banking for the customer.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What are the Benefits of Open Banking?

4 mins 20 secs

Key learning objectives:

Define Open Banking

Understand how Open Banking works

Outline the benefits of Open Banking

Overview:

Traditionally, consumers would use a single bank to manage all of their financial issues. Over the last two decades, it has grown more common for a firm or individual to deal with more than one bank. With the vast majority of customers having multiple banking relationships, it has become necessary to see an aggregated view of all information in one place and be able to take action across the entire portfolio.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What is Open Banking?

Open banking refers to the idea that customers have a right to see, and utilise their entire portfolio of account information across all financial institutions with whom they have a relationship.

How does Open Banking work?

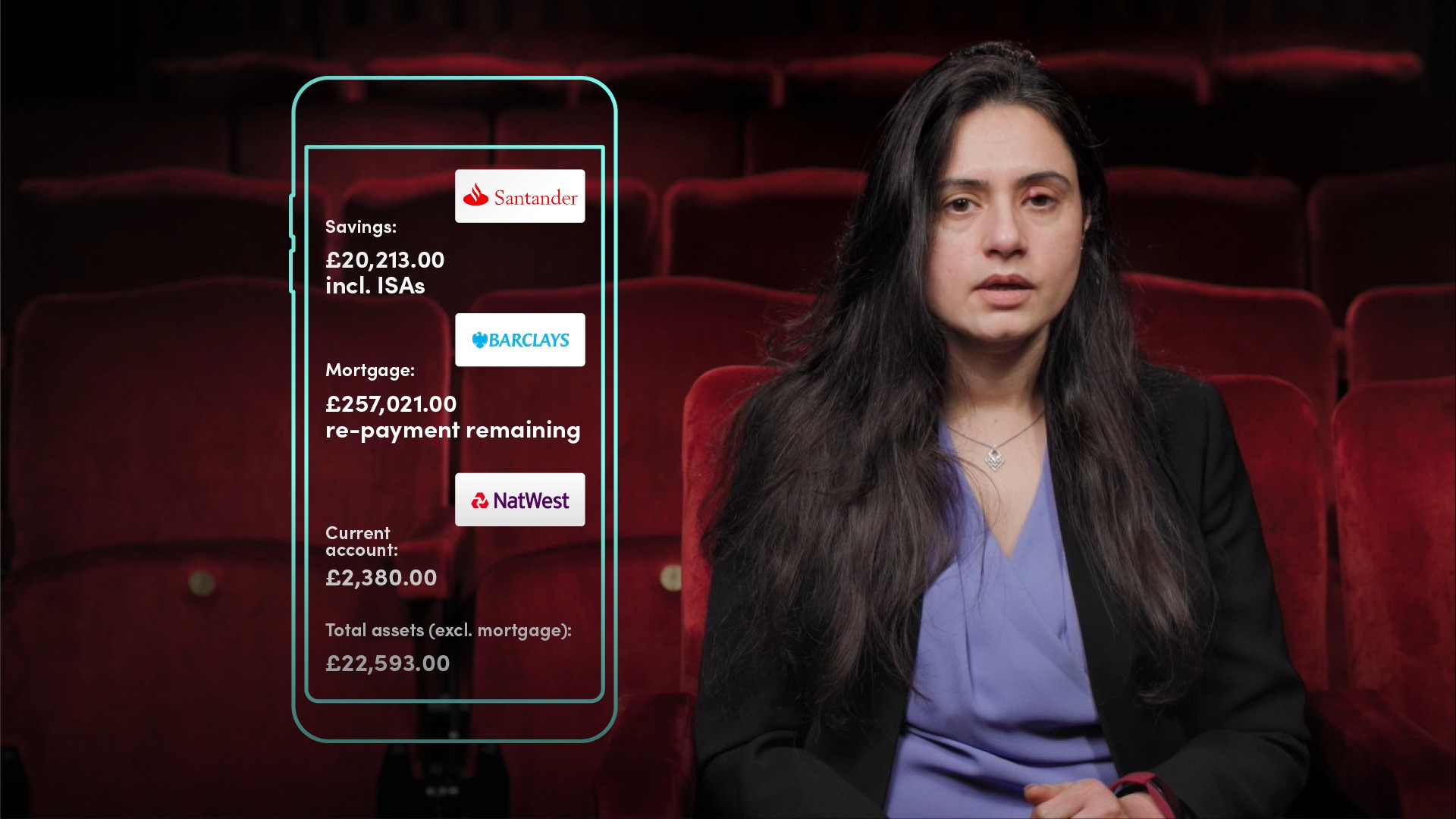

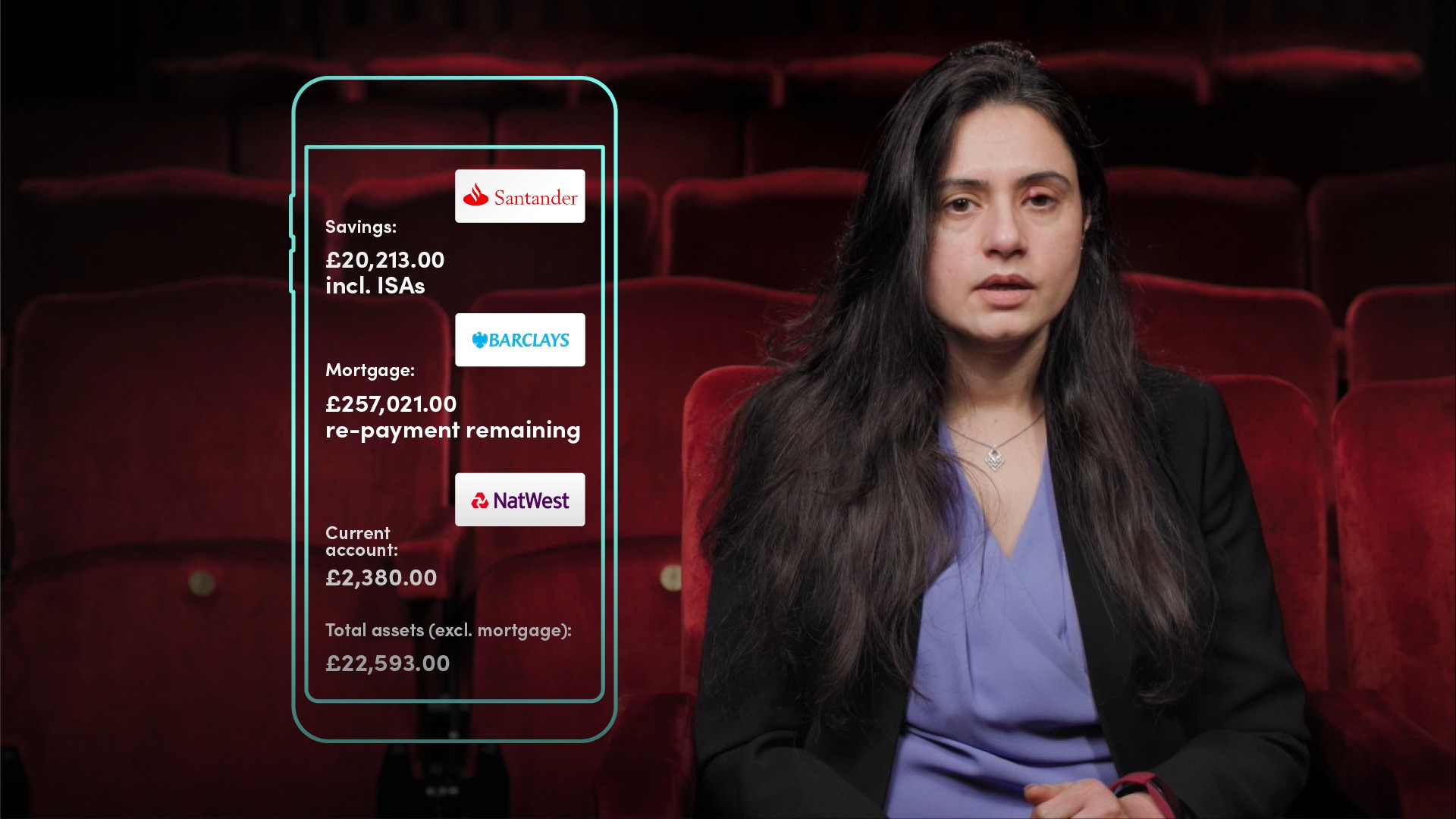

Account aggregation, which is the ability to use application programming interfaces, also known as APIs, to gather, aggregate, and display information from numerous sources for the benefit of the customer, is a key component of open banking.

The other key concept is payment initiation from a single interface or rather the ‘aggregated interface’.

What are the benefits of Open Banking?

Open banking allows the customer to:

- View consolidated position within one interface/portal.

- Take an action from the interface.

- Make an informed choice based on the comparable offerings presented or aggregated and most importantly saves the customer tedious efforts of sending and receiving information manually.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Ritu Sehgal

There are no available Videos from "Ritu Sehgal"