Double-entry Accounting

Saket Modi

20 years: Chartered accountant & educator

In the fifth video of the Accounting Basics series, Saket explores the notion of double-entry bookkeeping, discussing the numerous rules associated with it along with its impacts on the financial statements.

In the fifth video of the Accounting Basics series, Saket explores the notion of double-entry bookkeeping, discussing the numerous rules associated with it along with its impacts on the financial statements.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Double-entry Accounting

5 mins 16 secs

Key learning objectives:

Identify the rules of the double entry accounting system

Outline the impact of double entry accounting on the different elements of the financial statements

Overview:

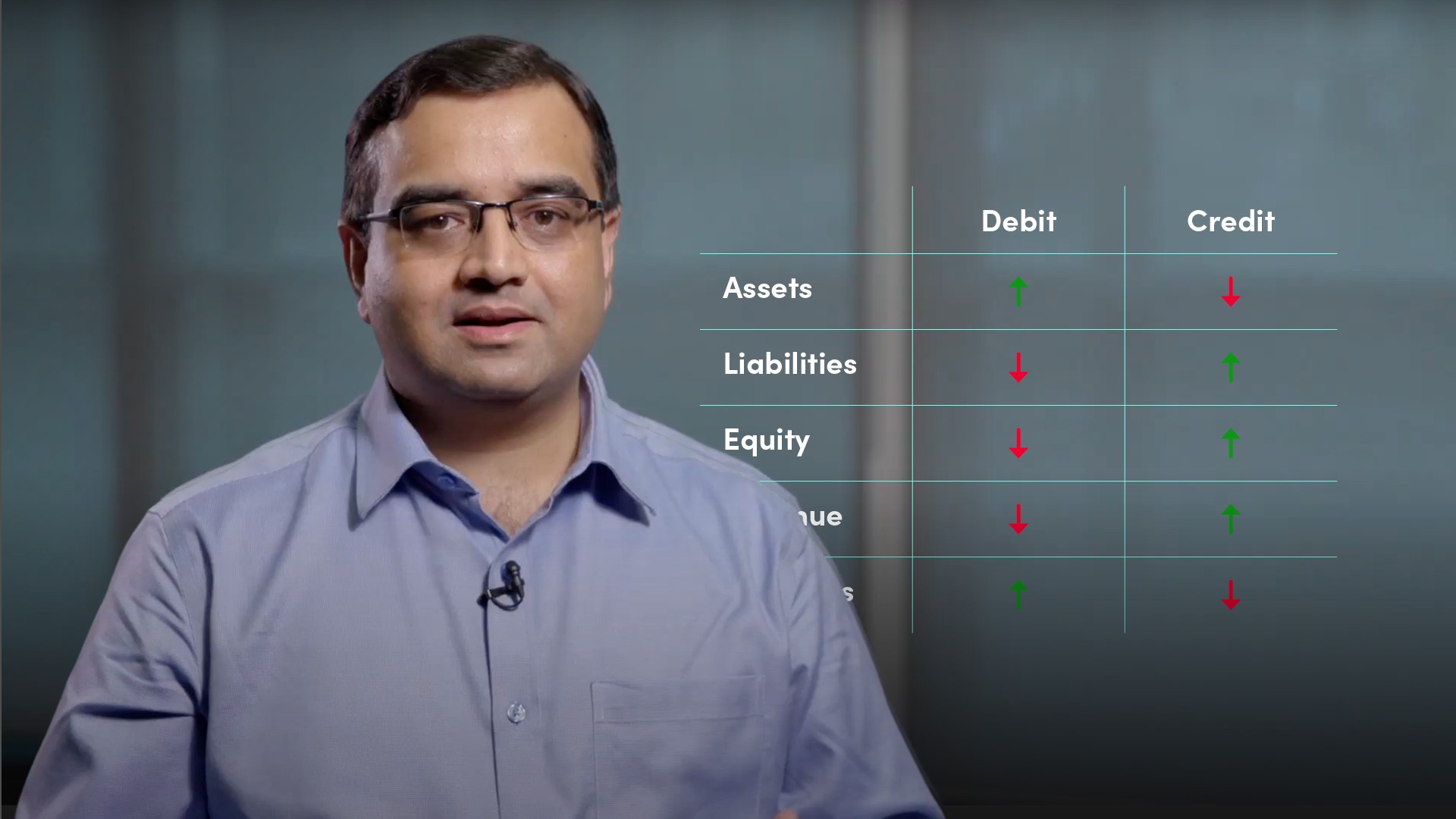

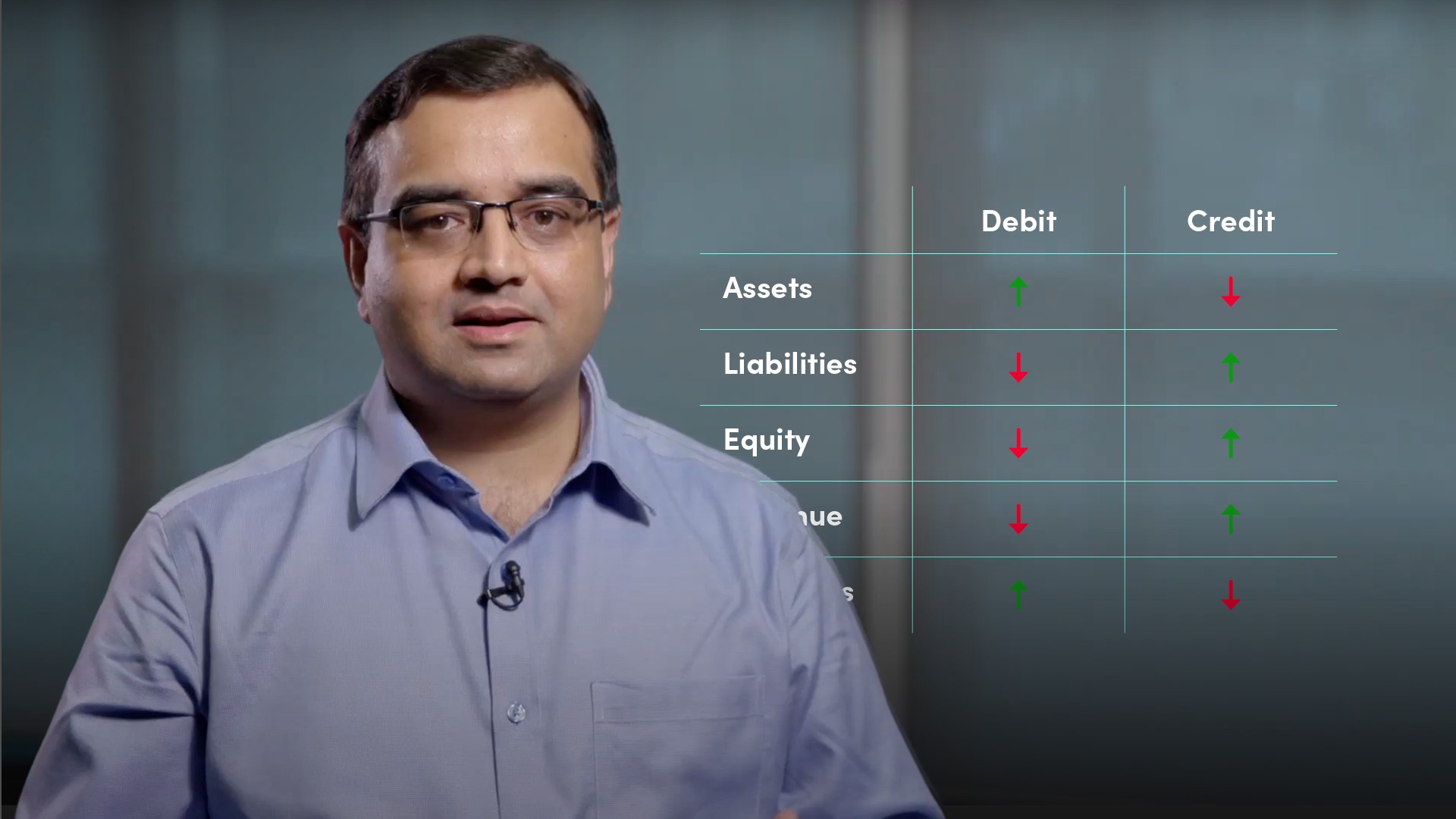

The double entry system of bookkeeping is a method of recording transactions based on a set of rules. Every transaction has two impacts, a Debit and a Credit. The rule is that “for every debit, there is corresponding credit and for every credit, there is a corresponding debit”. It is based on the accounting equation; Assets = Liabilities + Equity.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What are the rules of the double entry accounting system?

In every transaction there is a debit and a credit. For every debit, there is a corresponding credit and for every credit there is a corresponding debit.

If you buy an asset and pay for it in cash, then you:

- Increase or Debit the Truck Asset

- Decrease or Credit the Cash Asset

If you borrow money to buy an asset, there are two transactions:

When you borrow money or take out a loan:

- Increase or Debit the Cash Asset

- Increase or Credit the Loan Liability

When you use the proceeds to purchase the Truck Asset:

- Increase or Debit the Truck Asset

- Decrease or Credit the Cash Asset

What you are left with on the balance sheet is the Truck Asset and the Loan Liability.

The subsequent impact on the loan liability is:

Accrues interest on a daily basis:

- Increase or Debit the Finance Costs

- Increase or Credit the Loan Liability

When an instalment is paid:

- Decrease or Debit the Loan Liability

- Decrease or Credit the Cash Asset

As we have seen, the double entry accounting gets complicated when the purchase is funded through a loan rather than outright cash. The finance costs recognised as an expense in the income statement results in lower equity over time. There will also be a depreciation charge on the Truck asset but that is not affected by whether you purchase the Truck through outright cash payment or fund the purchase through a loan.

What is the impact of the double entry accounting on the different elements of the financial statements?

It is important to note that though assets, liabilities and equity may increase or decrease, revenue and expenses typically increase over time rather than decrease.

In summary, the double entry system records both sides of a transaction which provides a complete view of an entity’s financial affairs.

The relationship between increases or decreases in the different elements of the financial statements and the corresponding debits and credits is shown below:

- Debit increases in assets/expenses and Credit decreases in assets/expenses

- Credit increases in liabilities/equity/revenue and Debit decreases in liabilities/equity/revenue

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Saket Modi

There are no available Videos from "Saket Modi"