An Overview of MiFID

Carl Fernandes

20 years: Financial services law & regulation

The main purpose of this video by Carl is to provide an overview of “MiFID” – the Markets in Financial Instruments Directive which is the centrepiece of the EU's regulatory framework for securities markets designed to assist traders, investors, and other market participants in the financial sector.

The main purpose of this video by Carl is to provide an overview of “MiFID” – the Markets in Financial Instruments Directive which is the centrepiece of the EU's regulatory framework for securities markets designed to assist traders, investors, and other market participants in the financial sector.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

An Overview of MiFID

14 mins 8 secs

Key learning objectives:

Understand the background of MiFID

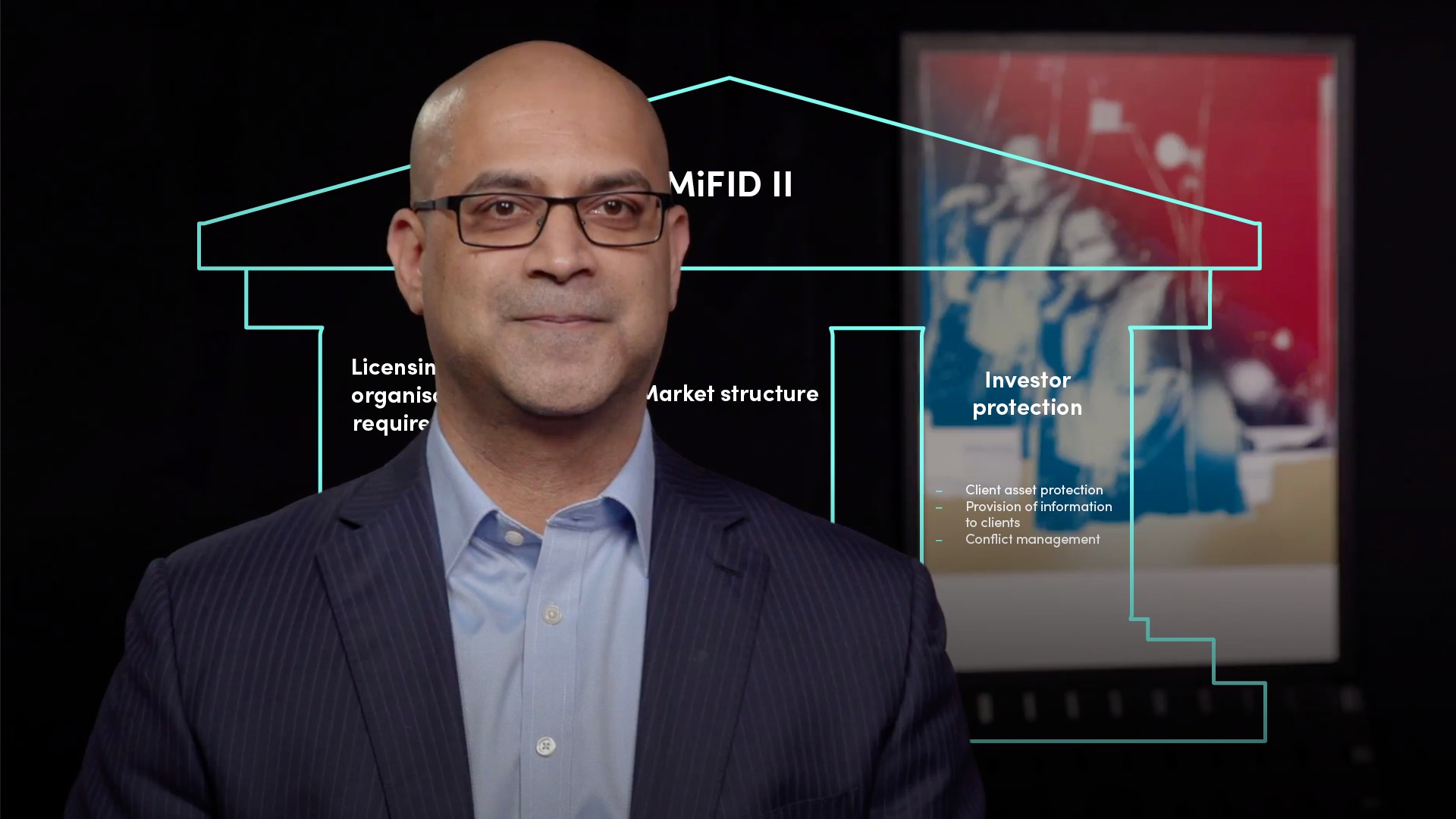

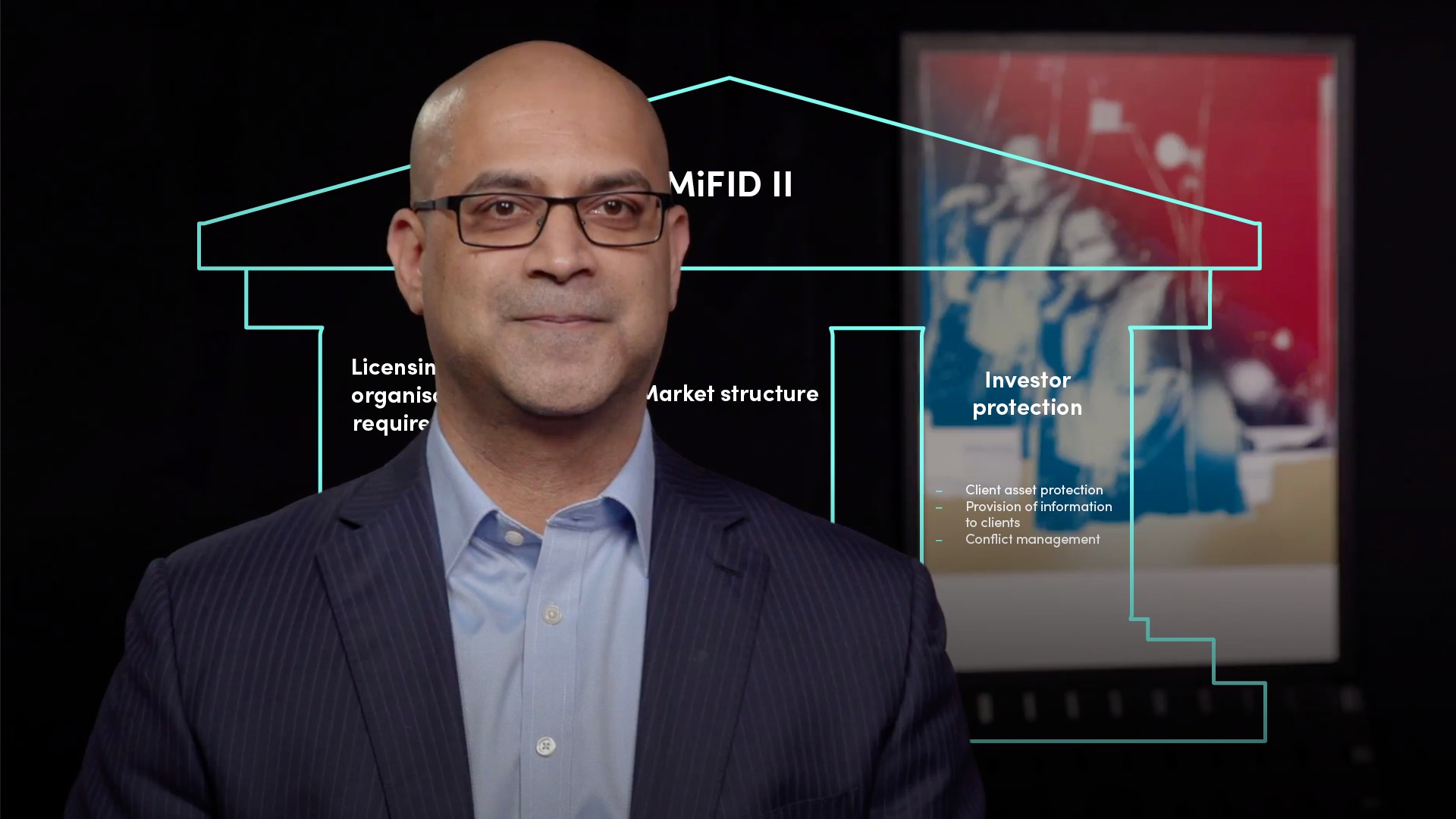

Outline the three key pillars of the MiFID regime

Overview:

“MiFID” – the Markets in Financial Instruments Directive and the related Regulations is the centrepiece of the EU’s regulatory framework for securities markets designed to assist traders, investors, and other participants in the financial sector.The primary aim of the MiFID requirements collection is to keep financial markets strong, fair, effective, and transparent.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Understand the background of MiFID

The original MiFID was established in 2004, and was itself pre-dated by the Investment Services Directive. In 2007, MiFID 1 went into operation throughout the European Union. Following the financial crisis, the European Commission adopted a legislative proposal for the reform of MiFID in 2011 to address certain perceived flaws in the original regime that were either revealed by the financial crisis or, more broadly, by the evolution of financial markets.

What are the 3 key pillars to the MiFID regime?

Licensing and organisation requirements for investment firms:

- The core requirement - It is for firms which engage in certain specified activities in relation to financial instruments to be licensed by their local European regulators. Dealing, advising, and making discretionary investment decisions in relation to a broad variety of financial instruments are among the licensable practices performed by investment banks and asset managers.

- Obtaining a licence - There are stringent requirements which firms need to satisfy in order to be granted a licence, including with respect to minimum capital requirements for the firm and fitness and propriety requirements for the individuals running the firm, and prescriptive forms and processes to comply with.

- Passporting - One of the primary benefits of being licensed under MiFID is that once a company is licensed by its home regulator in the EU, it has the ability to passport the provision of its services to clients in other EU jurisdictions, either cross-border or through the establishment of physical branches, without the need for additional licensing.

Market Structure:

- Trading venues - MiFID establishes many types of trading venues where securities transactions can or must take place. The most highly regulated venue is what is called a “regulated market” – these often act as both primary listing venues for issuers as well as secondary markets for brokers and dealers to trade for themselves or on behalf of their clients. Then we have “multilateral trading facilities” (or MTFs) which are mainly for equities trading and “organised trading facilities” (or OTFs) which are mainly for fixed income and derivative products. The final type of venue recognised by MiFID is what is called a “systematic internaliser”, which is a dealing firm that satisfies client orders by trading off-venue from its own inventory in volumes which are excess of certain defined thresholds.

- Mandatory trading - The rules require regulated firms to trade in equities and certain derivatives on one of the listed venues, with some exceptions, such as transactions that occur for reasons or in circumstances that the market generally considers do not contribute to the price discovery process.

- Transparency - The rules that underpin the transparency regime are very detailed and complicated, but their overall goal is to ensure that investors can better decide fair pricing for their trades based on recently executed trades and currently available prices.

Investor Protection:

- Client asset protection - The objective here is to ensure that firms that serve clients and accept or hold client money or assets in the process of delivering services, keep the client money and assets separate from their own, so that clients are not affected in the event of the service provider's financial distress.

- Provision of information to clients - Companies are obligated to provide customers with extensive details, from information on the company itself, its facilities, and cost and charges to customers, to detailed information on customer trades and on the customer's asset and money balance, which can be borrowed by the company for customers.

- Conflict management - Another key objective of the conduct rules is to ensure that regulated firms identify and manage conflicts of interest which may arise as between clients or as between the firm’s proprietary business and the services they provide to clients.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Carl Fernandes

There are no available Videos from "Carl Fernandes"