Letters of Credit Vs Documentary Collection

Aidan Applegarth

30 years: Commodity & trade finance

Following on from Aidan's video on the risk ladder, he continues his series on Trade Finance by looking at how the documentary Letter of Credit works and how its role is similar to that of the Documentary Collection.

Following on from Aidan's video on the risk ladder, he continues his series on Trade Finance by looking at how the documentary Letter of Credit works and how its role is similar to that of the Documentary Collection.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Letters of Credit Vs Documentary Collection

5 mins 52 secs

Key learning objectives:

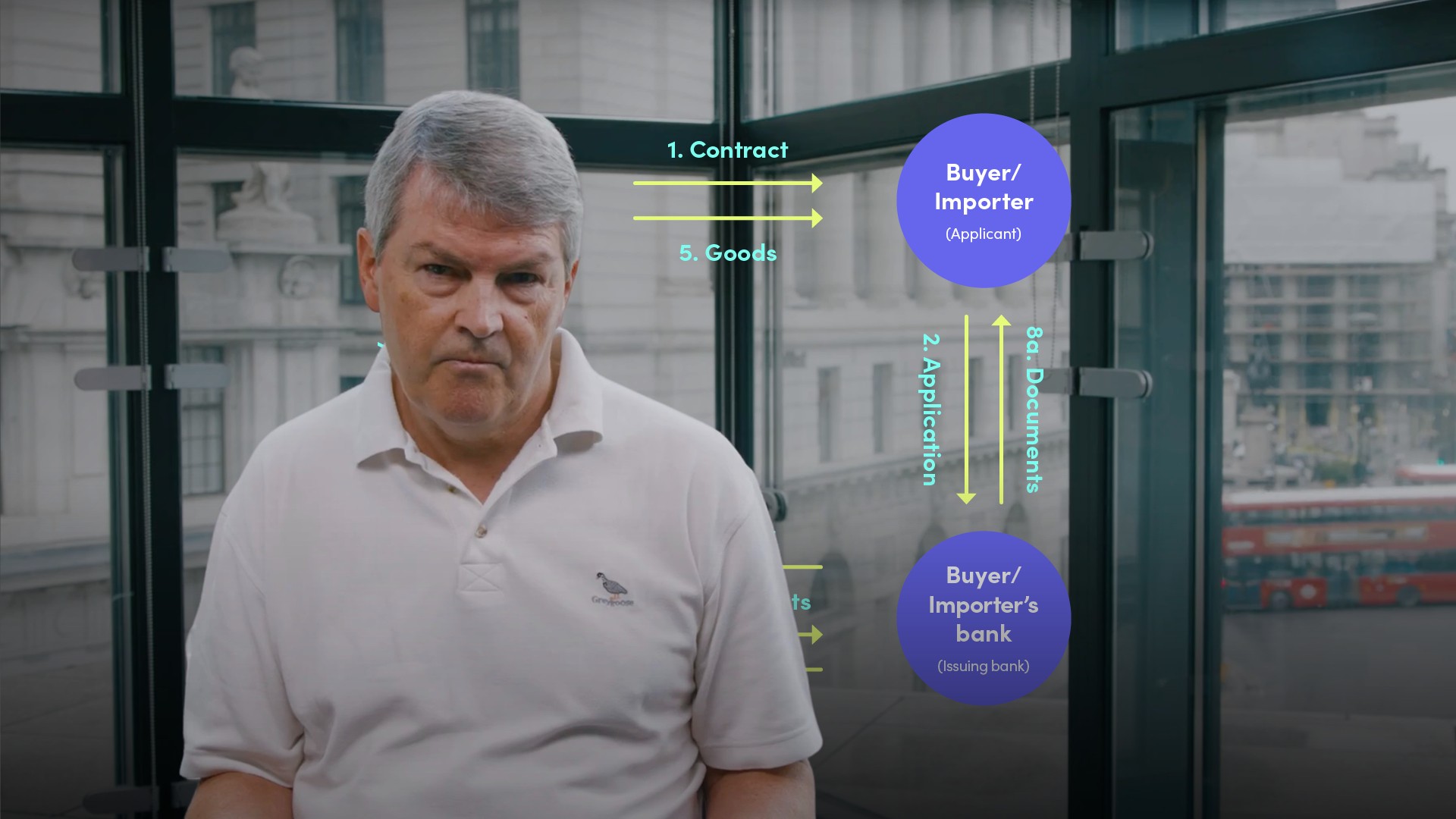

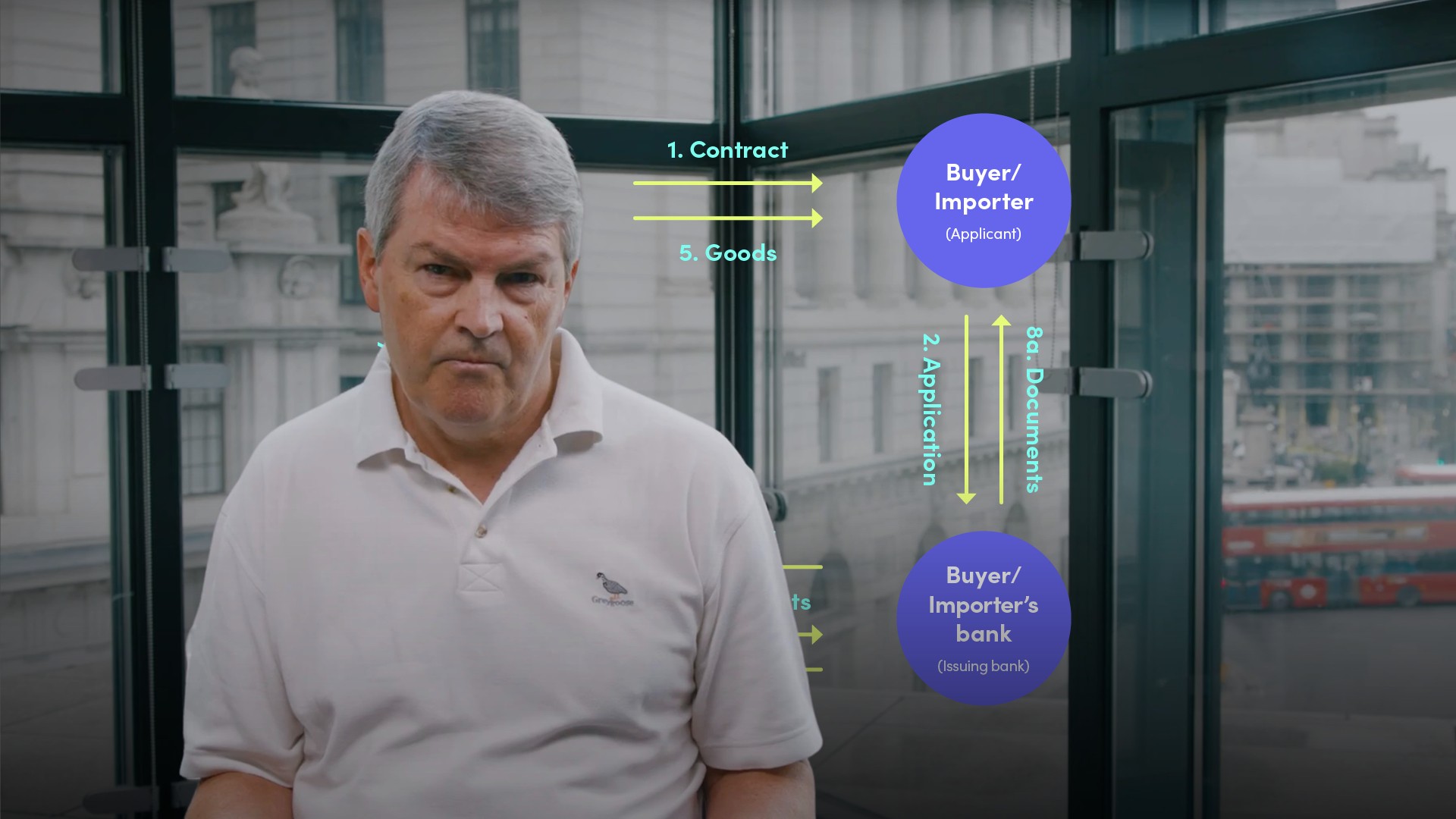

Understand how the LC process work

Understand how the documentary collection process work

Identify how banks use bonds and guarantees to manage risk

Overview:

In this video Aidan continues his series on Trade Finance by looking at how the documentary Letter of Credit works and how its role is similar to that of the Documentary Collection.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

How has the documentary letter of credit benefited both the buyer and seller?

- It has used the banking channel to intermediate on behalf of the seller to ensure that the documents to the goods are only released to the buyer when payment is made

- It has similarly used the banking channel to intermediate on behalf of the buyer to ensure that he only pays when he is satisfied that the requirements of the LC have been met

Why is the documentary LC secure?

This has been made possible by having an established process, governed by a Uniform Customs & Practice code (UCP 600) - itself backed up by case law.How does the LC process work?

Under this framework, the banks only deal in documents (not in the goods) and they enter into a separate binding contract (the LC) which is independent of the underlying commercial contract. So as long as the documentary evidence called for by the buyer is provided by the supplier, the supplier can be assured of getting paid.How does the documentary collection process work?

- The process flow puts the onus on the supplier to initiate and it is the supplier’s bank that drives the process. There is an obligation on the collecting bank to only release documents to the buyer upon either payment or acceptance of a bill of exchange

- Should the buyer refuse to take up and pay for the documents, the collection instructions will advise whether further action should be taken by the collecting bank to preserve the supplier’s rights or whether it should return all documents

What are the differences between the LC and a documentary collection?

- With a collection, there is no separate contract between the banks, indeed there is no obligation on either bank to make payment

- Documentary LC are therefore more secure for a seller than using a collection

- However, because the LC relies on a ‘tick box’ approach to evidence compliance with its terms, an innocent omission or mistake by the seller when presenting documents may give the buyer an excuse not to take up and pay should he no longer require the goods

What other risk management tools can the bank use?

- Advance Payment Guarantees - to cover the return of any monies paid up front by a buyer should the seller fail to deliver

- Tender, Performance and Retention Bonds - to cover the obligations of a seller towards a buyer (more commonly for capital goods)

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Aidan Applegarth

There are no available Videos from "Aidan Applegarth"