What is Behavioural Economics?

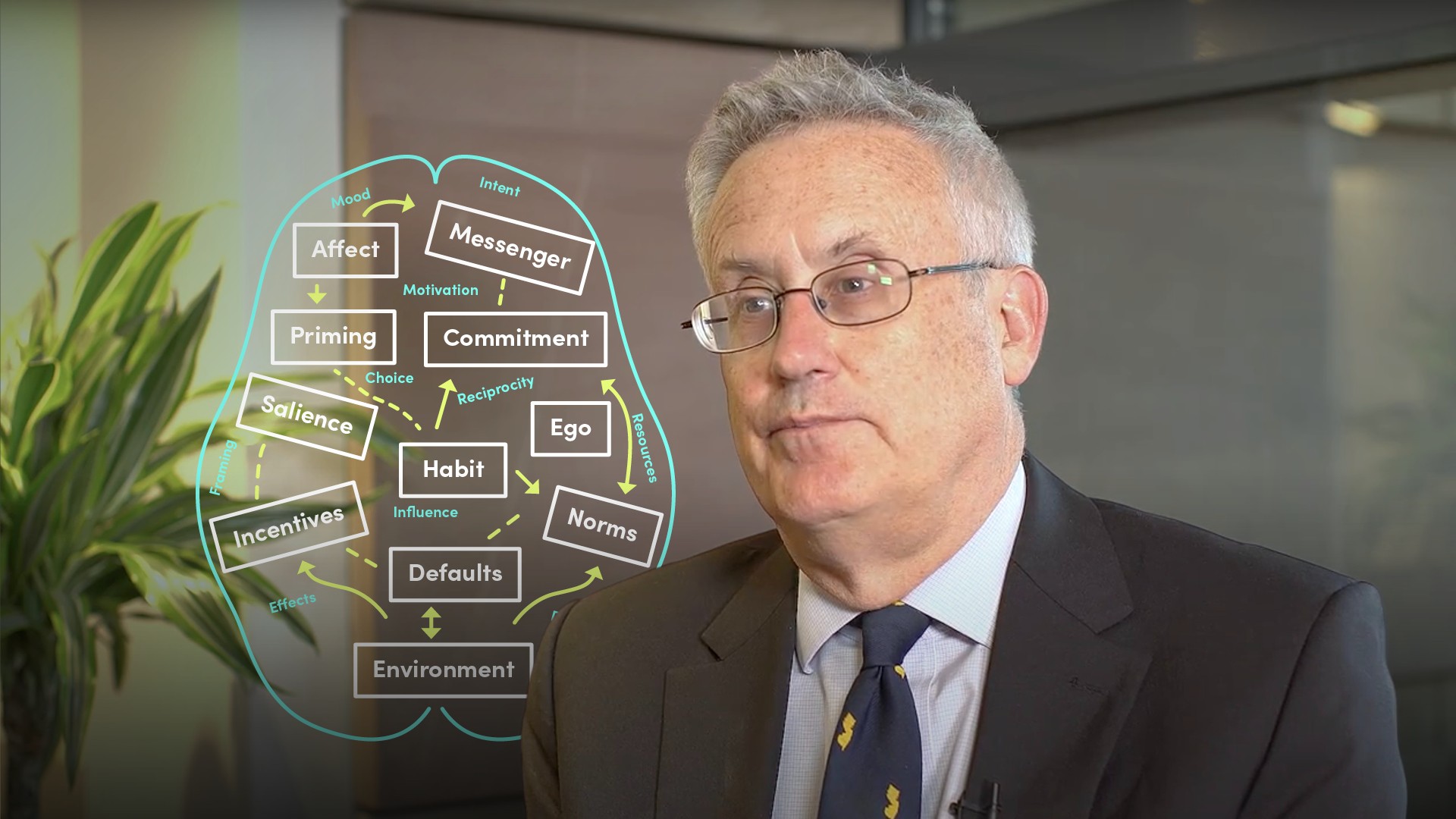

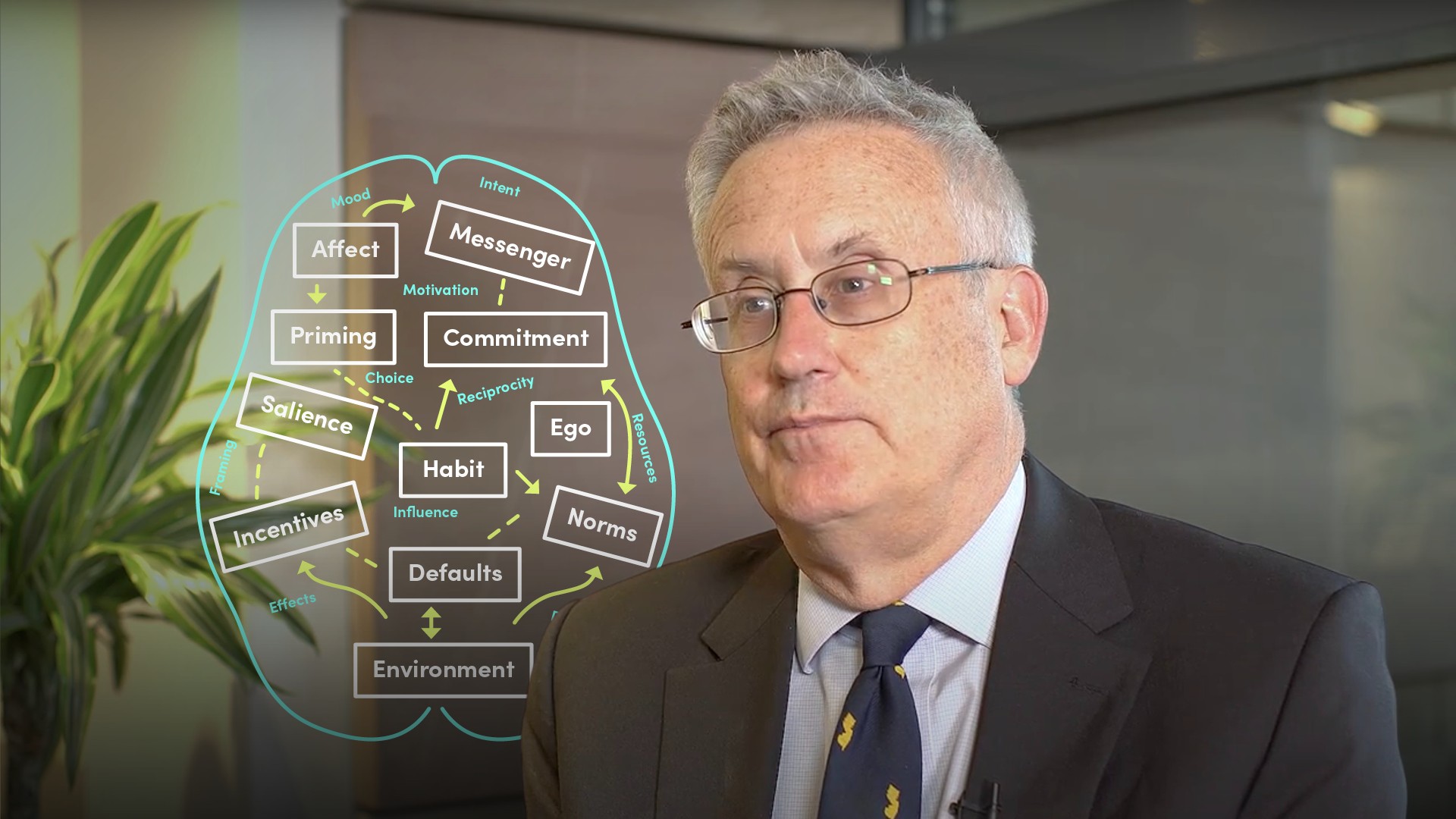

Peter Eisenhardt

30 years: Capital markets & investment banking

Understanding human behaviour is the key to better understanding outcomes and predictability. Peter provides an introduction to behavioural economics by discussing its importance, its focus, and how regulatory bodies utilise this relatively new area of study.

Understanding human behaviour is the key to better understanding outcomes and predictability. Peter provides an introduction to behavioural economics by discussing its importance, its focus, and how regulatory bodies utilise this relatively new area of study.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What is Behavioural Economics?

16 mins 2 secs

Key learning objectives:

Define Behavioral Economics

Explain why economics is not always systematic and predictable.

Understand the two focuses of behavioural economics

Overview:

Behavioural economics studies how psychological, cognitive, emotional, cultural, and social factors impact economic decisions. Economics is increasingly waking up to the fact that understanding human behaviour is the key to better understanding outcomes and predictability. This understanding has given rise to the field of behavioural economics.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Why is Behavioural Economics important?

Everything that a government does, whether that be making regulations, passing criminal laws or setting economic policy is based on incentives which try to get people to do the right thing. Businesses invest huge sums in trying to reach consumers. But if initiatives by governments and businesses don’t reach the public and don’t create the right responses, they have failed.

Is Economics always systematic?

Economics is not nearly as systematic, testable, or predictable. Why? The reason is because human beings are involved. There are two key examples from the book “Freakonomics” that clearly demonstrates this:

- Fine for Tardiness - A school that grew tired of parents showing up late to pick up their kids from school imposed a fine for tardiness. But late pick-ups immediately increased. Why? Because parents interpreted the fine as a cheap price to pay for extra child care

- Exam Scores for Students - Another school provided teachers with bonuses if student grades on national exams improved. At first the scheme seemed to work, as exam marks improved dramatically. But the school eventually found out the grades were achieved because teachers doctored the results, rather than through more committed and inspired teaching

Traditional economics has been based on the assumption that people, and markets, behave in a rational manner and respond to incentives as expected. But we know this is not the case. Human emotions and prejudices are just too powerful.

What are the Key Focuses of Behavioural Economics?

Behavioural economics focuses on two areas:

- Heuristics - the rules and mental shortcuts which people use to form judgments and make decisions. Heuristics simplify decisions, and we couldn’t function without these shortcuts. Shortcuts work just fine for everyday, routine decisions

- Prospect theory, or framing - How a proposition is put to someone can have a huge impact on decisions they make

Why should we use Behavioural Economics?

Behavioural economics has become a hot topic. The world’s ageing population cannot rely on either corporate or government pensions to meet their retirement needs. In just fifteen years, the average lifespan has increased by six years. Retirement can easily last thirty years. Some people will depend on retirement income for an amount of time equal to the time they spent in the workforce. People must engage with finance, become better educated, and invest wisely, or face difficult retirement years.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Peter Eisenhardt

There are no available Videos from "Peter Eisenhardt"