Introduction to Cryptocurrencies

Igor Pejic

Financial technology & blockchain specialist

While Bitcoin was the first cryptocurrency, it is not the only one. Igor outlines other major cryptocurrencies including Ethereum and Ripple, before commenting on the regulation of these types of currencies.

While Bitcoin was the first cryptocurrency, it is not the only one. Igor outlines other major cryptocurrencies including Ethereum and Ripple, before commenting on the regulation of these types of currencies.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Introduction to Cryptocurrencies

10 mins 53 secs

Key learning objectives:

Outline the cryptocurrencies described

Explain what stablecoins are through the use of examples

What regulatory actions have governments taken?

Overview:

The ICO (Initial Coin Offering) boom in 2017 enabled anybody who created a digital currency to raise capital without the administrative burden of an IPO. This resulted in the release of many alternatives to bitcoin, named altcoins. This video describes many of the major cryptocurrencies including Ethereum and Ripple alongside stablecoins, which are pegged to a fiat currency such as the US dollar or British pound. The regulatory actions of countries such as China are also discussed.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Outline the cryptocurrencies described

- Etherem (ETH)

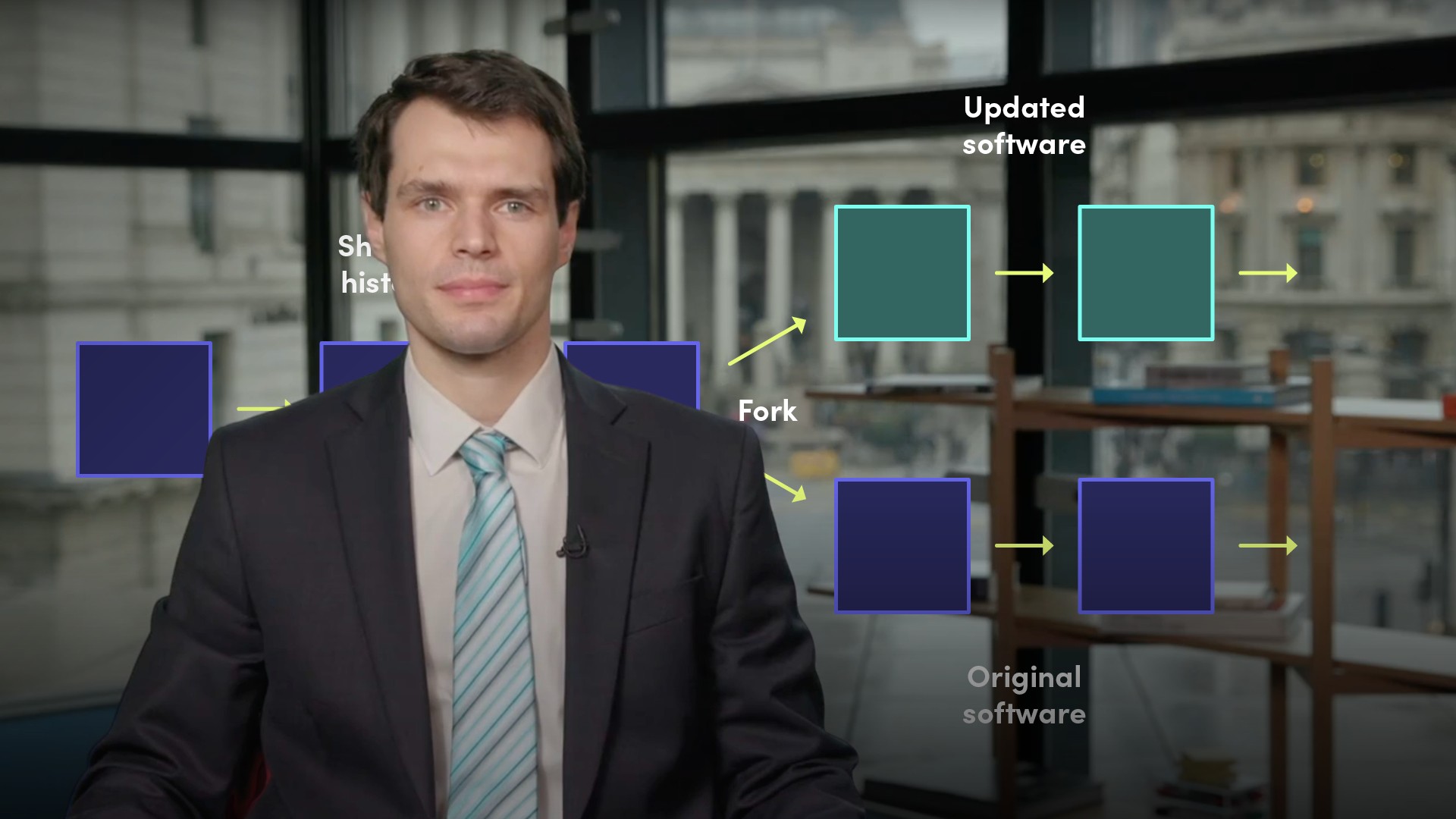

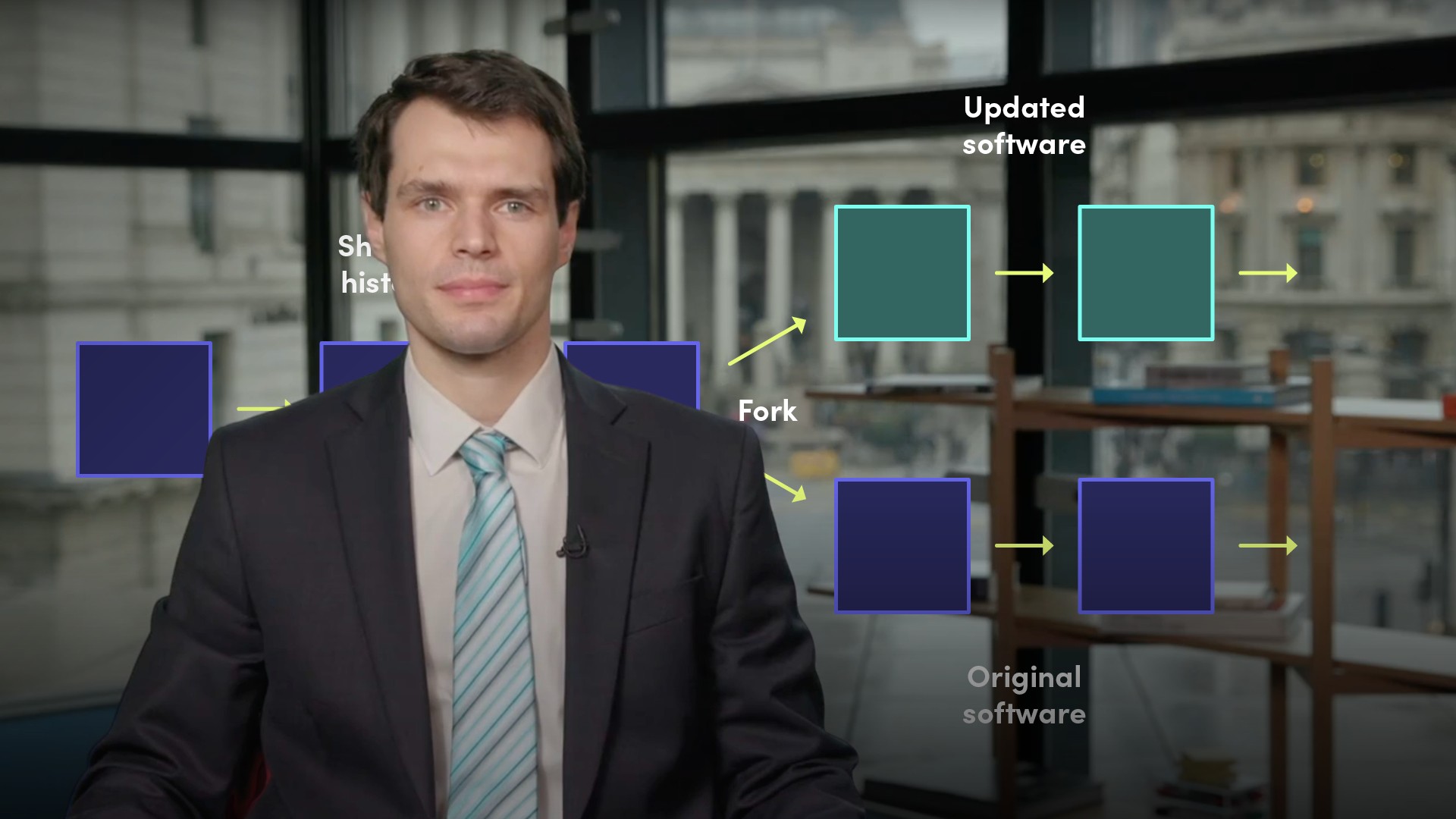

- The applications on Ethereum are run on its platform-specific cryptographic token, called Ether. In 2016 the Ethereum network went through a crisis with the infamous DAO-hack, where approximately $50 million was drained from the system. The cryptocurrency split into Ethereum (ETH) without the hack and Ethereum Classic (ETC) with the hack.

- Ripple

- Ripple used a consensus ledger validation method which is more centralised than most other cryptocurrencies. Furthermore, the needed tokens were already minted at Ripple’s inception and hence, Ripple’s structure doesn't require mining, this reduces the usage of computing power and minimises network latency.

- Bitcoin Cash (BCH)

- Bitcoin has a strict one megabyte limit on the size of blocks. BCH increases the block size from one MB to eight MB, allowing for faster transaction times.

- Litecoin (LTC)

- Litecoin has faster transactions than Bitcoin due to more efficient block generation

- Zcash (ZEC)

- Zcash specialises in privacy

- Monero (XMR)

- Monero specialises in privacy

- Dash

- Dash specialises in privacy

Explain what stablecoins are through the use of examples

Stablecoins are pegged to a fiat currency, such as a US dollar or British pound. They require the issuer to ensure a sufficient reserve of fiat to back up the coin. The stablecoin with the highest market cap is Tether(USDT), which claims to be backed up by USD reserves but continuously refused to be audited, eroding user trust. The most prominent stablecoin, Libra, has not been issued yet after being announced by Facebook in June 2019. The currency is bound to a basket of fiat currencies and managed by the Libra Association, a consortium based in Switzerland and made up of 28 founding members. Users will need Calibra to have access to the coins, which is a wallet provided by a subsidiary of Facebook.What regulatory actions have governments taken?

China was the most prominent country to ban trading with cryptocurrencies, however Western countries have been more liberal - the German government hinted that they should be allowed. With regard to stablecoins, the argument is centered around who should be the issuer. Germany and China condemned stablecoins issued by private companies however, in the US, the debate is still ongoing.Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Igor Pejic

There are no available Videos from "Igor Pejic"