Introduction to Blockchain in Trade Finance

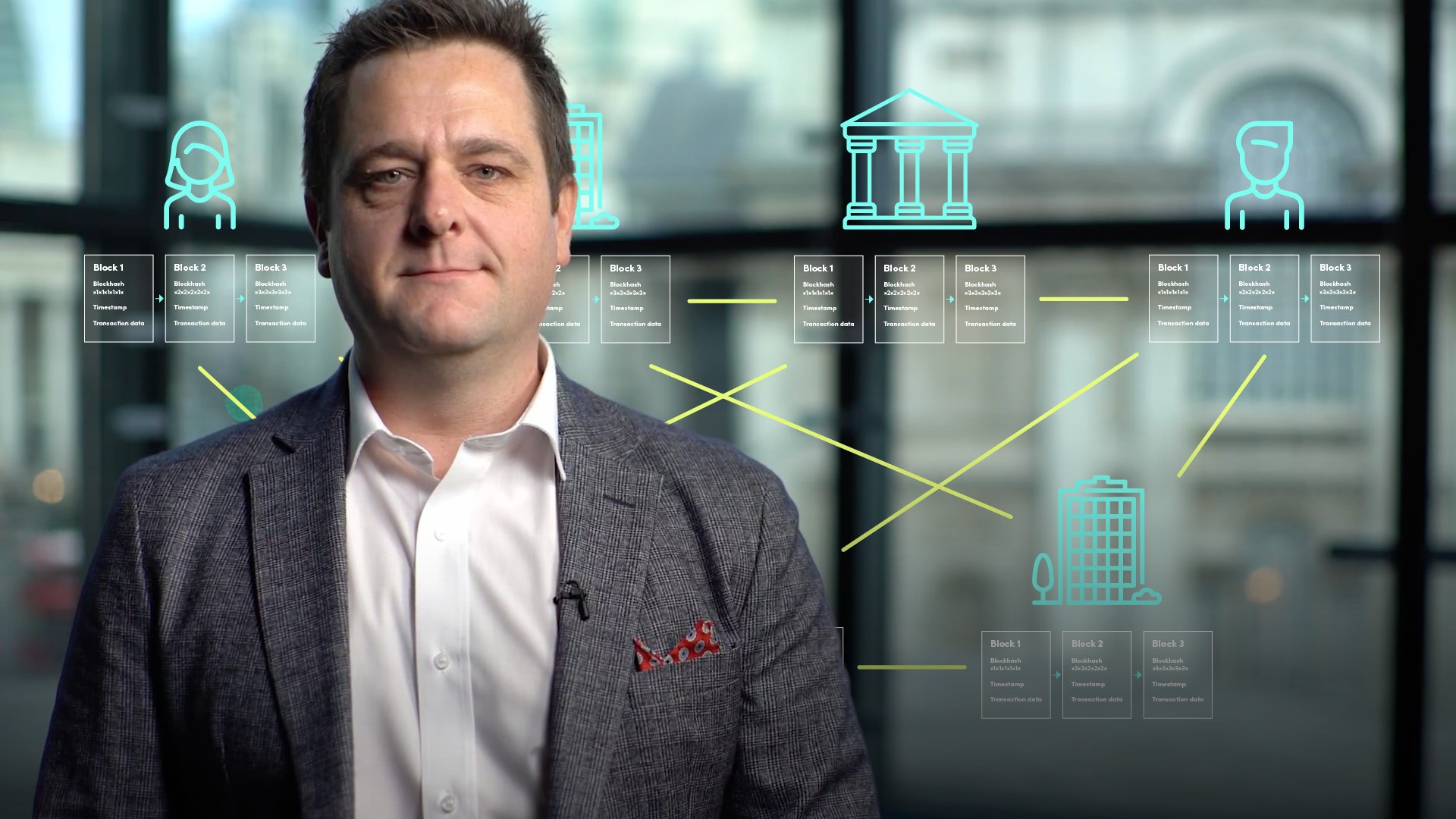

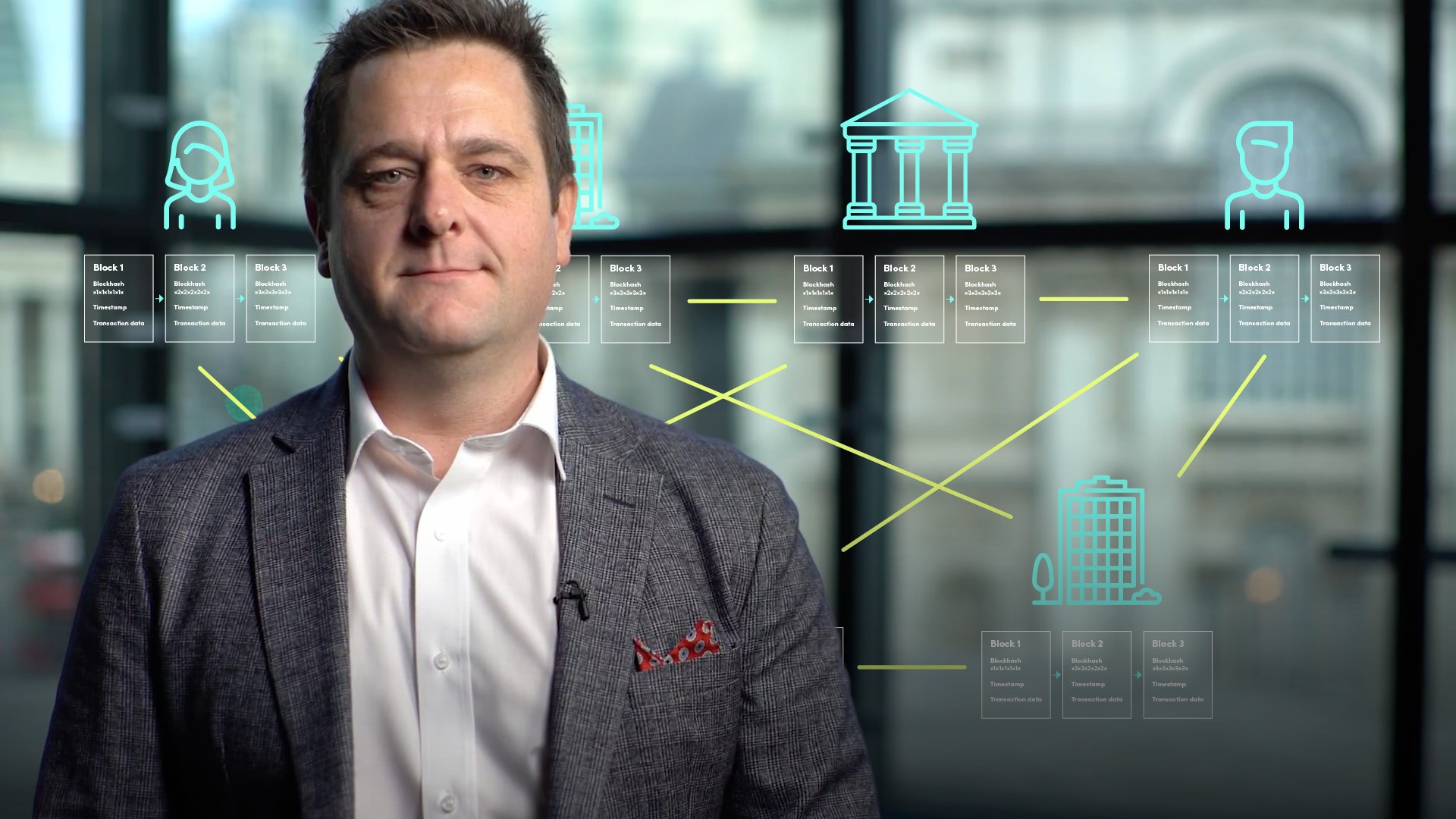

Andrew English

20 years: Trade finance

Blockchain can be applicable to solving real world problems, specifically in trade finance. In the first part of this two part series, Andrew provides an introduction to blockchain in trade finance and explains how it can be used to address certain challenges.

Blockchain can be applicable to solving real world problems, specifically in trade finance. In the first part of this two part series, Andrew provides an introduction to blockchain in trade finance and explains how it can be used to address certain challenges.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Introduction to Blockchain in Trade Finance

9 mins 5 secs

Key learning objectives:

Define blockchain and trade finance

Understand the issues with trade finance and how blockchain can solve them

Overview:

Blockchain is a data structure that stores transactions in a highly secure fashion. Trade finance suffers from the problems of being slow, costly and highly confidential; all problems which blockchain could easily solve.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What is Trade Finance?

Trade takes place both domestically and internationally and entails two parties agreeing to commercial terms where one party, “the buyer” agrees to procure products from another party, “the seller”.

In order for this commercial transaction to take place, there will likely be working capital requirements in order to fund different stages of the transaction, such as the manufacturing process, transportation period, or the deferred payment terms which are offered, which can put significant strain on a corporate’s working capital and cash flow. This can be supported through putting in place a trade finance facility.

Whilst more operationally intensive for banks on a day to day basis, they do provide greater visibility and control over financing requirements, thus helping to reduce credit, operation and fraud risks compared to other financing tools available, such as a traditional overdraft or commercial loan.

What is Blockchain?

Blockchain can be broken down to a few key elements:

- Simply a data structure, i.e. a database, which provides us with some very unique features

- A single ledger of data distributed across a network of parties, rather than being controlled by a central authority

- Transactions that are recorded in data structures referred to as blocks, which are time stamped and contain specific information

- Each block encompasses the transaction information, a cryptographic hash of this information and the cryptographic hash of the previous block. This ensures that if a block is tampered with, the hash, which can be thought of as a unique fingerprint, will not match the block before and all subsequent blocks will be invalid

What are the Issues in Trade Finance?

“Banks deal in documents” is a commonly used phrase and therefore, it is imperative that the system is secure, robust and trustworthy to ensure that any bad actors are weeded out and fraudulent transactions are not inadvertently financed because of falsified documents. This requires scores of people to manually check the information and documents provided, which is time consuming and expensive to process.

To date, there has not been a technological solution that can bring the parties of a transaction together in a way that the information shared between them can easily be verified and relied upon as truth. For this reason, trade finance has been left behind by innovation within the banking space.

How can Blockchain solve these problems?

Blockchain, as we explored earlier, allows for a single source of truth to exist between multiple parties. A single, golden source of truth to verify the status of a transaction which is agreed upon by everybody, which significantly reduces the operational time burden and associated costs.

It is worth also noting that in many commercial deployments of blockchain solutions, users are granted permissions to view information only to those transactions which pertain to them. This ensures those parties of the transaction are all in agreement, but protects sensitive commercial information from competitors eyes.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Andrew English

There are no available Videos from "Andrew English"