Board's Role in Promoting a Sustainability Culture

Natalia Nicolaidis

30 years: General Counsel

In this video, Natalia Nicolaidis explains the role of the board in promoting a sustainability culture across the organisation.

In this video, Natalia Nicolaidis explains the role of the board in promoting a sustainability culture across the organisation.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Board's Role in Promoting a Sustainability Culture

14 mins 47 secs

Key learning objectives:

Understand the evolution of sustainable leadership and its expanded definition

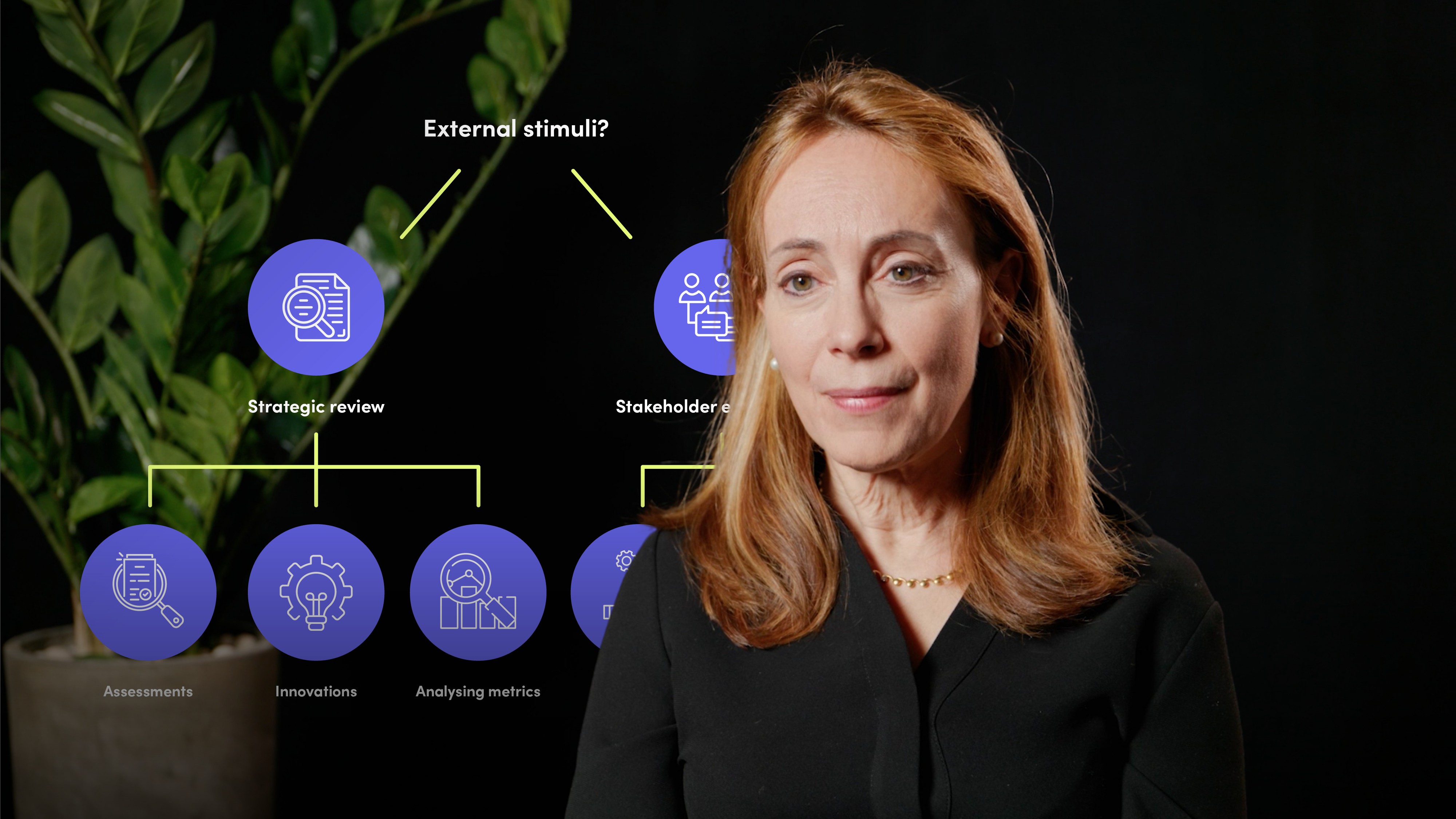

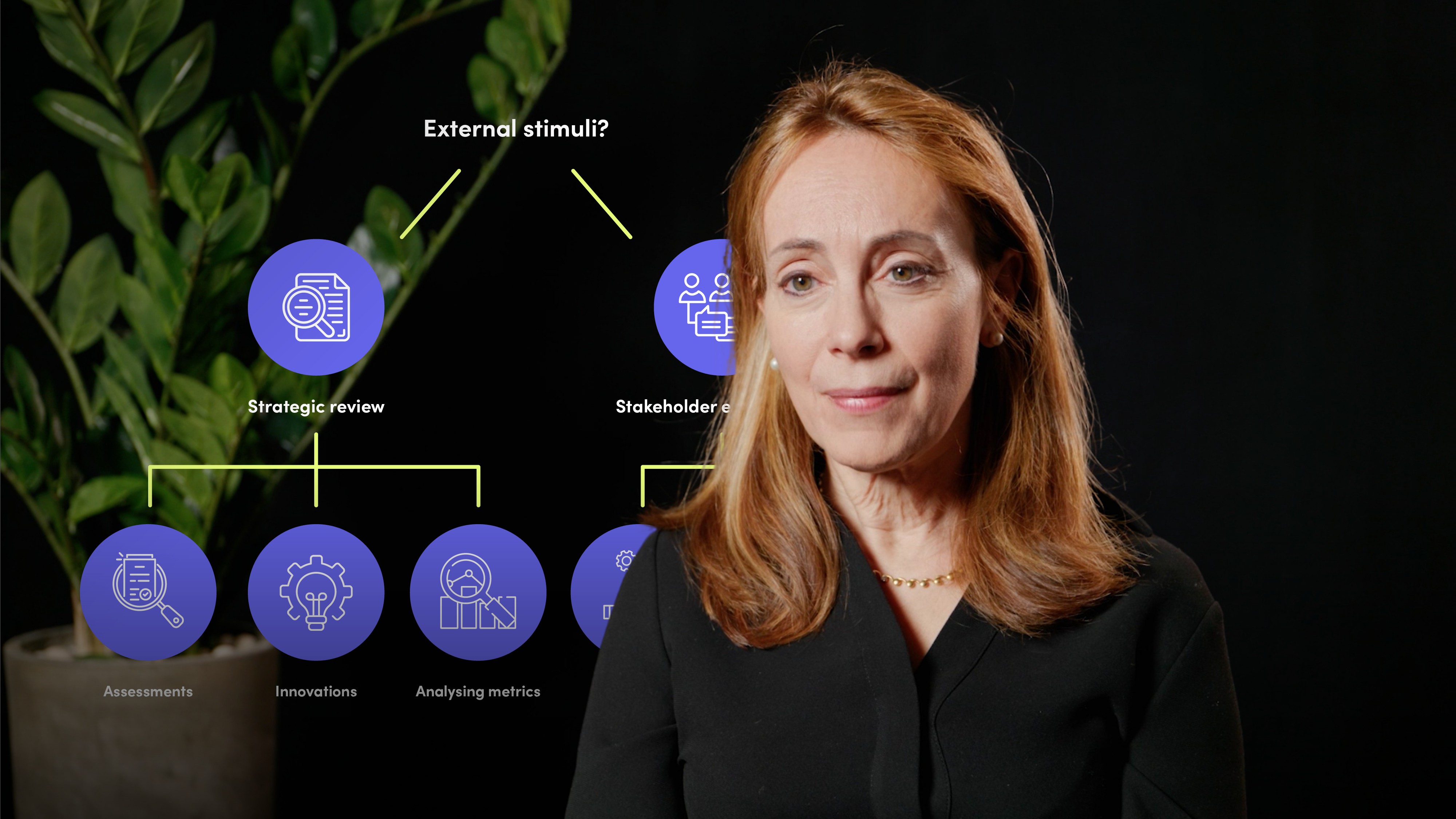

Understand the role of boards in responding to external stimuli

Overview:

Sustainable leadership has evolved since its definition in 1987 by the United Nations Brundtland Commission. Today, it encompasses a commitment to diversity and inclusion, long-term strategic imperatives, and rigorous reporting on sustainability. Boards recognise the value of diverse perspectives, and companies are increasingly adopting measures to improve diversity in the boardroom. Sustainability leadership requires a holistic approach that considers both the immediate and long-term implications of business decisions. Boards and management must respond to external stimuli through strategic reviews and stakeholder engagement. Strategic imperatives drive stakeholder demands for sustainability, and companies must assess their business models and address operational challenges to achieve sustainability goals.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

How has the United Nations Brundtland Commission defined "Sustainability Leadership"?

Meeting the needs of the present generation without compromising the ability of future generations to meet their own needs.

How can boards and management respond to external stimuli and promote sustainability in corporate strategies?

Boards and management can respond to external stimuli and promote sustainability in corporate strategies through strategic reviews and stakeholder engagement.

Strategic reviews involve assessing the company's resilience against key risks and challenges, such as environmental, social, and ethical risks in the value chain. This includes discussions on energy-consumptive products, the need for more sustainable solutions in energy-consumptive sectors, and the impact of regulatory changes on commercial activities. By taking a holistic view and considering multiple factors, boards and management can identify areas for improvement and innovation.

Stakeholder engagement is crucial for promoting sustainability in corporate strategies. Companies need to communicate their sustainability milestones and challenges in a credible way to stakeholders, including customers, investors, and regulators. This can be achieved through governance roadshows, where corporate boards review governance practices and address concerns about diversity and inclusion, environmental issues, and social impact. Additionally, investor activism plays a role in influencing management and encouraging companies to develop their corporate sustainability activities. Investors and their proxy advisors promote governance guidelines that emphasise "good" governance principles and sustainability practices.

What strategic approaches should be taken to achieve sustainability goals?

- Assessment

- Innvovations

- Analysing metrics (Measuring success)

How do financial materiality and carbon literacy pose challenges to the adoption of sustainable practices?

Financial materiality and carbon literacy present challenges to the adoption of sustainable practices.

Financial materiality refers to the perceived relevance of environmental, social, and governance (ESG) factors to a company's financial position. Some investors question the impact of sustainability on financial performance and prioritize short-term commercial imperatives over long-term sustainability goals. This skepticism can hinder the adoption of sustainable practices as companies need to demonstrate the financial benefits and materiality of their sustainability initiatives to gain investor support.

Carbon literacy, on the other hand, pertains to the understanding and meaningful communication of a company's environmental impact, particularly in terms of greenhouse gas (GHG) emissions. While companies may undertake efforts to measure and disclose their environmental sustainability data, it can be challenging to make this information meaningful and relatable to consumers. The complexities of global supply chains and production processes make it difficult for consumers to fully grasp the environmental consequences of their purchasing decisions.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Natalia Nicolaidis

There are no available Videos from "Natalia Nicolaidis"