Calculating Accrued Interest on a Bond

Abdulla Javeri

30 years: Financial markets trader

Abdulla explains the fundamental concepts: day count conventions, accruals and accrued interest, as applied in bond markets.

Abdulla explains the fundamental concepts: day count conventions, accruals and accrued interest, as applied in bond markets.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Calculating Accrued Interest on a Bond

6 mins 13 secs

Key learning objectives:

Understand how bonds are traded and how they accrue interest

Overview:

The bond markets use day counts in order to reflect the correct amount of accrued interest. Bonds use one of several major market conventions to perform this task.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

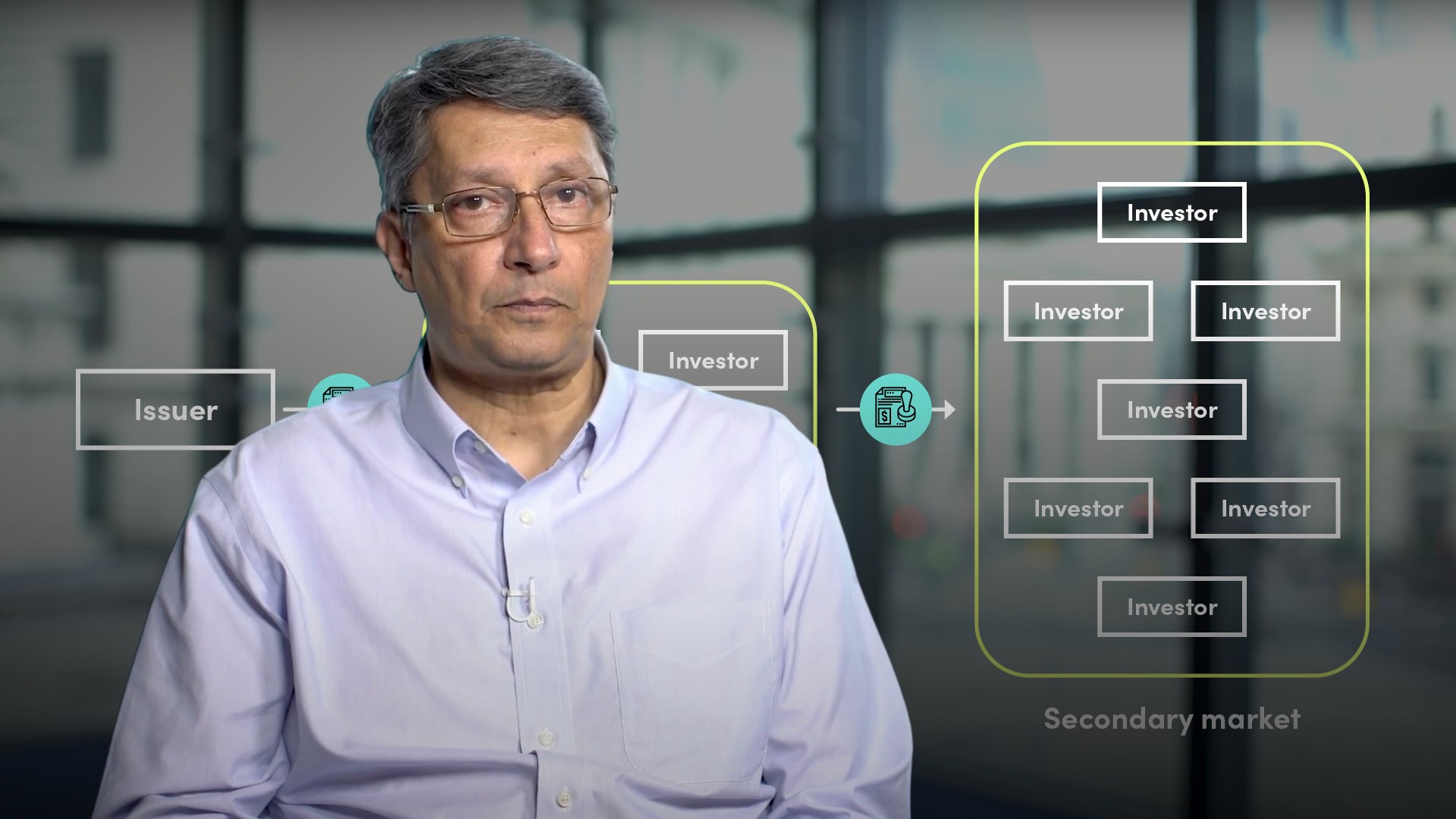

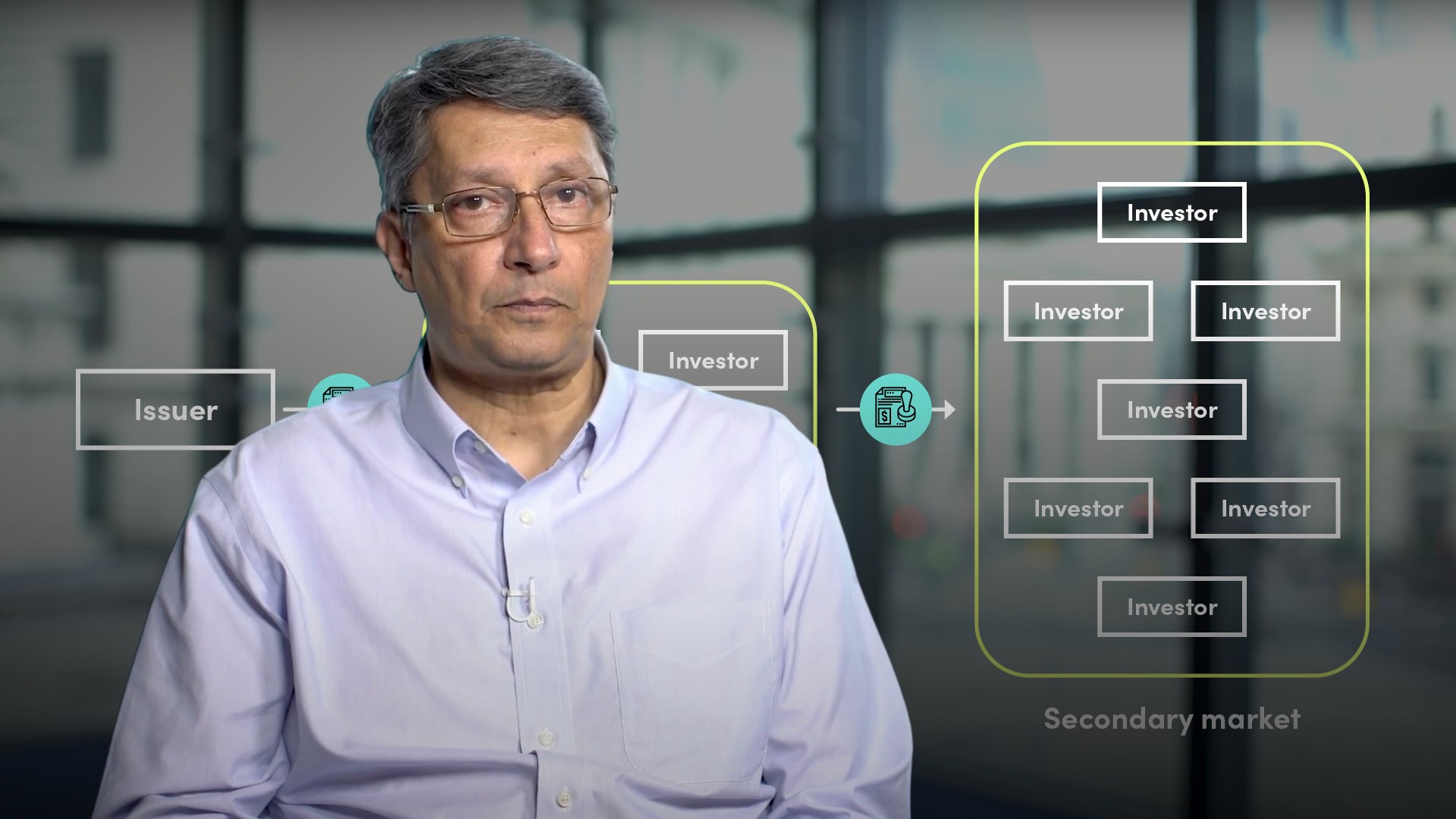

How are bonds traded?

A bond, once issued, is freely tradable in what is known as the secondary market and the market sets the price. The convention is to quote the clean price, which is the price without any accrued interest. The dirty price is the amount you actually pay for the bond on settlement day, which is the clean price plus the accrued interest.

How do you calculate the accrued interest using the bond market day count example?

The calculation of the accrued interest is determined by the day count convention applicable to the bond. We’ve got a bond that pays coupons twice a year, every 15th of January and 15th of July. As this is a semi-annual paying bond the coupon payment is half the annual coupon. Each coupon represents the interest for the previous 6 month period.

If you buy the bond in between coupon dates and settle purely at the clean price, it would be rational, other things remaining the same, to buy it on the day before the coupon payment, keep it for a day and collect 6 months interest. Even if you buy the bond on say the 12th of May at a clean, or market price of 115.65, you’d be keeping the bond for 2 months and getting 6 months interest. That clearly doesn’t work. We therefore have to apply the accrued interest to keep things equitable.

Next step is to calculate the accrued interest. You have to pay the interest that has accrued to the bond since the last coupon date up to the date that you settle. The accrual is the number of days since the last coupon divided by the number of days in the coupon paying period, which in turn is dictated by the day count convention. Generically you can think of accrual as days over base. The accrued interest is simply the accrual multiplied by the coupon payment.

The three major market conventions are, Actual/Actual, 30/360 and 30E/360. You’ll find the applicable convention in the small print of the bond’s paperwork.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Abdulla Javeri

There are no available Videos from "Abdulla Javeri"