Introduction to Buffettology

Peter Eisenhardt

30 years: Capital markets & investment banking

Warren Buffet is one of the greatest investors of all time. Peter discusses key concepts, including value investing and compounding, to explain why Warren Buffet has been so successful in his investments.

Warren Buffet is one of the greatest investors of all time. Peter discusses key concepts, including value investing and compounding, to explain why Warren Buffet has been so successful in his investments.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Introduction to Buffettology

9 mins 35 secs

Key learning objectives:

Outline some facts about Warren Buffett

Understand how the work of Benjamin Graham influence Buffett

Outline Buffett’s key principles for investing

Overview:

Warren Buffett is considered one of the greatest investors of all-time, with a net worth exceeding $80bn. Buffett has an uncanny ability to to articulate his ideas on investing: seven of which are outlined below.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What are some facts about Warren Buffett?

- Born in 1930.

- He lives in the same modest stucco house he bought for $31,000 in 1958.

- Buffett was taught by Benjamin Graham at Columbia University in the 1950s. Graham has been called the “Dean of Wall Street” and the “Father of Value Investing”.

- Referred to as the “Oracle of Omaha”.

- He hosts an annual event attended by 20,000 people.

- In 2011, he received America’s highest civilian honour, the Presentation Medal of Freedom.

How did the work of Benjamin Graham influence Buffett?

The first principle of value investing is capital preservation. This is vital to achieving strong investment returns. To achieve this, Graham’s strategy was:- To look for popular or neglected companies with low price to equity and price to book ratios

- He analysed returns on equity, debt and profit margins

- Finally, he studied footnotes to see whether companies had overlooked, hidden assets

What are Buffett’s key principles for investing?

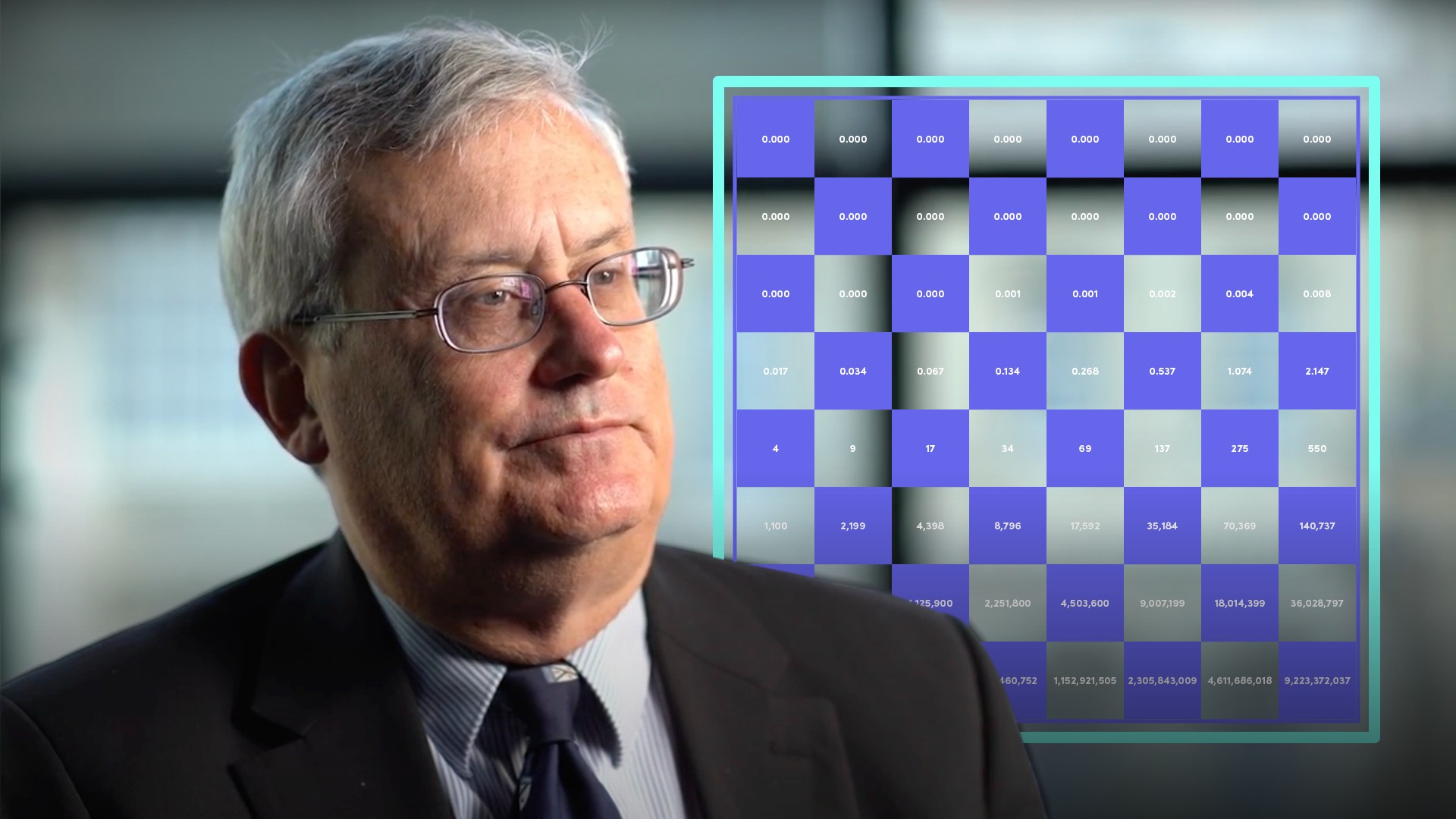

- Start investing early, and keep investing

- Buffett said “I made my first investment at age 11. I was wasting my life up until then”

- Be disciplined

- Buffet says “Do not save what is left after spending, but spend what is left after saving”

- Invest for the long-term

- Buffett says “Our favourite holding period is forever”

- Invest in quality

- Buffet says “Price is what you pay. Value is what you get. Weather its stocks or socks, I like buying quality merchandise when the price is marked down”

- Invest in what you understand

- Buffet will not invest without adequate information or knowledge. In fact, he has stayed away from many tech companies and IPOs. He states “Risk comes from not knowing what you’re doing”

- Be patient

- Buffett says “The difference between successful people and really successful people is that really successful people say no to almost everything”

- Stick with what works

- Buffett is not afraid to take large positions in companies in which he has real belief. In so doing, he exercises real shareowner capitalism by sheltering company management from the short-term pressures of the market

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Peter Eisenhardt

There are no available Videos from "Peter Eisenhardt"