The Great Moderation and the New Normal

Frances Coppola

25 years: Economic commentary & banking

In this second part of Frances's video on central banks, she covers some of the history that shaped the role they hold today, including the Great Moderation and the financial crisis.

In this second part of Frances's video on central banks, she covers some of the history that shaped the role they hold today, including the Great Moderation and the financial crisis.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

The Great Moderation and the New Normal

12 mins 41 secs

Key learning objectives:

Identify the monetary policy utilised pre and post-crisis

Define the Great Moderation

Identify what the central bank should do next

Overview:

The financial crisis caused a dramatic shift in monetary policy. Prior to the financial crisis, central banks used interest rate policy to control inflation. Since then, more unconventional forms, such as QE have had a huge impact on the global economy. However, central banks are now demanding an entire change of emphasis, suggesting that governments should share responsibility in restoring the economy.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What is the Great Moderation?

The period between 1993 and 2008. During this time, inflation in developed countries remained low and stable. Major developing countries such as China industrialised rapidly, pouring cheap goods into Western countries.

What occurred during the period of the Great Moderation?

- As central banks adopted inflation targeting and flexible interest rate regimes, governments stepped back from day-to-day management of the economy. Central banks were freed from political control and empowered to manage monetary policy themselves

- After 2001, inflation remained low, asset prices were rising to unprecedented heights, however, politics reassured that central banks were in control

- From mid-2007 onwards, banks started to fail and markets started to freeze. Interest rates remained at 5.25% in the US as the Fed was much more worried about inflation.

- In March 2008, the Fed bailed out the investment bank Bear Stearns, and in August 2008, Fannie and Freddie Mac were nationalised

- Lehman Brothers’ failure set off a tidal wave of bank collapses and market freezes that tipped the world into the deepest recession since the 1930s. The great financial crisis brought the Great Moderation to an abrupt, and disastrous end

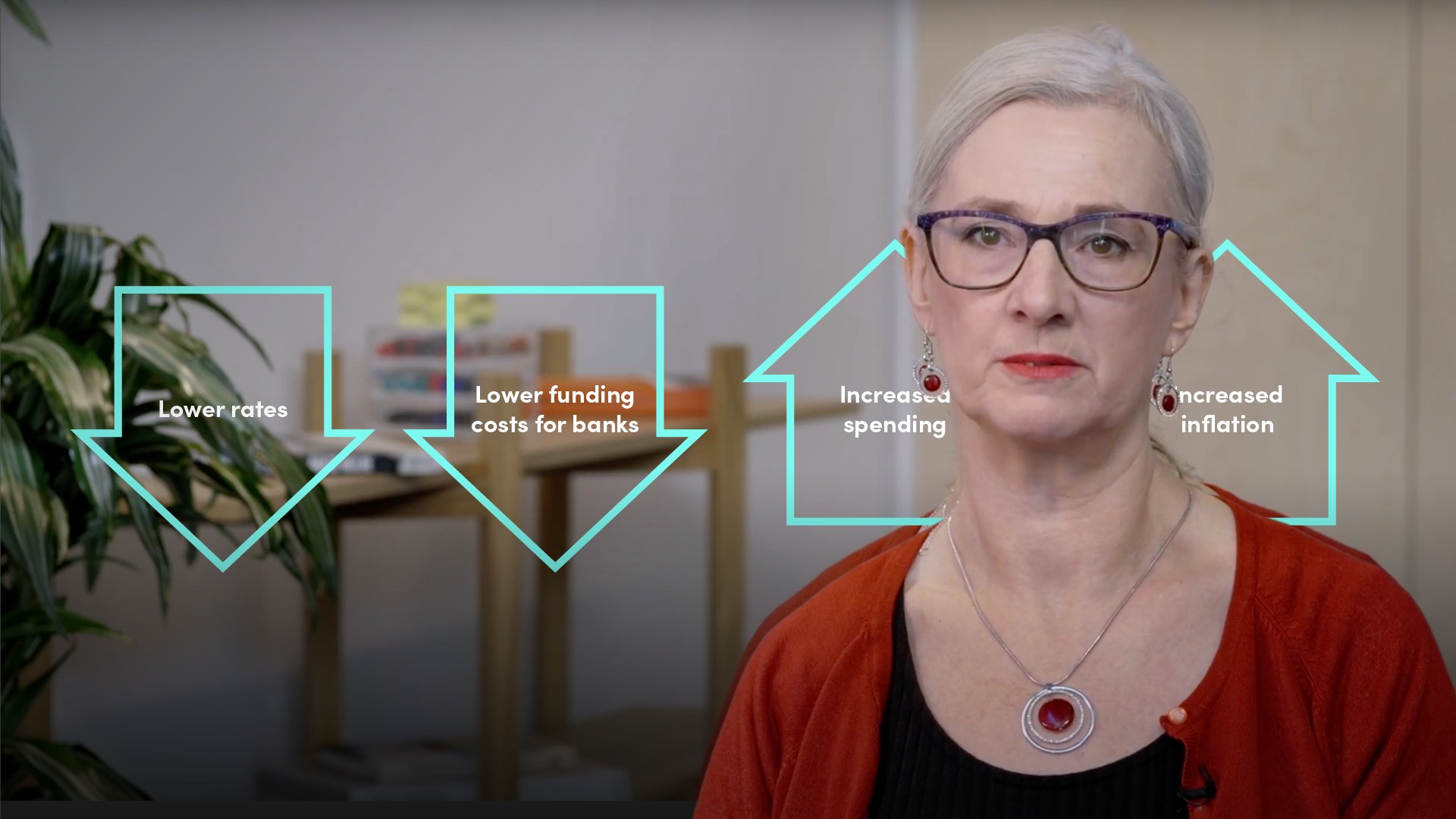

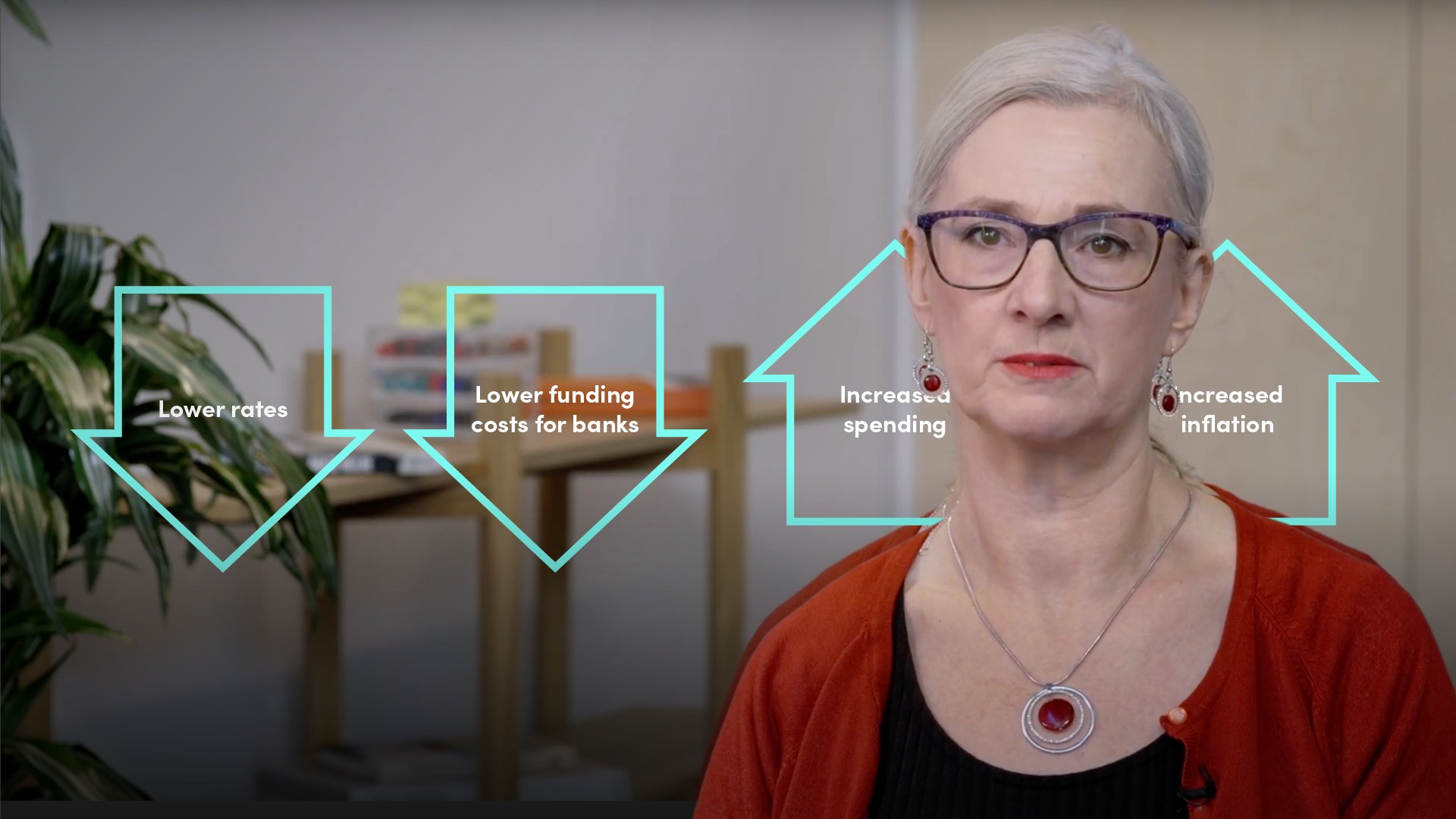

How does the central bank raising its policy rate slow growth?

- When the central bank raises its policy rate, banks must pay more to borrow the reserves they need to make a payment

- As banks earn their profits by lending at a higher interest rate than their cost of funds, when the policy rate rises, they raise interest rates for their customers (borrowers)

- This in turn discourages bank customers from taking out new loans - and increase interest payments on existing loans - if they are at variable rates (mortgages and business loans)

- Faced with higher costs, people cut spending, and businesses lay off workers. This raises unemployment and reduces inflation

What was the initial impact of the financial crisis on the global economy?

- Banks stopped lending to each other and their customers

- Investors withdrew capital from developing countries and risky enterprises

- Financial markets froze

- The payment systems which are the lifeblood of modern economies came dangerously close to collapse

What were the policy responses at the time?

- Bank bailouts - the British government bailed out RBS when it failed in October 2008

- Interest rates - Central banks cut interest rates to nearly zero

- Quantitative easing - buying large quantities of mainly government bonds form investors and banks, and paying for them with newly created money. The idea was that banks would lend out the new money, stimulating spending and encouraging businesses to hire.

How successful was QE?

QE pumped up asset prices all over the world, stock markets boomed, the price of prime real estate shot up, and commodity prices rose. The owners of assets have benefited from QE. There is also some evidence that employment rose faster in countries where the central bank was doing QE.

What has changed for central banks?

Central banks are still targeting inflation and primarily using interest rates to manage it. But whereas before the crisis, central banks feared that if they cut interest rates too much, inflation would take off, now they fear that inflation will fall below zero, and they will be unable to raise it. This is seen in the case of Japan, where inflation has been at or near zero since 1990.

What is the “new normal”?

- Low interest rates

- Low growth

- Low inflation

- High asset prices

What should central banks do next?

- Raising the inflation target to encourage central banks to be less worried about inflation is popular among some economists

- Others believe that it is time to stop seeing QE as exceptional, and simply regard it as part of the central bank toolkit

- Some economists believe that central banks should make greater use of negative interest rates. Whereas others suggest an occasional use to shock the economy out of a recession

- Instead of buying assets, central banks should distribute money directly to people. - This is known as “helicopter money”

- Central banks are calling for governments to share the responsibility for restoring their economies, as opposed to concentrating on reducing their own deficits

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Frances Coppola

There are no available Videos from "Frances Coppola"