What are Central Counterparties (CCPs)?

Peter Eisenhardt

30 years: Capital markets & investment banking

Central Counterparties, or CCPs, reduce settlement and credit risk and costs by netting transactions between multiple counterparties. Peter explains how and why CCPs perform this function.

Central Counterparties, or CCPs, reduce settlement and credit risk and costs by netting transactions between multiple counterparties. Peter explains how and why CCPs perform this function.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What are Central Counterparties (CCPs)?

1 min 53 secs

Key learning objectives:

Define CCPs and novation

Understand the significance of CCPs in the derivatives market

Outline examples of major CCPs

Overview:

Central Counterparties (CCPs) are an essential entity for derivative trades in certain markets. They are successful in reducing risk, but can constitute a systemic risk under extreme conditions.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

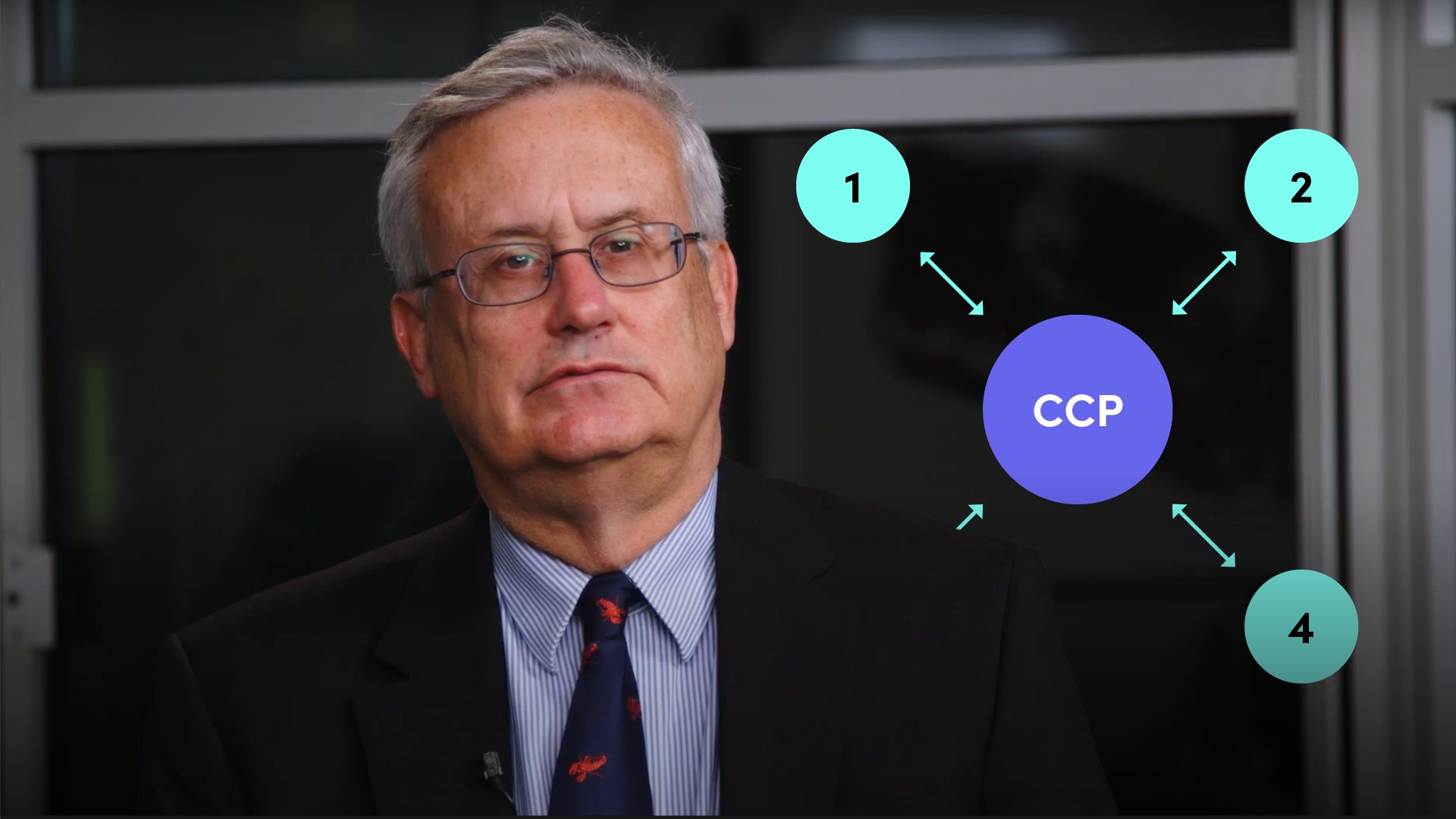

What are Central Counterparties?

Central Counterparties (CCPs) are entities that interpose themselves as the counterparty to derivative trades in certain markets. In markets where CCPs operate, the CCP becomes the buyer to every seller and the seller to every buyer.What is “novation”?

Novation - the legal process by which trades are transferred to the CCP.Why are Central Counterparties important in the derivatives market?

Following the Global Financial Crisis, the G20 leaders formulated their ambition at the 2009 Pittsburgh summit that all standardised derivatives contracts should be cleared through CCPs because:

- CCPs reduce settlement and credit risks and costs by netting offsetting transactions between multiple counterparties.

- Counterparties of the CCP must post margin in case they cannot meet their obligations.

- This requirement is especially important for derivatives, which can involve a stream of payments over years rather than a simple transfer of securities against cash for short settlement.

How risky are CCPs?

While CCPs are successful in reducing risk, in extreme conditions, multiple failures of counterparts to a CCP could theoretically lead to its own collapse, thereby representing a significant systemic risk. CCP reporting, pricing, margining, legal enforceability, and capitalisation are therefore paramount.What are some examples of CCPs?

Examples of CCPs are:

- NSCC - the U.S.

- LCH Clearnet - the UK

- Eurex - Germany

- JSCC - Japan

- Shanghai Clearing House - China

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Peter Eisenhardt

There are no available Videos from "Peter Eisenhardt"