Climate Risk Methodologies

David Carlin

Head of Climate Risk

In this video, David Carlin gives an overview of some of the current climate risk methodologies used by climate risk tool providers and he explores some of the approaches and general workflow for assessing both transition and physical climate risk.

In this video, David Carlin gives an overview of some of the current climate risk methodologies used by climate risk tool providers and he explores some of the approaches and general workflow for assessing both transition and physical climate risk.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Climate Risk Methodologies

5 mins 17 secs

Key learning objectives:

Understand the general process workflow and approach to transition risk assessment

Understand how physical risk assessment is conducted

Overview:

It is clear that there are a lot of factors for financial institutions to consider when carrying out a climate risk assessment. Transition risk assessment generally involves backward and forward-looking data, while physical risk assessment considers hazards, vulnerability, and exposure. The best way to approach this is through a comprehensive and multidimensional approach that covers both physical and transition risks.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

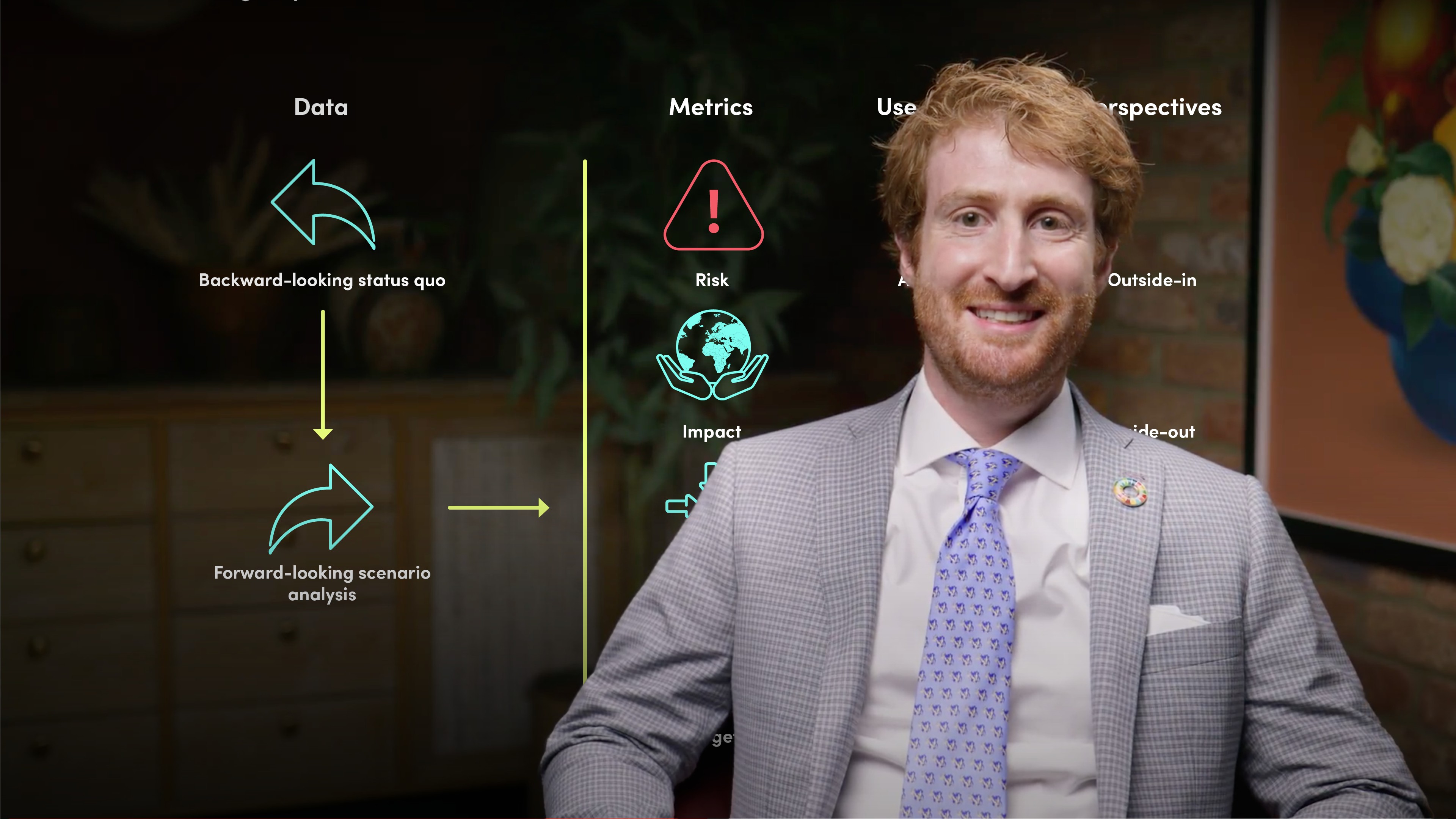

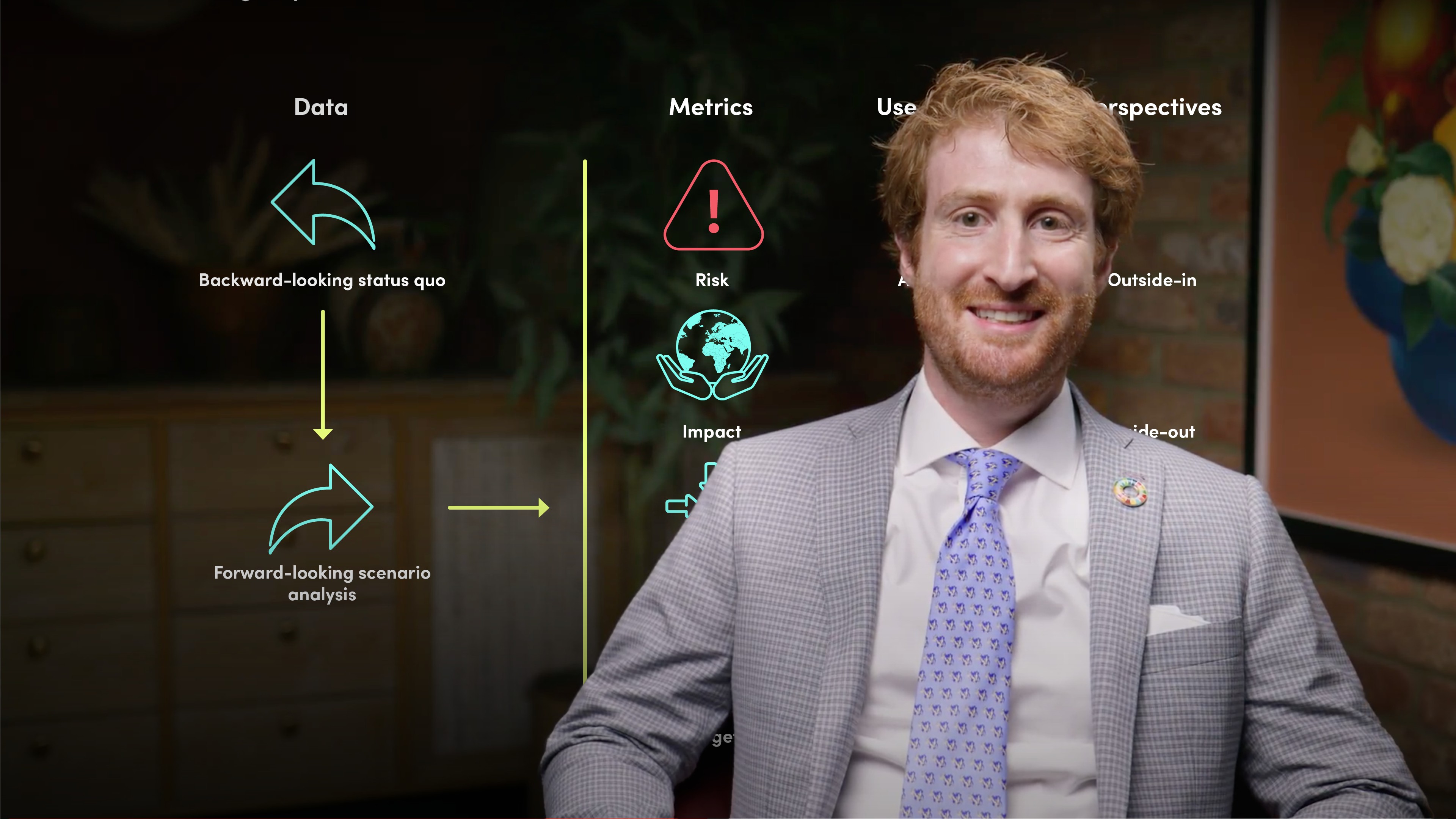

How can we approach transition risk assessment?

- Backward looking dataset - Reflects the status quo (eg: current emissions)

- Forward looking dataset - Projected for scenarios of different possible futures

What is the general workflow used in transition risk assessment?

How is physical risk expressed?

- Hazards refer to potentially damaging physical events or human activities that harm the environment, human health, or cause economic disruption.

- Exposure relates to the risk faced by assets in climate events.

- Vulnerability refers to the susceptibility to those hazards when thinking about physical, social, and economic factors.

How are physical climate risks assessed?

- Define needs and objectives

- Identify available data and resources

- Define the scope and approach

- Generate relevant scenarios

- Estimate the impacts

- Present and interpret the final results.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

David Carlin

There are no available Videos from "David Carlin"