CLO Illustration

Mike Peterson

20 years: Capital markets media

In this video, Mike explains how a CLO comes into existence and outlines the key events in its life. To describe this process, he will use a real example, Sound Point Euro CLO 1.

In this video, Mike explains how a CLO comes into existence and outlines the key events in its life. To describe this process, he will use a real example, Sound Point Euro CLO 1.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

CLO Illustration

9 mins 58 secs

Key learning objectives:

Understand the process of raising a CLO

Overview:

The text below shows an overview of an example of a CLO raised by Sound Point Capital.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What is the process for raising a CLO?

Let’s take a real example, Sound Point Euro CLO I:

(1) Appoint an IB:

Sound Point did what managers always do when they want to raise a new CLO. It appointed an investment bank to arrange the deal. The bank it chose as arranger for this particular CLO was one of the biggest in the business, Citibank. Citi’s role would be to sound out potential investors ahead of the deal, figure out what tranches of different ratings could be sold and what types of restrictions Sound Point face.

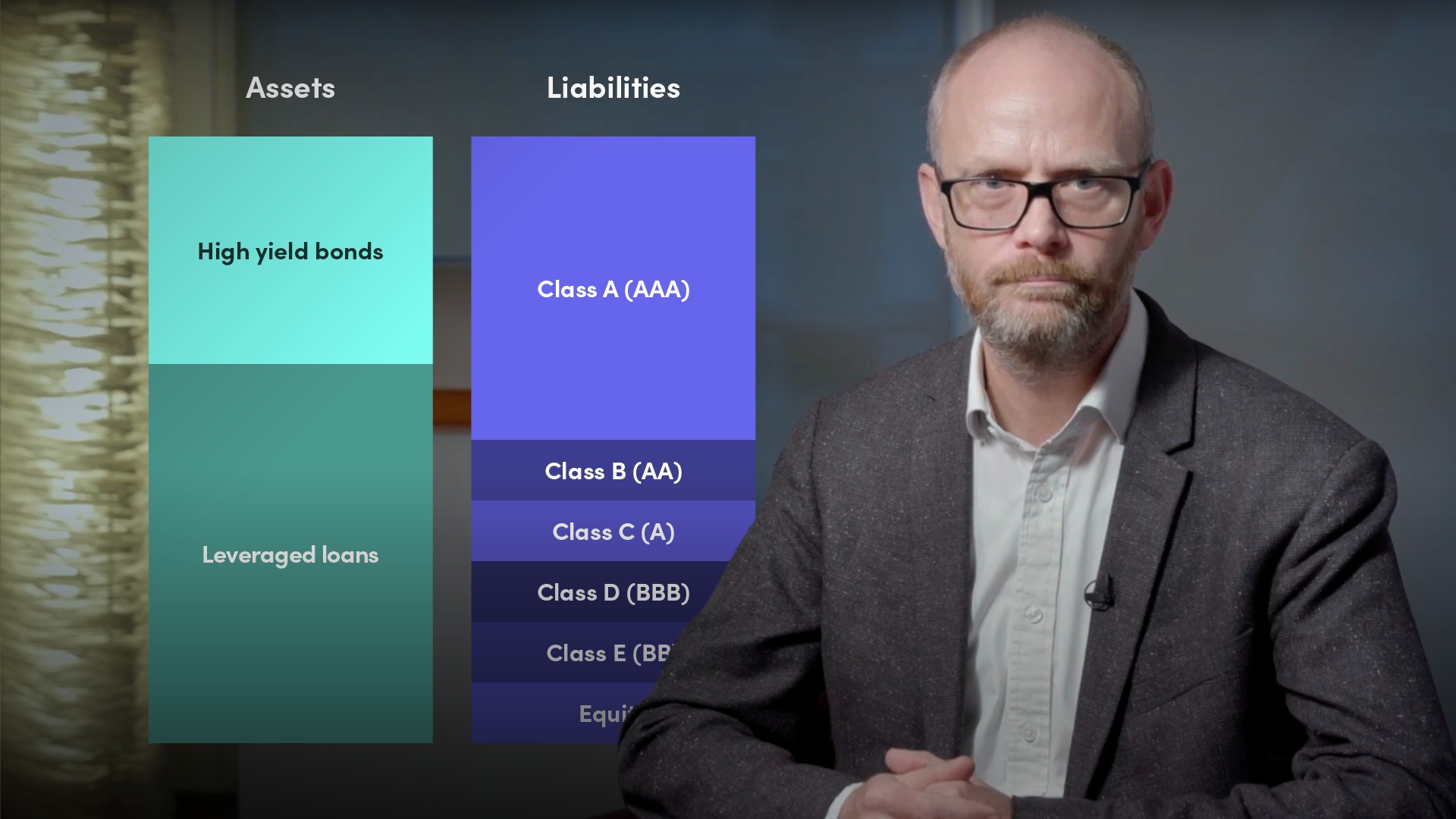

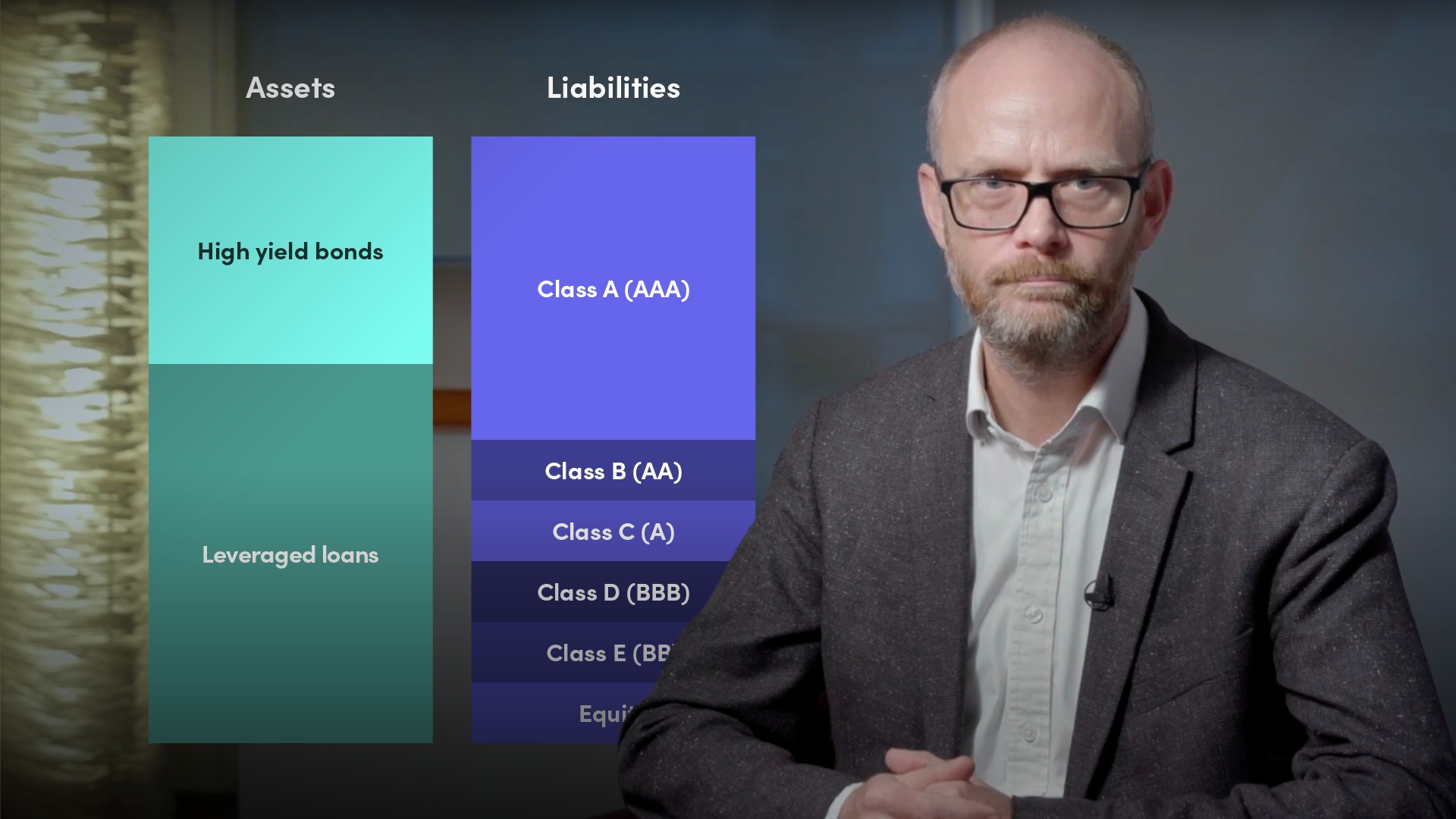

The structure of the deal was relatively standard. The CLO’s tranches fall into two types. We will refer to all the tranches that benefit from some kind of protection as debt tranches or CLO notes. The most junior tranche which carries the most risk is known as the CLO equity and it sits below the CLO notes.

(2) Identify key dates:

- Maturity date - A lot of the discussions around a CLO’s structure revolve around dates. Sound Point Euro CLO I has its legal maturity in April 2032. That is to say that each of the CLO’s debt tranches are bonds with the same maturity date 13 years in the future. In reality, a CLO may well have a much shorter life than this legal maturity. But April 2032 is the point when all the debt tranches must be repaid to investors in full. CLOs almost all have legal maturities of 11 or 12 years.

- Non-call period - As well as a maturity date, the CLO has a non-call period. This is another mechanism to protect the debt investors. The non-call period for Sound Point’s deal ends in May 2021. This two-year non-call period is standard for European CLOs issued in 2019.

- Reinvestment period - Another key date in the life of a CLO is the end of its reinvestment period. In this case, reinvestment ends in October 2023, giving the manager a relatively standard four-year period to buy and sell loans in the portfolio.

(3) Buying Loans:

Even while the structure was being finalised in early 2019, Sound Point had already made a start on buying loans to put into Sound Point Euro CLO I. The firm was able to do this thanks to a warehouse provided by Citibank. This meant that by its closing date, the CLO already owned EUR 375 million of assets.

(4) Pricing:

The closing date is the legal start of the existence of the CLO, and the point at which investors fund the deal. But before closing can take place, the exact terms, price and interest rate of all the notes have to be agreed with all investors simultaneously. For Sound Point Euro CLO I, that event, known as pricing, happened on 10 April 2019. Between the pricing and closing dates, the staff at Citi and lawyers at four separate law firms will still have been working feverishly to finalise the various legal contracts that govern the CLO.

(5) CLO becomes effective:

After Sound Point Euro CLO I closed on 9 May 2019, the work of the arranger and lawyers was complete. Now Sound Point needed to finish ramping up the CLO by a deadline of 8 January 2020. That is the latest date that this CLO is allowed to go effective. In fact, the manager was able to buy the remaining 125 million of loans it needed in only a couple of months, and declared the CLO effective in July 2019.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Mike Peterson

There are no available Videos from "Mike Peterson"