Collapse of Greensill Capital I

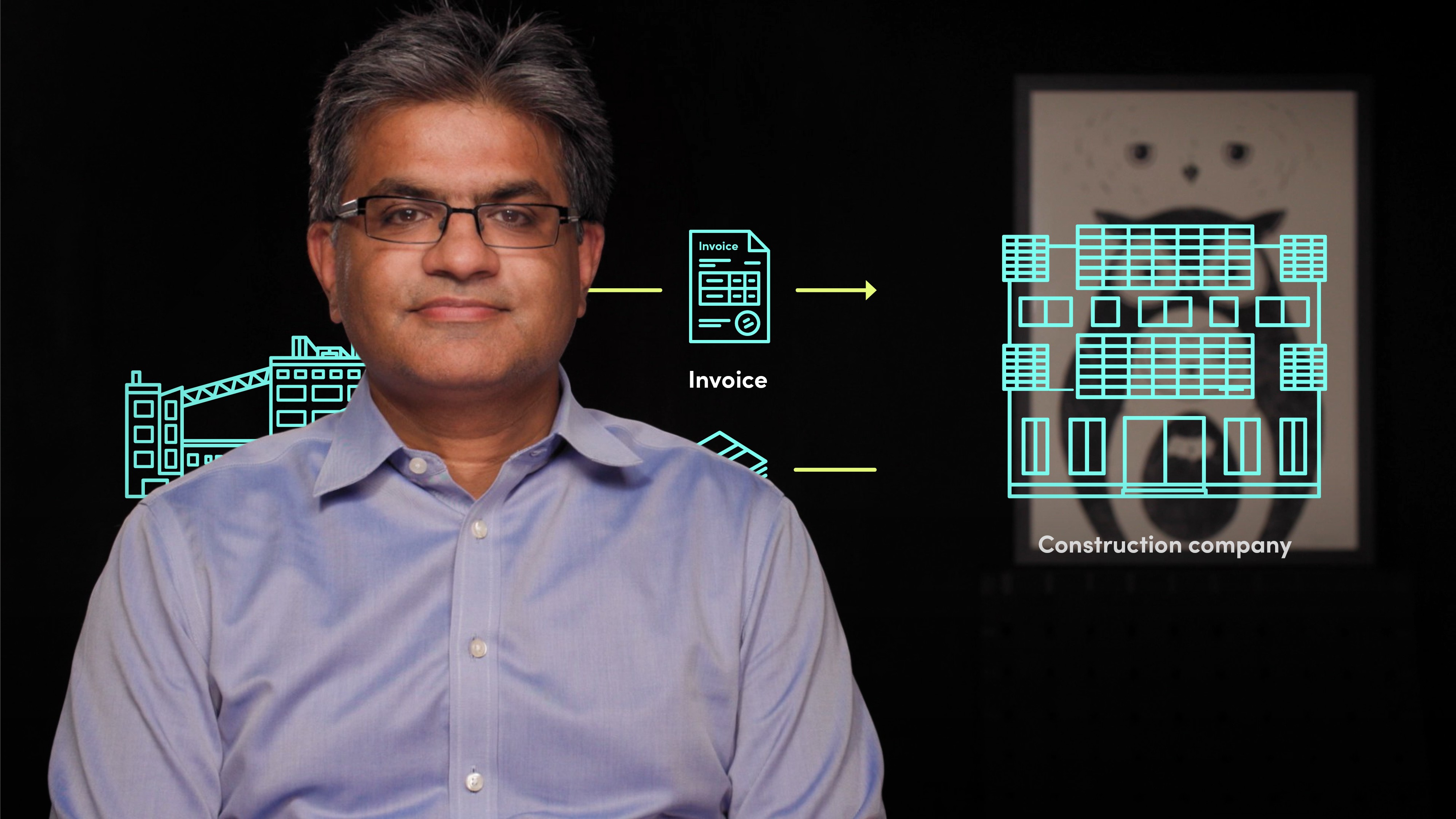

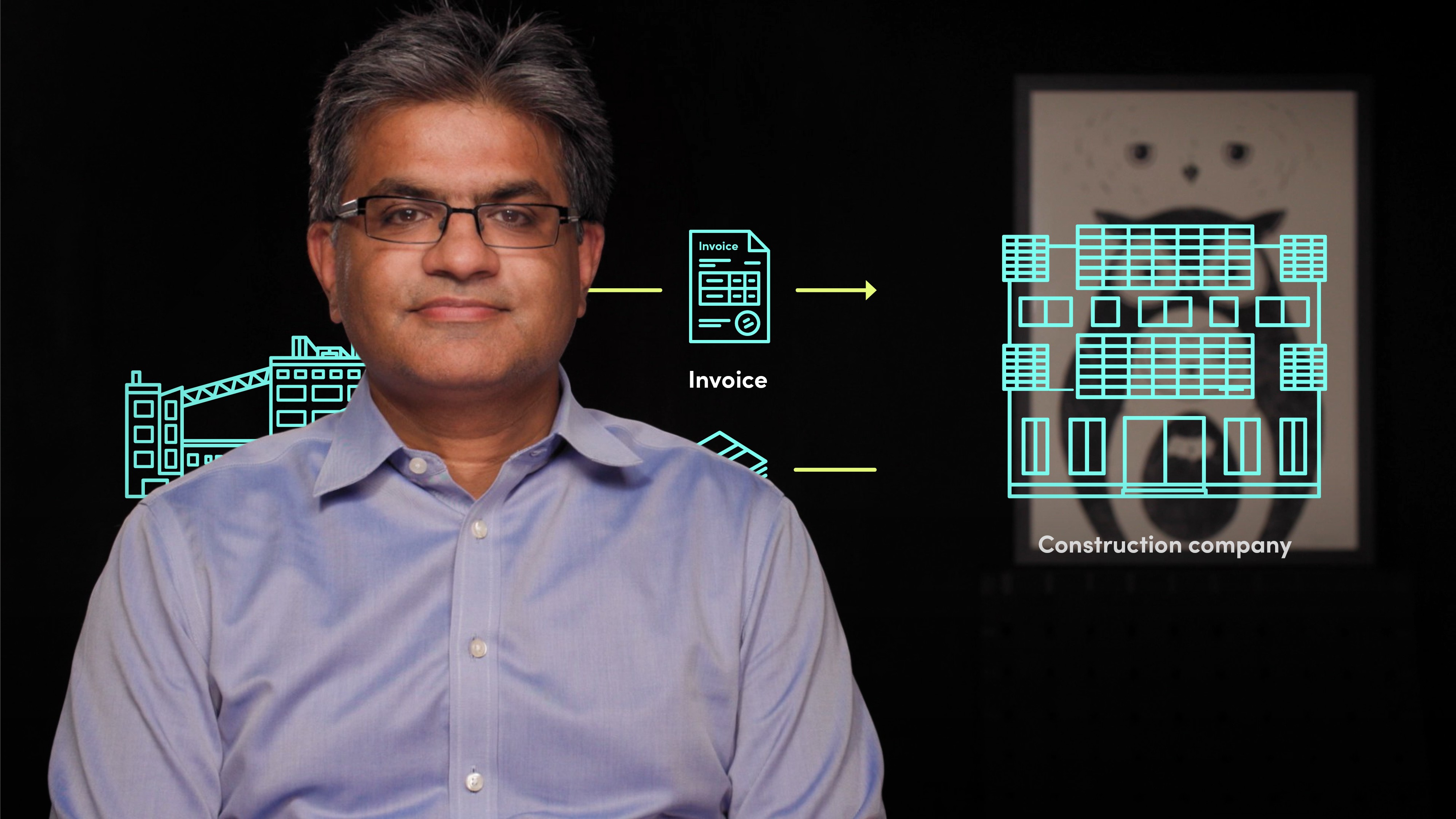

Faisal Sheikh

25 years: Wealth and risk management specialist

In the first of this two-part series on the collapse of Greensill Capital, Faisal Sheikh outlines the main service they provided; supply chain financing, as well as discussing who the main players involved in the collapse were.

In the first of this two-part series on the collapse of Greensill Capital, Faisal Sheikh outlines the main service they provided; supply chain financing, as well as discussing who the main players involved in the collapse were.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Collapse of Greensill Capital I

9 mins 39 secs

Key learning objectives:

Understand supply chain financing (factoring), the service Greensill Capital provided

Outline the main players involved in the collapse of Greensill Capital

Outline the concerns had been raised about Greensill Capital

Overview:

Greensill Capital entered administration in March 2021 owing an estimated £2.7bn to creditors, threatening 50,000 jobs worldwide. Greensill Capital provides supply chain financing to firms that traditionally had a delay between shipping goods and receiving payment. Greensill would pay the suppliers and then the customers would settle with Greensill at a later date. Greensill packaged the invoices into securities that they would then sell to investors, using the proceeds to pay suppliers.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What is supply chain financing (factoring)?

Supply chain financing (factoring) solves a common payment problem found in industry that has existed for hundreds of years. Traditionally, firms that supply goods have to endure a significant lag between issuing an invoice and receiving payment. With factoring, a financial institution like Greensill steps in to pay a supplier sooner on the customer’s behalf, minus a small discount which they take as their fee. The customer then settles with the financial institution at an agreed later date, often months later.

Who were the main players involved in the collapse of Greensill Capital

Lex Greensill, was CEO and founder of Greensill. He is the son of farmers, but went on to study law. His family farm was often in debt because it had to wait for significant time for payment for harvests. Whilst working at the Fruit and Vegetable Growers’ Association in Australia, he drew up a payment code that aimed to speed up the time it took buyers to pay farmers.

He moved to London, working for Morgan Stanley where he set up its supply-chain finance business and then at Citibank.

He founded Greensill Capital in 2011 and started packaging up invoices as securities to sell to investors. Lex Greensill was introduced into the highest levels of government and business until the firm collapsed in March 2021. Greensill leveraged his relationship with David Cameron to press for a new payments scheme in the NHS, an £800m programme. In 2021 Greensill was valued at $30bn, making Lex Greensill a billionaire on paper.

Sanjeev Gupta is a former commodities trader who heads a private family owned group of companies called GFG Alliance. The companies span steel, aluminium and energy.

GFC Alliance and its separate companies were the typical companies that used factoring or supply chain finance often selling steel and metals to manufacturers and getting paid with a significant lag. As a result it relied on Greensill to provide it with finance by selling invoices to it that it had raised against manufacturers.

What concerns had been raised about Greensill Capital and GFG Alliance’s relationship?

The FT found evidence that some of the invoices being sold to Greensill by GFG may have been fraudulent, some manufacturers disputed doing business with GFG Alliance, let alone owing it money.

There were also concerns raised about the secretive and opaque nature of GFG Alliance. It was a private business and therefore not listed and it was made up of hundreds of individual legal entities with cross holdings and common directors, with no overall consolidation of accounts because of the lack of a traditional holding company structure.

Also, concerns were identified that many of the companies that held very large complex metal assets were audited by a tiny audit firm lacking the resources and expertise to effectively audit them.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Faisal Sheikh

There are no available Videos from "Faisal Sheikh"