Negotiating the Right Comfort Letter

Kate Craven

35 years: Capital markets

In the second part of this two-part video series, Kate continues the discussion around comfort letters. Kate begins by talking about engagement letters, another way underwriters can potentially protect themselves against liability. Then she discusses certain issues with comfort letters, such as what happens when there is no comfort letter provided, and key things to watch out for when requesting a comfort letter.

In the second part of this two-part video series, Kate continues the discussion around comfort letters. Kate begins by talking about engagement letters, another way underwriters can potentially protect themselves against liability. Then she discusses certain issues with comfort letters, such as what happens when there is no comfort letter provided, and key things to watch out for when requesting a comfort letter.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Negotiating the Right Comfort Letter

7 mins 51 secs

Key learning objectives:

What is an engagement letter?

What due diligence procedures can underwriters carry out to address limited comfort or any issues flagged in the comfort letter?

What are some key things to watch out for to ensure the process goes smoothly?

Overview:

Comfort letters are challenging and can be tricky to negotiate. While there are steps you can take to try to smooth the process, you should also be aware that this will not always be possible. Auditors are skilful at cherry-picking the elements that they like from different markets – always striving to reduce their perceived liability.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

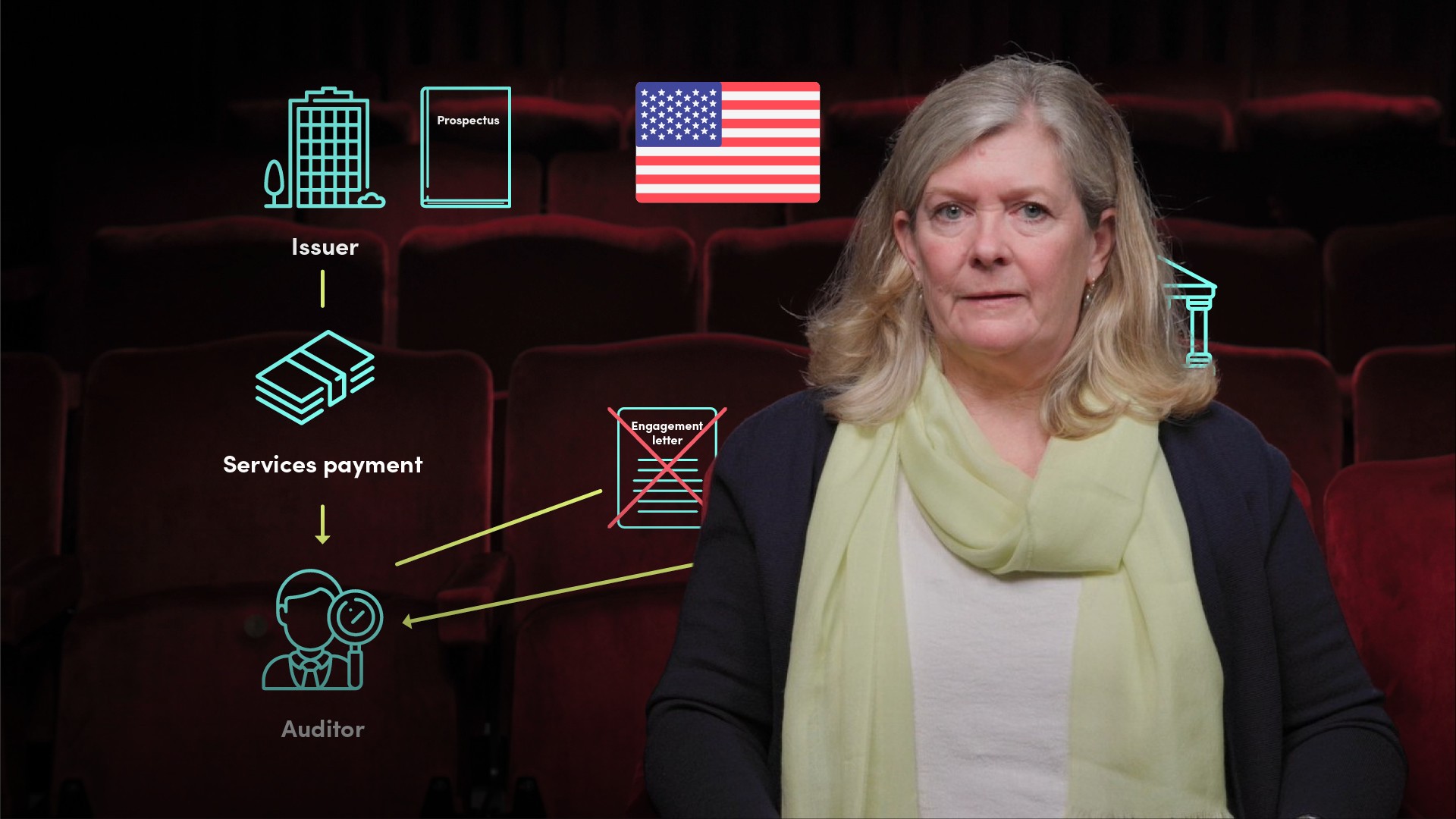

What are the auditors' approaches for Reg S/144a offerings?

- For the offers and sales within the US: underwriters will receive a standard US type comfort letter based on the standard US due diligence representation letter provided by the US underwriters

- For offers outside the US: there is a “look-alike” comfort letter for the Reg S portion of the issue, based on the non-US arrangement letter which is signed by the European affiliates of the US underwriters

What is an engagement letter?

Where the auditing firm will seek to include provisions that may limit its liability, for example, up to a specified amount, or to limit liability to the office of the firm that is issuing the comfort letter, or to carve out liability for indirect or consequential losses. Other provisions in the document may include,

- Restrictions on the use of the comfort letter, and in particular the inability of third parties to rely on it

- The procedures that the auditors will perform to deliver the letter

What due diligence procedures can underwriters carry out to address limited comfort or any issues flagged in the comfort letter?

- Discussing with the auditors the underlying reasons for being unable to provide the desired comfort level

- Can the prospectus be amended to add protective or enhanced disclosure in the risk factors or the recent developments section?

- Can the issuer representations and warranties in the Subscription Agreement be strengthened?

What are some key things to watch out for to ensure the process goes smoothly?

- Black-out periods. It is important to be aware of key dates in the issuer’s calendar to avoid problems. Auditors won’t be willing or able to provide a comfort letter if they are already working on their audit issuer’s annual accounts

- Involve the auditors early and ask whether they anticipate any problem in delivering their customary comfort letter

- Auditors are made aware of the timing of a new transaction – giving them sufficient time to prepare their comfort letter

- Check any limitations of liability (whether in the engagement/arrangement letter or in the comfort letter) as there may be local variations depending on the auditing firm or statutory limitations

- If there is to be a preliminary prospectus, it is good practice to try to finalise a fully-negotiated and signature-ready draft comfort letter before printing the prelim (as investors will be using this document to make their investment decision) and underwriter liability will therefore apply

- Pay attention to the governing law and jurisdiction clauses

- You will not get a comfort letter for a bond issue by a sovereign since they don’t prepare audited accounts

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Kate Craven

There are no available Videos from "Kate Craven"