Additional Corporate Banking Products and Services

Ritu Sehgal

20 years: Corporate banking

In the first part of this two part video series, Ritu talked about the role of corporate banking, and illustrated using a loan and swap example. In this video, she continues to cover the suite of corporate banking products, using the same illustration.

In the first part of this two part video series, Ritu talked about the role of corporate banking, and illustrated using a loan and swap example. In this video, she continues to cover the suite of corporate banking products, using the same illustration.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Additional Corporate Banking Products and Services

9 mins 9 secs

Key learning objectives:

Identify and explain the different corporate banking products

Understand what's next for corporate banking

Overview:

In this video Ritu explores the suite of corporate banking products and services such as working capital loans, letters of credit whilst using illustrations/examples.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Solar Plc has acquired the new equipment that will help it manufacture goods that it aims to export. How can a bank play a role in that?

- Straight lending

- Trade finance instruments like Letter of Credits, Guarantees and other supply chain financing that mitigate risks, shorten the working capital cycle and facilitate cross border or domestic trade.

What is working capital and working capital loans?

The difference between liquid, short term assets and the short term liabilities. It is the amount that the company uses in its day to day trading operations and can also be expressed in the number of days or working capital cycle. Solar Plc will need funds to finance buying of raw materials which Barclays or HSBC as relationship banks can provide through working capital loans. These are typically short term loans and are for the purpose of helping a corporate manage its working capital cycle.

What are trade loans?

These are an important trade finance product enabling finance to be provided until payment for goods is received and can be used to fund regular or one-off purchases of goods and raw materials.

How else can a bank help? (Utilise the example used in the video)

By issuing a Letter of Credit - This is an undertaking by a bank on behalf of the buyer to pay the supplier the agreed amount, at the end of the agreed term, subject to certain conditions being met.

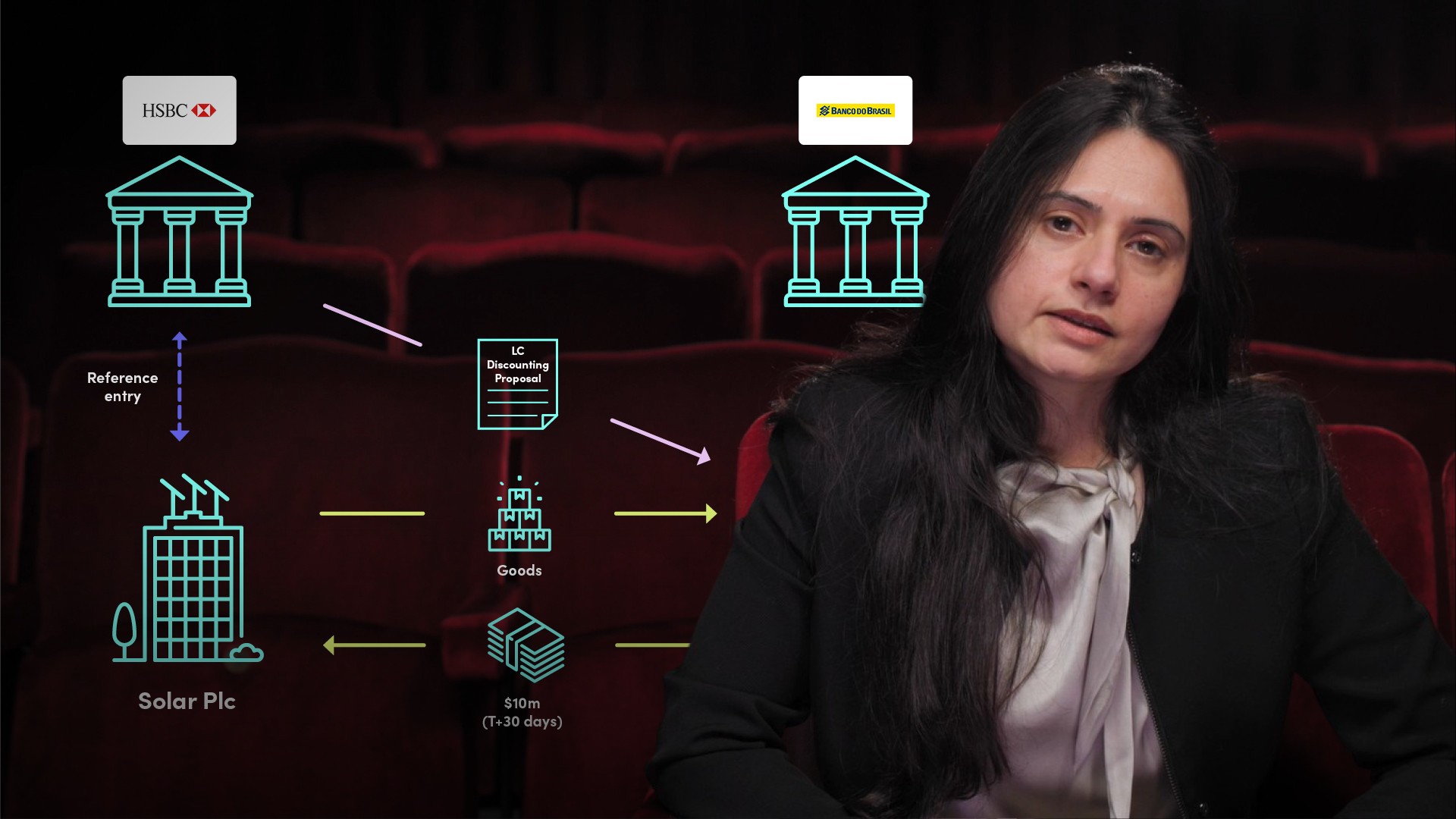

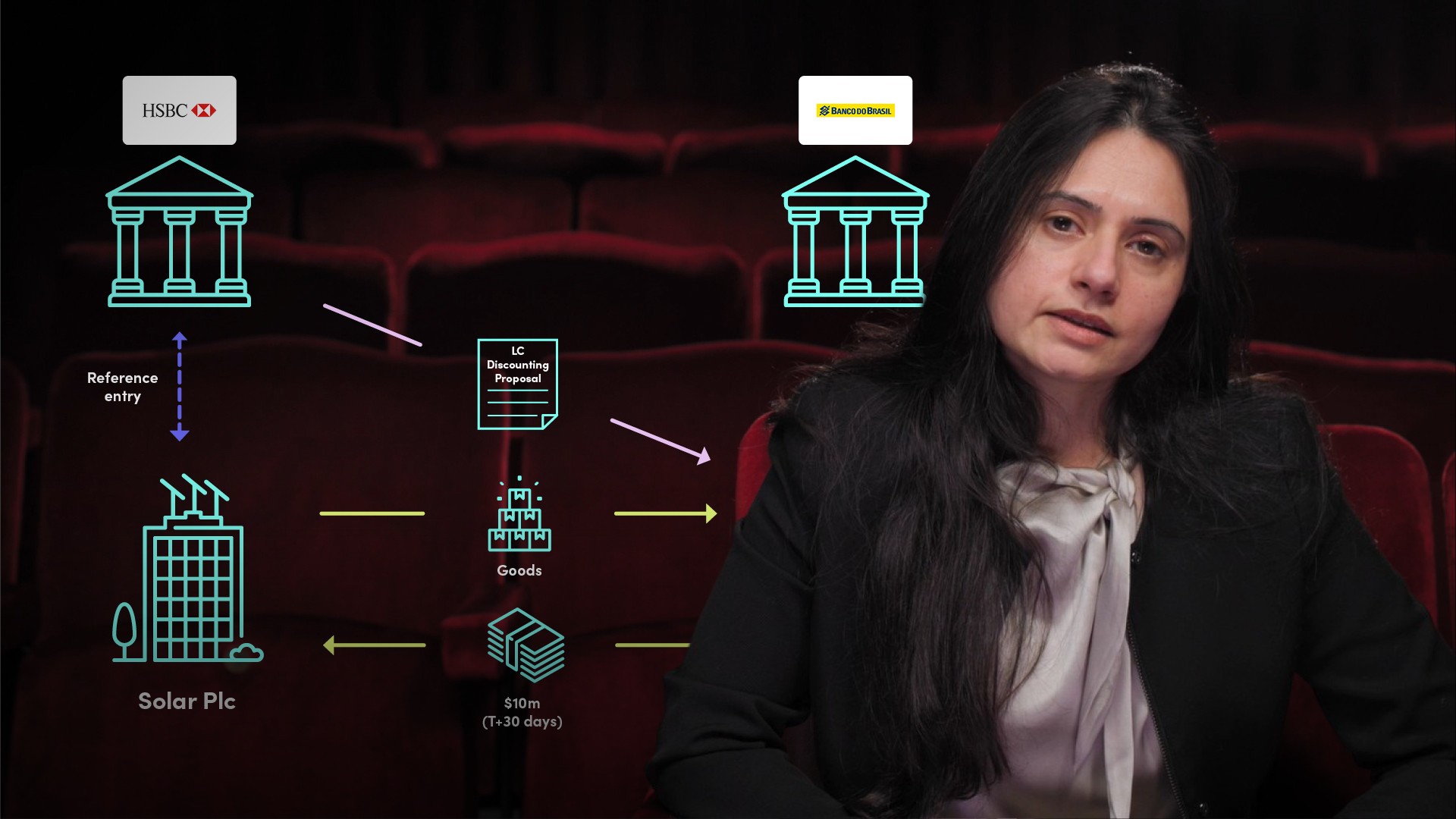

In this example, Banco do Brasil is issuing an Import LC. Solar Plc is receiving an Export LC. By accepting the LC issued by Banco do Brasil, John has transferred Solar Plc’s risk from BZ to Banco do Brasil. While Banco do Brasil has assumed credit risk on BZ, its existing corporate banking client.

How can banks help in financing in ways other than trade loans?

LC discounting -- a form of invoice discounting -- allows Solar PLc. to receive funds upfront but at a discount to the face value of the invoice.

How does this support Solar plc?

- It enables John to receive payment , improving the company’s cash flows and allowing him to pay his suppliers early

- It gives John the ability to offer BZ SA longer payment terms, which can put him in a stronger negotiating position on price

What else does John need to do?

- Manage actual physical payments for goods Solar Plc buys and the expenses the company incurs.

- Manage collection of funds for goods sold and any other payments like refunds the company receives

What money transfer and collection services do corporate banks provide?

- Physical cash

- Cheques from individual customers

- Wholesale electronic B-to-B transfers as well as digital money transfers

Why may sending and collecting payments be a cumbersome task for treasury departments?

- It requires: infrastructure in the form of accounting platforms,

- A decision about which channels to use to connect with the banks

- Reconciliation tools and accounting platforms

What next for corporate banking?

Most corporate banking products are being impacted by the digital revolution. Robotics, Artificial Intelligence and Machine Learning are changing the way banking is conducted and a key focus is on the consumer experience. Some examples are paperless, time efficient trade finance through block chains, Artificial Intelligence based automation of foreign exchange settlement, automated credit decisioning etc.

In addition, Corporate Banking is evolving to design Green products that not only consider environmental and social impact but also focus on transparency and speed of execution.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Ritu Sehgal

There are no available Videos from "Ritu Sehgal"