Covered Bond Public Policy

Richard Kemmish

30 years: Capital markets & covered bonds

Regulators tend to see the benefits of the covered bond product, but banks have argued that they have no need for more wholesale funding tools. In the final video of this series on covered bonds, Richard discusses some of the arguments in favour of the introduction of covered bonds, some of the objections that have been raised and what can be done to address those concerns.

Regulators tend to see the benefits of the covered bond product, but banks have argued that they have no need for more wholesale funding tools. In the final video of this series on covered bonds, Richard discusses some of the arguments in favour of the introduction of covered bonds, some of the objections that have been raised and what can be done to address those concerns.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Covered Bond Public Policy

8 mins 43 secs

Key learning objectives:

Explain the benefits of covered bonds

Discuss the problems around covered bonds

Define the ‘Vienna Initiative’

Overview:

Covered bonds have the potential to significantly improve financial stability and fund important sectors of the economy – however, there are concerns that must be addressed by putting in place appropriate safeguards.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

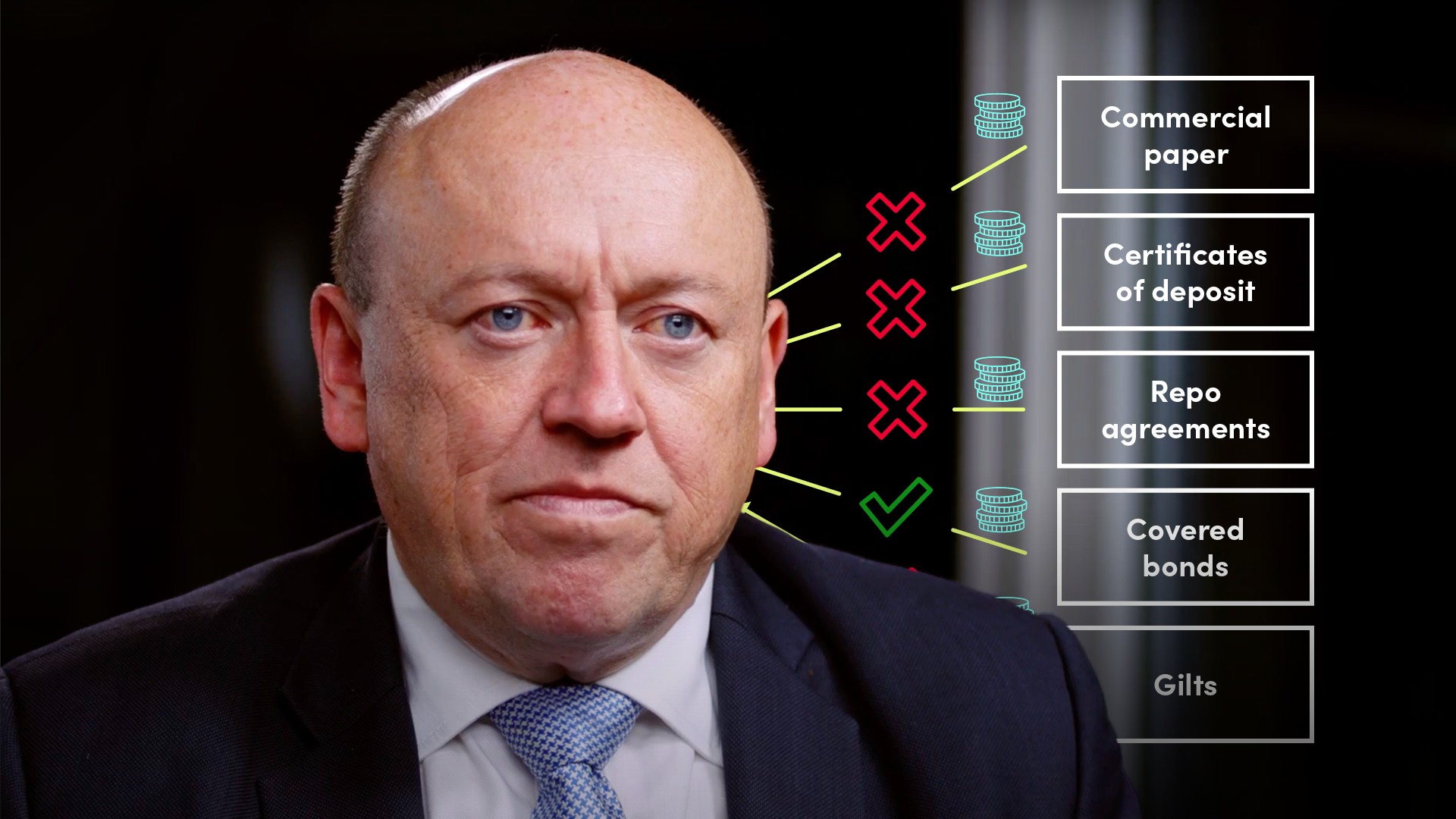

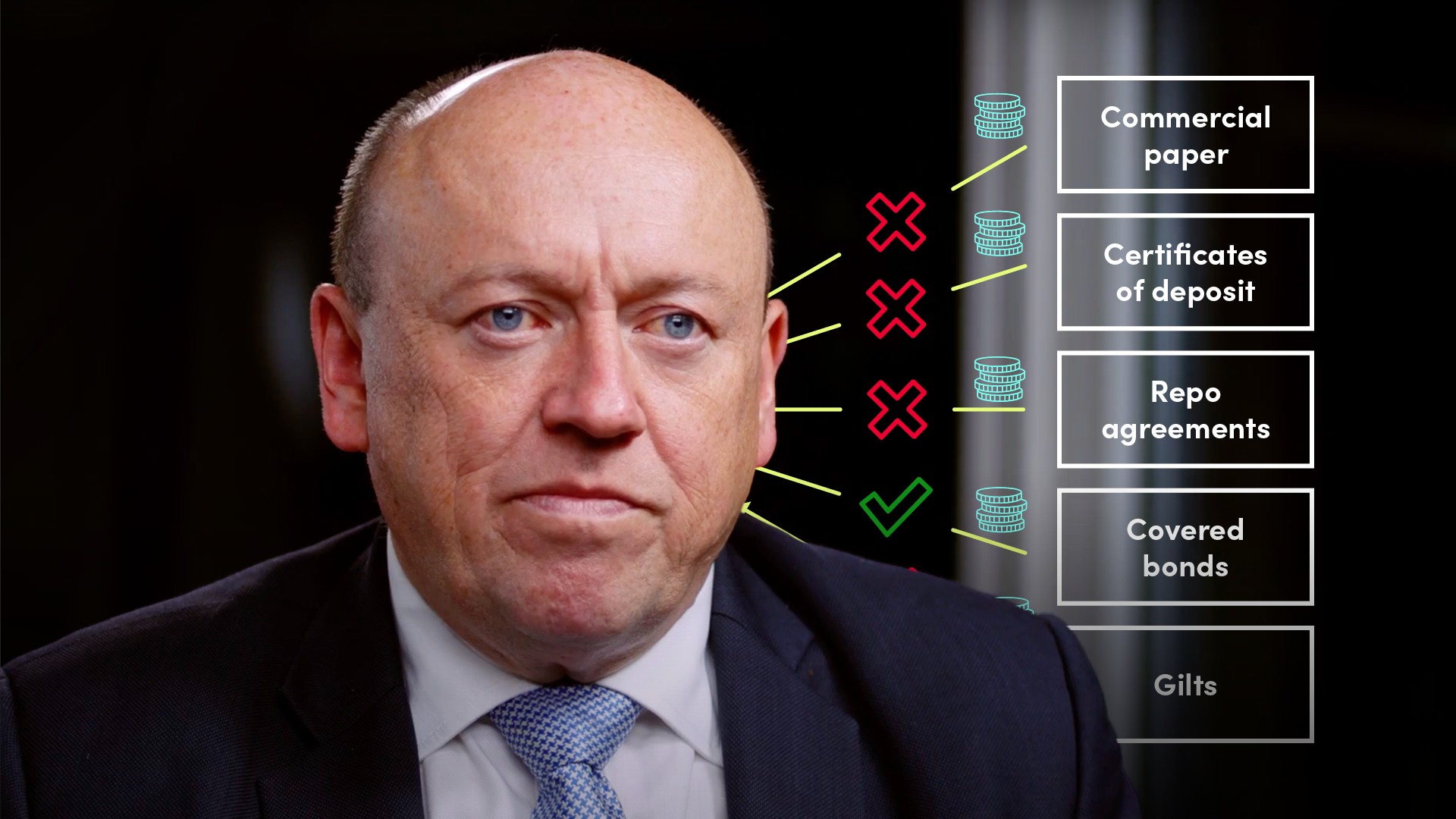

What are the benefits of covered bonds?

- Covered bonds offer banks a funding lifeline when other wholesale funding markets shut

- They can be used as collateral for emergency liquidity assistance from Central Banks

- Covered bonds increase the term of the funding of long-dated mortgage assets

- They improve the risk/return profile available for fixed-income investors

- By increasing the available pool of HQLA, the reliability of the liquidity book can be improved

- Covered bonds are seen as a way to develop market infrastructure and give pension funds and other investors a liquid alternative to investing offshore

What is ‘The Vienna Initiative’?

The Vienna Initiative was a plan undertaken in January 2009 by European banks and governments to reduce the vulnerability of banks in the CEE region to exogenous crises. One of the ways in which they achieved this is by improving the ability of subsidiary banks to enter financing in their home market and in their own name.What are the problems surrounding covered bonds?

- Covered bonds take the best assets away from the bank’s estate in insolvency

- They tend to favour larger banks by giving them a competitive funding advantage. This is based on the belief that the upfront costs of establishing a CB programme are high but larger banks can amortise this over a greater funding need

- By improving the funding access of mortgage banks, this helps facilitate house price bubbles

How is the consumer protected?

It is important to put in place protection to ensure that there is no differentiation between consumers whose loans are included in the pool and those who are not. This involves, for example, banking secrecy safeguards and operational requirements.Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Richard Kemmish

There are no available Videos from "Richard Kemmish"