DCF Valuations in Excel

Sarah Martin

30 years: Corporate Valuations

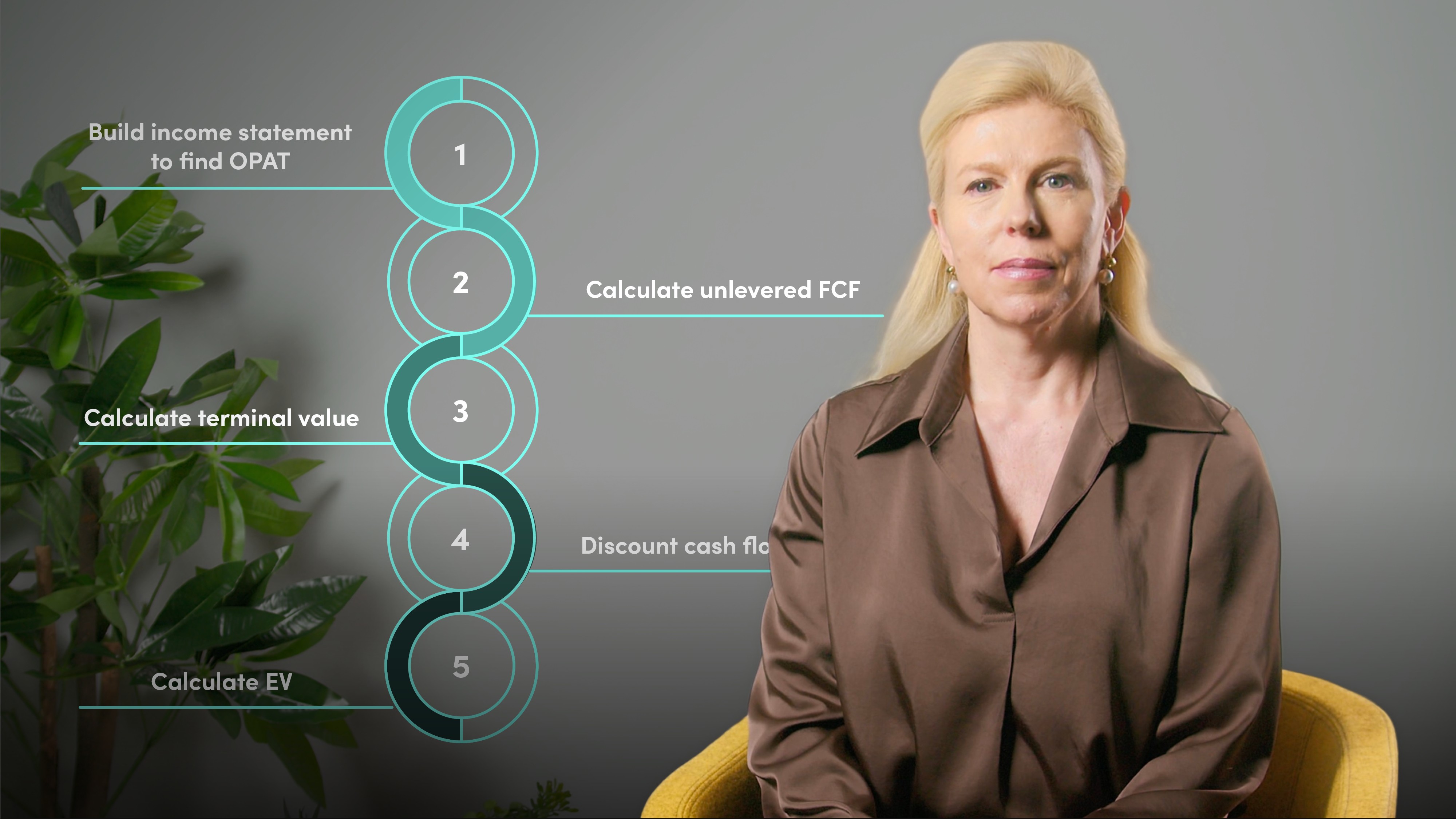

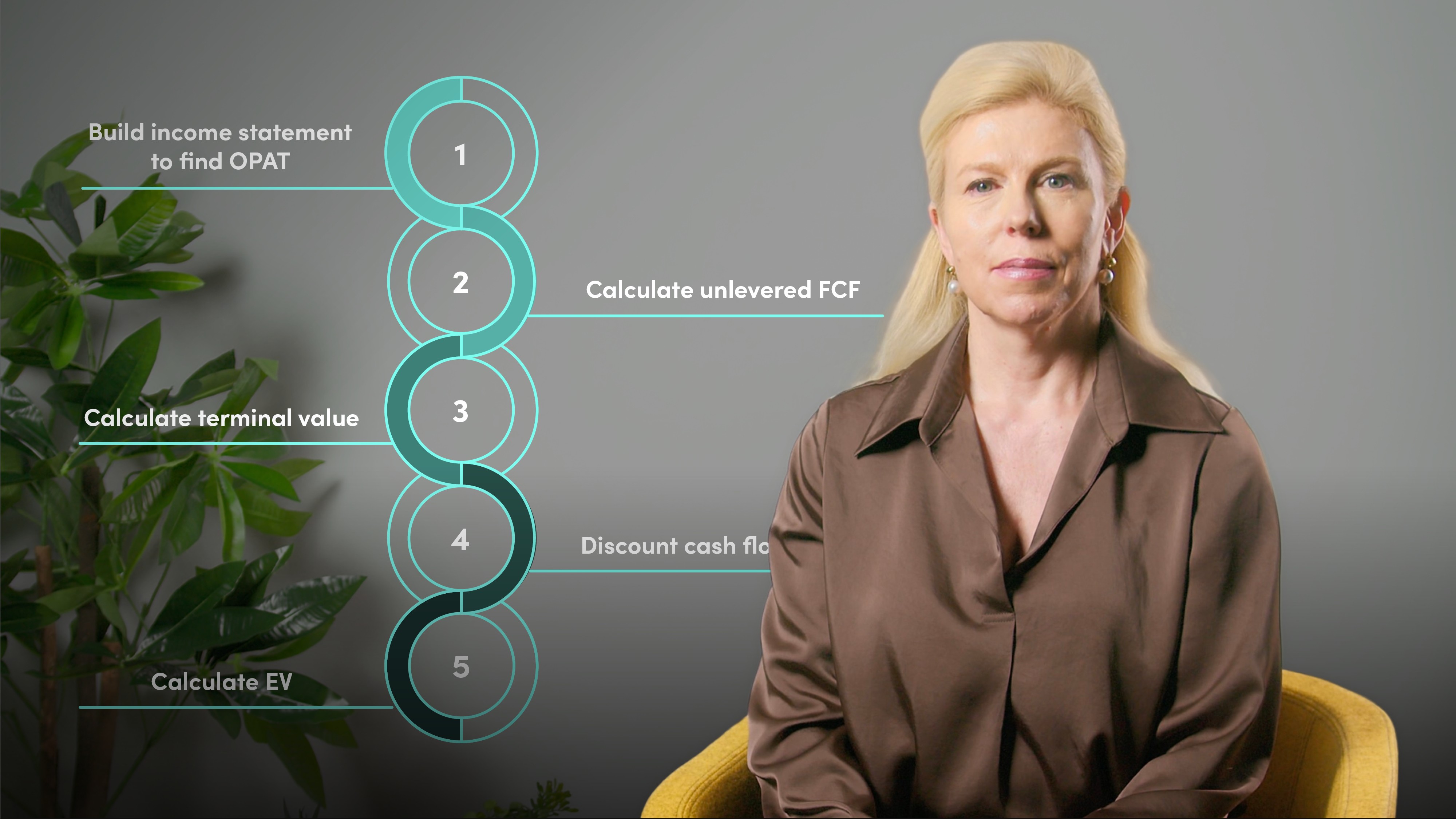

This video walks through how to carry out a Discounted Cash Flow (DCF) valuation using Excel. Sarah Martin breaks down the key steps from setting up assumptions and calculating free cash flow to deriving terminal values and computing enterprise value using the NPV function. This video prepares you to model DCFs independently.

This video walks through how to carry out a Discounted Cash Flow (DCF) valuation using Excel. Sarah Martin breaks down the key steps from setting up assumptions and calculating free cash flow to deriving terminal values and computing enterprise value using the NPV function. This video prepares you to model DCFs independently.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

DCF Valuations in Excel

13 mins

Key learning objectives:

Understand how to structure and execute a DCF model in Excel

Overview:

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

- Structure the sheet and fill in details and set up an income statement

- Calculate operating profit after tax and unlevered free cash flows

- Find the terminal value using 2 different methods (perpetuity formula and EBITDA multiple)

- Use Excel’s NPV function to discount future cash flows

- Combine the components to compute enterprise value

The model requires inputs for tax rate (20%), WACC (8%), terminal growth rate (1.5%), and an EBITDA exit multiple (10x), all of which are changeable.

OPAT is calculated by starting with EBITDA, subtracting non-cash items like depreciation and impairment, and applying the tax rate to EBIT. This reflects pre-financing operating profits after tax.

It forms the starting point for calculating unlevered free cash flow the cash available to all capital providers.

How do we calculate unlevered free cash flow?

From OPAT, add back non-cash charges (like depreciation), and subtract expected reinvestments such as capex and changes in working capital. These reflect ongoing operational cash requirements.

- Perpetuity method – assumes a constant growth rate beyond forecast years

- Multiple method – assumes the firm can be sold for a multiple of its final year (exit) EBITDA

It’s discounted back to the valuation date (end of 2023) using the same NPV approach, and added to the present value of free cash flows to calculate total enterprise value.

Failing to include zero placeholders in intermediate years when discounting the terminal value can distort results by shortening the discount period.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Sarah Martin

There are no available Videos from "Sarah Martin"