Derivatives Exchange Membership

Abdulla Javeri

30 years: Financial markets trader

In the final video of this series on derivatives exchanges, Abdulla examines the membership structure of those exchanges whilst noting that not all exchanges will be identical.

In the final video of this series on derivatives exchanges, Abdulla examines the membership structure of those exchanges whilst noting that not all exchanges will be identical.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Derivatives Exchange Membership

5 mins 22 secs

Key learning objectives:

Understand the difference between Clearing and Non-Clearing Members

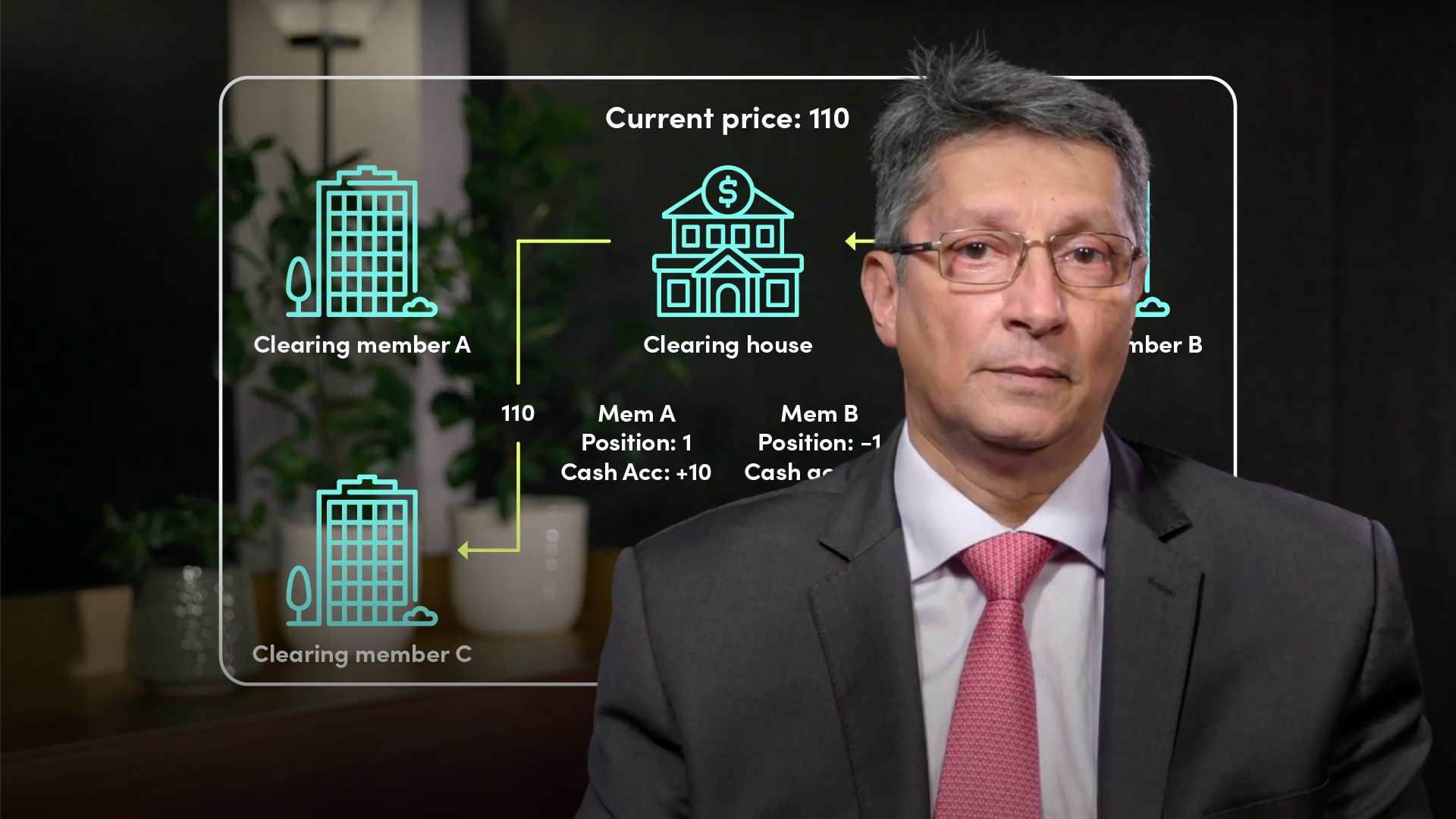

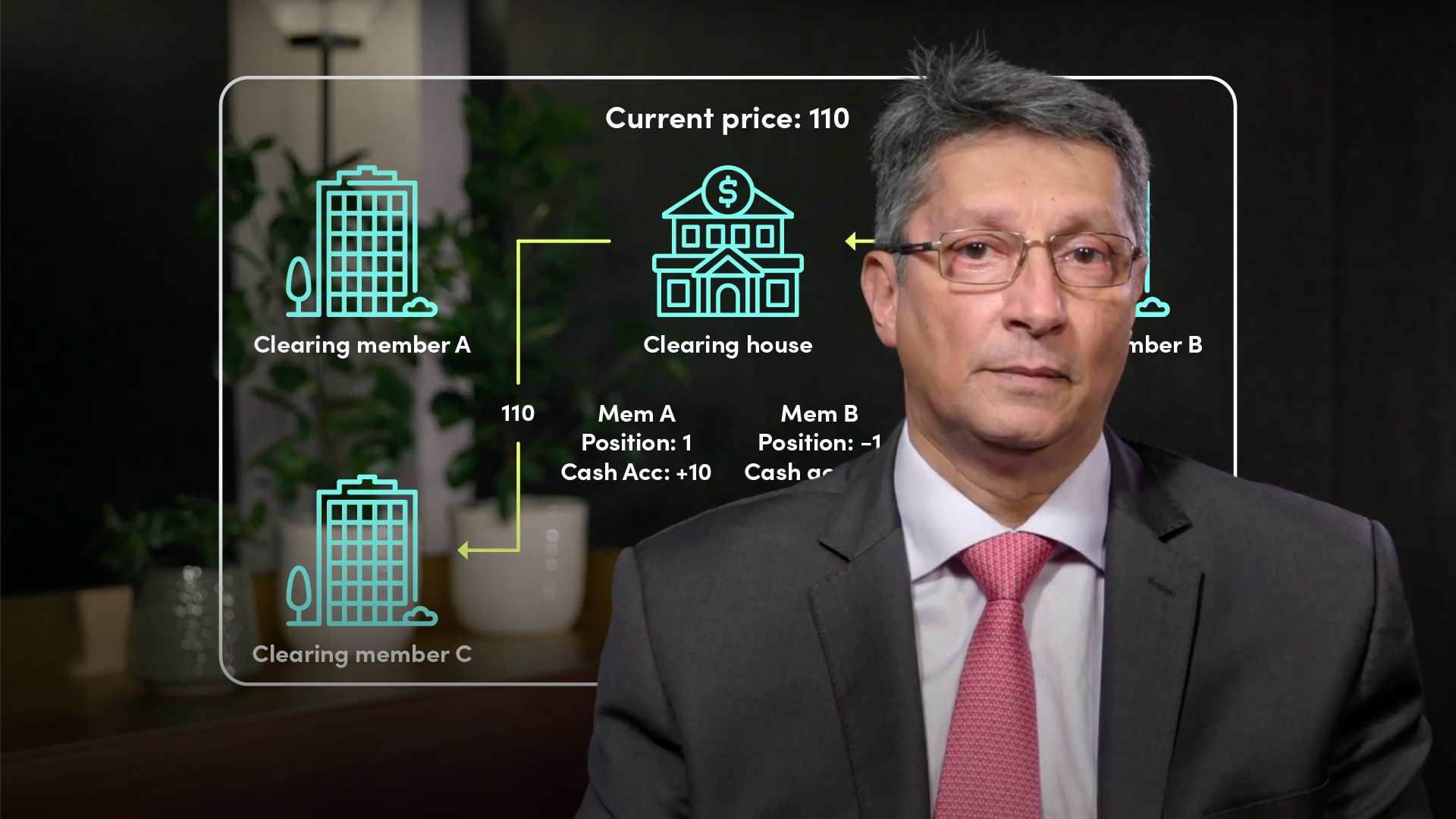

Understand the relationship between Clearing members, Non-Clearing members and the Clearing House

Outline the process of how trades are registered with the Clearing House

Identify the application and limits of Clearing House guarantees

Overview:

Exchange membership is a requirement to directly access the facilities of an Exchange, primarily its trading platform.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What are the cons of Exchange Membership?

Membership provides benefits, but it also imposes obligations to adhere to the rules of the Exchange e.g. in respect of minimum financial resources, regulatory approvals, dispute resolution and general conduct in relation to off-Exchange clients and other Exchange members.

What are the types of members?

There are a number of ‘levels’ of Exchange membership, generally described as Clearing Members and Non–Clearing Members.

Clearing Members are subject to substantially higher capital requirements than their Non Clearing counterparts. There is often a further sub category, Public Order and Non Public Order, which defines whether the Non Clearing member is allowed to directly execute trades on behalf of their clients who are not exchange members.

What is the exchange membership criteria?

As long as you can satisfy the criteria set by the Exchange, anyone can become a member. The criteria will include capital requirements as well as the necessary regulatory requirements imposed by financial regulators.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Abdulla Javeri

There are no available Videos from "Abdulla Javeri"