Different types of B2B Payments

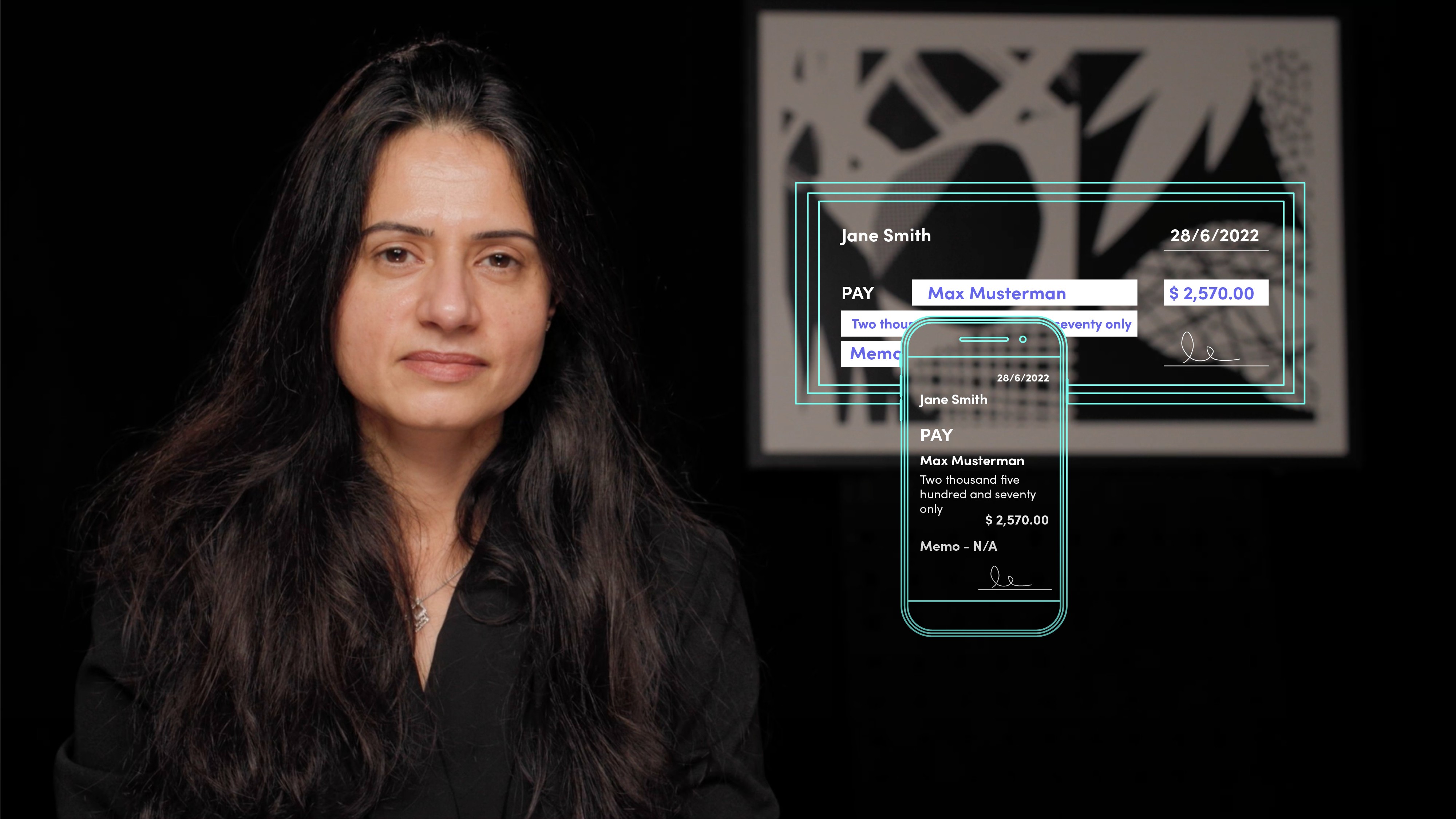

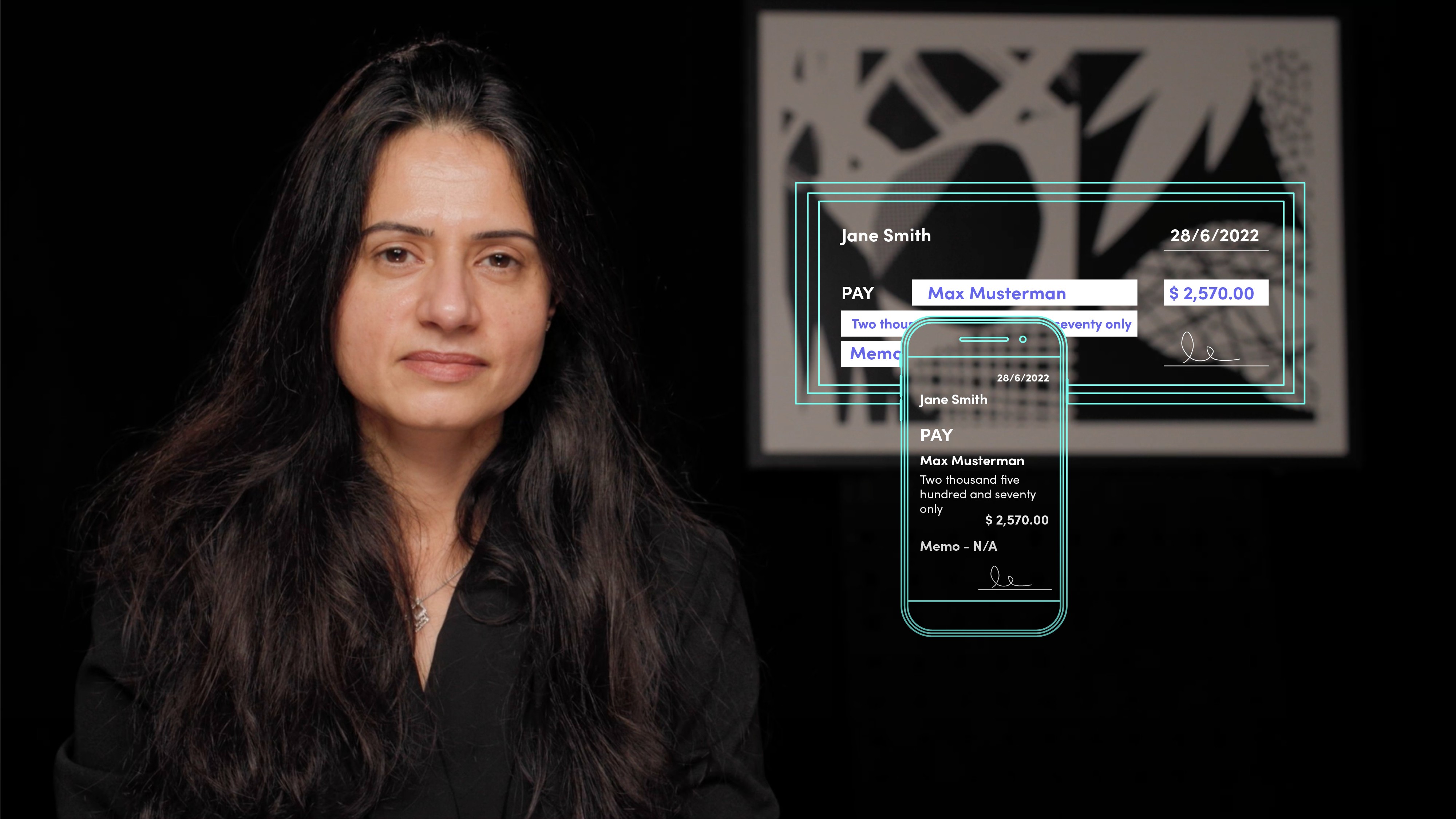

Ritu Sehgal

20 years: Corporate banking

Digital payments are increasingly common but come with significant cyber risks. Businesses can invest in secure networks to send and receive payments. They can choose processing partners with the ability to encrypt data, authenticate IDs and deploy secure channels. The risk can be efficiently mitigated if robust technology is applied to security and access control. Join Ritu as she explains how B2B payments are actually made.

Digital payments are increasingly common but come with significant cyber risks. Businesses can invest in secure networks to send and receive payments. They can choose processing partners with the ability to encrypt data, authenticate IDs and deploy secure channels. The risk can be efficiently mitigated if robust technology is applied to security and access control. Join Ritu as she explains how B2B payments are actually made.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Different types of B2B Payments

6 mins 54 secs

Key learning objectives:

Understand how B2B payments can be made

Understand how automation is driving change in the B2B market

Overview:

There are several routes through which B2B payments can be made, whether that is through cash, cheques, cards, electronic transfers, or through gateways and alternate payment methods. Solutions for B2B payments tend to get lower priority than B2C solutions but that trend is changing, with the value of automating B2B payments in improving cash flows, minimising risks, saving costs and improving reports and data being recognised.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

How can B2B payments be made?

- Cash:

Most traditional forms of payment, but one of the most inefficient in the B2B payments industry. Though the banks have, over time, simplified their cash handling solutions, it remains a relatively inferior option from a cost, time efficiency and reconciliation perspective. - Paper cheques:

Represent the second most outdated way of making payments after cash. Receiving funds can take up to seven days. They make the predictability of cash flows challenging as there could be a time lag between when the cheque is presented and when it is deposited. Developments have been made, including electronic cheque

scanners. - Cards:

Cards are one of the most widely used payment methods in B2B given their ease of use and acceptability. They have also seen significant expansion in flexibility and variety of options over time with the development of virtual cards, prepaid cards and single-use cards in addition to debit and credit cards to cater to the needs of different sectors. - Electronic transfers:

Electronic transfer networks process payments between banks. Though they have been around for decades, they are being used more and more as the use of cash and cheques declines. Electronic transfers can be both domestic and international. Though the industry is changing with the entry of disruptive fintechs placing pressure on legacy infrastructure and bank efficiency, this method, primarily reliant on banks, remains an expensive and slow option. With the digitisation of payments, banks are progressively offering APIs that can affect payments in near real-time and with tracking options that bridge the gap. - Gateways and alternate payment methods:

Gateways are platforms that provide multiple payment options to the payer or buyer as part of the checkout process. Secure Smart software sits behind the platforms that connect the sellers’ infrastructure to the payment options and ultimately facilitates the processing of the payments. Payments are eventually cleared through banks, non-bank clearers or card companies depending on what method the payer chooses.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Ritu Sehgal

There are no available Videos from "Ritu Sehgal"