Due Diligence Execution

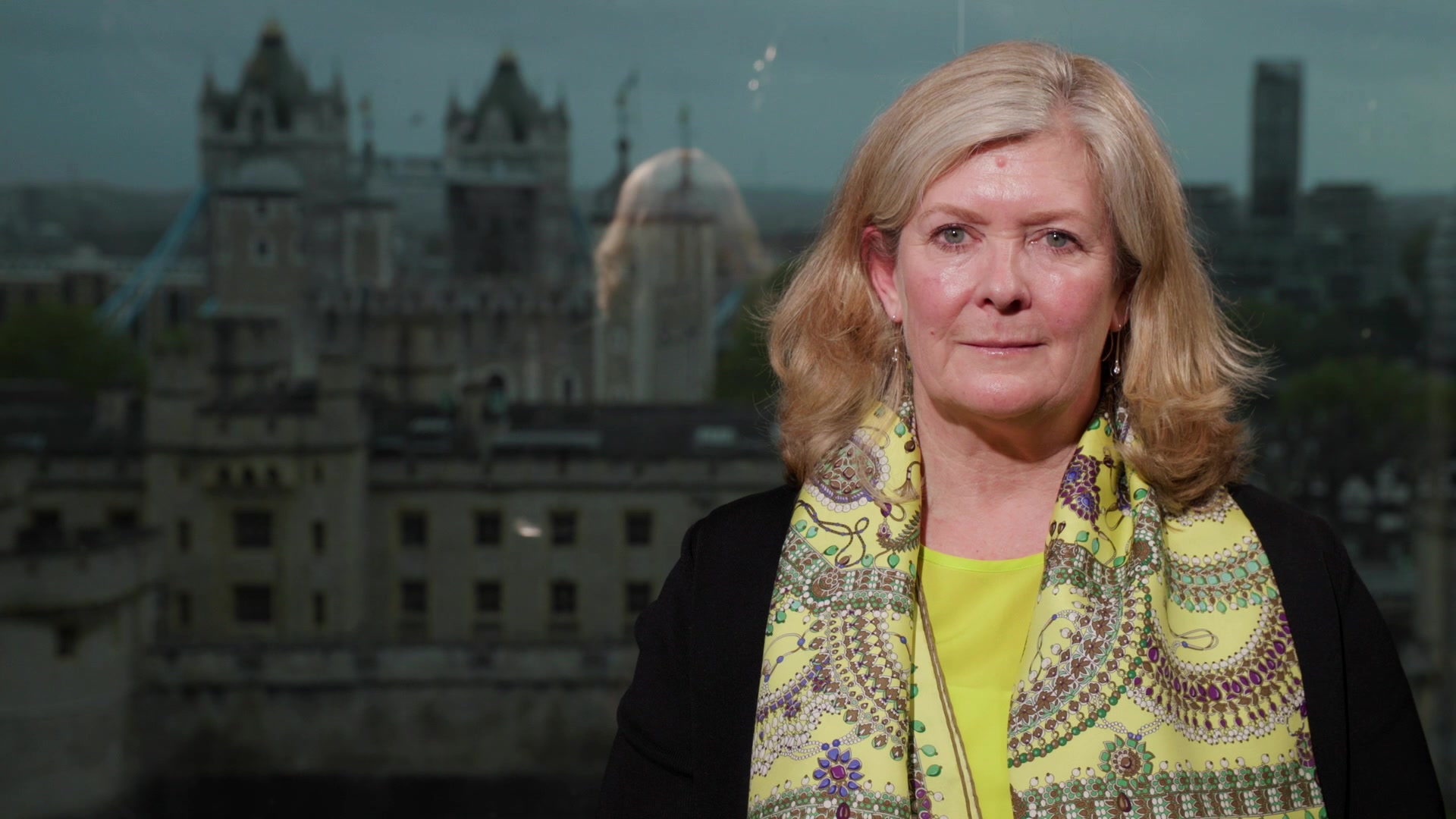

Kate Craven

35 years: Capital markets

In this video, Kate sets out the key elements of the due diligence investigation as well as the timing and extent of due diligence for different markets and different products. She further provides some insight into who is responsible for performing due diligence within banks.

In this video, Kate sets out the key elements of the due diligence investigation as well as the timing and extent of due diligence for different markets and different products. She further provides some insight into who is responsible for performing due diligence within banks.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Due Diligence Execution

12 mins 52 secs

Key learning objectives:

Understand the three elements that constitute due diligence

Understand the timing and extent of due diligence for different markets and different products

Overview:

The goal of the due diligence exercise is to protect the issuer and the lead manager (or lead managers) against potential claims made by investors. The best defence is to show that, in preparing the prospectus, the issuer behaved prudently and that duty of care owed to investors was properly discharged.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What are the key elements of due diligence investigation?

Essentially, there are three key elements to consider – financial due diligence, business due diligence and legal due diligence.

The comfort letter provided by the issuer's auditors is part of the financial due diligence process. It is important to think through what is really going on in the business. For a debut issuer or highly structured covenanted deal, the lawyers may also investigate and confirm that the new issue will not be in breach of existing covenants. Legal and documentary due diligence is covered by a combination of the legal opinion and the contractual protections. These must be looked at holistically and may need to be adapted to the specifics of a transaction.

For example, if an issuer asks the banks to waive a comfort letter, could additional questions be added to the due diligence call? If a 10b-5 letter is to be provided, the scope of documents to be reviewed will be extensive. These could include site visits to the issuer's key facilities and interviews with important third parties. Some of these documents will be commercially highly sensitive, and accordingly, access to them may be restricted to key members of the due diligence team.

Understand the timing and extent of due diligence for different markets and different products

The process for preparing a prospectus for an initial public offering (IPO) can begin with a series of due diligence meetings and follow-up discussions with the lead manager and senior management. For a first-time issuer, the process could take longer and involve considerably more work as the company may need to draft its own prospectus from scratch. For a standalone bond issue, due diligence will happen before pricing. For frequent issuers, as well as investment-grade issuers outside the U.S., due diligence is likely to take the form of a phone call. Due diligence will also be carried out at the establishment of a Medium Term Note programme and upon each annual update.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Kate Craven

There are no available Videos from "Kate Craven"