Equity Options Valuation

Imran Lakha

20 years: Equity derivatives trading

In this video Imran discusses about the main factors that determine the value of an equity option. He also addresses the Greeks which help us to define key sensitivities to the various factors. Finally, he will show how the value of an option can be broken down into its INTRINSIC and TIME value components.

In this video Imran discusses about the main factors that determine the value of an equity option. He also addresses the Greeks which help us to define key sensitivities to the various factors. Finally, he will show how the value of an option can be broken down into its INTRINSIC and TIME value components.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Equity Options Valuation

10 mins 23 secs

Key learning objectives:

Identify the factors determining an options equity value

Identify the different Greek Letters to signify an options sensitivity

Define the forward price and explain how it is it calculated

Understand the two components of the option value

Overview:

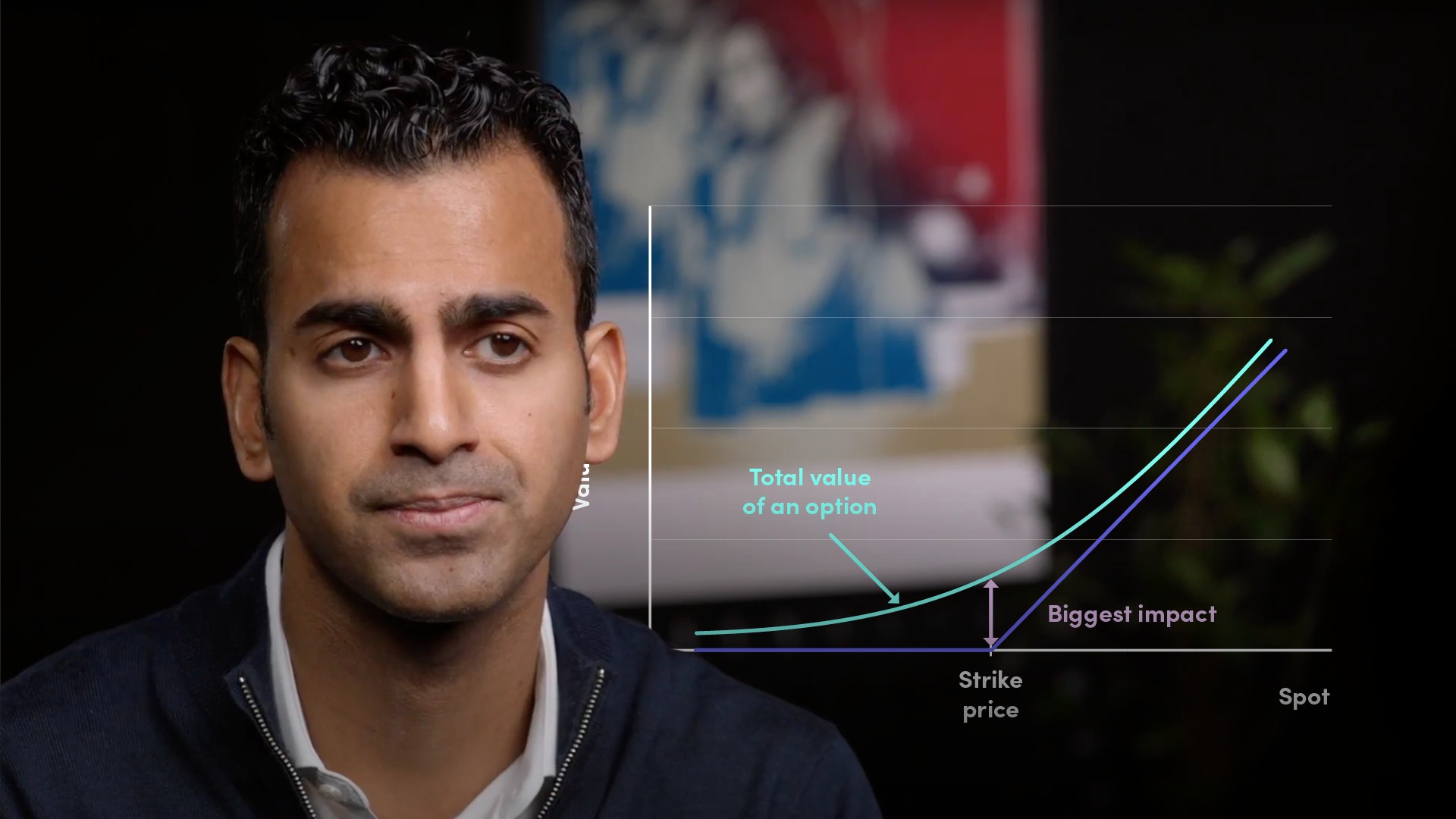

Trading in options means trading an asset that does not change in value in a linear fashion with respect to the stock price. Depending on the maturity and strike of the option, its price will behave like a curve with varying sensitivity to spot and this curve will also change shape through the passage of time.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What are the factors that determine the option value?

- Time to maturity - The more time you have until expiry, the more chance of the option ever getting in the money and being exercised and actually worth something

- Spot price relative to strike price - For CALLS, which are options to BUY a stock, if the spot increases, then this option becomes more valuable because the stock is now worth more, and you can buy it for a fixed price, for PUTS, a move lower in spot price will make the option to SELL more valuable

- Implied volatility - This signifies how much the market expects the stock to move on an annualised basis

- Interest rates, dividends and borrow cost - options expire at some point in the future, they are priced from the forward price

What are the different Greek Letters to signify an options sensitivity?

- Greek associated with time = Theta (Θ)

- Greek associated with sensitivity to spot = Delta (δ)

- Greek associated with implied volatility = Vega (v)

What is a Forward Price?

Forward price - This is the fair market assumption as to where the underlying asset should be at expiration, provided that all things are equal.

FORWARD PRICE = S (1+R-B)^T - DIVS

Where,

- S = Spot price

- R = risk free rate

- B=borrow rate

- T= maturity in years

- DIVS= total dividends expected to be paid before expiry

What are the components of the forward price?

- Spot price

- Interest rates

- Dividends

- Borrow cost

What are the two components of option value?

- Intrinsic value - Intrinsic value is the amount an option is in the money by, out of the money options have no intrinsic value. It can never be negative

- Time Value - The remainder of the option's value beyond its intrinsic value. Time value exists because an option has time to become in the money, even if it currently has no intrinsic value

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Imran Lakha

There are no available Videos from "Imran Lakha"